Banks

Financial officers from 21 states urge financial institutions to completely abandon ESG

From The Center Square

By

“BlackRock is playing a game of deceit. Fink and his team are trying to say all the right things to conservatives while quietly doubling down on their activist agenda behind the scenes.”

A group of 26 financial officers from 21 states sent letters to 18 major financial institutions this week, warning them to abandon environmental, social, and governance (ESG) practices if they wish to continue doing business with their states.

The letters said ESG has undermined the traditional fiduciary duty that firms owe their clients, focusing solely on financial return, and instead prioritizes advancing political agendas.

“Fiduciary duty has long been a critical safeguard that facilitated efficient capital allocation grounded in financial merit rather than political ideology,” the letter said. “But that clarity is being diluted under the banner of so-called ‘long-term risk mitigation,’ where speculative assumptions about the future, like climate change catastrophe, are used to justify ideological conclusions today.”

Signers include state treasurers, auditors, and comptrollers from states like Alabama, Arizona, Florida, Louisiana, Missouri, North Carolina, Pennsylvania and Utah. BlackRock CEO Larry Fink and 17 other financial leaders were recipients of the joint letter. Others include executives from Vanguard, Fidelity, JP Morgan, Goldman Sachs, and State Street.

The letter said that while some firms have started leaving global climate coalitions and reducing ESG-related proxy votes, the state financial officers want “durable assurances” that fiduciary duty, not politics, drives investment decisions.

“While some firms have recently taken encouraging steps, such as withdrawing from global climate coalitions and scaling back ESG rhetoric and proxy votes, and some states have permitted incremental reintegration, more work must be done,” the letter said. “The number one issue is a recommitment to the foundational principles of fiduciary duty, loyalty, objectivity, and financial focus.”

The move comes after Texas removed BlackRock from its blacklist earlier this month and resumed investing with the firm – a move that drew criticism from others still pushing back against ESG. The letter indicates that many states won’t follow suit.

“Financial institutions wishing to compete for our states’ business should provide durable assurances that their practices align with these principles,” the letter said. “Our responsibility is to ensure public assets are managed in the best financial interest of beneficiaries and taxpayers.”

O.J. Oleka, president of the State Financial Officers Foundation, said the states are right to demand proof that ESG is no longer a factor in investing for these companies.

“Actions always speak louder than words. Requiring America’s financial giants to prove their independence from woke ideology with concrete steps before doing business with a state’s dollars is fully necessary and just makes sense,” Oleka said. “These financial officers are doing the right thing for their states and the taxpayers whose financial security they’ve been entrusted to protect.”

Will Hild, executive director of Consumers’ Research, also praised the letter.

“BlackRock is playing a game of deceit,” Hild said. “Fink and his team are trying to say all the right things to conservatives while quietly doubling down on their activist agenda behind the scenes.”

Banks

Debanking Is Real, And It’s Coming For You

From the Frontier Centre for Public Policy

Marco Navarro-Genie warns that debanking is turning into Ottawa’s weapon of choice to silence dissent, and only the provinces can step in to protect Canadians.

Disagree with the establishment and you risk losing your bank account

What looked like a narrow, post-convoy overreach has morphed into something much broader—and far more disturbing. Debanking isn’t a policy misfire. It’s turning into a systemic method of silencing dissent—not just in Canada, but across the Western world.

Across Canada, the U.S. and the U.K., people are being cut off from basic financial services not because they’ve broken any laws, but because they hold views or support causes the establishment disfavors. When I contacted Eva Chipiuk after RBC quietly shut down her account, she confirmed what others had only whispered: this is happening to a lot of people.

This abusive form of financial blacklisting is deep, deliberate and dangerous. In the U.K., Nigel Farage, leader of Reform UK and no stranger to controversy, was debanked under the fig leaf of financial justification. Internal memos later revealed the real reason: he was deemed a reputational risk. Cue the backlash, and by 2025, the bank was forced into a settlement complete with an apology and compensation. But the message had already been sent.

That message didn’t stay confined to Britain. And let’s not pretend it’s just private institutions playing favourites. Even in Alberta—where one might hope for a little more institutional backbone—Tamara Lich was denied an appointment to open an account at ATB Financial. That’s Alberta’s own Crown bank. If you think provincial ownership protects citizens from political interference, think again.

Fortunately, not every institution has lost its nerve. Bow Valley Credit Union, a smaller but principled operation, has taken a clear stance: it won’t debank Albertans over their political views or affiliations. In an era of bureaucratic cowardice, Bow Valley is acting like a credit union should: protective of its members and refreshingly unapologetic about it.

South of the border, things are shifting. On Aug. 7, 2025, U.S. President Donald Trump signed an executive order titled “Guaranteeing Fair Banking for All Americans.” The order prohibits financial institutions from denying service based on political affiliation, religion or other lawful activity. It also instructs U.S. regulators to scrap the squishy concept of “reputational risk”—the bureaucratic smoke screen used to justify debanking—and mandates a review of past decisions. Cases involving ideological bias must now be referred to the Department of Justice.

This isn’t just paperwork. It’s a blunt declaration: access to banking is a civil right. From now on, in the U.S., politically motivated debanking comes with consequences.

Of course, it’s not perfect. Critics were quick to notice that the order conveniently omits platforms like PayPal and other payment processors—companies that have been quietly normalizing debanking for over a decade. These are the folks who love vague “acceptable use” policies and ideological red lines that shift with the political winds. Their absence from the order raises more than a few eyebrows.

And the same goes for another set of financial gatekeepers hiding in plain sight. Credit card networks like Visa, American Express and Mastercard have become powerful, unaccountable referees, denying service to individuals and organizations labelled “controversial” for reasons that often boil down to politics.

If these players aren’t explicitly reined in, banks might play by the new rules while the rest of the financial ecosystem keeps enforcing ideological conformity by other means.

If access to money is a civil right, then that right must be protected across the entire payments system—not just at your local branch.

While the U.S. is attempting to shield its citizens from ideological discrimination, there is a noticeable silence in Canada. Not a word of concern from the government benches—or the opposition. The political class is united, apparently, in its indifference.

If Ottawa won’t act, provinces must. That makes things especially urgent for Alberta and Saskatchewan. These are the provinces where dissent from Ottawa’s policies is most common—and where citizens are most likely to face politically motivated financial retaliation.

But they’re not powerless. Both provinces boast robust credit union systems. Alberta even owns ATB Financial, a Crown bank originally created to protect Albertans from central Canadian interference. But ownership without political will is just branding.

If Alberta and Saskatchewan are serious about defending civil liberties, they should act now. They can legislate protections that prohibit financial blacklisting based on political affiliation or lawful advocacy. They can require due process before any account is frozen. They can strip “reputational risk” from the rulebooks and make it clear to Ottawa: using banks to punish dissenters won’t fly here.

Because once governments—or corporations doing their bidding—can cut off your access to money for holding the wrong opinion, democracy isn’t just threatened.

It’s already broken.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Alberta

Your money isn’t as safe as you think

This article supplied by Troy Media.

The Emergencies Act proved how quickly bank accounts can be weaponized. Alberta must act now to protect its citizens.

When Eva Chipiuk (the Alberta lawyer who famously confronted former Prime Minister Justin Trudeau’s assertions at the Emergencies Act inquiry) found out her Royal Bank account was being shut down, it confirmed a chilling truth: those who challenge Ottawa are not safe from retribution.

Chipiuk committed no crime and was not charged with any offence. However, the Montreal-based Royal Bank refused to provide her services, citing an unspecified risk. The message is clear: if you challenge Ottawa, you may risk being treated as an economic non-person. This comes just months before Tamara Lich, an Alberta resident, is expected to be sentenced for standing up against COVID overreach.

The Alberta government cannot ignore these threats against its citizens. There is plenty Ottawa doesn’t like about Alberta and Albertans today. Given that, in a February 2022 Globe and Mail oped—written before he became prime minister—Mark Carney described civil protesters as “seditionists,” one doesn’t need much imagination to see how his government could treat Albertans who push for greater control over their future. The province must prepare now to shield its citizens from financial retaliation.

Albertans who think their money is safe if it’s parked at a credit union or ATB, instead of a chartered bank, are mistaken. It isn’t. Under the Criminal Code, the Proceeds of Crime (Money Laundering) and Terrorist Financing Act, and the Emergencies Act, Ottawa can force any “financial service provider”—including provincially regulated credit unions—to freeze accounts. For example, when Tamara Lich tried to open an account with ATB—Alberta’s Crown-owned financial institution—she was denied even an appointment.

Events such as these show that it doesn’t take a judge to determine you have run afoul of those laws—only a government that disagrees with you.

Alberta has the tools to defend its citizens, and it should use them. It should start by making ATB and its provincially regulated credit unions fortresses against politically motivated financial punishment. ATB, created in 1938 to shield farmers from the aggressive lending practices of Laurentian bankers, has a distinct status as an arm of the Alberta government.

That status can be leveraged today to keep Ottawa at bay by:

- Refocusing ATB on serving Albertans, not advancing trendy corporate agendas.

- Amending the ATB Financial Act to require judicial orders for any account freezes or closures, mandate public reporting of such actions, and enshrine political neutrality to ensure no Albertan is denied service for lawful political activity.

- Preparing to invoke the Sovereignty Act if Ottawa attempts another Emergencies Act-style move, instructing ATB and its credit unions to disregard unconstitutional federal orders unless validated by Alberta courts.

- Creating a Québec-style integrated financial regulator to oversee ATB and Alberta’s provincially regulated credit unions, insulating them from Ottawa’s reach.

- Exploring alternative payment systems to reduce reliance on Ottawa-controlled clearing mechanisms. Payments Canada—which Ottawa controls—could be used as a choke point against Alberta institutions. A provincial or private settlement system would blunt that weapon before it can be deployed.

Finally, Alberta should enact an Alberta Financial Rights Act guaranteeing that no one will be denied financial services and that no account can be frozen or closed without due process in open court.

Ottawa will not take this lying down. It can seek court injunctions, threaten ATB’s and our credit unions’ access to national payment systems, or pass legislation directly targeting provincial Crown corporations. Alberta must anticipate these moves now by drafting constitutional challenges, forging alliances with like-minded provinces, and building backup clearing systems.

When the federal government can freeze your account for giving $50 to the “wrong” cause, you are not a free citizen. You are a subject. The treatment of Tamara Lich and Eva Chipiuk’s debanking is a warning.

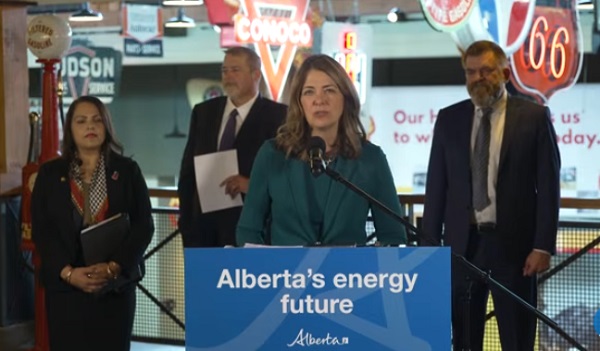

Alberta can either wait for the next wave of financial punishments to hit its citizens, or it can act decisively to make ATB and its provincially regulated credit unions fortresses that protect them. Premier Danielle Smith has a unique opportunity to put Alberta first again—and she should take it.

Marco Navarro-Genie is vice-president of research at the Frontier Centre for Public Policy and co-author, with Barry Cooper, of Canada’s COVID: The Story of a Pandemic Moral Panic (2023).

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta2 days ago

Alberta2 days agoAlberta’s E3 Lithium delivers first battery-grade lithium carbonate

-

Automotive2 days ago

Automotive2 days agoCanada’s EV subsidies are wracking up billions in losses for taxpayers, and not just in the auto industry

-

Business2 days ago

Business2 days agoLA skyscrapers for homeless could cost federal taxpayers over $1 billion

-

Crime1 day ago

Crime1 day agoThe “Strong Borders Act,” Misses the Mark — Only Deep Legal Reforms Will Confront Canada’s Fentanyl Networks

-

Agriculture21 hours ago

Agriculture21 hours ago“We Made it”: Healthy Ostriches Still Alive in Canada

-

Business1 day ago

Business1 day agoUK Government Dismisses Public Outcry, Pushes Ahead with Controversial Digital ID Plan

-

Energy2 days ago

Energy2 days agoNuclear power outperforms renewables every time

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days agoAI chatbots a child safety risk, parental groups report