Alberta

Cenovus replies to low-blow from Norway’s trillion dollar oil fund

From Cenovus Energy

Canada targeted (yet again) as a scapegoat for global climate change challenge

Alex Pourbaix, President & Chief Executive Officer, Cenovus Energy

The recent decision by the Norwegian wealth fund, Norges, to pull its investments in Cenovus Energy and three of our oil sands peers is another example of Canada being used as a pawn by institutions attempting to earn climate points. But these announcements are motivated more by public relations than fact. The data they used to assess Cenovus’s greenhouse gas performance is outdated and incorrect.

Here’s what Norges failed to consider in its decision. Cenovus has reduced the emissions intensity of our oil sands operations by approximately 30 percent over the past 15 years. We’ve set ambitious targets to reduce our per-barrel emissions by another 30 percent across our operations by 2030 and hold absolute emissions flat during that time. We are also focused on innovation that will help us achieve our aspiration of net zero emissions by 2050. Our peers have similar emissions reductions achievements and commitments.

The hypocrisy of the move by Norges is particularly rich, given the sovereign wealth fund amassed its $1 trillion value primarily from oil production profits. Moreover, Norway’s former energy minister is on record saying the country will produce oil for as long as oil is used. Energy is important to Norway’s economy, as it is to Canada’s.

The oil and natural gas industry accounts for the largest share of Canada’s exports and is the most significant contributor to the country’s gross domestic product. This country is amassing a huge deficit as a result of the COVID-19 response, with the parliamentary budget officer suggesting our national debt could hit $1 trillion. That’s more than $26,000 for every man, woman and child in Canada. Key to reversing this unprecedented debt load will be secure and stable tax revenue to support the economic recovery. Canada’s energy sector has contributed an average of $8 billion annually to provincial and federal government coffers and its strength is fundamental to ensuring this country emerges from the downturn stronger than ever.

Yet, the Canadian oil sands have become an easy target for primarily European investment firms and insurers who have made a big splash announcing they are severing ties with Canadian companies. Pulling out of the oil sands earns these firms headlines but doesn’t have an impact on their business because most of them were not heavily invested in Canada. Canada’s oil sands have long been the poster child for the anti-oil movement. It’s easier to attack a country that has a regulatory system designed to ensure transparency on its environmental, social and governance (ESG) performance than it is to go after oil producing nations such as Russia and Saudi Arabia where the commitment to regulation and transparency substantially lags Canadian expectations and standards.

As the leader of a Canadian company whose sector contributes billions to the national economy and directly and indirectly employs 800,000 people – including being the country’s largest employer of Indigenous people – I am standing up for our industry and for Canada. Enough is enough with these unwarranted attacks.

Cenovus and our peers are committed to doing our part to help meet Canada’s climate commitments and contribute to global climate change solutions. We’re investing millions in technologies to reduce our own emissions and collaborating with innovators around the world, including the support of initiatives like the NRG COSIA Carbon XPrize, which is focused on solutions to convert greenhouse gas emissions into valuable products and consumer goods.

Canada is the largest oil-producing jurisdiction in the world with a national price on carbon, and Alberta’s cap on oil sands emissions is an unprecedented commitment. Our industry is committed to achieving Canada’s 45 percent reduction target for methane emissions, addressing a greenhouse gas that is more potent than carbon dioxide. If investors are truly concerned about global greenhouse gas emissions, they should place greater value on Canadian oil and natural gas.

The world is undergoing an energy transition as action is taken to limit global temperature rise. Canada’s energy sector is going to play a key role in supporting the transition. But as we see today, energy and economic growth are inextricably linked and even the most aggressive emissions-reduction scenarios recognize that oil and natural gas will continue to be a significant part of the energy mix for decades to come. Canada has the world’s third largest oil reserves and a significant opportunity to provide the world with the low cost, lower carbon energy it demands.

Just as support for a strong energy sector has benefitted Norwegians, it’s essential for Canadians to recognize the importance of Canada’s energy sector in contributing to our collective economic future.

Alberta

Housing in Calgary and Edmonton remains expensive but more affordable than other cities

From the Fraser Institute

By Tegan Hill and Austin Thompson

In cities across the country, modest homes have become unaffordable for typical families. Calgary and Edmonton have not been immune to this trend, but they’ve weathered it better than most—largely by making it easier to build homes.

Specifically, faster permit approvals, lower municipal fees and fewer restrictions on homebuilders have helped both cities maintain an affordability edge in an era of runaway prices. To preserve that edge, they must stick with—and strengthen—their pro-growth approach.

First, the bad news. Buying a home remains a formidable challenge for many families in Calgary and Edmonton.

For example, in 2023 (the latest year of available data), a typical family earning the local median after-tax income—$73,420 in Calgary and $70,650 in Edmonton—had to save the equivalent of 17.5 months of income in Calgary ($107,300) or 12.5 months in Edmonton ($73,820) for a 20 per cent down payment on a typical home (single-detached house, semi-detached unit or condominium).

Even after managing such a substantial down payment, the financial strain would continue. Mortgage payments on the remaining 80 per cent of the home’s price would have required a large—and financially risky—share of the family’s after-tax income: 45.1 per cent in Calgary (about $2,757 per month) and 32.2 per cent in Edmonton (about $1,897 per month).

Clearly, unless the typical family already owns property or receives help from family, buying a typical home is extremely challenging. And yet, housing in Calgary and Edmonton remains far more affordable than in most other Canadian cities.

In 2023, out of 36 major Canadian cities, Edmonton and Calgary ranked 8th and 14th, respectively, for housing affordability (relative to the median after-tax family income). That’s a marked improvement from a decade earlier in 2014 when Edmonton ranked 20th and Calgary ranked 30th. And from 2014 to 2023, Edmonton was one of only four Canadian cities where median after-tax family income grew faster than the price of a typical home (in Calgary, home prices rose faster than incomes but by much less than in most Canadian cities). As a result, in 2023 typical homes in Edmonton cost about half as much (again, relative to the local median after-tax family income) as in mid-sized cities such as Windsor and Kelowna—and roughly one-third as much as in Toronto and Vancouver.

To be clear, much of Calgary and Edmonton’s improved rank in affordability is due to other cities becoming less and less affordable. Indeed, mortgage payments (as a share of local after-tax median income) also increased since 2014 in both Calgary and Edmonton.

But the relative success of Alberta’s two largest cities shows what’s possible when you prioritize homebuilding. Their approach—lower municipal fees, faster permit approvals and fewer building restrictions—has made it easier to build homes and helped contain costs for homebuyers. In fact, homebuilding has been accelerating in Calgary and Edmonton, in contrast to a sharp contraction in Vancouver and Toronto. That’s a boon to Albertans who’ve been spared the worst excesses of the national housing crisis. It’s also a demographic and economic boost for the province as residents from across Canada move to Alberta to take advantage of the housing market—in stark contrast to the experience of British Columbia and Ontario, which are hemorrhaging residents.

Alberta’s big cities have shown that when governments let homebuilders build, families benefit. To keep that advantage, policymakers in Calgary and Edmonton must stay the course.

Alberta

Danielle Smith slams Skate Canada for stopping events in Alberta over ban on men in women’s sports

From LifeSiteNews

The Alberta premier has denounced Skate Canada as ‘disgraceful’ for refusing to host events in the province because of a ban on ‘transgender’ men in women’s sports.

Alberta Premier Danielle Smith has demanded an apology after Skate Canada refused to continue holding events in Alberta.

In a December 16 post on X, Smith denounced Skate Canada’s recent decision to stop holding competitions in Alberta due to a provincial law keeping gender-confused men from competing in women’s sports.

“Women and girls have the right to play competitive sports in a safe and fair environment against other biological females,” Smith declared. “This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.”

Women and girls have the right to play competitive sports in a safe and fair environment against other biological females.

This view is held by a vast majority of Albertans and Canadians. It is also common sense and common decency.

Skate Canada‘s refusal to hold events in… pic.twitter.com/n4vbkTx6B0

— Danielle Smith (@ABDanielleSmith) December 16, 2025

“Skate Canada‘s refusal to hold events in Alberta because we choose to protect women and girls in sport is disgraceful,” she declared.

“We expect they will apologize and adjust their policies once they realize they are not only compromising the fairness and safety of their athletes, but are also offside with the international community, including the International Olympic Committee, which is moving in the same direction as Alberta,” Smith continued.

Earlier this week, Skate Canada announced their decision in a statement to CBC News, saying, “Following a careful assessment of Alberta’s Fairness and Safety in Sport Act, Skate Canada has determined that we are unable to host events in the province while maintaining our national standards for safe and inclusive sport.”

Under Alberta’s Fairness and Safety in Sport Act, passed last December, biological men who claim to be women are prevented from competing in women’s sports.

Notably, Skate Canada’s statement failed to address safety and fairness concerns for women who are forced to compete against stronger, and sometimes violent, male competitors who claim to be women.

Under their 2023 policy, Skate Canada states “skaters in domestic events sanctioned by Skate Canada who identify as trans are able to participate in the gender category in which they identify.”

While Skate Canada maintains that gender-confused men should compete against women, the International Olympic Committee is reportedly moving to ban gender-confused men from women’s Olympic sports.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely that males have a considerable innate advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Alberta1 day ago

Alberta1 day agoDanielle Smith slams Skate Canada for stopping events in Alberta over ban on men in women’s sports

-

International1 day ago

International1 day agoTOTAL AND COMPLETE BLOCKADE: Trump cuts off Venezuela’s oil lifeline

-

Crime2 days ago

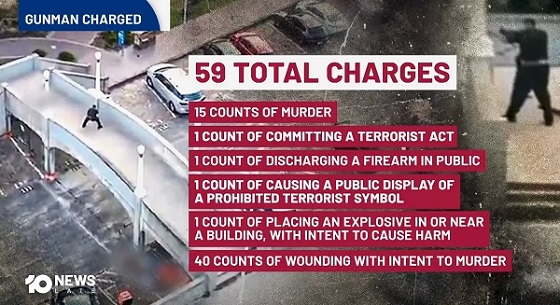

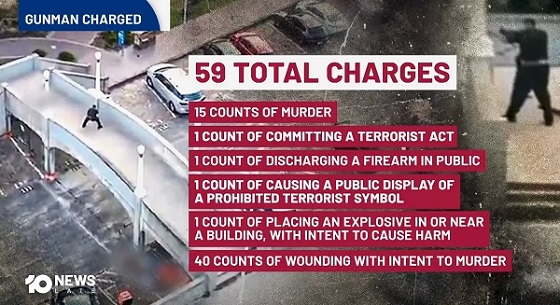

Crime2 days agoThe Uncomfortable Demographics of Islamist Bloodshed—and Why “Islamophobia” Deflection Increases the Threat

-

COVID-191 day ago

COVID-191 day agoSenator Demands Docs After ‘Blockbuster’ FDA Memo Links Child Deaths To COVID Vaccine

-

Business15 hours ago

Business15 hours agoCanada Hits the Brakes on Population

-

COVID-191 day ago

COVID-191 day agoChina Retaliates Against Missouri With $50 Billion Lawsuit In Escalating Covid Battle

-

Energy2 days ago

Energy2 days agoLiberals Twisted Themselves Into Pretzels Over Their Own Pipeline MOU

-

International2 days ago

International2 days agoBondi Beach Shows Why Self-Defense Is a Vital Right