Business

Carbon Tax poll reveals what we already knew

Written By Dan McTeague of Canadians for Affordable Energy

Written By Dan McTeague of Canadians for Affordable Energy

The chickens are coming home to roost for the Trudeau government.

Last month (August 6th) Nanos Research released a new poll showing that two thirds of Canadians think that now is a bad time to increase the Carbon Tax. This is not exactly a shocking revelation. It really didn’t take a poll to determine what everyday Canadians already know. Adding a Carbon Tax to a struggling economy is a bad idea.

Anyone who has gone to the grocery store lately, or has filled up their vehicle, knows that the cost of living has skyrocketed. Social media is flooded with Canadians sharing their stories of how they are at the breaking point with the cost of living. It doesn’t take an economist to know that higher consumption taxes have the immediate effect of increasing the cost of everything. That has not stopped the green Agenda driven Trudeau government that seems determined to make life unaffordable for Canadians.

But back to that Nanos poll –

Let’s break this down a bit more to understand what this poll is really saying about how Canadians feel about Carbon Taxes.

First, it is evident that Nanos is approaching this poll with a clear bias in favor of Carbon Taxes. Participants were asked three (3) questions: 1) Do you think a carbon tax on things like gas is an effective, somewhat effective, somewhat ineffective, or ineffective way to encourage people to use less fuel? 2) Is now a very good, good, average, poor or very poor time to increase carbon taxes on things like gas? 3) On a scale from 0 to 10 where 0 is not at all effective and 10 is extremely effective, how effective do you think the federal government’s Carbon Pollution Pricing system, often called the carbon tax, is to combat climate change?

Notice the poll did not ask Canadians whether or not they think Carbon Taxes are a good idea or whether they want them at all.

The assumption is that Canadians buy into the narrative that climate change is real, and a “real problem” that requires government action, that “using less carbon” such as fuel is a key, if not the key, to reducing “carbon consumption”.

We know not every Canadian believes this; but the Nanos poll didn’t even ask.

That said, looking at the results of what they did ask, two thirds of Canadians say that now is a bad time to increase carbon taxes.

In the prairie provinces, this number was 79% and in Atlantic Canada 73% of respondents said the timing is “poor” or “very poor”.

Of even greater political significance: in Ontario, where the next federal election will likely be decided, a whopping 68.7% of respondents said that now is a bad time to increase the Carbon Tax. And yet Justin Trudeau keeps increasing this most hated tax.

In terms of effectiveness, 64.3% in Ontario think that a new carbon tax is not effective at encouraging people to use less fuel. This comes as no surprise. A majority of Canadians rely on their vehicles to get to work, the grocery store, kids practices, and family vacations. Normal daily activities for life in Canada. In most cases not driving is not an option. It only means that getting there is more expensive, and other items in the budget need to be sacrificed instead.

And as we know the Carbon Tax is one of the culprits for higher prices.

Conservative MP Kyle Seeback articulated it well in the House of Commons when he explained to Trudeau’s Environment Minister Stephen Guilbeault how the Carbon Tax is driving up inflation. “Mr. Speaker, it is incredible, he actually does not know how food ends up on his plate. The farmer pays a carbon tax, the truck that picks up the farmer’s food pays a carbon tax to take it to the processor, the processor pays a carbon tax, the truck that picks it up from the processor to take it to the grocery store pays a carbon tax, the grocery store pays a carbon tax and then Canadians cannot pay for food.”

Canadians for Affordable Energy has been advocating for affordability since 2017 and have known that Carbon Taxes are a threat to affordable energy in Canada and will drive up the cost of everything. And that is exactly what is happening. Fuel prices are skyrocketing, food prices are at record highs, and Canadians are struggling to make ends meet. Energy affordability is the key to success in Canada and therefore it is the view of CAE that there is never a good time to implement a Carbon Tax. Full stop.

Canadians are finally starting to connect the dots on a path that leads directly back to bad energy and environmental policies. Policies that have stifled our resource economy and punished working Canadians. Policies that are hitting Canadians’ pocketbooks really hard, especially when trying to fill up their vehicles and feed their families. Policies that won’t even help the environment.

Pierre Poilievre and his Conservative government have committed to scrapping the carbon tax. Let’s hope they follow through on this promise if they come into power in the next election. Because not all Canadians buy the narrative that Carbon Taxes are a good thing.

Banks

Bank of Canada Cuts Rates to 2.25%, Warns of Structural Economic Damage

Governor Tiff Macklem concedes the downturn runs deeper than a business cycle, citing trade wars, weak investment, and fading population growth as permanent drags on Canada’s economy.

In an extraordinary press conference on October 29th, 2025, Bank of Canada Governor Tiff Macklem stood before reporters in Ottawa and calmly described what most Canadians have already been feeling for months: the economy is unraveling. But don’t expect him to say it in plain language. The central bank’s message was buried beneath bureaucratic doublespeak, carefully manicured forecasts, and bilingual spin. Strip that all away, and here’s what’s really going on: the Canadian economy has been gutted by a combination of political mismanagement, trade dependence, and a collapsing growth model based on mass immigration. The central bank knows it. The data proves it. And yet no one dares to say the quiet part out loud.

Start with the headline: the Bank of Canada cut interest rates by 25 basis points, bringing the policy rate down to 2.25%, its second consecutive cut and part of a 100 basis point easing campaign this year. That alone should tell you something is wrong. You don’t slash rates in a healthy economy. You do it when there’s pain. And there is. Canada’s GDP contracted by 1.6% in the second quarter of 2025. Exports are collapsing, investment is weak, and the unemployment rate is stuck at 7.1%, the highest non-pandemic level since 2016.

Macklem admitted it: “This is more than a cyclical downturn. It’s a structural adjustment. The U.S. trade conflict has diminished Canada’s economic prospects. The structural damage caused by tariffs is reducing the productive capacity of the economy.” That’s not just spin—that’s an admission of failure. A major trading nation like Canada has built its economic engine around exports, and now, thanks to years of reckless dependence on U.S. markets and zero effort to diversify, it’s all coming apart.

And don’t miss the implications of that phrase “structural adjustment.” It means the damage is permanent. Not temporary. Not fixable with a couple of rate cuts. Permanent. In fact, the Bank’s own Monetary Policy Report says that by the end of 2026, GDP will be 1.5% lower than it was forecast back in January. Half of that hit comes from a loss in potential output. The other half is just plain weak demand. And the reason that demand is weak? Because the federal government is finally dialing back the immigration faucet it’s been using for years to artificially inflate GDP growth.

The Bank doesn’t call it “propping up” GDP. But the facts are unavoidable. In its MPR, the Bank explicitly ties the coming consumption slowdown to a sharp drop in population growth: “Population growth is a key factor behind this expected slowdown, driven by government policies designed to reduce the inflow of newcomers. Population growth is assumed to slow to average 0.5% over 2026 and 2027.” That’s down from 3.3% just a year ago. So what was driving GDP all this time? People. Not productivity. Not innovation. Not exports. People.

And now that the government has finally acknowledged the political backlash of dumping half a million new residents a year into an overstretched housing market, the so-called “growth” is vanishing. It wasn’t real. It was demographic window dressing. Macklem admitted as much during the press conference when he said: “If you’ve got fewer new consumers in the economy, you’re going to get less consumption growth.” That’s about as close as a central banker gets to saying: we were faking it.

And yet despite all of this, the Bank still clings to its bureaucratic playbook. When asked whether Canada is heading into a recession, Macklem hedged: “Our outlook has growth resuming… but we expect that growth to be very modest… We could get two negative quarters. That’s not our forecast, but we can’t rule it out.” Translation: It’s already here, but we’re not going to admit it until StatsCan confirms it six months late.

Worse still, when reporters pressed him on what could lift the economy out of the ditch, he passed the buck. “Monetary policy can’t undo the damage caused by tariffs. It can’t target the hard-hit sectors. It can’t find new markets for companies. It can’t reconfigure supply chains.” So what can it do? “Mitigate spillovers,” Macklem says. That’s central banker code for “stand back and pray.”

So where’s the recovery supposed to come from? The Bank pins its hopes on a moderate rebound in exports, a bit of resilience in household consumption, and “ongoing government spending.” There it is. More public sector lifelines. More debt. More Ottawa Band-Aids.

And looming behind all of this is the elephant in the room: U.S. trade policy. The Bank explicitly warns that the situation could worsen depending on the outcome of next year’s U.S. election. The MPR highlights that tariffs are already cutting into Canadian income, raising business costs, and eliminating entire trade-dependent sectors. Governor Macklem put it plainly: “Unless something else changes, our incomes will be lower than they otherwise would have been.”

Canadians should be furious. For years, we were told everything was fine. That our economy was “resilient.” That inflation was “transitory.” That population growth would solve all our problems. Now we’re being told the economy is structurally impaired, trade-dependent to a fault, and stuck with weak per-capita growth, high unemployment, and sticky core inflation between 2.5–3%. And the people responsible for this mess? They’ve either resigned (Trudeau), failed upward (Carney), or still refuse to admit they spent a decade selling us a fantasy.

This isn’t just bad economics. It’s political malpractice.

Canada isn’t failing because of interest rates or some mysterious global volatility. It’s failing because of deliberate choices—trade dependence, mass immigration without infrastructure, and a refusal to confront reality. The central bank sees the iceberg. They’re easing the throttle. But the ship has already taken on water. And no one at the helm seems willing to turn the wheel.

So here’s the truth: The Bank of Canada just rang the alarm bell. Quietly. Cautiously. But clearly. The illusion is over. The fake growth era is ending. And the reckoning has begun.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Business

Ford’s Liquor War Trades Economic Freedom For Political Theatre

From the Frontier Centre for Public Policy

By Conrad Eder

Consumer choice, not government coercion, should shape the market. Doug Ford’s alcohol crackdown trades symbolic outrage for sound policy and Ontarians will pay the price

Ontario politicians have developed an insatiable appetite for prohibition. Having already imposed a sweeping ban on all American alcohol, Premier Doug Ford has now threatened to remove Crown Royal, Smirnoff and potentially other brands from LCBO shelves. Such authoritarian impulses reflect a disturbing shift in our political culture—one that undermines economic prosperity and individual liberty.

After Diageo, the multinational behind brands like Crown Royal and Smirnoff, announced in August that it would close its Amherstburg, Ont., bottling facility, affecting 200 workers, the political response was swift. NDP MPP Lisa Gretzky urged the government to retaliate by pulling Crown Royal from LCBO shelves. Days later, Ford dramatically dumped a bottle of the whisky during a press conference, signalling he might follow through.

Now, the premier has escalated the threat, vowing to remove Smirnoff and potentially other Diageo products.

These gestures may make headlines, but they come at a cost. They undermine business confidence, discourage investment, and send the wrong message to employers. More fundamentally, they reflect a poor understanding of how free societies settle disputes and make decisions.

To understand what’s at stake, it helps to consider the two basic mechanisms available to democratic societies: the marketplace and the ballot box. At the ballot box, citizens vote once, and majority rule determines a single outcome. The marketplace, by contrast, allows people to vote continuously with their dollars. Individuals make countless choices reflecting their own values and priorities. You get what you choose—without overriding anyone else’s preference.

There’s a role for government in correcting market failures, where there’s fraud, monopoly power or public risk. But banning legal products simply because of political displeasure with a company’s decision is not market correction. It’s coercion.

Diageo’s decision to close a facility may be unfortunate, but it doesn’t involve deception, unfair dominance, or harm to the public. Bans aren’t rooted in sound principle; they’re political, plain and simple.

Some argue the government is justified in acting to protect Ontario jobs. But that line of thinking is short-sighted. If job protection alone warranted banning products, we’d resist every innovation or trade deal that disrupted the status quo. Sustainable job growth depends on encouraging investment and innovation, not shielding every position from change.

The appropriate response to plant closures is policy reform, not retaliation. Ontario should focus on creating an environment where businesses want to invest and grow. That means fostering a stable, competitive business climate with clear rules, reasonable taxes, and efficient regulation. Threatening companies with bans only creates uncertainty and drives investment elsewhere.

With Ontarians spending $740 million annually on Diageo products, removing them from store shelves would impose real economic costs. Consumers would face fewer choices, weaker competition, and higher prices. Restaurants and retailers would be forced to adjust. The LCBO, Ontario’s government-run liquor retailer, would lose sales.

This isn’t hypothetical. The province’s ban on American alcohol is already projected to block nearly $1 billion in annual sales, while doing nothing to benefit Ontario consumers. The LCBO is serving political interests, not the public.

Supporters of such bans often reveal their lack of confidence in public opinion. Rather than persuade others to boycott a product voluntarily, they demand that government enforce a blanket restriction.

There’s a better way. Consumer-led boycotts offer accountability without coercion. They allow individuals to act on their beliefs without forcing others to comply. And they tend to be more effective, as companies respond faster to falling sales than to political theatrics.

But the issue at hand goes beyond liquor. It’s about whether elected officials should impose a single set of preferences on everyone, or whether citizens are trusted to decide for themselves.

Each new ban makes the next one easier to justify. Over time, these interventions accumulate and normalize government interference in private choice. Unlike consumer preferences, which can shift quickly and reverse, government prohibitions often persist. The LCBO’s century-old structure is evidence of how long some policies endure, even when they no longer serve the public interest.

This isn’t a call to eliminate government’s role. But it is a call for principled governance, the kind that distinguishes between legitimate oversight and overreach rooted in symbolism or political frustration.

Ontario’s government would do better to focus on long-term prosperity. That means building an economy where investors feel welcome, businesses can grow, and consumers are free to choose.

Ontarians are perfectly capable of making their own choices about which products to buy and which companies to support. They don’t need politicians like Ford making those decisions for them.

Conrad Eder is a policy analyst at the Frontier Centre for Public Policy.

-

Alberta2 days ago

Alberta2 days agoPremier Smith sending teachers back to school and setting up classroom complexity task force

-

International1 day ago

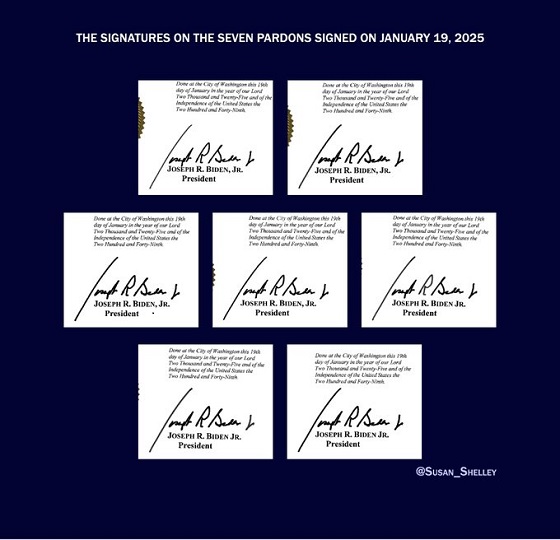

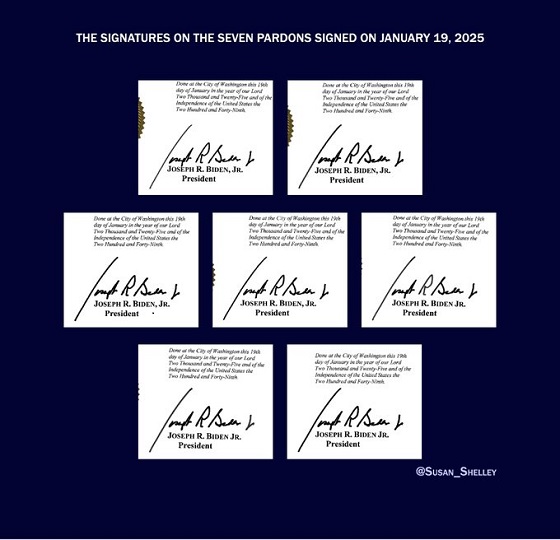

International1 day agoBiden’s Autopen Orders declared “null and void”

-

Business1 day ago

Business1 day agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Alberta2 days ago

Alberta2 days agoThousands of Albertans march to demand independence from Canada

-

Crime2 days ago

Crime2 days agoSuspect caught trying to flee France after $100 million Louvre jewel robbery

-

Business1 day ago

Business1 day agoCanada’s combative trade tactics are backfiring

-

Canada Free Press1 day ago

Canada Free Press1 day agoThe real genocide is not taking place in Gaza, but in Nigeria

-

Business24 hours ago

Business24 hours agoCanada has given $109 million to Communist China for ‘sustainable development’ since 2015