Business

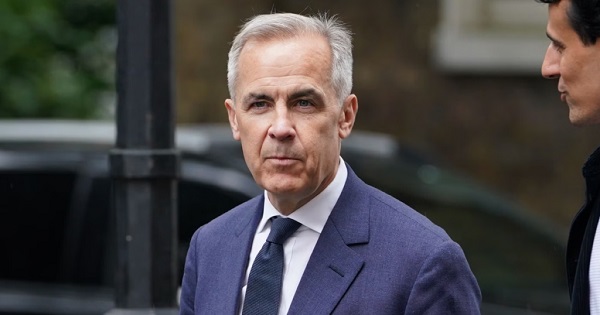

Carney’s carbon madness

Dan McTeague

Dan McTeague

Well, we are in quite the pickle.

In nine plus years as prime minister, Justin Trudeau has waged a multi-front war on the consumption and production of hydrocarbon energy, and, with that, on our economy, our quality of life, and our cost of living.

Trudeau zealously pursued and implemented anti-energy policies, most infamously the consumer Carbon Tax, but let’s not forget his so-called ”Clean Fuel” regulations; his Industrial Carbon Tax; his proposed emissions caps; his Electric Vehicle subsidies and mandates; Bill C-59, which bans businesses from touting the environmental positives of their work if it doesn’t meet a government-approved standard; and various other pieces of legislation which make the construction of new pipelines nearly impossible and significantly reduces our ability to sell our oil and gas overseas.

Every one of these policies can be traced back to the pernicious Net Zero ideology which informs them, and in which Trudeau and his bosom buddies — Gerald Butts, Steven Guilbeault, Mark Carney, etc — remain true believers.

And yet, despite those policies contributing to his party’s collapsing poll numbers and Trudeau’s unceremonious ouster, the Liberals are on the verge of naming as his replacement Mark Carney, one of the very Trudeau consiglieri who got us into this mess in the first place!

Now, Carney is currently doing everything in his power to downplay and dance around those aspects of his career which voters might find objectionable. He’s making quite a habit of it, in fact. And on the energy file, he’s being especially misleading, walking back his long-time support of the Carbon Tax — he’s said it has “served a purpose up until now” — and claiming that he intends to repeal it, while finding other ways to “make polluters pay.”

This is nonsense. In fact, Carney is a Carbon Tax superfan, and, if you listen to him closely, his actual critique of the Trudeau tax isn’t that it has made it more expensive to heat our homes, gas up our cars, and pay for our groceries (which it has.) It’s that it is too visible to voters. His vow to “make polluters pay” means, in fact, that he intends to “beef up” Trudeau’s less discussed Industrial Carbon Tax, targeting businesses, which will ultimately pass the cost down to consumers.

He’s even discussed enacting a Carbon tariff, which would apply to trade with countries which don’t adopt the onerous Net Zero policies which he wants to force on Canada.

That’s just who Mark Carney is.

And, unfortunately, Donald Trump’s tariff threats have provoked a “rally round the flag” sentiment, enabling the Liberals to close the polling gap with the Conservatives, with some polls currently showing them neck-and-neck. Which is to say, there is a possibility that, whenever we get around to having an election, anti-American animus could keep the Liberals in power, and propel Carney to the top job in our government.

This is, in a word, madness.

Let us not forget that it was the Liberals’ policies — especially their assault on our “golden goose,” the natural resource sector — which left us in such a precarious fiscal state that Trudeau felt the need to fly to Mar-a-Lago and tell the newly elected president that a tariff would “kill” our economy. That’s what provoked Trump’s “51st state” crack in the first place.

Access to U.S. markets will always be important for Canadian prosperity — they, by leaps and bounds, are our largest trading partner, after all — but without the Net Zero nonsense, we could have been an energy superpower, providing an alternative source of oil and natural gas for those countries leary about relying for energy on less-environmentally conscious, human-rights-abusing petrostates. We could have filled the void created by Russia, when they made themselves a pariah state in Europe by invading Ukraine.

In short, we might have been set up to negotiate with the Trump Administration from a position of strength. Instead, we’re proposing to double-down on Net Zero, pledging allegiance to a program which will make us less competitive and more likely to be steamrolled by major powers, including the U.S. but also (and less frequently mentioned) China.

Talk about cutting off your nose to spite your face! And all in the name of nationalism.

Here’s hoping we wise up and change course while there’s still time. Because, in the words of America’s greatest philosopher, Yogi Berra, “It’s getting late early.”

Dan McTeague is President of Canadians for Affordable Energy.

Support Dan’s Work to Keep Canadian Energy Affordable!

Canadians for Affordable Energy is run by Dan McTeague, former MP and founder of Gas Wizard. We stand up and fight for more affordable energy.

Business

Canada needs serious tax cuts in 2026

What Prime Minister Mark Carney gives with his left hand, he takes away with his right hand.

Canadians are already overtaxed and need serious tax cuts to make life more affordable and make our economy more competitive. But at best, the New Year will bring a mixed bag for Canadian taxpayers.

The federal government is cutting income taxes, but it’s hiking payroll taxes. The government cancelled the consumer carbon tax, but it’s hammering Canadian businesses with a higher industrial carbon tax.

The federal government cut the lowest income tax bracket from 15 to 14 per cent. That will save the average taxpayer $190 in 2026, according to the Parliamentary Budget Officer.

But the government is taking more money from Canadians’ paycheques with higher payroll taxes.

Workers earning $85,000 or more will pay $5,770 in federal payroll taxes in 2026. That’s a $262 payroll tax hike. Their employers will also be forced to pay $6,219.

So Canadians will save a couple hundred bucks from the income tax cut in the new year, but many Canadians will pay a couple hundred bucks more in payroll taxes.

It’s the same story with carbon taxes.

After massive backlash from ordinary Canadians, the federal government dropped its consumer carbon tax that cost average families hundreds of dollars every year and increased the price of gas by about 18 cents per litre.

But Carney’s first budget shows he wants higher carbon taxes on Canadian businesses. Carney still hasn’t provided Canadians a clear answer on how much his business carbon tax will cost. He did, however, provide a hint during a press conference he held after signing a memorandum of understanding with the Alberta government.

“It means more than a six times increase in the industrial price on carbon,” Carney said.

Carney previously said that by “changing the carbon tax … We are making the large companies pay for everybody.”

Carney’s problem is that Canadians aren’t buying what he’s selling on carbon taxes.

Just 12 per cent of Canadians believe Carney that businesses will pay most of the cost of his carbon tax, according to a Leger poll. Nearly 70 per cent of Canadians say businesses will pass most or some of the cost to consumers.

Canadians understand that it doesn’t matter what type of lipstick politicians put on their carbon tax pig, all carbon taxes make life more expensive.

Carney is also continuing his predecessor’s tradition of automatically increasing booze taxes.

Ottawa will once again hike taxes on beer, wine and spirits in 2026 through its undemocratic alcohol tax escalator.

First passed in the 2017 federal budget, the alcohol escalator tax automatically increases federal taxes on beer, wine and spirits every year without a vote in Parliament.

Federal alcohol taxes are expected to increase by two per cent on April 1, and cost taxpayers $41 million in 2026. Since being imposed, the alcohol escalator tax has cost taxpayers about $1.6 billion, according to industry estimates.

Canadians are overtaxed and need the federal government to seriously lighten the load.

The biggest expense for the average Canadian family isn’t the home they live in, the food they eat or the clothes they buy. It’s the taxes they pay to all levels of government. More than 40 per cent of the average family’s budget goes to paying taxes, according to the Fraser Institute.

Politicians are taking too much money from Canadians. And their high taxes are driving away investment and jobs.

Canada ranks a dismal 27th out of 38 industrialized countries on individual tax competitiveness, according to the Tax Foundation. Canada ranks 22nd on business tax competitiveness. Canada is behind the United States on both measures.

A little bit of tax relief here and there isn’t going to cut it. Carney’s New Year’s resolution needs to be to embark on a massive tax cutting campaign.

Business

DOOR TO DOOR: Feds descend on Minneapolis day cares tied to massive fraud

Federal agents are now going “DOOR TO DOOR” in Minneapolis, launching what the Department of Homeland Security itself describes as an on-the-ground sweep of businesses and day-care centers tied to Minnesota’s exploding fraud scandal — a case that has already burned through at least $1 billion in taxpayer money and is rapidly closing in on Democrat Gov. Tim Walz and his administration.

ICE agents, working under the umbrella of the Department of Homeland Security, fanned out across the city this week, showing up unannounced at locations suspected of billing state and federal programs for services that never existed. One day-care worker told reporters Monday that masked agents arrived at her facility, demanded paperwork, and questioned staff about operations and enrollment.

“DHS is on the ground in Minneapolis, going DOOR TO DOOR at suspected fraud sites,” the agency posted on X. “The American people deserve answers on how their taxpayer money is being used and ARRESTS when abuse is found.”

DHS is on the ground in Minneapolis, going DOOR TO DOOR at suspected fraud sites.

The American people deserve answers on how their taxpayer money is being used and ARRESTS when abuse is found. Under the leadership of @Sec_Noem, DHS is working to deliver results. pic.twitter.com/7XtRflv36b

— Homeland Security (@DHSgov) December 29, 2025

Authorities say the confirmed fraud already totals roughly $300 million tied to fake food programs, $220 million linked to bogus autism services, and more than $300 million charged for housing assistance that never reached the people it was meant to help. Investigators from the FBI, Justice Department, and Department of Labor have now expanded their probes after a viral investigation exposed taxpayer-funded day cares that received more than $1 million each while allegedly serving few — or zero — children.

One of the most glaring examples, the Minneapolis-based Quality “Learing” Center — infamous for its misspelled sign — suddenly appeared busy Monday as national media arrived. Locals told reporters the center is typically empty and often looks permanently closed, despite receiving about $1.9 million in public funds. State inspection records show the facility has racked up 95 violations since 2019. Employees allegedly cursed at reporters while children were bused in during posted afternoon hours.

DHS officials say the “DOOR TO DOOR” operation is deliberate. In videos released online, agents are seen questioning nearby business owners about whether adjacent buildings ever had foot traffic, whether they appeared open, and whether operators used subcontractors or outside partners to pad billing. DHS Secretary Kristi Noem posted footage of agents pressing workers about business relationships and transportation services used by suspected fraud sites.

“This is a large-scale investigation,” DHS Assistant Secretary Tricia McLaughlin told the New York Post, confirming that Homeland Security Investigations and ICE are targeting fraudulent day-care and health-care centers as well as related financial schemes.

FBI Director Kash Patel warned that what investigators have uncovered so far is “just the tip of a very large iceberg.” He pointed to the bureau’s dismantling of a $250 million COVID-era food-aid scam tied to the Feeding Our Future network, a case that resulted in 78 indictments and 57 convictions. Patel has also made clear that denaturalization and deportation remain on the table for convicted fraudsters where the law allows.

Dozens of arrests have already been made across the broader scheme, many involving Somali immigrants, though federal officials stress the investigation targets criminal behavior — not communities. Some local residents say the scandal is hurting law-abiding families. One Somali Uber driver told reporters he works 16-hour days and is furious that “some people are taking advantage of the system,” making the entire community look bad.

Now, with federal agents going “DOOR TO DOOR” across Minneapolis, the era of polite indifference appears to be over. The message from Washington is blunt: the money trail is being followed, the paperwork is being checked, and the days of treating taxpayer-funded programs like an open vault are coming to an end.

-

Energy1 day ago

Energy1 day agoWhy Japan wants Western Canadian LNG

-

Business2 days ago

Business2 days agoWhat Do Loyalty Rewards Programs Cost Us?

-

Business1 day ago

Business1 day agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud

-

Business1 day ago

Business1 day agoLand use will be British Columbia’s biggest issue in 2026

-

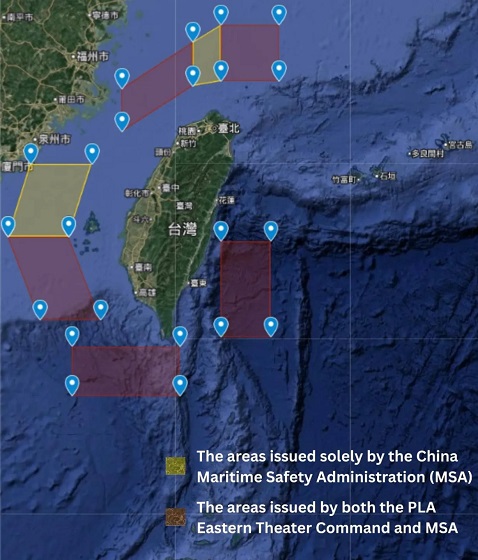

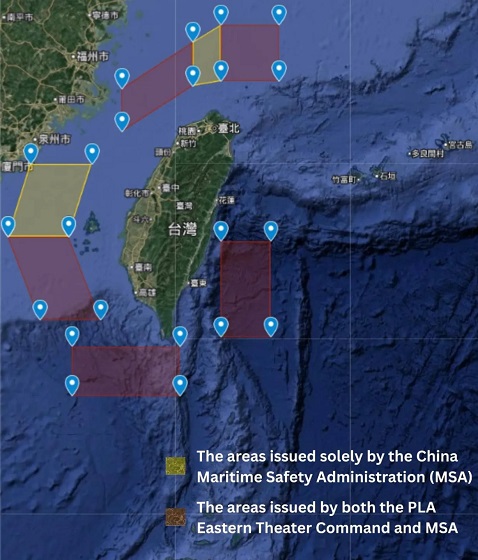

International18 hours ago

International18 hours agoChina Stages Massive Live-Fire Encirclement Drill Around Taiwan as Washington and Japan Fortify

-

Digital ID17 hours ago

Digital ID17 hours agoThe Global Push for Government Mandated Digital IDs And Why You Should Worry

-

Haultain Research2 days ago

Haultain Research2 days agoSweden Fixed What Canada Won’t Even Name

-

Energy19 hours ago

Energy19 hours agoRulings could affect energy prices everywhere: Climate activists v. the energy industry in 2026