Fraser Institute

Canadian generosity hits lowest point in 20 years

From the Fraser Institute

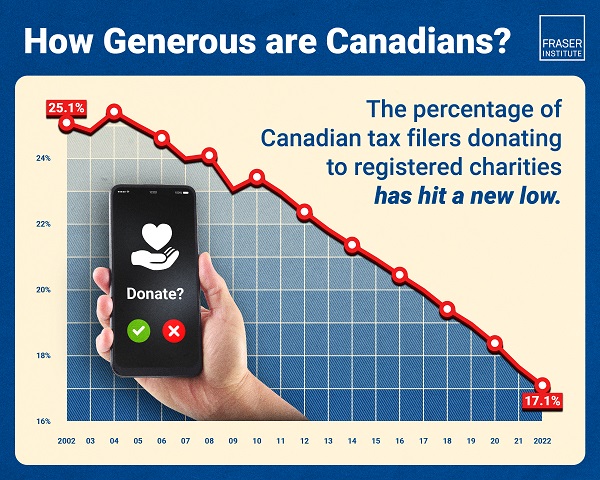

The number of Canadians donating to charity—as a percentage of all tax filers—is at the lowest point in 20 years, finds a new study published by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“The holiday season is a time to reflect on charitable giving, and the data shows Canadians are consistently less charitable every year, which means charities face greater challenges to secure resources to help those in need,” said Jake Fuss, director of Fiscal Studies at the Fraser Institute and co-author of Generosity in Canada: The 2024 Generosity Index.

The study finds that the percentage of Canadian tax filers donating to charity during the 2022 tax year—just 17.1 per cent—is the lowest proportion of Canadians donating since at least 2002.

Canadians’ generosity peaked at 25.4 per cent of tax-filersdonating in 2004, before declining in subsequent years.

Nationally, the total amount donated to charity by Canadian tax filers has also fallen from 0.61 per cent of income in 2002 to 0.50 per cent of income in 2022.

The study finds that Manitoba had the highest percentage of tax filers that donated to charity among the provinces (19.3 per cent) during the 2022 tax year while New Brunswick had the lowest (14.7 per cent).

Likewise, Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71 per cent) while Quebec donated the lowest (0.26 per cent).

“A smaller proportion of Canadians are donating to registered charities than what we saw in previous decades, and those who are donating are donating less,” said Fuss.

“This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond,” said Grady Munro, policy analyst and co-author.

NOTE: Table based on 2022 tax year, the most recent year of comparable data in Canada

Generosity in Canada: The 2024 Generosity Index

- Manitoba had the highest percentage of tax filers that donated to charity among the provinces (19.3%) during the 2022 tax year while New Brunswick had the lowest (14.7%).

- Manitoba also donated the highest percentage of its aggregate income to charity among the provinces (0.71%) while Quebec donated the lowest (0.26%).

- Nationally, the percentage of Canadian tax filers donating to charity has fallen over the last decade from 22.4% in 2012 to 17.1% in 2022.

- The percentage of aggregate income donated to charity by Canadian tax filers has also decreased from 0.55% in 2012 to 0.50% in 2022.

- This decline in generosity in Canada undoubtedly limits the ability of Canadian charities to improve the quality of life in their communities and beyond.

Fraser Institute

Long waits for health care hit Canadians in their pocketbooks

From the Fraser Institute

Canadians continue to endure long wait times for health care. And while waiting for care can obviously be detrimental to your health and wellbeing, it can also hurt your pocketbook.

In 2024, the latest year of available data, the median wait—from referral by a family doctor to treatment by a specialist—was 30 weeks (including 15 weeks waiting for treatment after seeing a specialist). And last year, an estimated 1.5 million Canadians were waiting for care.

It’s no wonder Canadians are frustrated with the current state of health care.

Again, long waits for care adversely impact patients in many different ways including physical pain, psychological distress and worsened treatment outcomes as lengthy waits can make the treatment of some problems more difficult. There’s also a less-talked about consequence—the impact of health-care waits on the ability of patients to participate in day-to-day life, work and earn a living.

According to a recent study published by the Fraser Institute, wait times for non-emergency surgery cost Canadian patients $5.2 billion in lost wages in 2024. That’s about $3,300 for each of the 1.5 million patients waiting for care. Crucially, this estimate only considers time at work. After also accounting for free time outside of work, the cost increases to $15.9 billion or more than $10,200 per person.

Of course, some advocates of the health-care status quo argue that long waits for care remain a necessary trade-off to ensure all Canadians receive universal health-care coverage. But the experience of many high-income countries with universal health care shows the opposite.

Despite Canada ranking among the highest spenders (4th of 31 countries) on health care (as a percentage of its economy) among other developed countries with universal health care, we consistently rank among the bottom for the number of doctors, hospital beds, MRIs and CT scanners. Canada also has one of the worst records on access to timely health care.

So what do these other countries do differently than Canada? In short, they embrace the private sector as a partner in providing universal care.

Australia, for instance, spends less on health care (again, as a percentage of its economy) than Canada, yet the percentage of patients in Australia (33.1 per cent) who report waiting more than two months for non-emergency surgery was much higher in Canada (58.3 per cent). Unlike in Canada, Australian patients can choose to receive non-emergency surgery in either a private or public hospital. In 2021/22, 58.6 per cent of non-emergency surgeries in Australia were performed in private hospitals.

But we don’t need to look abroad for evidence that the private sector can help reduce wait times by delivering publicly-funded care. From 2010 to 2014, the Saskatchewan government, among other policies, contracted out publicly-funded surgeries to private clinics and lowered the province’s median wait time from one of the longest in the country (26.5 weeks in 2010) to one of the shortest (14.2 weeks in 2014). The initiative also reduced the average cost of procedures by 26 per cent.

Canadians are waiting longer than ever for health care, and the economic costs of these waits have never been higher. Until policymakers have the courage to enact genuine reform, based in part on more successful universal health-care systems, this status quo will continue to cost Canadian patients.

Business

84% of Swiss hospitals and 60% of hospitalizations are in private facilities, and they face much lower wait times

From the Fraser Institute

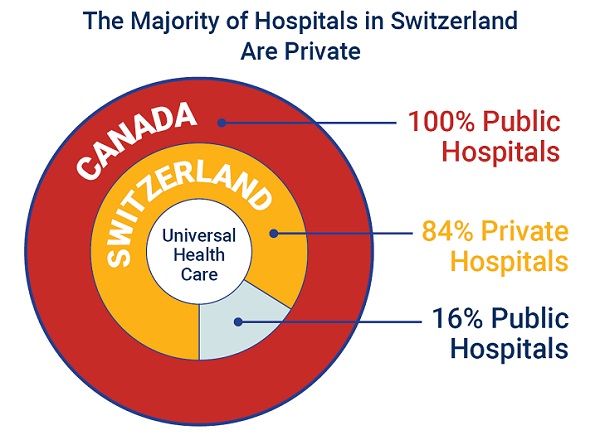

If Canada reformed to emulate Switzerland’s approach to universal health care, including its much greater use of private sector involvement, the country would deliver far better results to patients and reduce wait times, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian policy think-tank.

“The bane of Canadian health care is lack of access to timely care, so it’s critical to look to countries like Switzerland with more successful universal health care,” said Yanick Labrie, senior fellow at the Fraser Institute and author of Integrating Private Health Care Into Canada’s Public System: What We Can Learn from Switzerland. The study highlights how Switzerland successfully integrates the private sector into their universal health-care system, which consistently outperforms Canada on most health-care metrics, including wait times.

For example, in 2022, the percentage of patients who waited less than two months for a specialist appointment was 85.3 per cent in Switzerland compared to just 48.3 per cent in Canada.

In Switzerland, 84.2 per cent of all hospitals are private (either for-profit or not-for profit) institutions, and the country’s private hospitals provide 60.2 per cent of all hospitalizations, 60.9 per cent of all births, and 67.1 per cent of all operating rooms.

Crucially, Swiss patients can obtain treatment at the hospital of their choice, whether located inside or outside their geographic location, and hospitals cannot discriminate against patients, based on the care required.

“Switzerland shows that a universal health-care system can reconcile efficiency and equity–all while being more accessible and responsive to patients’ needs and preferences,” Labrie said.

“Based on the success of the Swiss model, provinces can make these reforms now and help improve Canadian health care.”

Integrating Private Health Care into Canada’s Public System: What We Can Learn from Switzerland

- Access to timely care remains the Achilles’ heel of Canada’s health systems. To reduce wait times, some provinces have partnered with private clinics for publicly funded surgeries—a strategy that has proven effective, but continues to spark debate in Canada.

- This study explores how Switzerland successfully integrates private health care into a universal public system and considers what Canada can learn from this model.

- In Switzerland, universal coverage is delivered through a system of managed competition among 44 non-profit private insurers, while decentralized governance allows each of the 26 cantons to coordinate and oversee hospital services in ways that reflect local needs and priorities.

- Nearly two-thirds of Swiss hospitals are for-profit institutions; they provide roughly half of all hospitalizations, births, and hospital beds across the country.

- All hospitals are treated equally—regardless of legal status—and funded through the same activity-based model, implemented nationwide in 2012.

- The reform led to a significant increase in the number of cases treated without a corresponding rise in expenditures per case, suggesting improved efficiency, better use of resources, and expanded access to hospital care.

- The average length of hospital stay steadily decreased over time and now stands at 4.87 days in for-profit hospitals versus 5.53 days in public ones, indicating faster patient turnover and more streamlined care pathways.

- Hospital-acquired infection rates are significantly lower in private hospitals (2.7%) than in public hospitals (6.2%), a key indicator of care quality.

- Case-mix severity is as high or higher in private hospitals, countering the notion that they only take on simpler or less risky cases.

- Patient satisfaction is slightly higher in private hospitals (4.28/5) than in public ones (4.17/5), reflecting strong user experience across multiple dimensions.

- Canada could benefit from regulated competition between public and private providers and activity-based funding, without breaching the Canada Health Act.