Fraser Institute

Claims about ‘unmarked graves’ don’t withstand scrutiny

From the Fraser Institute

By Tom Flanagan

The new book Dead Wrong: How Canada Got the Residential School Story So Wrong is a follow-up to Grave Error, published by True North in 2023. Grave Error instantly became a best-seller. People wanted to read the book because it contained well-documented information not readily available elsewhere concerning the history of Canada’s Indian Residential Schools (IRS) and the facts surrounding recent claims about “unmarked graves.”

Why another book? Because the struggle for accurate information continues. Let me share with you a little of what’s in Dead Wrong.

Outrageously, the New York Times, one of the world’s most prestigious newspapers, has never retracted its absurd headline that “mass graves” were uncovered in Kamloops, British Columbia. Jonathan Kay, the North American editor of Quillette, exposes that scandal.

The legacy media were enthused about the so-called documentary Sugarcane, a feature-length film sponsored by National Geographic, which was nominated for an Academy Award. The only reporter to spot the dozens of factual errors in Sugarcane was independent journalist Michelle Stirling; Dead Wrong includes her analysis “The Bitter Roots of Sugarcane.”

In the spring of 2024, the small city of Quesnel, B.C., made national news when the mayor’s wife bought 10 copies of Grave Error for distribution to friends. After noisy protests held by people who had never read the book, Quesnel city council voted to censure Mayor Ron Paull and tried to force him from office. It’s all described in Dead Wrong.

Also not to be forgotten is how the Law Society of B.C. forced upon its members training materials asserting against all evidence that children’s remains have been discovered in Kamloops. As told by James Pew, B.C. MLA Dallas Brodie was expelled from the Conservative caucus for daring to point out the emperor’s lack of clothing.

Then there’s the story of Jim McMurtry, suspended by the Abbotsford District School Board shortly after the 2021 Kamloops announcement about “unmarked graves.” McMurtry’s offence was to tell students the truth that, while some Indigenous students did die in residential schools, the main cause was tuberculosis. His own book The Scarlet Lesson is excerpted here.

Historian Ian Gentles and former IRS teacher Pim Wiebel offer a richly detailed analysis of health and medical conditions in the schools. They show that these were much better than what prevailed in the Indian reserves from which most students came.

Another important contribution to understanding the medical issues is by Dr. Eric Schloss, narrating the history of the Charles Camsell Indian Hospital in Edmonton. IRS facilities usually included small clinics, but students with serious problems were often transferred to Indian Hospitals for more intensive care. Schloss, who worked in the Camsell, describes how it delivered state-of-the-art medicine, probably better than the care available to most children anywhere in Canada at the time.

Rodney Clifton’s contribution, “They would call me a ‘Denier,’” describes his experiences working in two IRS in the 1960s. Clifton does not tell stories of hunger, brutal punishment and suppression of Indigenous culture, but of games, laughter and trying to learn native languages from his Indian and Inuit charges.

Toronto lawyer and historian Greg Piasetzki explains how “Canada Wanted to Close All Residential Schools in the 1940s. Here’s why it couldn’t.” For many Indian parents, particularly single parents and/or those with large numbers of children, the IRS were the best deal available. And they offered paid employment to large numbers of Indians as cooks, janitors, farmers, health-care workers, and even teachers and principals.

Finally, Frances Widdowson analyzes the charge of residential school “denialism” used by true believers in the Kamloops narrative to shut down criticism or questions. Winnipeg Centre MP Leah Gazan in 2022 persuaded the House of Commons to give unanimous consent to a resolution on residential school genocide: “That, in the opinion of the House this government must recognize what happened in Canada’s Indian residential schools as genocide.”

In 2024, Gazan took the next step by introducing a private member’s bill to criminalize dissent about the IRS system. The bill failed to pass, but Gazan reintroduced it in 2025. Had these provisions been in force back in 2021, it might well have become a crime to point out that the Kamloops ground-penetrating radar (GPR) survey had identified soil anomalies, not buried bodies.

While the wheels of legislation and litigation grind and spin, those who wish to limit open discussion of residential schools attack truth-tellers as “denialists,” a term drawn from earlier debates about the Holocaust. As the proponents of the Kamloops narrative fail to provide convincing hard evidence for it, they hope to mobilize the authority of the state to stamp out dissent. One of the main goals of publishing Dead Wrong is to head off this drive toward authoritarianism.

Happily, Dead Wrong, like Grave Error, has already become an Amazon best-seller. The struggle for truth continues.

Alberta

Here’s why city hall should save ‘blanket rezoning’ in Calgary

From the Fraser Institute

By Tegan Hill and Austin Thompson

According to Calgarians for Thoughtful Growth (CFTG)—an organization advocating against “blanket rezoning”— housing would be more affordable if the mayor and council restricted what homes can be built in Calgary and where. But that gets the economics backwards.

Blanket rezoning—a 2024 policy that allowed homebuilders to construct duplexes, townhomes and fourplexes in most neighbourhoods—allowed more homebuilding, giving Calgarians more choice, and put downward pressure on prices. Mayor Farkas and several councillors campaigned on repealing blanket rezoning and on December 15 council will debate a motion that could start that process. As Calgarians debate the city’s housing rules, residents should understand the trade-offs involved.

When CFTG claims that blanket rezoning does “nothing” for affordability, it ignores a large body of economic research showing the opposite.

New homes are only built when they can be sold to willing homebuyers for a profit. Restrictions that limit the range of styles and locations for new homes, or that lock denser housing behind a long, costly and uncertain municipal approval process, inevitably eliminate many of these opportunities. That means fewer new homes are built, which worsens housing scarcity and pushes up prices. This intuitive story is backed up by study after study. An analysis by Canada’s federal housing agency put it simply: “higher residential land use regulation seems to be associated with lower housing affordability.”

CFTG also claims that blanket rezoning merely encourages “speculation” (i.e. buying to sell in the short-term for profit) by investors. Any profitable housing market may invite some speculative activity. But homebuilders and investors can only survive financially if they make homes that families are willing to buy or rent. The many Calgary families who bought or rented a new home enabled by blanket rezoning did so because they felt it was their best available option given its price, amenities and location—not because they were pawns in some speculative game. Calgarians benefit when they are free to choose the type of home and neighbourhood that best suits their family, rather than being constrained by the political whims of city hall.

And CFTG’s claim that blanket rezoning harms municipal finances also warrants scrutiny. More specifically, CFTG suggests that developers do not pay for infrastructure upgrades in established neighbourhoods, but this is simply incorrect. The City of Calgary charges an “Established Area Levy” to cover the cost of water and wastewater upgrades spurred by redevelopment projects—raising $16.5 million in 2024 alone. Builders in the downtown area must pay the “Centre City Levy,” which funds several local services (and generated $2.5 million in 2024).

It’s true that municipal fees on homes in new communities are generally higher, but that reflects the reality that new communities require far more new pipes, roads and facilities than established neighbourhoods.

Redeveloping established areas of the city means more residents can make use of streets, transit and other city services already in place, which is often the most cost-effective way for a city to grow. The City of Calgary’s own analysis finds that redevelopment in established neighbourhoods saves billions of taxpayer dollars on capital and operating costs for city services compared to an alternative scenario where homebuilding is concentrated in new suburban communities.

An honest debate about blanket rezoning ought to acknowledge the advantages this system has in promoting housing choice, housing affordability and the sustainability of municipal finances.

Clearly, many Calgarians felt blanket rezoning was undesirable when they voted for mayoral and council candidates who promised to change Calgary’s zoning rules. However, Calgarians also voted for a mayor who promised that more homes would be built faster, and at affordable prices—something that will be harder to achieve if city hall imposes tighter restrictions on where and what types of homes can be built. This unavoidable tension should be at the heart of the debate.

CFTG is promoting a comforting fairy tale where Calgary can tighten restrictions on homebuilding without limiting supply or driving up prices. In reality, no zoning regime delivers everything at once—greater neighbourhood control inevitably comes at the expense of housing choice and affordability. Calgarians—including the mayor and council—need a clear understanding of the trade-offs.

Business

Albertans give most on average but Canadian generosity hits lowest point in 20 years

From the Fraser Institute

By Jake Fuss and Grady Munro

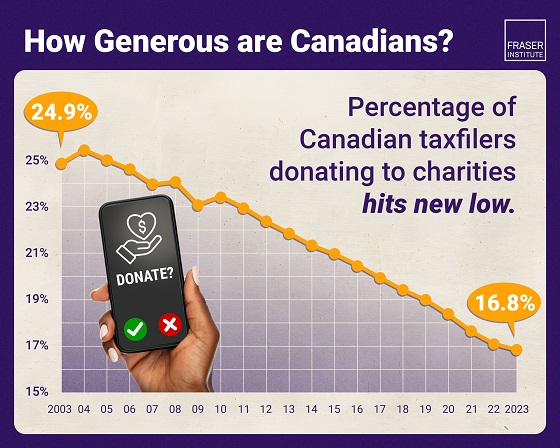

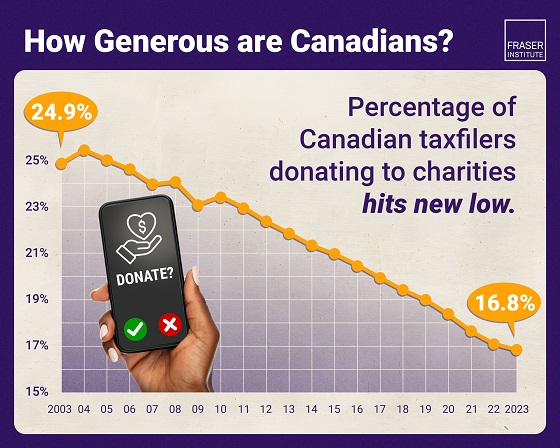

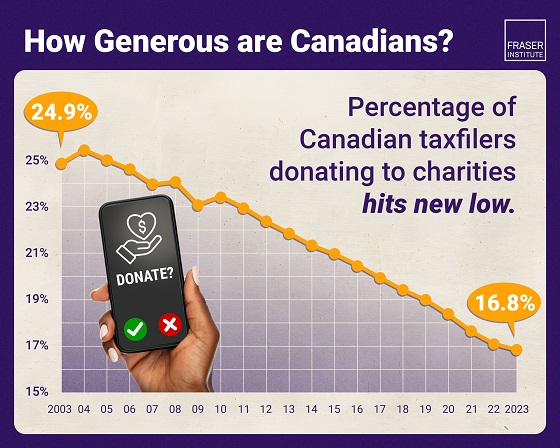

The number of Canadians donating to charity—as a percentage of all tax filers—is at the lowest point in 20 years, finds a new study published by the

Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The holiday season is a time to reflect on charitable giving, and the data shows Canadians are consistently less charitable every year, which means charities face greater challenges to secure resources to help those in need,” said Jake Fuss, director of Fiscal Studies at the Fraser Institute and co-author of Generosity in Canada: The 2025 Generosity Index.

The study finds that the percentage of Canadian tax filers donating to charity during the 2023 tax year—just 16.8 per cent—is the lowest proportion of Canadians donating since at least 2003. Canadians’ generosity peaked at 25.4 per cent of tax-filers donating in 2004, before declining in subsequent years.

Nationally, the total amount donated to charity by Canadian tax filers has also fallen from 0.55 per cent of income in 2013 to 0.52 per cent of income in 2023.

The study finds that Manitoba had the highest percentage of tax filers that donated to charity among the provinces (18.7 per cent) during the 2023 tax year while New Brunswick had the lowest (14.4 per cent).

Likewise, Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71 per cent) while Quebec and Newfoundland and Labrador donated the lowest (both 0.27 per cent).

“A smaller proportion of Canadians are donating to registered charities than what we saw in previous decades, and those who are donating are donating less,” said Fuss.

“This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond,” said Grady Munro, policy analyst and co-author.

Generosity of Canadian provinces and territories

Ranking (2025) % of tax filers who claiming donations Average of all charitable donations % of aggregate income donated

Manitoba 18.7 $2,855 0.71

Ontario 17.2 $2,816 0.58

Quebec 17.1 $1,194 0.27

Alberta 17.0 $3,622 0.68

Prince Edward Island 16.6 $1,936 0.45

Saskatchewan 16.4 $2,597 0.52

British Columbia 15.9 $3,299 0.61

Nova Scotia 15.3 $1,893 0.40

Newfoundland and Labrador 15.0 $1,333 0.27

New Brunswick 14.4 $2,076 0.44

Yukon 14.1 $2,180 0.27

Northwest Territories 10.2 $2,540 0.20

Nunavut 5.1 $2,884 0.15

NOTE: Table based on 2023 tax year, the most recent year of comparable data in Canada

Generosity in Canada: The 2025 Generosity Index

- Manitoba had the highest percentage of tax filers that donated to charity among the provinces (18.7%) during the 2023 tax year while New Brunswick had the lowest (14.4%).

- Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71%) while Quebec and Newfoundland and Labrador donated the lowest (both 0.27%).

- Nationally, the percentage of Canadian tax filers donating to charity has fallen over the last decade from 21.9% in 2013 to 16.8% in 2023.

- The percentage of aggregate income donated to charity by Canadian tax filers has also decreased from 0.55% in 2013 to 0.52% in 2023.

- This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond.

-

C2C Journal2 days ago

C2C Journal2 days agoWisdom of Our Elders: The Contempt for Memory in Canadian Indigenous Policy

-

Sports1 day ago

Sports1 day agoEgypt, Iran ‘completely reject’ World Cup ‘Pride Match’ plan

-

Alberta1 day ago

Alberta1 day agoAlberta introducing three “all-season resort areas” to provide more summer activities in Alberta’s mountain parks

-

Business12 hours ago

Business12 hours agoTaxpayers Federation calls on politicians to reject funding for new Ottawa Senators arena

-

Automotive2 days ago

Automotive2 days agoThe $50 Billion Question: EVs Never Delivered What Ottawa Promised

-

Business13 hours ago

Business13 hours agoAlbertans give most on average but Canadian generosity hits lowest point in 20 years

-

National10 hours ago

National10 hours agoCanada’s free speech record is cracking under pressure

-

Crime1 day ago

Crime1 day agoU.S. seizes Cuba-bound ship with illicit Iranian oil history