Fraser Institute

Carney government’s housing plan poses major risks to taxpayers

From the Fraser Institute

By Jake Fuss and Austin Thompson

A trade war, Trump’s threats to Canada’s sovereignty, and global economic volatility loomed large in the recent federal election. Yet many voters remained focused on an issue much closer to home: housing affordability.

In 2023, under Justin Trudeau, Canada added a record high 1.2 million new residents—more than double the previous record in 2019—and another 951,000 new residents last year. All told, Canada’s population has grown by about 3 million people since 2022—roughly matching the total population increase during the entire decade of the 1990s. Not surprisingly, homebuilding has failed to keep pace. In fact, housing construction rates have barely exceeded 1970s levels, even though the population has more than tripled since then. The result—a historic surge in housing costs.

On the campaign trail, the Liberals set an immigration target of about 400,000 per year, which is lower than the recent record highs but still high by historical standards, and tabled a plan they claim will double Canada’s residential construction rate to 500,000 new homes per year within a decade. But is it a good plan? And can the Liberals deliver it?

First, the good news. To help boost private homebuilding, the Carney government promised to introduce tax incentives including a rental building allowance, which would help reduce the tax bill on new multi-unit rental buildings, and a GST exemption for some first-time homebuyers, which may reduce the cost of newly-built homes and spur more homebuilding. The government also plans to expand the “Housing Accelerator Fund,” which offers federal dollars to municipalities in exchange for more flexible municipal building rules, and modernize the federal building code, which could shorten construction timelines. While much will depend on execution, these policies rightly aim to make it faster, cheaper and more attractive for the private sector to build homes.

Now, the bad news. The Carney government plans to create a new federal entity called Build Canada Homes (BCH) to “get the government back in the business of building.” According to Carney’s vision, the BCH will act “as a developer to build affordable housing” and provide more than “$25 billion in financing” to homebuilders and “$10 billion in low-cost financing and capital” for homebuilders to build “affordable” homes.

We’ve seen a similar movie before. In 2017, the Trudeau government created the Canada Infrastructure Bank (CIB) to invest in the “next generation of infrastructure Canadians need.” Since then, the CIB has approved approximately $13.2 billion in investments across 76 projects (as of July 2024), yet only two CIB-funded projects had been completed, prompting the authors of a multi-party House of Commons committee report to recommend abolishing the CIB.

The bureaucrats who will run the BCH won’t have the private sector’s expertise in housing development, nor the same incentives to keep costs down. BCH’s mandate is already muddled by competing goals—it must deliver “affordable” homes while simultaneously prioritizing certain building materials (e.g. Canadian softwood lumber), which could increase building costs.

The plan for BCH’s multi-billion-dollar loan portfolio includes significant “low cost” (that is, taxpayer subsidized) financing, a huge bet on prefabricated homebuilding, and no certainty about who will be on the hook for any failed projects—combined, this represents a major increase in costs and risks for taxpayers at a time when they already shoulder rising federal deficits and debt.

There’s also a real risk that BCH will simply divert limited investment dollars and construction resources away from private homebuilding—where projects respond to the needs of Canadian homebuyers and renters—and toward government-backed housing projects shaped by political goals. Instead of boosting overall homebuilding, BCH may simply reshuffle limited resources. And, as noted by the government, there’s a severe shortage of skilled construction labour in Canada.

It’s hard to see how Carney’s housing plan would double the pace of homebuilding in Canada—a very ambitious target that would require not only prudent housing policies but greater domestic savings, an implausibly large expansion in the construction workforce (which grew by only 18.4 per cent over the last decade), and the political fortitude to endure vocal opposition to housing development in certain neighbourhoods and on public lands.

Canada’s housing crisis will benefit from federal leadership—but not federal overreach. Rather than overpromising what it can’t deliver, the Carney government should refocus on what it’s best positioned to do: reform incentives, streamline regulations, and nudge municipalities and provinces to remove constraints on homebuilding. Trying to also act as a housing developer and lender is a far riskier approach.

Business

Massive government child-care plan wreaking havoc across Ontario

From the Fraser Institute

By Matthew Lau

It’s now more than four years since the federal Liberal government pledged $30 billion in spending over five years for $10-per-day national child care, and more than three years since Ontario’s Progressive Conservative government signed a $13.2 billion deal with the federal government to deliver this child-care plan.

Not surprisingly, with massive government funding came massive government control. While demand for child care has increased due to the government subsidies and lower out-of-pocket costs for parents, the plan significantly restricts how child-care centres operate (including what items participating centres may purchase), and crucially, caps the proportion of government funds available to private for-profit providers.

What have families and taxpayers got for this enormous government effort? Widespread child-care shortages across Ontario.

For example, according to the City of Ottawa, the number of children (aged 0 to 5 years) on child-care waitlists has ballooned by more than 300 per cent since 2019, there are significant disparities in affordable child-care access “with nearly half of neighbourhoods underserved, and limited access in suburban and rural areas,” and families face “significantly higher” costs for before-and-after-school care for school-age children.

In addition, Ottawa families find the system “complex and difficult to navigate” and “fewer child care options exist for children with special needs.” And while 42 per cent of surveyed parents need flexible child care (weekends, evenings, part-time care), only one per cent of child-care centres offer these flexible options. These are clearly not encouraging statistics, and show that a government-knows-best approach does not properly anticipate the diverse needs of diverse families.

Moreover, according to the Peel Region’s 2025 pre-budget submission to the federal government (essentially, a list of asks and recommendations), it “has maximized its for-profit allocation, leaving 1,460 for-profit spaces on a waitlist.” In other words, families can’t access $10-per-day child care—the central promise of the plan—because the government has capped the number of for-profit centres.

Similarly, according to Halton Region’s pre-budget submission to the provincial government, “no additional families can be supported with affordable child care” because, under current provincial rules, government funding can only be used to reduce child-care fees for families already in the program.

And according to a March 2025 Oxford County report, the municipality is experiencing a shortage of child-care staff and access challenges for low-income families and children with special needs. The report includes a grim bureaucratic predication that “provincial expansion targets do not reflect anticipated child care demand.”

Child-care access is also a problem provincewide. In Stratford, which has a population of roughly 33,000, the municipal government reports that more than 1,000 children are on a child-care waitlist. Similarly in Port Colborne (population 20,000), the city’s chief administrative officer told city council in April 2025 there were almost 500 children on daycare waitlists at the beginning of the school term. As of the end of last year, Guelph and Wellington County reportedly had a total of 2,569 full-day child-care spaces for children up to age four, versus a waitlist of 4,559 children—in other words, nearly two times as many children on a waitlist compared to the number of child-care spaces.

More examples. In Prince Edward County, population around 26,000, there are more than 400 children waitlisted for licensed daycare. In Kawartha Lakes and Haliburton County, the child-care waitlist is about 1,500 children long and the average wait time is four years. And in St. Mary’s, there are more than 600 children waitlisted for child care, but in recent years town staff have only been able to move 25 to 30 children off the wait list annually.

The numbers speak for themselves. Massive government spending and control over child care has created havoc for Ontario families and made child-care access worse. This cannot be a surprise. Quebec’s child-care system has been largely government controlled for decades, with poor results. Why would Ontario be any different? And how long will Premier Ford allow this debacle to continue before he asks the new prime minister to rethink the child-care policy of his predecessor?

Business

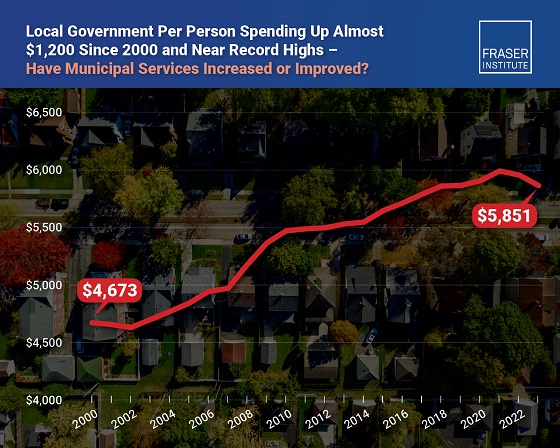

Municipal government per-person spending in Canada hit near record levels

From the Fraser Institute

Municipal government spending in Canada hit near record levels in recent years, finds a new study by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“In light of record-high spending in municipalities across Canada, residents should consider whether or not crime, homelessness, public transit and other services have actually improved,” said Austin Thompson, senior policy analyst at the Fraser Institute and author of The Expanding Finances of Local Governments in Canada.

From 2000 to 2023, per-person spending (inflation-adjusted) increased by 25.2 per cent, reaching a record-high $5,974 per person in 2021 before declining slightly to $5,851 in 2023, the latest year of available data.

During that same period, municipal government revenue—generated from property taxes and transfers from other levels of government—increased by 33.7 per cent per person (inflation-adjusted).

And yet, among all three levels of government including federal and provincial, municipal government spending (adjusted for inflation) has actually experienced the slowest rate of growth over the last 10 years, underscoring the large spikes in spending at all government levels across Canada.

“Despite claims from municipal policymakers about their dire financial positions, Canadians should understand the true state of finances at city hall so they can decide whether they’re getting good value for their money,” said Jake Fuss, director of fiscal studies at the Fraser Institute.

The Expanding Finances of Local Governments in Canada, 1990–2023

- Canada’s local governments have experienced substantial fiscal growth in recent decades.

- Revenue and expenditure by local governments—including municipal governments, school boards, and Indigenous governments—have increased faster than population growth and inflation combined. From 1990 to 2023, real per-capita revenue rose by 32.7%, and expenditure by 30.0%.

- Local governments represent a significant component of Canada’s broader public sector. In 2023, net of inter-governmental transfers, municipal governments and school boards accounted for 18.6% of total government expenditure and 11.1% of revenue.

- Despite this growth, local governments’ share of overall government revenue and expenditure has declined over time—especially since the COVID-19 pandemic—as federal and provincial budgets have expanded even more rapidly.

- Nevertheless, between 2008 and 2023 the inflation-adjusted per-capita revenue of municipal governments in-creased by 10.1% and their expenditure by 12.4% , on average across the provinces.

- Over the same period, municipal governments recorded above-inflation increases in their combined annual operating surpluses, which contributed to an 88.1% inflation-adjusted rise in their net worth—raising important questions about the allocation of accumulated resources.

- In 2023, Ontario recorded the highest per-capita municipal revenue among the provinces ($4,156), while Alberta had the highest per-capita expenditure ($3,750). Prince Edward Island reported the lowest per-capita municipal revenue ($1,635) and expenditure ($1,186).

- Wide variation in per-capita municipal revenue and expenditure across the provinces reflects differences in the responsibilities provinces assign to municipalities, as well as possible disparities in the efficiency of service delivery—issues that warrant further scrutiny.

Click Here To Read The Full Study

-

Alberta10 hours ago

Alberta10 hours agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Business2 days ago

Business2 days agoTrump on Canada tariff deadline: ‘We can do whatever we want’

-

Automotive2 days ago

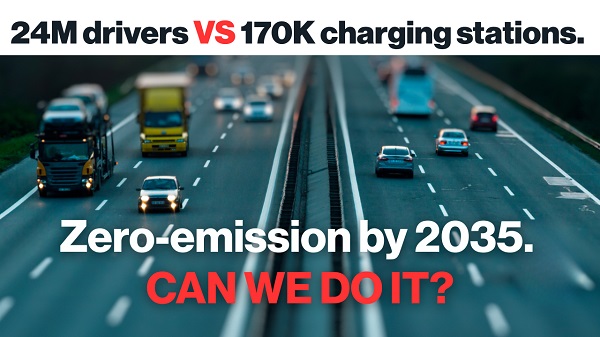

Automotive2 days agoElectric vehicle sales are falling hard in BC, and it is time to recognize reality.

-

Automotive1 day ago

Automotive1 day agoPower Struggle: Electric vehicles and reality

-

Business12 hours ago

Business12 hours agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Crime12 hours ago

Crime12 hours agoSuspected ambush leaves two firefighters dead in Idaho

-

Energy2 days ago

Energy2 days agoChina undermining American energy independence, report says

-

Alberta9 hours ago

Alberta9 hours agoWhy the West’s separatists could be just as big a threat as Quebec’s