Business

ESG Is Collapsing And Net Zero Is Going With It

From the Daily Caller News Foundation

By David Blackmon

The chances of achieving the goal of net-zero by 2050 are basically net zero

Just a few years ago, ESG was all the rage in the banking and investing community as globalist governments in the western world focused on a failing attempt to subsidize an energy transition into reality. The strategy was to try to strangle fossil fuel industries by denying them funding for major projects, with major ESG-focused institutional investors like BlackRock and State Street, and big banks like J.P. Morgan and Goldman Sachs leveraging their control of trillions of dollars in capital to lead the cause.

But a funny thing happened on the way to a green Nirvana: It turned out that the chosen rent-seeking industries — wind, solar and electric vehicles — are not the nifty plug-and-play solutions they had been cracked up to be.

Even worse, the advancement of new technologies and increased mining of cryptocurrencies created enormous new demand for electricity, resulting in heavy new demand for finding new sources of fossil fuels to keep the grid running and people moving around in reliable cars.

In other words, reality butted into the green narrative, collapsing the foundations of the ESG movement. The laws of physics, thermodynamics and unanticipated consequences remain laws, not mere suggestions.

Making matters worse for the ESG giants, Texas and other states passed laws disallowing any of these firms who use ESG principles to discriminate against their important oil, gas and coal industries from investing in massive state-governed funds. BlackRock and others were hit with sanctions by Texas in 2023. More recently, Texas and 10 other states sued Blackrock and other big investment houses for allegedly violating anti-trust laws.

As the foundations of the ESG movement collapse, so are some of the institutions that sprang up around it. The United Nations created one such institution, the “Net Zero Asset Managers Initiative,” whose participants maintain pledges to reach net-zero emissions by 2050 and adhere to detailed plans to reach that goal.

The problem with that is there is now a growing consensus that a) the forced march to a green energy transition isn’t working and worse, that it can’t work, and b) the chances of achieving the goal of net-zero by 2050 are basically net zero. There is also a rising consensus among energy companies of a pressing need to prioritize matters of energy security over nebulous emissions reduction goals that most often constitute poor deployments of capital. Even as the Biden administration has ramped up regulations and subsidies to try to force its transition, big players like ExxonMobil, Chevron, BP, and Shell have all redirected larger percentages of their capital budgets away from investments in carbon reduction projects back into their core oil-and-gas businesses.

The result of this confluence of factors and events has been a recent rush by big U.S. banks and investment houses away from this UN-run alliance. In just the last two weeks, the parade away from net zero was led by major banks like Goldman Sachs, Morgan Stanley, Citigroup, Bank of America, Wells Fargo, and, most recently, JP Morgan. On Thursday, the New York Post reported that both BlackRock and State Street, a pair of investment firms who control trillions of investor dollars (BlackRock alone controls more than $10 trillion) are on the brink of joining the flood away from this increasingly toxic philosophy.

In June, 2023, BlackRock CEO Larry Fink made big news when told an audience at the Aspen Ideas Festival in Aspen, Colorado that he is “ashamed of being part of this [ESG] conversation.” He almost immediately backed away from that comment, restating his dedication to what he called “conscientious capitalism.” The takeaway for most observers was that Fink might stop using the term ESG in his internal and external communications but would keep right on engaging in his discriminatory practices while using a different narrative to talk about it.

But this week’s news about BlackRock and the other big firms feels different. Much has taken place in the energy space over the last 18 months, none of it positive for the energy transition or the net-zero fantasy. Perhaps all these big banks and investment funds are awakening to the reality that it will take far more than devising a new way of talking about the same old nonsense concepts to repair the damage that has already been done to the world’s energy system.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Business

Resurfaced Video Shows How Somali Scammers Used Day Care Centers To Scam State

From the Daily Caller News Foundation

A resurfaced 2018 video from a Minneapolis-area TV station shows how Somali scammers allegedly bilked Minnesota out of millions of dollars for services that they never provided.

Independent journalist Nick Shirley touched off a storm on social media Friday after he posted a photo of one day-care center, which displayed a banner calling it “The Greater Learing Center” on X, along with a 42-minute video that went viral showing him visiting that and other day-care centers. The surveillance video, which aired on Fox 9 in 2018 after being taken in 2015, showed parents taking kids into the center, then leaving with them minutes later, according to Fox News.

“They were billing too much, they went up to high,” Hennepin County attorney Mike Freeman told Fox 9 in 2018. “It’s hard to imagine they were serving that many people. Frankly if you’re going to cheat, cheat little, because if you cheat big, you’re going to get caught.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Democratic Gov. Tim Walz of Minnesota was accused of engaging in “systemic” retaliation against whistleblowers in a Nov. 30 statement by state employees. Assistant United States Attorney Joe Thompson announced on Dec. 18 that the amount of suspected fraud in Minnesota’s Medicaid program had reached over $9 billion.

After Shirley’s video went viral, FBI Director Kash Patel announced the agency was already sending additional resources in a Sunday post on X, citing the case surrounding Feeding Our Future, which at one point accused the Minnesota government of racism during litigation over the suspension of funds after earlier allegations of fraud.

KSTP reported that the Quality Learning Center, one of the centers visited by Shirley, had 95 citations for violations from one Minnesota agency between 2019 to 2023.

President Donald Trump announced in a Nov. 21 post on Truth Social that he would end “Temporary Protected Status” for Somalis in the state in response to allegations of welfare fraud and said that the influx of refugees had “destroyed our country.”

Business

Disclosures reveal Minnesota politician’s husband’s companies surged thousands-fold amid Somali fraud crisis

Rep. Ilhan Omar’s latest financial disclosures reveal seemingly sudden wealth accumulation inside her household, even as Minnesota grapples with revelations of massive fraud that may have siphoned more than $9 billion from government programs. The numbers, drawn from publicly filed congressional reports, show two companies tied to Omar’s husband, Tim Mynett, surging in value at a pace that raises more questions than answers.

According to the filings, Rose Lake Capital LLC — a business advisory firm Mynett co-founded in 2022 — jumped from an assessed range of $1 to $1,000 in 2023 to between $5 million and $25 million in 2024. Even using the most conservative assumptions allowed under Congress’ broad valuation ranges, the company’s value would have increased thousands of times in a single year. The firm advertises itself as a facilitator of “deal-making, mergers and acquisitions, banking, politics and diplomacy.”

Archived versions of Rose Lake’s website once showcased an eye-catching lineup of political heavyweights: former Ambassador to Bahrain Adam Ereli, former Sen. Max Baucus, and prominent Democratic National Committee alumni William Derrough and Alex Hoffman. But as scrutiny surrounding Omar intensifies — particularly over whether her political network intersected with sprawling fraud schemes exposed in Minnesota — the company has quietly scrubbed its online footprint. Names and biographies of team members have vanished, and the firm has not clarified whether these figures remain involved. Omar’s office offered no comment when asked to explain the company’s sudden growth or the removal of its personnel listings.

Mynett, Omar’s third husband, has long been a controversial presence in her political orbit, but the dramatic swell in his business holdings comes at a moment when trust in Minnesota’s oversight systems is already badly shaken. Federal and state investigators now estimate that fraud involving pandemic-era and nonprofit programs may exceed $9 billion, a staggering figure for a state often held up as a model of progressive governance. For many residents, the revelation that Omar’s household wealth soared during the same period only deepens skepticism about who benefited from Minnesota’s expansive social-spending apparatus.

The financial story doesn’t stop with Rose Lake. A second Mynett-linked entity, ESTCRU LLC — a boutique winery registered in Santa Rosa, California — reported an assessed value of $1 million to $5 million in 2024. Just a year earlier, Omar disclosed its worth at $15,000 to $50,000. Despite the dramatic valuation spike, ESTCRU’s online storefront does not appear to function, its last social media activity dates back to early 2023, and the phone number listed on its website is no longer in service. As with Rose Lake, Omar’s office declined to comment on the winery’s sudden rise in reported value.

The House clerk has yet to release 2025 disclosures, leaving unanswered how these companies are performing today — and how such explosive growth materialized in the first place.

-

Business15 hours ago

Business15 hours agoDisclosures reveal Minnesota politician’s husband’s companies surged thousands-fold amid Somali fraud crisis

-

International2 days ago

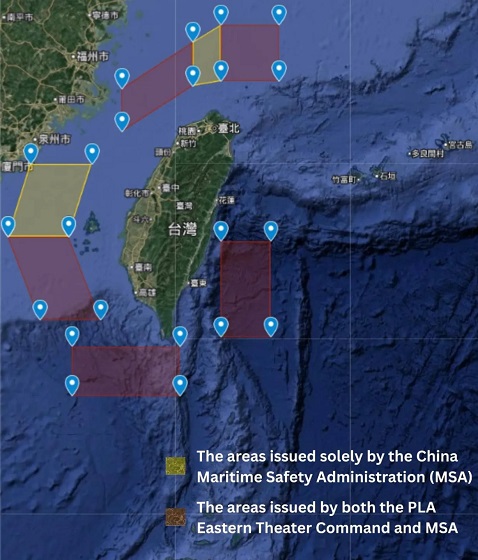

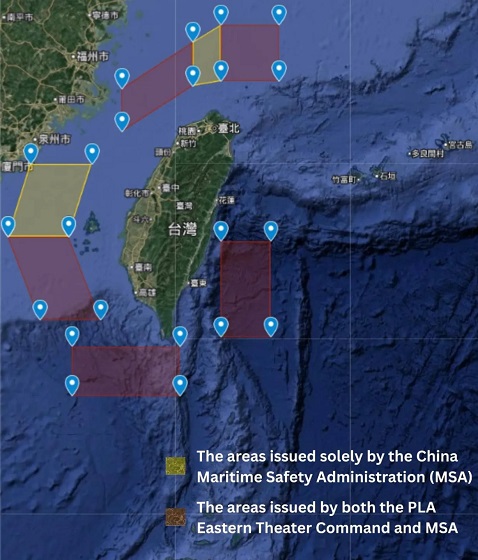

International2 days agoChina Stages Massive Live-Fire Encirclement Drill Around Taiwan as Washington and Japan Fortify

-

Energy2 days ago

Energy2 days agoRulings could affect energy prices everywhere: Climate activists v. the energy industry in 2026

-

Digital ID2 days ago

Digital ID2 days agoThe Global Push for Government Mandated Digital IDs And Why You Should Worry

-

Alberta15 hours ago

Alberta15 hours agoThe Canadian Energy Centre’s biggest stories of 2025

-

Business1 day ago

Business1 day agoCanada needs serious tax cuts in 2026

-

Business1 day ago

Business1 day agoDOOR TO DOOR: Feds descend on Minneapolis day cares tied to massive fraud

-

Business14 hours ago

Business14 hours agoResurfaced Video Shows How Somali Scammers Used Day Care Centers To Scam State