Business

Cash-Strapped California Inches Closer To Handing Taxpayer Home Loans To Illegal Migrants

From the Daily Caller News Foundation

From the Daily Caller News Foundation

California lawmakers are one step closer to making hundreds of millions of taxpayer-funded home loans available to residents living in the country illegally.

Democrats on the California Senate Appropriations Committee unanimously approved AB 1840 to move forward on Thursday, according to an official vote tally of the legislation. The bill has one last chance to be struck down on the Senate floor, where Democrats wield majority power, before it lands on Gov. Gavin Newsom’s desk.

The legislation seeks to amend the California Dream For All Shared Appreciation Loan program, an initiative launched last year that provides first-time homebuyers with a loan of up to 20% of the house’s purchase price for down payment or closing cost. If passed and signed into law, illegal migrants living in California would be eligible to apply for a piece of the pie.

“Once again, California has chosen to prioritize illegal immigration and fiscal irresponsibility over the needs of its citizens, all while facing a $60 billion deficit that will ultimately be passed onto taxpayers,” San Diego County Supervisor Jim Desmond said in a statement provided to the Daily Caller News Foundation.

“California is in dire financial straits, yet lawmakers continue to prioritize programs that incentivize illegal immigration and strain local resources,” Desmond continued. “Expanding this program to include illegal immigrants is not just another handout — it’s a massive overreach that shifts the financial burden onto law-abiding taxpayers.”

These taxpayer-funded home loans are interest-free and borrowers are not required to dole out monthly payments, making the program incredibly popular with California residents.

When applications for the $300 million program first opened up in May 2023 — offering interest-free loans to roughly 2,300 middle and lower-income homebuyers — the money ran out in less than two weeks, according to the LA Times. State officials have since tightened eligibility for the program, requiring that at least one of the applicants be a first-generation home buyer and replacing the first-come-first-serve model with a lottery.

Despite California struggling to cope with a budget deficit in the tens of billions of dollars, and availability for the program incredibly tight already, one state lawmaker felt the loan program wasn’t inclusive enough.

Assemblymember Joaquin Arambula, a Democrat from Fresno, first introduced AB 1840 in January, with the goal of broadening the definition of “first-time home buyer” to include illegal immigrants. The lawmaker argued in March that the “social and economic benefits of homeownership should be available to everyone,” according to a local news KTLA. Arambula did not immediately respond to the the DCNF’s request for comment.

The legislation has since easily passed the Democrat-dominated California Assembly and sailed through the Senate Appropriations Committee — with opposition exclusively relegated to GOP lawmakers.

“California’s budget deficit continues to grow and Democratic lawmakers are so out of touch with everyday Californians that they and are quite literally taking money away from law-abiding citizens, their own constituents, and handing it over as a free gift to people who broke federal law to cross the border illegally,” California Sen. Brian Dahle stated to the DCNF.

“There’s no accountability and transparency when it comes to the Democrats’ spending sprees, and it’s unfortunate because many Californians see homeownership as nothing more than an illusion at this point,” Dahle continued.

California is experiencing a massive budget shortfall.

State lawmakers in June approved a budget that slashed spending and temporarily raised taxes on businesses in an effort to shore up a nearly $50 billion budget deficit, according to the Associated Press. The dire financial situation marks a far cry from the more than $100 billion surplus the state enjoyed roughly two years ago, but those revenue spikes proved only temporary as rising unemployment, inflation and a slowing of the tech industry has battered California pocketbooks.

The state’s deficit was roughly $ 32 billion in 2023, which grew to more than $46 billion earlier this year and is now around $60 billion, according to California Republicans — drawing questions as to why lawmakers would open up a highly-coveted loan program to a large swath of the population that does not hold legal status.

Nearly two million illegal migrants live in California, according to data published by the Pew Research Center in July.

It’s not immediately clear if Newsom will sign the legislation. When reached for comment, a spokesperson said the governor’s office does not typically comment on pending legislation, adding that the governor would “evaluate the legislation on its merits” should it reach his desk.

Approval of AB 1840 came on the same day that Vice President Kamala Harris’ campaign announced she would be unveiling a proposal similar to her home state’s current program: $25,000 in down payment support for first-time homebuyers, including greater support for first-generation homeowners.

It’s not clear if the proposal from Harris — who has recently attempted to cast herself as more of a border hawk — would explicitly exclude illegal immigrants. Her campaign did not respond to a request for comment from the DCNF.

California Republicans, in the meantime, are left balking at their own state’s legislative actions.

“Many legal California residents can’t afford a home in their own state,” California Sen. Brian Jones said to the DCNF. He is one of only two GOP members on the Senate Appropriations Committee.

“Instead of addressing the housing crisis, radical Democrat lawmakers want to help illegal immigrants buy houses with the gift of taxpayer funds,” Jones continued. “With a $62 billion budget deficit, we need to focus on preserving essential government functions, not unfair political spending for those here illegally.”

Business

Trump makes impact on G7 before he makes his exit

Trump Rips Into Obama and Trudeau at G7 for a “Very Big Mistake” on Russia

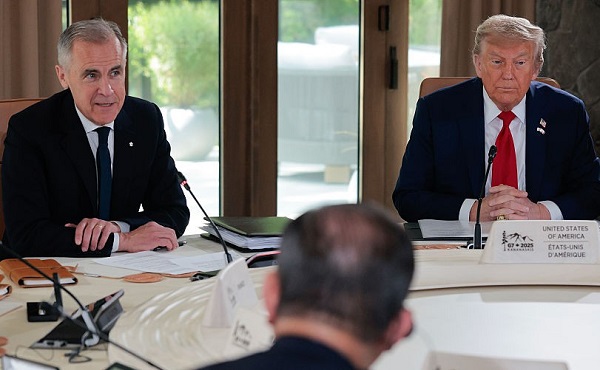

At the G7 in Canada, President Trump didn’t just speak—he delivered a headline-making indictment.

Standing alongside Canada’s Prime Minister, he directly blasted Barack Obama and Justin Trudeau, accusing them of committing a “very big mistake” by booting Russia out of the G8. He warned that this move didn’t deter conflict—it unleashed it, and he insists it paved the way for the war in Ukraine.

Before the working sessions began, the two leaders fielded questions. The first topic: the ongoing trade negotiations between the U.S. and Canada. Trump didn’t hesitate to point out that the issue wasn’t personal—it was philosophical.

“It’s not so much holding up. I think we have different concepts,” Trump said. “I have a tariff concept, Mark [Carney] has a different concept, which is something that some people like.”

He made it clear that he prefers a more straightforward approach. “I’ve always been a tariff person. It’s simple, it’s easy, it’s precise and it just goes very quickly.”

Carney, he added, favors a more intricate framework—“also very good,” Trump said. The goal now, according to Trump, is to examine both strategies and find a path forward. “We’re going to look at both and we’re going to come out with something hopefully.”

When asked whether a deal could be finalized in a matter of days or weeks, Trump didn’t overpromise, but he left the door open. “It’s achievable but both parties have to agree.”

Then the conversation took an unexpected turn.

Standing next to Canada’s Prime Minister, whose predecessor helped lead that push, Trump argued that isolating Moscow may have backfired. “The G7 used to be the G8,” he said, pointing to the moment Russia was kicked out.

He didn’t hold back. “Barack Obama and a person named Trudeau didn’t want to have Russia in, and I would say that was a mistake because I think you wouldn’t have a war right now if you had Russia in.”

This wasn’t just a jab at past leaders. Trump was drawing a direct line from that decision to the war in Ukraine. According to him, expelling Russia took away any real chance at diplomacy before things spiraled.

“They threw Russia out, which I claimed was a very big mistake even though I wasn’t in politics then, I was loud about it.” For Trump, diplomacy doesn’t mean agreement—it means keeping adversaries close enough to negotiate.

“It was a mistake in that you spent so much time talking about Russia, but he’s no longer at the table. It makes life more complicated. You wouldn’t have had the war.”

Then he made it personal. Trump compared two timelines—one with him in office, and one without. “You wouldn’t have a war right now if Trump were president four years ago,” he said. “But it didn’t work out that way.”

Before reporters could even process Trump’s comments on Russia, he shifted gears again—this time turning to Iran.

Asked whether there had been any signs that Tehran wanted to step back from confrontation, Trump didn’t hesitate. “Yeah,” he said. “They’d like to talk.”

The admission was short but revealing. For the first time publicly, Trump confirmed that Iran had signaled interest in easing tensions. But he made it clear they may have waited too long.

“They should have done that before,” he said, referencing a missed 60-day negotiation window. “On the 61st day I said we don’t have a deal.”

Even so, he acknowledged that both sides remain under pressure. “They have to make a deal and it’s painful for both parties but I would say Iran is not winning this war.”

Then came the warning, delivered with unmistakable urgency. “They should talk and they should talk IMMEDIATELY before it’s too late.”

Eventually, the conversation turned back to domestic issues: specifically, immigration and crime.

He confirmed he’s directing ICE to focus its efforts on sanctuary cities, which he accused of protecting violent criminals for political purposes.

He pointed directly at major Democrat-led cities, saying the worst problems are concentrated in deep blue urban centers. “I look at New York, I look at Chicago. I mean you got a really bad governor in Chicago and a bad mayor, but the governor is probably the worst in the country, Pritzker.”

And he didn’t stop there. “I look at how that city has been overrun by criminals and New York and L.A., look at L.A. Those people weren’t from L.A. They weren’t from California most of those people. Many of those people.”

According to Trump, the crime surge isn’t just a local failure—it’s a direct consequence of what he called a border catastrophe under President Biden. “Biden allowed 21 million people to come into our country. Of that, vast numbers of those people were murderers, killers, people from gangs, people from jails. They emptied their jails into the U.S. Most of those people are in the cities.”

“All blue cities. All Democrat-run cities.”

He closed with a vow—one aimed squarely at the ballot box. Trump said he’ll do everything in his power to stop Democrats from using illegal immigration to influence elections.

“They think they’re going to use them to vote. It’s not going to happen.”

Just as the press corps seemed ready for more, Prime Minister Carney stepped in.

The momentum had clearly shifted toward Trump, and Carney recognized it. With a calm smile and hands slightly raised, he moved to wrap things up.

“If you don’t mind, I’m going to exercise my role, if you will, as the G7 Chair,” he said. “Since we have a few more minutes with the president and his team. And then we actually have to start the meeting to address these big issues, so…”

Trump didn’t object. He didn’t have to.

By then, the damage (or the impact) had already been done. He had steered the conversation, dropped one headline after another, and reshaped the narrative before the summit even began.

By the time Carney tried to regain control, it was already too late.

Wherever Trump goes, he doesn’t just attend the event—he becomes the event.

Thanks for reading! This post took time and care to put together, and we did our best to give this story the coverage it deserved.

If you like my work and want to support me and my team and help keep this page going strong, the most powerful thing you can do is sign up for the email list and become a paid subscriber.

Your monthly subscription goes further than you think. Thank you so much for your support.

This story was made possible with the help of Overton —I couldn’t have done it without him.

If you’d like to support his growing network, consider subscribing for the month or the year. Your support helps him expand his team and cover more stories like this one.

We both truly appreciate your support!

Business

The CBC is a government-funded giant no one watches

This article supplied by Troy Media.

By Kris Sims

By Kris Sims

The CBC is draining taxpayer money while Canadians tune out. It’s time to stop funding a media giant that’s become a political pawn

The CBC is a taxpayer-funded failure, and it’s time to pull the plug. Yet during the election campaign, Prime Minister Mark Carney pledged to pump another $150 million into the broadcaster, even as the CBC was covering his campaign. That’s a blatant conflict of interest, and it underlines why government-funded journalism must end.

The CBC even reported on that announcement, running a headline calling itself “underfunded.” Think about that. Imagine being a CBC employee asking Carney questions at a campaign news conference, while knowing that if he wins, your employer gets a bigger cheque. Meanwhile, Conservative Leader Pierre Poilievre has pledged to defund the CBC. The broadcaster is literally covering a story that determines its future funding—and pretending there’s no conflict.

This kind of entanglement isn’t journalism. It’s political theatre. When reporters’ paycheques depend on who wins the election, public trust is shattered.

And the rot goes even deeper. In the Throne Speech, the Carney government vowed to “protect the institutions that bring these cultures and this identity to the world, like CBC/RadioCanada.” Before the election, a federal report recommended nearly doubling the CBC’s annual funding. Former heritage minister Pascale St-Onge said Canada should match the G7 average of $62 per person per year—a move that would balloon the CBC’s budget to $2.5 billion annually. That would nearly double the CBC’s current public funding, which already exceeds $1.2 billion per year.

To put that in perspective, $2.5 billion could cover the annual grocery bill for more than 150,000 Canadian families. But Ottawa wants to shovel more cash at an organization most Canadians don’t even watch.

St-Onge also proposed expanding the CBC’s mandate to “fight disinformation,” suggesting it should play a formal role in “helping the Canadian population understand fact-based information.” The federal government says this is about countering false or misleading information online—so-called “disinformation.” But the Carney platform took it further, pledging to “fully equip” the CBC to combat disinformation so Canadians “have a news source

they know they can trust.”

That raises troubling questions. Will the CBC become an official state fact-checker? Who decides what qualifies as “disinformation”? This isn’t about journalism anymore—it’s about control.

Meanwhile, accountability is nonexistent. Despite years of public backlash over lavish executive compensation, the CBC hasn’t cleaned up its act. Former CEO Catherine Tait earned nearly half a million dollars annually. Her successor, Marie Philippe Bouchard, will rake in up to $562,700. Bonuses were scrapped after criticism—but base salaries were quietly hiked instead. Canadians struggling with inflation and rising costs are footing the bill for bloated executive pay at a broadcaster few of them even watch.

The CBC’s flagship English-language prime-time news show draws just 1.8 per cent of available viewers. That means more than 98 per cent of TV-viewing Canadians are tuning out. The public isn’t buying what the CBC is selling—but they’re being forced to pay for it anyway.

Government-funded journalism is a conflict of interest by design. The CBC is expensive, unpopular, and unaccountable. It doesn’t need more money. It needs to stand on its own—or not at all.

Kris Sims is the Alberta Director for the Canadian Taxpayers Federation

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWOKE NBA Stars Seems Natural For CDN Advertisers. Why Won’t They Bite?

-

Crime1 day ago

Crime1 day agoUK finally admits clear evidence linking Pakistanis and child grooming gangs

-

Health1 day ago

Health1 day agoLast day and last chance to win this dream home! Support the 2025 Red Deer Hospital Lottery before midnight!

-

conflict14 hours ago

conflict14 hours agoTrump: ‘We’ have control over Iranian airspace; know where Khomeini is hiding

-

Business1 day ago

Business1 day agoCarney praises Trump’s world ‘leadership’ at G7 meeting in Canada

-

Energy2 days ago

Energy2 days agoCould the G7 Summit in Alberta be a historic moment for Canadian energy?

-

Crime2 days ago

Crime2 days agoMinnesota shooter arrested after 48-hour manhunt

-

conflict1 day ago

conflict1 day agoIsrael bombs Iranian state TV while live on air