Business

ESG: The Use of Non-Financial Metrics by the Investment Industry is a Lawsuit Waiting to Happen

Business

Looks like the Liberals don’t support their own Pipeline MOU

From Pierre Poilievre

Business

Canada Can Finally Profit From LNG If Ottawa Stops Dragging Its Feet

From the Frontier Centre for Public Policy

By Ian Madsen

Canada’s growing LNG exports are opening global markets and reducing dependence on U.S. prices, if Ottawa allows the pipelines and export facilities needed to reach those markets

Canada’s LNG advantage is clear, but federal bottlenecks still risk turning a rare opening into another missed opportunity

Canada is finally in a position to profit from global LNG demand. But that opportunity will slip away unless Ottawa supports the pipelines and export capacity needed to reach those markets.

Most major LNG and pipeline projects still need federal impact assessments and approvals, which means Ottawa can delay or block them even when provincial and Indigenous governments are onside. Several major projects are already moving ahead, which makes Ottawa’s role even more important.

The Ksi Lisims floating liquefaction and export facility near Prince Rupert, British Columbia, along with the LNG Canada terminal at Kitimat, B.C., Cedar LNG and a likely expansion of LNG Canada, are all increasing Canada’s export capacity. For the first time, Canada will be able to sell natural gas to overseas buyers instead of relying solely on the U.S. market and its lower prices.

These projects give the northeast B.C. and northwest Alberta Montney region a long-needed outlet for its natural gas. Horizontal drilling and hydraulic fracturing made it possible to tap these reserves at scale. Until 2025, producers had no choice but to sell into the saturated U.S. market at whatever price American buyers offered. Gaining access to world markets marks one of the most significant changes for an industry long tied to U.S. pricing.

According to an International Gas Union report, “Global liquefied natural gas (LNG) trade grew by 2.4 per cent in 2024 to 411.24 million tonnes, connecting 22 exporting markets with 48 importing markets.” LNG still represents a small share of global natural gas production, but it opens the door to buyers willing to pay more than U.S. markets.

LNG Canada is expected to export a meaningful share of Canada’s natural gas when fully operational. Statistics Canada reports that Canada already contributes to global LNG exports, and that contribution is poised to rise as new facilities come online.

Higher returns have encouraged more development in the Montney region, which produces more than half of Canada’s natural gas. A growing share now goes directly to LNG Canada.

Canadian LNG projects have lower estimated break-even costs than several U.S. or Mexican facilities. That gives Canada a cost advantage in Asia, where LNG demand continues to grow.

Asian LNG prices are higher because major buyers such as Japan and South Korea lack domestic natural gas and rely heavily on imports tied to global price benchmarks. In June 2025, LNG in East Asia sold well above Canadian break-even levels. This price difference, combined with Canada’s competitive costs, gives exporters strong margins compared with sales into North American markets.

The International Energy Agency expects global LNG exports to rise significantly by 2030 as Europe replaces Russian pipeline gas and Asian economies increase their LNG use. Canada is entering the global market at the right time, which strengthens the case for expanding LNG capacity.

As Canadian and U.S. LNG exports grow, North American supply will tighten and local prices will rise. Higher domestic prices will raise revenues and shrink the discount that drains billions from Canada’s economy.

Canada loses more than $20 billion a year because of an estimated $20-per-barrel discount on oil and about $2 per gigajoule on natural gas, according to the Frontier Centre for Public Policy’s energy discount tracker. Those losses appear directly in public budgets. Higher natural gas revenues help fund provincial services, health care, infrastructure and Indigenous revenue-sharing agreements that rely on resource income.

Canada is already seeing early gains from selling more natural gas into global markets. Government support for more pipelines and LNG export capacity would build on those gains and lift GDP and incomes. Ottawa’s job is straightforward. Let the industry reach the markets willing to pay.

Ian Madsen is a senior policy analyst at the Frontier Centre for Public Policy.

-

Business1 day ago

Business1 day agoThe EU Insists Its X Fine Isn’t About Censorship. Here’s Why It Is.

-

Focal Points2 days ago

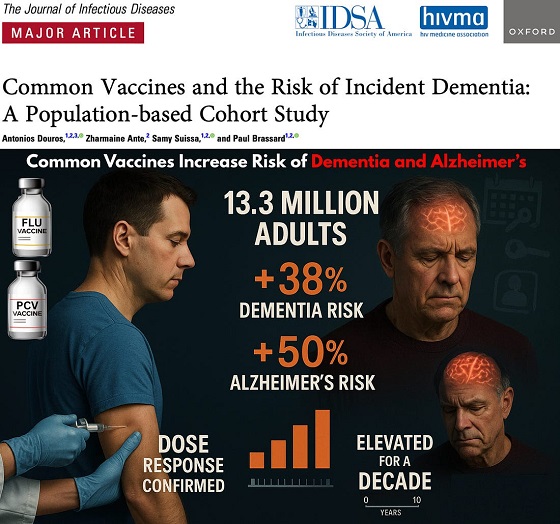

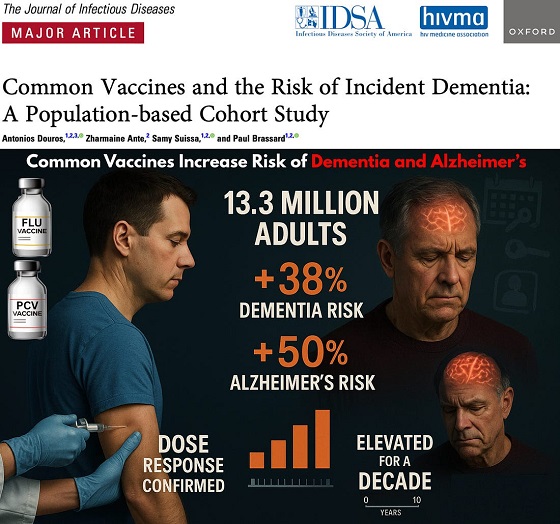

Focal Points2 days agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

National8 hours ago

National8 hours agoLiberal bill “targets Christians” by removing religious exemption in hate-speech law

-

Business1 day ago

Business1 day agoCanada invests $34 million in Chinese drones now considered to be ‘high security risks’

-

Economy1 day ago

Economy1 day agoAffordable housing out of reach everywhere in Canada

-

Health1 day ago

Health1 day agoCDC Vaccine Panel Votes to End Universal Hep B Vaccine for Newborns

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoWayne Gretzky’s Terrible, Awful Week.. And Soccer/ Football.

-

Business18 hours ago

Business18 hours agoThe Climate-Risk Industrial Complex and the Manufactured Insurance Crisis