Canadian Energy Centre

Coastal GasLink completion key to unlocking Canadian natural gas for the world

Construction underway on the Coastal GasLink pipeline, which will transport natural gas from northeast BC to the LNG Canada terminal in Kitimat. Photograph courtesy of Coastal GasLink

From the Canadian Energy Centre

By Cody CionaOnce the pipeline is in service, 17 of the twenty First Nations along the pipeline route have signed an agreement for the option to buy a 10 per cent stake

Canada’s natural gas industry has made a major step forward in efforts to export much needed supply to energy-hungry markets in Asia.

The key is the completion of the Coastal GasLink pipeline at the end of 2023.

The project, nearly 12 years in the making, is Canada’s only natural gas export pipeline to the west coast.

It will deliver supply to the port of Kitimat, about 1,400 kilometres northwest of Vancouver. There it will be supercooled and turned into the lowest carbon liquefied natural gas (LNG) in the world and shipped across to global customers from the export facility. That facility is expected to begin operations next year.

It is estimated that the two projects could reduce between 60 to 90 million tonnes of global emissions per year by replacing coal-fired power in Asia

“Coastal GasLink reached mechanical completion in early November 2023 ahead of schedule and is ready to deliver natural gas to LNG Canada’s facility, which will depend on their own commissioning process,” said Natasha Westover, manager of external relations for TC Energy

“Which means, sustainably produced LNG could be shipped to global markets by 2025, via this world-class, safety-leading pipeline.”

The project continues momentum for economic reconciliation with Indigenous communities, with Coastal GasLink set to become one of Canada’s largest infrastructure projects with Indigenous ownership.

Once the pipeline is in service, 17 of the twenty First Nations along the pipeline route have signed an agreement for the option to buy a 10 per cent stake.

“The opportunity was made available to all 20 Indigenous communities holding existing agreements with Coastal GasLink and is an important step on the path to true partnership through equity ownership in the project,” Westover said.

The ownership stakes are in addition to numerous agreements and contracts reached with Indigenous communities along Coastal GasLink’s path. In all, the project spent $1.8 billion with Indigenous and local businesses.

According to TC Energy, the project created more than 25,700 full-time equivalent jobs and took 55 million hours to complete. The project generated $3.2 billion to B.C.’s GDP, some $331 million in tax revenue, and $3.95 billion in spending with B.C. businesses and suppliers.

As well, during construction, Coastal GasLink and TC Energy spent over $13 million in community investments and sponsorships to support local and Indigenous community initiatives.

Once operating, it is estimated that over $26 million in annual tax revenue will be generated for communities along the pipeline’s path. Even with construction coming to an end, local communities will continue to see economic spinoffs. More than $42 million is expected to be generated each year through local economic activity.

“These accomplishments mark the end of the project’s five-year construction phase, during which time our workers, contractors, Indigenous and local communities collaborated to complete Canada’s first pipeline to the west coast in 70 years,” Westover said.

Work will now continue on environmental reclamation and preparing communities and workers for the start of operations.

“Coastal GasLink looks forward to continuing to be a part of the local community as we prepare for safe operations for decades to come,” Westover said.

Canadian Energy Centre

Cross-Canada economic benefits of the proposed Northern Gateway Pipeline project

From the Canadian Energy Centre

Billions in government revenue and thousands of jobs across provinces

Announced in 2006, the Northern Gateway project would have built twin pipelines between Bruderheim, Alta. and a marine terminal at Kitimat, B.C.

One pipeline would export 525,000 barrels per day of heavy oil from Alberta to tidewater markets. The other would import 193,000 barrels per day of condensate to Alberta to dilute heavy oil for pipeline transportation.

The project would have generated significant economic benefits across Canada.

The following projections are drawn from the report Public Interest Benefits of the Northern Gateway Project (Wright Mansell Research Ltd., July 2012), which was submitted as reply evidence during the regulatory process.

Financial figures have been adjusted to 2025 dollars using the Bank of Canada’s Inflation Calculator, with $1.00 in 2012 equivalent to $1.34 in 2025.

Total Government Revenue by Region

Between 2019 and 2048, a period encompassing both construction and operations, the Northern Gateway project was projected to generate the following total government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $11.5 billion

- Federal government revenue: $8.9 billion

- Total: $20.4 billion

Alberta

- Provincial government revenue: $49.4 billion

- Federal government revenue: $41.5 billion

- Total: $90.9 billion

Ontario

- Provincial government revenue: $1.7 billion

- Federal government revenue: $2.7 billion

- Total: $4.4 billion

Quebec

- Provincial government revenue: $746 million

- Federal government revenue: $541 million

- Total: $1.29 billion

Saskatchewan

- Provincial government revenue: $6.9 billion

- Federal government revenue: $4.4 billion

- Total: $11.3 billion

Other

- Provincial government revenue: $1.9 billion

- Federal government revenue: $1.4 billion

- Total: $3.3 billion

Canada

- Provincial government revenue: $72.1 billion

- Federal government revenue: $59.4 billion

- Total: $131.7 billion

Annual Government Revenue by Region

Over the period 2019 and 2048, the Northern Gateway project was projected to generate the following annual government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $340 million

- Federal government revenue: $261 million

- Total: $601 million per year

Alberta

- Provincial government revenue: $1.5 billion

- Federal government revenue: $1.2 billion

- Total: $2.7 billion per year

Ontario

- Provincial government revenue: $51 million

- Federal government revenue: $79 million

- Total: $130 million per year

Quebec

- Provincial government revenue: $21 million

- Federal government revenue: $16 million

- Total: $37 million per year

Saskatchewan

- Provincial government revenue: $204 million

- Federal government revenue: $129 million

- Total: $333 million per year

Other

- Provincial government revenue: $58 million

- Federal government revenue: $40 million

- Total: $98 million per year

Canada

- Provincial government revenue: $2.1 billion

- Federal government revenue: $1.7 billion

- Total: $3.8 billion per year

Employment by Region

Over the period 2019 to 2048, the Northern Gateway Pipeline was projected to generate the following direct, indirect and induced full-time equivalent (FTE) jobs by region:

British Columbia

- Annual average: 7,736

- Total over the period: 224,344

Alberta

- Annual average: 11,798

- Total over the period: 342,142

Ontario

- Annual average: 3,061

- Total over the period: 88,769

Quebec

- Annual average: 1,003

- Total over the period: 29,087

Saskatchewan

- Annual average: 2,127

- Total over the period: 61,683

Other

- Annual average: 953

- Total over the period: 27,637

Canada

- Annual average: 26,678

- Total over the period: 773,662

Business

Natural gas pipeline ownership spreads across 36 First Nations in B.C.

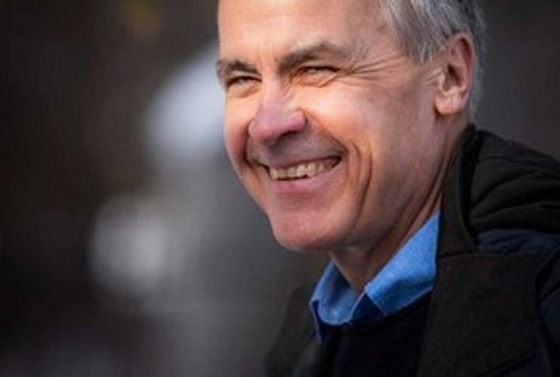

Chief David Jimmie is president of Stonlasec8 and Chief of Squiala First Nation in B.C. He also chairs the Western Indigenous Pipeline Group. Photo courtesy Western Indigenous Pipeline Group

From the Canadian Energy Centre

Stonlasec8 agreement is Canada’s first federal Indigenous loan guarantee

The first federally backed Indigenous loan guarantee paves the way for increased prosperity for 36 First Nations communities in British Columbia.

In May, Canada Development Investment Corporation (CDEV) announced a $400 million backstop for the consortium to jointly purchase 12.5 per cent ownership of Enbridge’s Westcoast natural gas pipeline system for $712 million.

In the works for two years, the deal redefines long-standing relationships around a pipeline that has been in operation for generations.

“For 65 years, there’s never been an opportunity or a conversation about participating in an asset that’s come through the territory,” said Chief David Jimmie of the Squiala First Nation near Vancouver, B.C.

“We now have an opportunity to have our Nation’s voices heard directly when we have concerns and our partners are willing to listen.”

Jimmie chairs the Stonlasec8 Indigenous Alliance, which represents the communities buying into the Enbridge system.

The name Stonlasec8 reflects the different regions represented in the agreement, he said.

The Westcoast pipeline stretches more than 2,900 kilometres from northeast B.C. near the Alberta border to the Canada-U.S. border near Bellingham, Wash., running through the middle of the province.

It delivers up to 3.6 billion cubic feet per day of natural gas throughout B.C. and the Lower Mainland, Alberta and the U.S. Pacific Northwest.

“While we see the benefits back to communities, we are still reminded of our responsibility to the land, air and water so it is important to think of reinvestment opportunities in alternative energy sources and how we can offset the carbon footprint,” Jimmie said.

He also chairs the Western Indigenous Pipeline Group (WIPG), a coalition of First Nations communities working in partnership with Pembina Pipeline to secure an ownership stake in the newly expanded Trans Mountain pipeline system.

There is overlap between the communities in the two groups, he said.

CDEV vice-president Sébastien Labelle said provincial models such as the Alberta Indigenous Opportunities Corporation (AIOC) and Ontario’s Indigenous Opportunities Financing Program helped bring the federal government’s version of the loan guarantee to life.

“It’s not a new idea. Alberta started it before us, and Ontario,” Labelle said.

“We hired some of the same advisors AIOC hired because we want to make sure we are aligned with the market. We didn’t want to start something completely new.”

Broadly, Jimmie said the Stonlasec8 agreement will provide sustained funding for investments like housing, infrastructure, environmental stewardship and cultural preservation. But it’s up to the individual communities how to spend the ongoing proceeds.

The long-term cash injections from owning equity stakes of major projects can provide benefits that traditional funding agreements with the federal government do not, he said.

Labelle said the goal is to ensure Indigenous communities benefit from projects on their traditional territories.

“There’s a lot of intangible, indirect things that I think are hugely important from an economic perspective,” he said.

“You are improving the relationship with pipeline companies, you are improving social license to do projects like this.”

Jimmie stressed the impact the collaborative atmosphere of the negotiations had on the success of the Stonlasec8 agreement.

“It takes true collaboration to reach a successful partnership, which doesn’t always happen. And from the Nation representation, the sophistication of the group was one of the best I’ve ever worked with.”

-

conflict2 days ago

conflict2 days agoOne dead, over 60 injured after Iranian missiles pierce Iron Dome

-

Crime11 hours ago

Crime11 hours agoManhunt on for suspect in shooting deaths of Minnesota House speaker, husband

-

Business36 mins ago

Business36 mins agoCarney’s European pivot could quietly reshape Canada’s sovereignty

-

Alberta15 mins ago

Alberta15 mins agoAlberta’s grand bargain with Canada includes a new pipeline to Prince Rupert