Energy

First Nations Buy Into Pipelines

From the Frontier Centre for Public Policy

“Meaningful Indigenous participation in our resource economy is maturing. At first, First Nations used to ask for compensation, the jobs, and then for the contracts that created those jobs, Now they seek purchase equity in the project itself. Soon they will create the project and seek others to invest in it. Then they will have real economic power.”

It’s taken years to get here, but there’s a new trend in Canada’s pipeline industry, and it couldn’t come soon enough. That’s because the path we’ve been on until now has been one to ruin.

On July 30, TC Energy announced it was in the process of selling 5.34 per cent of its Nova Gas Transmission Ltd. (NGTL) System and the Foothills Pipeline assets for a gross purchase price of $1 billion. “The Agreement is backed by the Alberta Indigenous Opportunities Corporation (AIOC) and was negotiated by a consortium committee (Consortium) representing specific Indigenous Communities (Communities) across Alberta, British Columbia and Saskatchewan. This results in an implied enterprise value of approximately $1.65 billion, inclusive of the proportionate share of the Partnership Assets’ collective debt,” TC Energy said.

This comes a few months after its March 14 announcement to sell “all outstanding shares in Prince Rupert Gas Transmission Holdings Ltd. and the limited partnership interests in Prince Rupert Gas Transmission Limited Partnership (collectively, PRGT). PRGT is a wholly owned subsidiary of TC Energy and the developer of a natural gas pipeline project in British Columbia and potential delivery corridor that would further unlock Canada as a secure, affordable and sustainable source of LNG.”

The Nova system sale is significant. It’s the principal natural gas gathering system throughout Alberta and a bit into B.C. In addition to supplying Alberta with its gas needs, Nova, in turn, feeds the TC Energy Mainline. It also supplies Saskatchewan via Many Islands Pipe Lines and TransGas, both subsidiaries of SaskEnergy. And since Saskatchewan’s domestic gas production keeps falling, we now rely heavily on Alberta gas to keep our furnaces lit and our new gas fired power plants turning, keeping the lights on. When you look at the Nova map, it’s basically the map of Alberta.

Some of the most significant difficulties in getting major pipeline projects built in this country over the last 16 years has been Indigenous opposition. One of the first stories I wrote about with Pipeline News during the summer of 2008 was a First Nations protest on the Enbridge right of way at Kerrobert, complete with a teepee. That was for the Alberta Clipper project, but it was relatively quickly resolved.

Then there was Enbridge’s Northern Gateway project, which was approved by the Conservative federal government but halted by the courts because of insufficient Indigenous consultation. It was ultimately killed very early into the Trudeau-led Liberal administration, when he said, “The Great Bear Rainforest was no place for a pipeline, a crude pipeline.”

Northern Gateway would have terminated at Kitimat. Yet, curiously enough, that same forest had to be crossed to built the TC Energy Coastal GasLink project. It went grossly overbudget in no small part due to delays and resistance in every manner possible from the Wet’suweten in northern B.C. As Canadian Press reported on Dec. 11, 2023, “By the time the pipeline was finished, its estimated construction cost had ballooned from $6.6 billion to $14.5 billion.”

And then there was Trans Mountain Expansion. It had opposition from the BC government, City of Burnaby, and everyone who could apply a Sharpie marker to a Bristol board. But Indigenous opposition was a major factor. As Pipeline Online reported via the Canadian Press, “The project’s $34-billion price tag has ballooned from a 2017 estimate of $7.4 billion, with Trans Mountain Corp. blaming the increase on “extraordinary” factors including evolving compliance requirements, Indigenous accommodations, stakeholder engagement, extreme weather and the COVID-19 pandemic.”

By this spring, the number was $34 billion, and I anticipate its final cost will be higher still.

Maturing

There’s been a big change in recent years, not just in pipelines, but in other energy industries like wind and solar. That change had gone from consultation to jobs to equity investment.

The word used almost always is “reconciliation.” That can be a loaded word in many ways, Some feel it will heal wounds, and right past wrongs, or at least try to. Others would say it’s a form of extortion. And some take issue with racial overtones. But here’s something I heard this week that makes a lot of sense:

“Meaningful Indigenous participation in our resource economy is maturing. At first, First Nations used to ask for compensation, the jobs, and then for the contracts that created those jobs, Now they seek purchase equity in the project itself. Soon they will create the project and seek others to invest in it. Then they will have real economic power.”

That’s what Steve Halabura, professional geologist, told me. And he would know, since he’s been working with First Nations on this economic development front.

And you see that in the timeline I laid out. The 2008 protests were very much about compensation and jobs. Trans Mountain Expansion saw significant First Nations’ owned and operated firms awarded contracts. And now, they’re buying equity positions.

You know what? If First Nations bands, and people, do indeed become owners in these resource companies and infrastructure, if it helps pay for housing and water treatment plants, if it means meaningful work and paycheques, are they likely to fight the next project tooth and nail? Or will they want to be a part of it?

And think of it this way – if we could have gotten to this point ten years ago, maybe these projects might have gone much more smoothly. Maybe their final costs wouldn’t have been double, or quadruple, the original budget. When you think of it in that perspective – if a billion dollar equity stake meant Coastal GasLink could have cost $5 billion less, would it have been worth it to bring First Nations in as equity partners?

Some will say that’s extortion. Others would say it’s justice, or reconciliation. But maybe, just maybe, this is how we move forward, and everyone in the end wins. And maybe then Canada can, once again, build great things.

Brian Zinchuk is editor and owner of Pipeline Online and occasional contributor to the Frontier Centre for Public Policy. He can be reached at [email protected].

Energy

China undermining American energy independence, report says

From The Center Square

By

The Chinese Communist Party is exploiting the left’s green energy movement to hurt American energy independence, according to a new report from State Armor.

Michael Lucci, founder and CEO of State Armor, says the report shows how Energy Foundation China funds green energy initiatives that make America more reliant on China, especially on technology with known vulnerabilities.

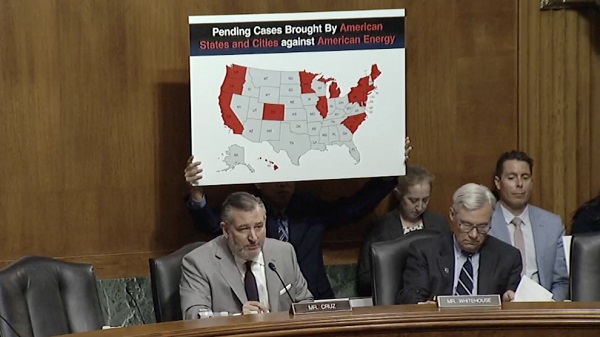

“Our report exposes how Energy Foundation China functions not as an independent nonprofit, but as a vehicle advancing the strategic interests of the Chinese Communist Party by funding U.S. green energy initiatives to shift American supply chains toward Beijing and undermine our energy security,” Lucci said in a statement before the Senate Judiciary Subcommittee’s hearing on Wednesday titled “Enter the Dragon – China and the Left’s Lawfare Against American Energy Dominance.”

Lucci said the group’s operations represent a textbook example of Chinese influence in America.

“This is a very good example of how the Chinese Communist Party operates influence operations within the United States. I would actually describe it as a perfect case study from their perspective,” he told The Center Square in a phone interview. “They’re using American money to leverage American policy changes that make the American energy grid dependent upon China.”

Lucci said one of the most concerning findings is that China-backed technology entering the U.S. power grid includes components with “undisclosed back doors” – posing a direct threat to the power grid.

“These are not actually green tech technologies. They’re red technologies,” he said. “We are finding – and this is open-source news reporting – they have undisclosed back doors in them. They’re described in a Reuters article as rogue communication devices… another way to describe that is kill switches.”

Lucci said China exploits American political divisions on energy policy to insert these technologies under the guise of environmental progress.

“Yes, and it’s very crafty,” he said. “We are not addressing the fact that these green technologies are red. Technologies controlled by the Communist Party of China should be out of the question.”

Although Lucci sees a future for carbon-free energy sources in the United States – particularly nuclear and solar energy – he doesn’t think the country should use technology from a foreign adversary to do it.

“It cannot be Chinese solar inverters that are reported in Reuters six weeks ago as having undisclosed back doors,” he said. “It cannot be Chinese batteries going into the grid … that allow them to sabotage our grid.”

Lucci said energy is a national security issue, and the United States is in a far better position to achieve energy independence than China.

“We are luckily endowed with energy independence if we choose to have it. China is not endowed with that luxury,” he said. “They’re poor in natural resources. We’re very well endowed – one of the best – with natural resources for energy production.”

He said that’s why China continues to build coal plants – and some of that coal comes from Australia – while pushing the United States to use solar energy.

“It’s very foolish of us to just make ourselves dependent on their technologies that we don’t need, and which are coming with embedded back doors that give them actual control over our energy grid,” he said.

Lucci says lawmakers at both the state and federal levels need to respond to this threat quickly.

“The executive branch should look at whether Energy Foundation China is operating as an unregistered foreign agent,” he said. “State attorneys general should be looking at these back doors that are going into our power grid – undisclosed back doors. That’s consumer fraud. That’s a deceptive trade practice.”

Energy

Carney’s Bill C-5 will likely make things worse—not better

From the Fraser Institute

By Niels Veldhuis and Jason Clemens

The Carney government’s signature legislation in its first post-election session of Parliament—Bill C-5, known as the Building Canada Act—recently passed the Senate for final approval, and is now law. It gives the government unprecedented powers and will likely make Canada even less attractive to investment than it is now, making a bad situation even worse.

Over the past 10 years, Canada has increasingly become known as a country that is un-investable, where it’s nearly impossible to get large and important projects, from pipelines to mines, approved. Even simple single-site redevelopment projects can take a decade to receive rezoning approval. It’s one of the primary reasons why Canada has experienced a mass exodus of investment capital, some $387 billion from 2015 to 2023. And from 2014 to 2023, the latest year of comparable data, investment per worker (excluding residential construction and adjusted for inflation) dropped by 19.3 per cent, from $20,310 to $16,386 (in 2017 dollars).

In theory, Bill C-5 will help speed up the approval process for projects deemed to be in the “national interest.” But the cabinet (and in practical terms, the prime minister) will determine the “national interest,” not the private sector. The bill also allows the cabinet to override existing laws, regulations and guidelines to facilitate investment and the building of projects such as pipelines, mines and power transmission lines. At a time when Canada is known for not being able to get large projects done, many are applauding this new approach, and indeed the bill passed with the support of the Opposition Conservatives.

But basically, it will allow the cabinet to go around nearly every existing hurdle impeding or preventing large project developments, and the list of hurdles is extensive: Bill C-69 (which governs the approval process for large infrastructure projects including pipelines), Bill C-48 (which effectively bans oil tankers off the west coast), the federal cap on greenhouse gas emissions for only the oil and gas sector (which effectively means a cap or even reductions in production), a quasi carbon tax on fuel (called the Clean Fuels Standard), and so on.

Bill C-5 will not change any of these problematic laws and regulations. It simply will allow the cabinet to choose when and where they’re applied. This is cronyism at its worst and opens up the Carney government to significant risks of favouritism and even corruption.

Consider firms interested in pursuing large projects. If the bill becomes the law of the land, there won’t be a new, better and more transparent process to follow that improves the general economic environment for all entrepreneurs and businesses. Instead, there will be a cabinet (i.e. politicians) with new extraordinary powers that firms can lobby to convince that their project is in the “national interest.”

Indeed, according to some reports, some senators are referring to Bill C-5 as the “trust me” law, meaning that because there aren’t enough details and guardrails within the legislation, senators who vote in favour are effectively “trusting” Prime Minister Carney and his cabinet to do the right thing, effectively and consistently over time.

Consider the ambiguity in the legislation and how it empowers discretionary decisions by the cabinet. According to the legislation, cabinet “may consider any factor” it “considers relevant, including the extent to which the project can… strengthen Canada’s autonomy, resilience and security” or “provide economic benefits to Canada” or “advance the interests of Indigenous peoples” or “contribute to clean growth and to meeting Canada’s objectives with respect to climate change.”

With this type of “criteria,” nearly anything cabinet or the prime minister can dream up could be deemed in the “national interest” and therefore provide the prime minister with unprecedented and near unilateral powers.

In the preamble to the legislation, the government said it wants an accelerated approval process, which “enhances regulatory certainty and investor confidence.” In all likelihood, Bill C-5 will do the opposite. It will put more power in the hands of a very few in government, lead to cronyism, risks outright corruption, and make Canada even less attractive to investment.

-

Business6 hours ago

Business6 hours agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Alberta1 day ago

Alberta1 day agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Crime18 hours ago

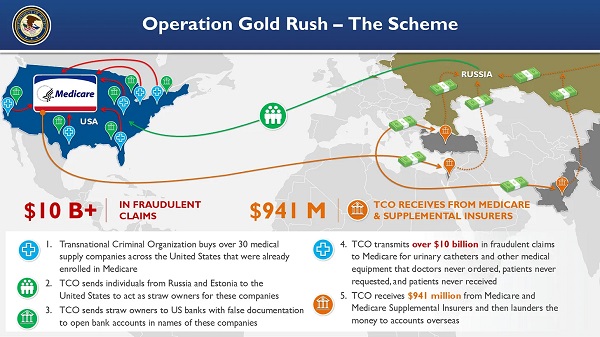

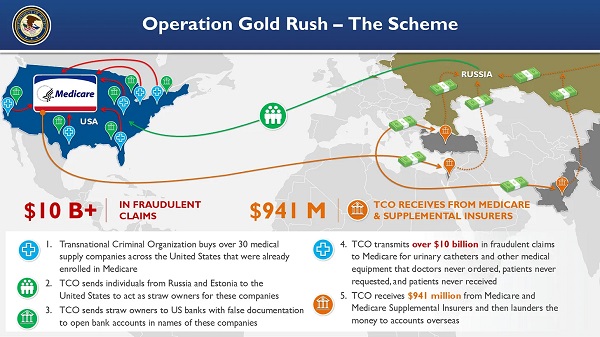

Crime18 hours agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Crime1 day ago

Crime1 day agoSuspected ambush leaves two firefighters dead in Idaho

-

Alberta1 day ago

Alberta1 day agoWhy the West’s separatists could be just as big a threat as Quebec’s

-

Business1 day ago

Business1 day agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Health18 hours ago

Health18 hours agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Business1 day ago

Business1 day agoMassive government child-care plan wreaking havoc across Ontario