National

Censured doctor who’s now a Conservative MP calls COVID mandates ‘full Communism’

From LifeSiteNews

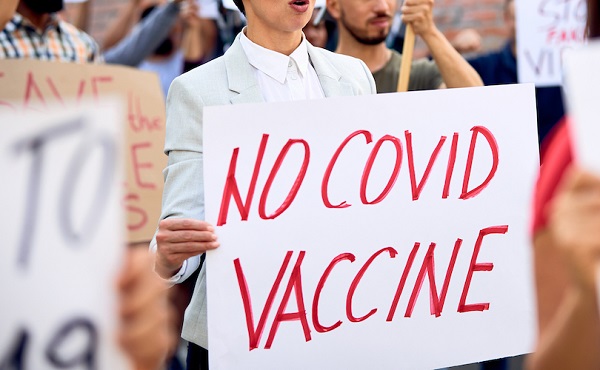

Dr. Matt Strauss, just elected as a Conservative Party of Canada MP, used his first speech in Parliament to blast COVID mandates

A censured Canadian doctor critical of virus lockdowns who was just elected as a new Conservative Party of Canada (CPC) MP used his first speech in Parliament to blast COVID mandates as “full Communism,” which he said allowed governments full “top-down” control of people’s lives.

“The zenith of all this top-down control came during the pandemic,” Dr. Matt Strauss, CPC MP for Kitchener South-Hespeler, Ontario, said to Parliament on Tuesday.

“The members opposite went full Communism.”

I gave my maiden speech in Canada's House of Commons:

The Liberals trampled on the Charter rights of Canadians. I see no indication the leopard can change it's spots. I am here to speak truth to their power. pic.twitter.com/tkmLgZilH0

— Matt Strauss (@strauss_matt) June 3, 2025

While working as an emergency care doctor, Strauss was critical of COVID lockdowns and mandates. In 2021, he observed that full hospitals in Canada have been the norm for decades.

For speaking out, he was the target of Queen’s University after it allegedly censored him and enacted professional reprisals against him because of his outspoken views against COVID mandates and lockdowns. Elon Musk’s X helped fund Strauss’s legal against his former employer Queen’s University after it forced him to resign.

In his speech, Strauss lamented that the Canadian government under former Prime Minister Justin Trudeau “ruined” people’s lives due to mandated lockdowns and mandates.

“They locked Canadians down in their homes, ruined weddings, funerals, Easters, proms and Christmases, closed the borders, kept mothers from children and brothers from sisters, deprived the House of its ancient rights, spent $600 billion of taxpayer money with no budget and doubled our national debt to pay healthy 16-year-olds to sit in their basement,” a visibly emotional Strauss said.

He blasted the fact this was all done “in the name of crisis management” as well as the fact those who opposed the COVID dictates were “hunted down.”

“Physicians, professors and journalists who spoke out against these abuses were hunted down. They had their licenses and their jobs threatened. I know this because it happened to me,” he said.

Strauss said that “every member of the Liberal caucus voted to trample their rights further.”

Many Canadian doctors who spoke out against COVID mandates and the experimental mRNA injections were censured by their medical boards.

In October 2021, Trudeau announced unprecedented COVID-19 shot mandates for all federal workers and those in the transportation sector and said the unvaccinated will no longer be able to travel by air, boat, or train, both domestically and internationally.

This policy resulted in thousands losing their jobs or being placed on leave for non-compliance.

Trudeau had disparaged unvaccinated Canadians, saying those opposing his measures were of a “small, fringe minority” who hold “unacceptable views” and do not “represent the views of Canadians who have been there for each other.”

LifeSiteNews has published an extensive amount of research on the dangers of the experimental COVID mRNA jabs that include heart damage and blood clots.

Censorship Industrial Complex

Legal warning sent to Ontario school board for suspending elected school council member

The Justice Centre for Constitutional Freedoms announces that a legal warning letter has been sent to the Hamilton-Wentworth District School Board after it suspended a parent from her role on the School Council for respectfully objecting to land acknowledgements.

Catherine Kronas, a concerned parent with a child enrolled at Ancaster High Secondary School, was re-elected to serve on School Council in October 2024.

During a Council meeting on April 9, 2025, Ms. Kronas asked that her respectful objection to land acknowledgements be noted in the minutes. No disruption occurred; her comments were limited to requesting that her dissenting viewpoint be recorded.

On May 22, 2025, however, the School Board informed Ms. Kronas that her involvement on the Council was being “paused” based on allegations that she had caused harm and had violated a Code of Conduct Policy. She has not been permitted to attend the next scheduled meeting.

Ms. Kronas was unsettled by the Board’s decision, saying, “I was taken aback by the Board’s decision to suspend me from the School Council after delivering a respectful objection, especially given assurances made at a previous council meeting and outlined in the Council bylaws that open dialogue and diverse perspectives are welcomed.”

“By barring me from the next meeting, the Council sends a troubling message to all parents: that even respectful disagreement may be met not with dialogue, but with disciplinary action. I am grateful to the Justice Centre for Constitutional Freedoms for assisting me in this matter,” she remarked.

Constitutional lawyer Hatim Kheir said Ms. Kronas’ comments “were a reasonable and measured expression of a viewpoint held by many Canadians.”

“The Board’s decision to suspend her from the Council, which she has a right to sit on as an elected parent member, is an act of censorship that offends the right to freedom of expression,” he explained.

Mr. Kheir is calling for Ms. Kronas to be immediately reinstated to the Council and to be allowed to fulfill her elected role without further retaliation for expressing her views.

To view a brief video summary of this matter, click here.

To receive regular updates from the Justice Centre, click on this link to join our email list.

Business

This Sunday, June 8, is Tax Freedom Day, when Canadians finally start working for themselves

From the Fraser Institute

By Milagros Palacios, Jake Fuss and Nathaniel Li

This Sunday, June 8, Canadians will celebrate Tax Freedom Day, the day in the year when they start working for themselves and not government, finds a new study published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“If Canadians paid all their taxes up front, they would work the first 158 days of this year before bringing any money home for themselves and their families,” said Jake Fuss, director of fiscal studies at the Fraser Institute.

Tax Freedom Day measures the total annual tax burden imposed on Canadian families by federal, provincial, and municipal governments.

In 2025, the average Canadian family (with two or more people) will pay $68,266 in total taxes. That’s 43.1 per cent of its annual income ($158,533) going to income taxes, payrolltaxes (including the Canada Pension Plan), health taxes, sales taxes (like the GST), property taxes, fuel taxes, “sin” taxes and more.

Represented as days on the calendar, the total tax burden comprises more than five months of income—from January 1 to June 7. On June 8th—Tax Freedom Day—Canadians finally start working for themselves, and not government.

But Canadians should also be worried about the nearly $90 billion in deficits the federal and provincial governments are forecasting this year, because they will have substantial tax implications in future years.

To better illustrate this point, the study also calculates a Balanced Budget Tax Freedom Day—the day of the year when the average Canadian finally would finally start working for themselves if governments paid for all of this year’s spending with taxes collected this year.

In 2025, the Balanced Budget Tax Freedom Day won’t arrive until June 21. “Tax Freedom Day helps put the total tax burden in perspective, and helps Canadians understand just how much of their money they pay in taxes every year,” Fuss said. “Canadians need to decide for themselves whether they are getting their money’s worth when it comes to how governments are spending their tax dollars.”

Tax Freedom Day for each province varies according to the extent of the provincially and locally levied tax burden.

2025 Provincial Tax Freedom Days

Manitoba May 17

Saskatchewan May 31

British Columbia May 31

Alberta May 31

Prince Edward Island June 2

New Brunswick June 4

Ontario June 7

Nova Scotia June 10

Newfoundland & Labrador June 19

Quebec June 21

CANADA June 8

Canadians Celebrate Tax Freedom Day on June 8, 2025

- In 2025, the average Canadian family will earn $158,533 in income and pay an estimated $68,266 in total taxes (43.1%).

- If the average Canadian family had to pay its taxes up front, it would have worked until June 7 to pay the total tax bill imposed on it by all three levels of government (federal, provincial, and local).

- This means that Tax Freedom Day, the day in the year when the average Canadian family has earned enough money to pay the taxes imposed on it, falls on June 8.

- Tax Freedom Day in 2025 comes one day earlier than in 2024, when it fell on June 9. This change is due to the expectation that the total tax revenues forecasted by Canadian governments will increase slower than the incomes of Canadians.

- Tax Freedom Day for each province varies according to the extent of the provincially levied tax burden. The earliest provincial Tax Freedom Day falls on May 17 in Manitoba, while the latest falls on June 21 in Quebec.

- Canadians are right to be thinking about the tax implications of the $89.4 billion in projected federal and provincial government deficits in 2025. For this reason, we calculated a Balanced Budget Tax Freedom Day, the day on which average Canadians would start working for themselves if governments were obliged to cover current expenditures with current taxation. In 2025, the Balanced Budget Tax Freedom Day arrives on June 21.

-

Bruce Dowbiggin20 hours ago

Bruce Dowbiggin20 hours agoI’m A Victim, You’re A Victim, Wouldn’t You Like To Be A Victim, Too?

-

Alberta2 days ago

Alberta2 days agoAlberta Sports Hall of Fame to Induct Class of 2025

-

Alberta1 day ago

Alberta1 day agoPro-life activist describes how child traffickers take advantage of Alberta’s abortion lax laws

-

Business2 days ago

Business2 days agoMeta inks 20 year deal for nuclear power

-

Business2 days ago

Business2 days agoTo Build BIG THINGS Canada Needs to Rid Itself of BIG BARRIERS

-

Crime2 days ago

Crime2 days agoBoulder ‘terror’ suspect’s family in ICE custody, pending deportation

-

Business1 day ago

Business1 day agoCarney’s Energy Mirage: Why the Prospects of Economic Recovery Remain Bleak

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoBC nurse faces $163k legal bill for co-sponsored a billboard reading, “I [heart] JK Rowling.”