Business

Department of Energy returning $13B climate agenda funding to taxpayers

From The Center Square

By

The U.S. Department of Energy will be returning to American taxpayers $13 billion in “unobligated wasteful spending” that was originally intended for former President Joe Biden’s climate agenda.

In response, Larry Behrens from Power the Future told The Center Square that “by returning $13 billion, the Department of Energy under President Trump is showing respect for taxpayers and a willingness to end funding for programs that don’t work.”

Power the Future is a nonprofit dedicated to Americans who work in reliable energy sources.

Behrens told The Center Square that the Department of Energy’s action “is a welcome step toward restoring accountability and letting free markets – not bureaucrats – determine our energy future.”

“The American people made it crystal clear at the ballot box that they don’t want another taxpayer dollar wastefully spent on green scam pet projects,” Behrens said.

Diana Furchtgott-Roth of the Heritage Foundation told The Center Square that with the return of $13 billion, “the deficit will be lower than otherwise.”

When asked what other actions the Department of Energy should take to end wasteful spending, Furchtgott-Roth said that “the Department should comb through its budget and see what projects can be accomplished by the private sector, then end those projects.”

“The Department should also look through its regulations and see which ones impose costs on businesses and families,” Furchtgott-Roth said.

“For instance, the Department should eliminate appliance regulations that prevent companies from producing the gas stoves, boilers, or water heaters that people want to buy,” Furchtgott Roth said.

The Department of Energy announced Wednesday its “intention to return more than $13 billion in unobligated funds initially appropriated to advance the previous Administration’s wasteful Green New Scam agenda.”

The department said its announcement reflects “the [Trump] Administration’s commitment to halt wasteful spending and refocus the department to its core mission.”

For instance, Trump signed the Working Families Tax Cut into law earlier this year, the release said, which “directed the Energy Department to rein in bloated federal spending and expedite the return of unobligated funds to the U.S. Treasury to support hardworking Americans.

“The Department of Energy is working to advance its critical mission of unleashing affordable, reliable and secure energy for all Americans while increasing efficiency and promoting better stewardship of taxpayer dollars,” the release said.

The Department of Energy has not yet responded to The Center Square’s request for comment.

U.S. Secretary of Energy Chris Wright said in the news release: “The American people elected President Trump largely because of the last administration’s reckless spending on climate policies that fed inflation and failed to provide any real benefit to the American people.”

“Thanks to President Trump and Congress, those days are over,” Wright said.

Renewable energy group American Council on Renewable Energy has not yet responded to The Center Square’s two requests for comment.

Behrens told The Center Square, “keep in mind it was Biden’s DOE that funneled billions to an electric vehicle charging program that failed to deliver results.”

“Over $6 billion in EV charging funding has now been flagged as wasteful,” Behrens said.

Behrens also referred The Center Square to a White House document entitled “Ending the Green New Scam.”

Furchtgott-Roth informed The Center Square that “in general, states with the most expensive electricity require renewables (with the exception of Alaska), and states with the least expensive electricity do not require renewables.”

“States should prioritize affordable, resilient, reliable energy,” Furchtgott-Roth said.

“This means getting rid of requirements that a share of electricity be produced with renewables,” Furchtgott-Rott said.

Business

BC Ferries Deal With China Risks Canada’s Security

From the Frontier Centre for Public Policy

A BC Ferries contract with China risks national security, public transparency and Canadian safety. Why are we still looking the other way?

Scott McGregor exposes how a billion-dollar BC Ferries deal with a Chinese shipyard reflects a deeper failure: Canadian institutions are shielding Beijing’s interests—at taxpayers’ expense—while ignoring glaring national security risks.

BC Ferries, the taxpayer-owned company operating ferry services along the B.C. coast, didn’t just sign a billion-dollar shipbuilding contract in China; it handed Beijing leverage over Canadian infrastructure.

Behind the bureaucratic talk of cost and efficiency lies a deeper scandal: a taxpayer-funded deal that puts national security, public transparency and Canadian citizens at risk, all to benefit a hostile regime.

When theBreaker.news, an independent investigative outlet in BC, filed freedom of information requests to uncover the contract’s details, BC Ferries refused to release a single page. The excuse? Disclosure might threaten its financial position, safety and the “interests of third parties.”

This refusal didn’t happen in a vacuum. It came the same day Chinese President Xi Jinping stood next to Russian President Vladimir Putin and North Korean leader Kim Jong Un in Beijing, giving a vivid display of authoritarian solidarity.

BC Ferries’ secrecy is bad optics. It flies in the face of multiple rulings by the B.C. Information and Privacy Commissioner, who has repeatedly upheld the public’s right to see contracts signed by public bodies. Cities and Crown corporations have been ordered to disclose their agreements with FIFA, the international soccer governing body, and with B.C. Place Stadium.

In fact, public institutions have disclosed deals far less sensitive than this one. Yet BC Ferries, propped up by a $1-billion loan from the Canada Infrastructure Bank (CIB), insists its Chinese shipbuilder must remain shielded from scrutiny. The result isn’t protection for taxpayers. It’s protection for Beijing’s leverage.

And that’s just the beginning. The more dangerous problem is legal. Canada has no bilateral agreements with China to guarantee fair legal treatment of its citizens. No non-prosecution provisions. No mutual legal assistance mechanisms. No safety net.

At home, corporations can sign remediation agreements to avoid prosecution if they cooperate and commit to reforms. But those agreements stop at Canada’s borders. They offer no protection for Canadians working in Weihai, the Chinese city where the vessels are built. If a dispute arises or Beijing flexes its power, those Canadians could face arbitrary detention, exit bans or national security charges. In a diplomatic crisis, they could become pawns.

This isn’t a theoretical risk. Michael Kovrig and Michael Spavor spent nearly three years in Chinese prisons after Canada detained Huawei executive Meng Wanzhou. That episode exposed the Chinese Communist Party’s playbook of hostage diplomacy. It should have ruled out any deal that places Canadian citizens or Crown assets under Chinese jurisdiction.

Yet even with that memory still fresh, the arrangement continues, quietly, with little public debate.

What we’re witnessing is a textbook case of hybrid warfare. Economic deals masked as trade. State financing disguised as commercial contracts. Political leverage embedded in infrastructure projects. And Canada, still clinging to the outdated promises of globalization, is paying for its own exposure.

At the moment when Beijing is supplying components for Russia’s war machine, Ottawa is greenlighting the outsourcing of core coastal infrastructure to a state-owned Chinese shipyard.

Parliament appears to be taking notice of the situation. The House of Commons Transport Committee has initiated a review of the $1 billion federal loan associated with the BC Ferries deal. The expected witnesses for this review include the CEO of the corporation, the CEO of the Canada Infrastructure Bank (CIB), Transport Minister Chrystia Freeland and Infrastructure Minister Gregor Robertson.

The review follows political pushback, including criticism from Freeland, who resigned from cabinet on Sept. 16, and had previously called the outsourcing decision “disappointing.”

This review is necessary because BC Ferries is a Crown-owned utility, governed by an NDP-appointed board and funded through federal support.

When a public entity conceals the terms of a massive contract and hands work to a Chinese state-controlled firm, it’s not just acting secretively. It’s normalizing a culture of opacity that weakens Canadian sovereignty and shields foreign interests from democratic accountability.

BC Ferries defends the deal by pointing to its projected economic benefits: four new major vessels, hybrid propulsion systems, 50,000 job-years and more than $4.5 billion in forecasted economic output.

But those figures come at the cost of strategic blindness.

Time and again, Canadian policymakers treat China like an ordinary business partner, even as the Chinese Communist Party uses law, finance and supply chains as tools of global influence. While other democracies are pulling back from partnerships with Chinese state firms, Canada looks the other way, tethered to outdated trade assumptions and short-term economics.

The remedy starts with sunlight. Contracts signed by public bodies must be disclosed, especially when they involve authoritarian regimes. But transparency is only the first step.

Canada must adopt a hybrid warfare lens for every major economic decision. That means asking hard questions: Does this deal strengthen or weaken our position? Does it open the door to foreign influence? Does it endanger Canadians abroad? Short-term savings can breed long-term dependency, and in China’s case, geopolitical exposure.

BC Ferries’ shipbuilding contract with China isn’t just a procurement mistake. It’s a warning.

Without legal safeguards, public oversight and strategic foresight, Canada isn’t just buying ferries; it’s handing over control.

And Canadians deserve better.

Scott McGregor is an intelligence consultant and co-author of The Mosaic Effect. He is a senior fellow at the Council on Countering Hybrid Warfare and writes here for the Frontier Centre for Public Policy.

Business

Canada Is Still Paying The Price For Trudeau’s Fiscal Delusions

From the Frontier Centre for Public Policy

By Lee Harding

Trudeau’s reckless spending has left Canadians with record debt, poorer services and no path back to a balanced budget.

It’s time for Canada to break free from Trudeau’s big-spending legacy. With soaring deficits, mounting debt, and stalled growth, we need a budget that cuts red tape, flattens taxes, and puts the economy first.

Justin Trudeau may be gone, but the economic consequences of his fiscal approach, chronic deficits, rising debt costs and stagnating growth, are still weighing heavily on Canada.

Before becoming prime minister, Justin Trudeau famously said, “The budget will balance itself.” He argued that if expenditures stayed the same, economic growth would drive higher tax revenues and eventually outpace spending. Voila–balance!

But while the theory may have been sound, Trudeau had no real intention of pursuing a balanced budget. In 2015, he campaigned on intentionally overspending and borrowing to build infrastructure, arguing that low interest rates made it the right time to run deficits.

This argument, weak in its concept, proved even more flawed in practice. Post-pandemic deficits have been horrendous, far exceeding the modest overspending initially promised. The budgetary deficit was $327.7 billion in 2020–21, $90.3 billion the year following, and between $35.3 billion and $61.9 billion in the years since.

Those formerly historically low interest rates are also gone now, partly because the federal government has spent so much. The original excuse for deficits has vanished, but the red ink and Canada’s infrastructure deficit remain.

For two decades, interest payments on federal debt steadily declined, falling from 24.6 per cent of government revenues in 1999–2000 to just 5.9 per cent in 2021–22, thanks largely to falling interest rates and prior fiscal restraint. But that trend has reversed. By 2023–24, payments surged past 10 per cent for the first time in over a decade, as rising interest rates collided with record federal debt built up under Trudeau.

Rising debt costs are only part of the story. Federal revenues aren’t what they could have been because Canada’s economy has stagnated. Population growth pads our overall GDP growth stats, but masks our productivity problem. From 2014 to 2022, Canada had near-lowest GDP growth among 30 countries in the Organization for Economic Co-operation and Development. Canada’s average growth rate during that period (0.6 per cent) was only ahead of Luxembourg (0.5 per cent) and Mexico (0.4 per cent).Why should a country like Canada, so blessed with natural resources and know-how, do so poorly? Capital investment has fled because our government has made onerous regulations, especially hindering our energy industry. In theory, there’s now a remedy. Thanks to new legislation, the Carney government can extend its magic sceptre to those who align with its agenda to fast-track major projects and bypass the labyrinth it created. But unless you’re onside, the red tape still strangles you.

But as the private sector withers under red tape, Ottawa’s civil service keeps ballooning. Some trimming has begun, rattling public sector unions. Still, Canada will be left with at least five times as many federal tax employees per capita as the U.S.

Canada also needs to ease its hell-bent pursuit of net-zero carbon emissions. Hydrocarbons still power the Canadian economy, from vehicles to home heating, and aren’t practically replaceable. Canada has already demonstrated that pursuing net-zero targets can result in near-zero per capita growth. Despite high immigration, the OECD projects Canada to have the lowest overall GDP growth from 2030 to 2060.

The Nov. 4 release of the federal budget is better late than never. So would be a plan to grow the economy, slash red tape and eliminate the deficit. But we’re unlikely to get one.

Lee Harding is a research fellow with the Frontier Centre for Public Policy.

-

Business1 day ago

Business1 day agoCanadians responsible for $2.3 trillion in government debt: Every single person in Alberta owes $40,939

-

Business2 days ago

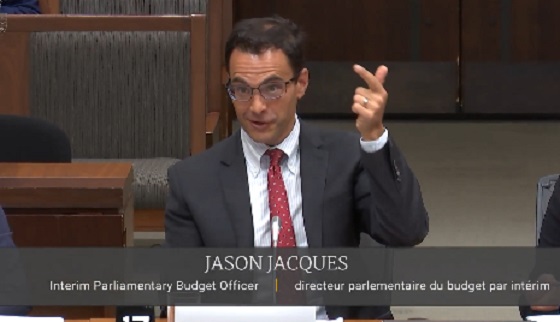

Business2 days ago“If you don’t change, this is dying.” PBO warns Carney’s massive deficits are an extinction level threat

-

Agriculture2 days ago

Agriculture2 days agoThe Fight to Save 398 Ostriches in British Columbia: A Test of Ethics, Science, and Policy

-

Business2 days ago

Business2 days agoTrump approves deal for majority-American control of controversial app TikTok

-

Business5 hours ago

Business5 hours agoBC Ferries Deal With China Risks Canada’s Security

-

Business24 hours ago

Business24 hours agoCanada Is Still Paying The Price For Trudeau’s Fiscal Delusions

-

International14 hours ago

International14 hours agoTrump says he won’t back down on Antifa terrorism designation

-

Health1 day ago

Health1 day agoRFK Jr. says US rejects WHO with powerful message about sovereignty and the chronic disease crisis