Calgary

City of Calgary Update On Response To COVID-19

The City continues maintaining essential services during a state of emergency with orders to prevent the spread of COVID-19. All City services including police, fire, water, transit, water & recycling are continuing and managing well.

Please see below for the latest updates.

Supporting business and local operators

The City of Calgary working with City Councillors, partners and business stakeholders from various industries has created a Business Sector Support Taskforce to monitor, evaluate and manage sustainability and wellness throughout the business community as we weather the COVID-19 storm together. Recently (March 20), the taskforce launched an online resource for businesses to serve as a centralized hub of information to support the business community during these challenging times. As new information is released from the different orders of government, communication via a centralized information hub for businesses can be found at calgary.ca/covid-business. Additionally, the taskforce will communicate business stakeholder challenges, and financial options for support.

Plus 15 Network closures

Similar to restrictions in place for public access to The City of Calgary Municipal Complex, we have adjusted Plus 15 access. Please refer to the Plus 15 map to see which walkways have limited access weekdays from 6 a.m.-6 p.m. The network will be closed on weekends until further notice.

Livery Transport Services

Taxi and limousine driver’s licences expiring in March or April 2020 are being automatically extended. Eligible licensees are being contacted via email with the new expiry date. To support physical distancing, drivers are asked to avoid visiting the LTS office in person. Drivers who also drive for a Transportation Network Company are asked to contact their company regarding the renewal process, which may be available online.

For more information visit calgary.ca.

Safety with household cleaning supplies

We are cautioning citizens to avoid trying to make their own cleaning compounds with the hope of finding a “super cleaner.”

If your preferred over-the-counter cleaner isn’t readily available at your store, creating your own version can be very dangerous to you, your family and your home if not done correctly.

When using over-the-counter cleaners, sanitizers or disinfectants, never mix them together.

Always use products as recommended by the manufacturer on the product packaging. Remember, more is not better.

Many household chemicals are not compatible and mixing products together may cause a strong chemical reaction that produces dangerous and harmful gas. Many are flammable including alcohol based hand sanitizer. Serious injury may result from breathing the gas and fumes or being near flame or open heat (even after drying).

When diluting Chlorine bleach, always use clean cool water, be careful not to spill or splash, and always follow specific instructions from a credible source such as:

- Alberta Health Services

- Health Canada

- US Centers for Disease Control

- World Health Organization

These diluted products may need to be prepared fresh daily as needed.

Water

We are asking homeowners to work with us in avoiding unnecessary repairs to home and City sewer (wastewater) systems by flushing only toilet paper and human waste down toilets. This will allow our crews to focus on the delivery of essential services and maintain social distancing guidelines.

Flushing anything other than human waste and toilet paper down the toilet can clog pipes and create sewer back-ups, which can be costly for both homeowners and The City.

Wipes that claim to be flushable aren’t. After they’re flushed, they don’t break down like toilet paper does. Toilet paper will disintegrate after it’s flushed, but so-called “flushable” wipes retain their shape and strength, causing blockages in pipes.

Facial tissue (Kleenex), serviettes and paper towel cannot be flushed down your toilet. They do not break down as toilet paper does, and lead to clogs and sewer back-ups.

Wipes, paper towel and all other items used as a toilet paper alternatives should be bagged and disposed of in your black cart. They do not belong in your green or blue bins.

There is additional information of what can’t go down your sink and toilet.

For more stories, visit Todayville Calgary

Alberta

Calgary’s High Property Taxes Run Counter to the ‘Alberta Advantage’

By David Hunt and Jeff Park

Of major cities, none compare to Calgary’s nearly 50 percent property tax burden increase between censuses.

Alberta once again leads the country in taking in more new residents than it loses to other provinces and territories. But if Canadians move to Calgary seeking greater affordability, are they in for a nasty surprise?

In light of declining home values and falling household incomes amidst rising property taxes, Calgary’s overall property tax burden has skyrocketed 47 percent between the last two national censuses, according to a new study by the Aristotle Foundation for Public Policy.

Between 2016 and 2021 (the latest year of available data), Calgary’s property tax burden increased about twice as fast as second-place Saskatoon and three-and-a-half times faster than Vancouver.

The average Calgary homeowner paid $3,496 in property taxes at the last census, compared to $2,736 five years prior (using constant 2020 dollars; i.e., adjusting for inflation). By contrast, the average Edmonton homeowner paid $2,600 in 2021 compared to $2,384 in 2016 (in constant dollars). In other words, Calgary’s annual property tax bill rose three-and-a-half times more than Edmonton’s.

This is because Edmonton’s effective property tax rate remained relatively flat, while Calgary’s rose steeply. The effective rate is property tax as a share of the market value of a home. For Edmontonians, it rose from 0.56 percent to 0.62 percent—after rounding, a steady 0.6 percent across the two most recent censuses. For Calgarians? Falling home prices collided with rising taxes so that property taxes as a share of (market) home value rose from below 0.5 percent to nearly 0.7 percent.

Plug into the equation sliding household incomes, and we see that Calgary’s property tax burden ballooned nearly 50 percent between censuses.

This matters for at least three reasons. First, property tax is an essential source of revenue for municipalities across Canada. City councils set their property tax rate and the payments made by homeowners are the backbone of municipal finances.

Property taxes are also an essential source of revenue for schools. The province has historically required municipalities to directly transfer 33 percent of the total education budget via property taxes, but in the period under consideration that proportion fell (ultimately, to 28 percent).

Second, a home purchase is the largest expense most Canadians will ever make. Local taxes play a major role in how affordable life is from one city to another. When municipalities unexpectedly raise property taxes, it can push homeownership out of reach for many families. Thus, homeoowners (or prospective homeowners) naturally consider property tax rates and other local costs when choosing where to live and what home to buy.

And third, municipalities can fall into a vicious spiral if they’re not careful. When incomes decline and residential property values fall, as Calgary experienced during the period we studied, municipalities must either trim their budgets or increase property taxes. For many governments, it’s easier to raise taxes than cut spending.

But rising property tax burdens could lead to the city becoming a less desirable place to live. This could mean weaker residential property values, weaker population growth, and weaker growth in the number of residential properties. The municipality then again faces the choice of trimming budgets or raising taxes. And on and on it goes.

Cities fall into these downward spirals because they fall victim to a central planner’s bias. While $853 million for a new arena for the Calgary Flames or $11 million for Calgary Economic Development—how City Hall prefers to attract new business to Calgary—invite ribbon-cuttings, it’s the decisions about Calgary’s half a million private dwellings that really drive the city’s finances.

Yet, a virtuous spiral remains in reach. Municipalities tend to see the advantage of “affordable housing” when it’s centrally planned and taxpayer-funded but miss the easiest way to generate more affordable housing: simply charge city residents less—in taxes—for their housing.

When you reduce property taxes, you make housing more affordable to more people and make the city a more desirable place to live. This could mean stronger residential property values, stronger population growth, and stronger growth in the number of residential properties. Then, the municipality again faces a choice of making the city even more attractive by increasing services or further cutting taxes. And on and on it goes.

The economy is not a series of levers in the mayor’s office; it’s all of the million individual decisions that all of us, collectively, make. Calgary city council should reduce property taxes and leave more money for people to make the big decisions in life.

Jeff Park is a visiting fellow with the Aristotle Foundation for Public Policy and father of four who left Calgary for better affordability. David Hunt is the research director at the Calgary-based Aristotle Foundation for Public Policy. They are co-authors of the new study, Taxing our way to unaffordable housing: A brief comparison of municipal property taxes.

Alberta

Calgary taxpayers forced to pay for art project that telephones the Bow River

From the Canadian Taxpayers Federation

The Canadian Taxpayers Federation is calling on the City of Calgary to scrap the Calgary Arts Development Authority after it spent $65,000 on a telephone line to the Bow River.

“If someone wants to listen to a river, they can go sit next to one, but the City of Calgary should not force taxpayers to pay for this,” said Kris Sims, CTF Alberta Director. “If phoning a river floats your boat, you do you, but don’t force your neighbour to pay for your art choices.”

The City of Calgary spent $65,194 of taxpayers’ money for an art project dubbed “Reconnecting to the Bow” to set up a telephone line so people could call the Bow River and listen to the sound of water.

The project is running between September 2024 and December 2025, according to documents obtained by the CTF.

The art installation is a rerun of a previous version set up back in 2014.

Emails obtained by the CTF show the bureaucrats responsible for the newest version of the project wanted a new local 403 area code phone number instead of an 1-855 number to “give the authority back to the Bow,” because “the original number highlighted a proprietary and commercial relationship with the river.”

Further correspondence obtained by the CTF shows the city did not want its logo included in the displays, stating the “City of Calgary (does NOT want to have its logo on the artworks or advertisements).”

Taxpayers pay about $19 million per year for the Calgary Arts Development Authority. That’s equivalent to the total property tax bill for about 7,000 households.

Calgary bureaucrats also expressed concern the project “may not be received well, perceived as a waste of money or simply foolish.”

“That city hall employee was pointing out the obvious: This is a foolish waste of taxpayers’ money and this slush fund should be scrapped,” said Sims. “Artists should work with willing donors for their projects instead of mooching off city hall and forcing taxpayers to pay for it.”

-

Crime1 day ago

Crime1 day agoCanada Seizes 4,300 Litres of Chinese Drug Precursors Amid Trump’s Tariff Pressure Over Fentanyl Flows

-

Alberta22 hours ago

Alberta22 hours agoFrom Underdog to Top Broodmare

-

Alberta1 day ago

Alberta1 day agoHow one major media torqued its coverage – in the take no prisoners words of a former Alberta premier

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoGet Ready: Your House May Not Be Yours Much Longer

-

Alberta1 day ago

Alberta1 day agoProvince orders School Boards to gather data on class sizes and complexity by Nov 24

-

Business2 days ago

Business2 days agoCanada’s attack on religious charities makes no fiscal sense

-

Business2 days ago

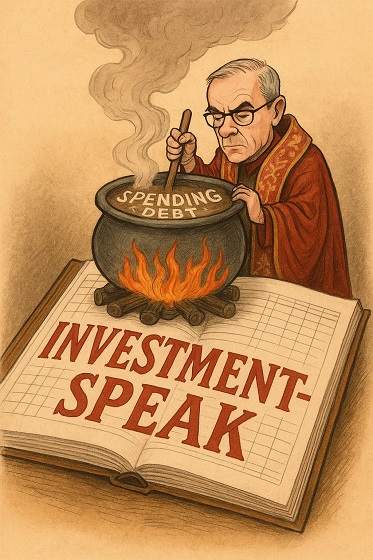

Business2 days agoWhen Words Cook the Books: The Politics of ‘Investment-Speak’

-

Opinion1 day ago

Opinion1 day agoBill Gates Shakes Up the Climate Discussion