Business

Disney faces losing control of its kingdom with Florida bill

By Mike Schneider in Orlando

ORLANDO, Fla. (AP) — Disney’s government in Florida has been the envy of any private business, with its unprecedented powers in deciding what to build and how to build it at the Walt Disney World Resort, issuing bonds and holding the ability to build its own nuclear plant if it wanted.

Those days are numbered as a new bill released this week puts the entertainment giant’s district firmly in the control of Florida’s governor and legislative leaders in what some see as punishment for Disney’s opposition to the so-called “Don’t Say Gay” lawchampioned by Republican Gov. Ron DeSantis and the Republican-controlled Legislature.

“Disney won’t like it because they’re not in control,” said Richard Foglesong, professor emeritus at Rollins College, who wrote a definitive account of Disney’s Reedy Creek Improvement Districtin his book, “Married to the Mouse: Walt Disney World and Orlando.”

With that loss of control comes an uncertainty about how Disney’s revamped government and Walt Disney World, which it governs, will work together — whether the left hand always will be in sync with the right hand as it has been with the company overseeing both entities.

The uniqueness of Disney’ government, where building inspectors examine black box structures holding thrill rides instead of office buildings, also complicates matters. The district essentially runs a midsize city. On any given day, as many as 350,000 people are on Disney World’s 27,000 acres (11,000 hectares) as theme park visitors, overnight hotel guests or employees. The 55-year-old district has to manage the traffic, dispose of the waste and control the plentiful mosquitoes.

“What kind of control is preferable? Control by a private business or corporation, or control by appointed officials, appointed by governor of the state?” Foglesong said. “Will they have the expertise to be able to make the new district work as efficiently as the old district works?”

The bill prohibits anybody who has worked or had a contract with a theme park or entertainment complex in the past three years, or their relatives, from serving on the revamped district’s board of supervisors, a prohibition that some experts say eliminates people with expertise in the field.

The bill’s sponsor, Florida Rep. Fred Hawkins, a Republican from St. Cloud, defended the exclusion Tuesday.

“This was a provision I requested,” Hawkins said. “We want to try to avoid any conflicts of interest of the new board members.”

Under the bill’s proposals, Florida’s governor appoints the five-member board of supervisors to the renamed Central Florida Tourism Oversight District instead of Disney. Limits would be placed on the district’s autonomy by making it subject to oversight and regulation by state agencies, and it would be unable to adopt any codes that conflict with state regulations. The district also would no longer have the ability, if it wanted, to own and operate an airport, stadium, convention center or nuclear power plant.

DeSantis started gunning for Disney’s private government last year when the entertainment giant publicly opposed what critics call the “Don’t Say Gay” law, which bars instruction on sexual orientation, gender identity and other lessons deemed not age-appropriate in kindergarten through third grade. Republican critics of the Disney district also argued it has given the company an unfair advantage over rivals in issuing bonds and financing expansion.

The Legislature passed a bill last year to dissolve the Disney government by June 2023.

Lawmakers are meeting this week for a special session to complete the state takeover of the district and approve other key conservative priorities of the governor on immigration and voter fraud. A Senate committee approved separate bills Tuesday to expand the governor’s migrant relocation program and allow the statewide prosecutor to bring election crime charges.

Florida Rep. Anna Eskamani, a Democrat from Orlando, calledthe Disney bill on Monday a “power grab” by DeSantis, a potential 2024 presidential candidate who has emerged as a fierce opponent of what he describes as “woke” policies on race, gender and public health. Such positions endear him to the GOP’s conservative base but threaten to alienate independents and moderate voters in both parties who are influential in presidential politics.

The changes proposed in the legislation were welcomed by at least one group of Reedy Creek employees — firefighters who have clashed in the past with district leaders. Tim Stromsnes, a spokesperson for Reedy Creek Professional Firefighters Local 2117, said all the current board cares about is “bonds and low-interest loans for building Disney infrastructure, and zero about treating its employees fairly.”

“We think they are going to be more receptive to first responders,” Stomsnes said Tuesday of the proposed new board. “They’re calling the governor a fascist for doing this … but he is actually fixing a fascist, Disney-owned government.”

To the relief of taxpayers in neighboring Orange and Osceola counties, the district won’t be dissolved, a prospect that had raised fears that the counties would have to absorb the district’s responsibilities and raise property taxes significantly. The Reedy Creek Improvement District has more than $1 billion in bond debt.

In a statement, Orange County said officials were monitoring the bill.

The new bill appears to address some key questions raised by last year’s legislation, primarily preserving the district’s ability to raise revenue and service outstanding debt, said Michael Rinaldi, head of local government ratings for Fitch Ratings.

Foglesong expects a legal challenge should the bill pass. Disney didn’t respond to an inquiry asking about any potential lawsuits.

“Disney works under a number of different models and jurisdictions around the world, and regardless of the outcome, we remain committed to providing the highest quality experience for the millions of guests who visit each year,” Jeff Vahle, president of Walt Disney World Resort, said in a statement.

Disney could make an argument that their rights as a private business are being undermined, Foglesong said.

“It will have political appeal, the arguments they make, in a Republican state for a potential presidential candidate,” Foglesong said. “It will be like, legally, ‘How can you do this to us?’ and politically, ‘How can you do this to a corporation that has done so much for the state of Florida?'”

___

Associated Press writer Anthony Izaguirre in Tallahassee, Florida contributed to this report.

___

Follow Mike Schneider on Twitter at @MikeSchneiderAP

Business

Rhetoric—not evidence—continues to dominate climate debate and policy

From the Fraser Institute

Myths, fallacies and ideological rhetoric continue to dominate the climate policy discussion, leading to costly and ineffective government policies,

according to a new study published today by the Fraser Institute, an independent, nonpartisan Canadian public policy think-tank.

“When considering climate policies, it’s important to understand what the science and analysis actually show instead of what the climate alarmists believe to be true,” said Kenneth P. Green, Fraser Institute senior fellow and author of Four Climate Fallacies.

The study dispels several myths about climate change and popular—but ineffective—emission reduction policies, specifically:

• Capitalism causes climate change: In fact, according to several environment/climate indices and the Fraser Institute’s annual Economic Freedom of the World Index, the more economically free a country is, the more effective it is at protecting its environment and combatting climate change.

• Even small-emitting countries can do their part to fight climate change: Even if Canada reduced its greenhouse gas emissions to zero, there would be

little to no measurable impact in global emissions, and it distracts people from the main drivers of emissions, which are China, India and the developing

world.

• Vehicle electrification will reduce climate risk and clean the air: Research has shown that while EVs can reduce GHG emissions when powered with

low-GHG energy, they often are not, and further, have offsetting environmental harms, reducing net environmental/climate benefits.

• Carbon capture and storage is a viable strategy to combat climate change: While effective at a small scale, the benefits of carbon capture and

storage to reduce global greenhouse gas emissions on a massive scale are limited and questionable.

“Citizens and their governments around the world need to be guided by scientific evidence when it comes to what climate policies make the most sense,” Green said.

“Unfortunately, the climate policy debate is too often dominated by myths, fallacies and false claims by activists and alarmists, with costly and ineffective results.”

Kenneth P. Green

Senior Fellow, Fraser Institute

Business

Canada’s economic pain could be a blessing in disguise

This article supplied by Troy Media.

By Roslyn Kunin

By Roslyn Kunin

Tariffs, inflation, and falling incomes sound bad, but what if they’re forcing us to finally fix what’s broken?

Canada is facing serious economic headwinds—from falling incomes to rising inflation and U.S. trade hostility—but within this turmoil lies an opportunity. If we respond wisely, this crisis could become a turning point, forcing long-overdue reforms and helping us build a stronger, more independent economy.

Rather than reacting out of frustration, we can use these challenges to reassess what’s holding us back and move forward with practical solutions. From

trade policy to labour shortages and energy development, there are encouraging shifts already underway if we stay focused.

A key principle when under pressure is not to make things worse for ourselves. U.S. tariffs on Canadian steel and aluminum, and the chaotic renegotiation of NAFTA/CUSMA, certainly hurt our trade-dependent economy. But retaliatory tariffs don’t work in our favour. Canadian imports make

up a tiny fraction of the U.S. economy, so countermeasures barely register there, while Canadian consumers end up paying more. The federal government’s own countertariffs on items like orange juice and whisky raised costs here without changing American policy.

Fortunately, more Canadians are starting to realize this. Some provinces have reversed bans on U.S. goods. Saskatchewan, for example, recently lifted

restrictions on American alcohol. These decisions reflect a growing recognition that retaliating out of pride often means punishing ourselves.

More constructively, Canada is finally doing what should have happened long ago: diversifying trade. We’ve put too many economic eggs in one

basket, relying on an unpredictable U.S. market. Now, governments and businesses are looking for buyers elsewhere, an essential step toward greater stability.

At the same time, we’re starting to confront domestic barriers that have held us back. For years, it’s been easier for Canadian businesses to trade with the U.S. than to ship goods across provincial borders. These outdated restrictions—whether on wine, trucks or energy—have fractured our internal market. Now, federal and provincial governments are finally taking steps to create a unified national economy.

Labour shortages are another constraint limiting growth. Many Canadian businesses can’t find the skilled workers they need. But here, too, global shifts

are opening doors. The U.S.’s harsh immigration and research policies are pushing talent elsewhere, and Canada is emerging as the preferred alternative.

Scientists, engineers and graduate students, especially in tech and clean energy, are increasingly choosing Canada over the U.S. due to visa uncertainty and political instability. Our universities are already benefiting. If we continue to welcome international students and skilled professionals, we’ll gain a long-term advantage.

Just as global talent is rethinking where to invest their future, Canada has a chance to reassert leadership in one of its foundational industries: energy.

The federal government is now adopting a more balanced climate policy, shifting away from blanket opposition to carbon-based energy and focusing instead on practical innovation. Technologies such as carbon capture and storage are reducing emissions and helping clean up so-called dirty oil. These cleaner energy products are in demand globally.

To seize that opportunity, we need infrastructure: pipelines, refining capacity and delivery systems to get Canadian energy to world markets and across our own country. Projects like the Trans Mountain pipeline expansion, along with east-west grid connections and expanded refining, are critical to reducing dependence on U.S. imports and unlocking Canada’s full potential.

Perhaps the most crucial silver lining of all is a renewed awareness of the value of this country. As we approach July 1, more Canadians are recognizing how fortunate we are. Watching the fragility of democracy in the U.S., and confronting the uncomfortable idea of being reduced to a 51st state, has reminded us that Canada matters. Not just to us, but to the world.

Dr. Roslyn Kunin is a respected Canadian economist known for her extensive work in economic forecasting, public policy, and labour market analysis. She has held various prominent roles, including serving as the regional director for the federal government’s Department of Employment and Immigration in British Columbia and Yukon and as an adjunct professor at the University of British Columbia. Dr. Kunin is also recognized for her contributions to economic development, particularly in Western Canada.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Alberta23 hours ago

Alberta23 hours agoAlberta health care blockbuster: Province eliminating AHS Health Zones in favour of local decision-making!

-

Crime2 days ago

Crime2 days agoUK finally admits clear evidence linking Pakistanis and child grooming gangs

-

conflict1 day ago

conflict1 day agoTrump: ‘We’ have control over Iranian airspace; know where Khomeini is hiding

-

Health2 days ago

Health2 days agoLast day and last chance to win this dream home! Support the 2025 Red Deer Hospital Lottery before midnight!

-

Business2 days ago

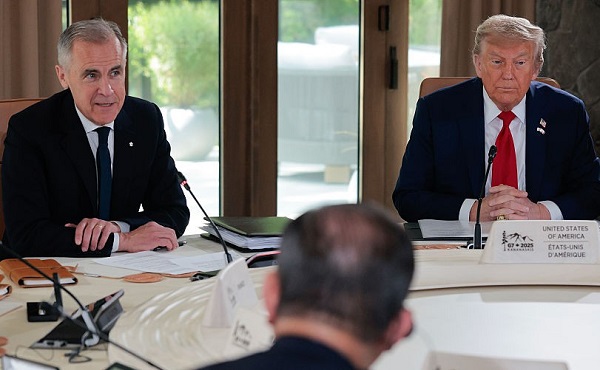

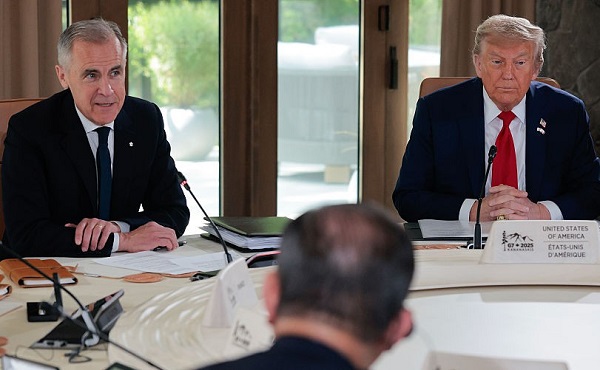

Business2 days agoCarney praises Trump’s world ‘leadership’ at G7 meeting in Canada

-

Alberta14 hours ago

Alberta14 hours agoAlberta pro-life group says health officials admit many babies are left to die after failed abortions

-

conflict2 days ago

conflict2 days agoIsrael bombs Iranian state TV while live on air

-

Daily Caller14 hours ago

Daily Caller14 hours ago‘Not Held Hostage Anymore’: Economist Explains How America Benefits If Trump Gets Oil And Gas Expansion