Business

Canada’s productivity and prosperity slump

From Resource Works

“The U.S. is on track to produce nearly 50 percent more per person than Canada will. This stunning divergence is unprecedented in modern history.”

National productivity is key to our personal prosperity and standard of living—and we’re in trouble.

Canada’s productivity, a measure of our efficiency in producing goods and services, has been seriously slumping for years, and we are now one of the least productive G7 nations.

Now, business leaders say part of the solution could, and should, lie in producing natural resources and supercharging the resource sector.

The Royal Bank of Canada reports: “The Canadian economy has continued to underperform global peers. Declines in per-capita output in seven of the last eight quarters have left average income per person back at decade-ago levels, and the unemployment rate has risen more than in other advanced economies.

“Canada is not ‘officially’ in a recession… but per-capita gross domestic product and the unemployment rate are more representative of what individual households and workers are experiencing in the current economy, and on that basis, it certainly feels like one.”

Now, a new report by the Canadian Chamber of Commerce says a comprehensive national strategy is needed to promote resource investments.

“We really need to lean into our strengths as a country,” says report author Andrew DiCapua. “We are lucky to live in a country where we have abundant natural resources… We should be trying to find ways to attract investment to supercharge the sector.”

Senior economist DiCapua notes: “With Canada facing significant economic challenges—below-trend growth, declining living standards, regulatory uncertainty, and weak business investment—the Canadian economy is not keeping pace.

“The main recommendation here is to create regulations and policies that provide regulatory certainty—or rather clarity—so that investment can be attracted into this crucial (natural-resource) sector.”

The national business group says the new approach should include streamlining government regulations, recognizing the need for timely approval of major projects, and ensuring policy stability.

It also recommends speeding up the delivery of investment tax credits for projects that cut emissions and adopting a trade infrastructure plan to ensure the country has sufficient roads, ports, and energy transmission lines for accessing resources in remote areas.

The Chamber notes that the natural-resources sector is the second-largest in Canada, paying compensation last year that was $25,000 more than the national average.

“The sector can do this because of its productivity prowess, which is closely linked to the country’s prosperity and long-term standard of living. This is why increasing investment in high-productivity sectors, particularly within natural resources, is an obvious remedy to our productivity challenges.”

And it adds: “Given the natural resources sector’s higher-than-average Indigenous workforce participation, higher wage opportunities can help increase Indigenous employment and economic participation, furthering economic reconciliation efforts by supporting Indigenous-owned businesses, equity partnerships, and employment.”

Economists, business leaders, and the Bank of Canada have highlighted the country’s productivity woes for years—and the level of concern is growing.

As TD Economics pointed out in a worrisome report: “Canadians’ standard of living, as measured by real GDP per person, was lower in 2023 than in 2014.

“Without improved productivity growth, workers will face stagnating wages, and government revenues will not keep pace with spending commitments, requiring higher taxes or reduced public services.”

And: “Over the decade prior to the pandemic, business sector productivity grew at a respectable rate of 1.2% annually. Since 2019, it has ceased to expand at all, setting Canada apart as one of the worst-performing advanced economies, not to mention in stark contrast to the United States…

“The woes are widespread. Relative to growth in the decade prior to the pandemic, only a few service industries have managed to improve their performance… To get the same output, it now requires more hours from workers. Hard to believe this could occur in a digital age.”

Economist Trevor Tombe of the University of Calgary states: “The gap between the Canadian and American economies has now reached its widest point in nearly a century.

“If this continues, we’ll not have persistently seen this wide of a gap since the days of John A. Macdonald… Taking bolder action to address this growing prosperity gap is needed. And fast.

“The U.S. is on track to produce nearly 50 percent more per person than Canada will. This stunning divergence is unprecedented in modern history.”

Earlier this year, Carolyn Rogers, senior deputy governor of the Bank of Canada, gave this warning on our productivity: “You’ve seen those signs that say, ‘In emergency, break glass.’ Well, it’s time to break the glass.”

Rogers said in a Halifax speech: “An economy with low productivity can grow only so quickly before inflation sets in. But an economy with strong productivity can have faster growth, more jobs, and higher wages with less risk of inflation…

“We thought productivity would improve coming out of the pandemic as firms found their footing and workers trained back up. We’ve seen that happen in the US economy, but it hasn’t happened here. In fact, the level of productivity in Canada’s business sector is more or less unchanged from where it was seven years ago.”

It’s beyond time for our federal and provincial governments to get in gear and take steps to help get our productivity back on track.

The Chamber of Commerce’s recommendations would be a good place to start: adopt sensible regulations and stable policies that encourage investment in our natural resources, and speed up the approval of major projects.

Business

Canada needs serious tax cuts in 2026

What Prime Minister Mark Carney gives with his left hand, he takes away with his right hand.

Canadians are already overtaxed and need serious tax cuts to make life more affordable and make our economy more competitive. But at best, the New Year will bring a mixed bag for Canadian taxpayers.

The federal government is cutting income taxes, but it’s hiking payroll taxes. The government cancelled the consumer carbon tax, but it’s hammering Canadian businesses with a higher industrial carbon tax.

The federal government cut the lowest income tax bracket from 15 to 14 per cent. That will save the average taxpayer $190 in 2026, according to the Parliamentary Budget Officer.

But the government is taking more money from Canadians’ paycheques with higher payroll taxes.

Workers earning $85,000 or more will pay $5,770 in federal payroll taxes in 2026. That’s a $262 payroll tax hike. Their employers will also be forced to pay $6,219.

So Canadians will save a couple hundred bucks from the income tax cut in the new year, but many Canadians will pay a couple hundred bucks more in payroll taxes.

It’s the same story with carbon taxes.

After massive backlash from ordinary Canadians, the federal government dropped its consumer carbon tax that cost average families hundreds of dollars every year and increased the price of gas by about 18 cents per litre.

But Carney’s first budget shows he wants higher carbon taxes on Canadian businesses. Carney still hasn’t provided Canadians a clear answer on how much his business carbon tax will cost. He did, however, provide a hint during a press conference he held after signing a memorandum of understanding with the Alberta government.

“It means more than a six times increase in the industrial price on carbon,” Carney said.

Carney previously said that by “changing the carbon tax … We are making the large companies pay for everybody.”

Carney’s problem is that Canadians aren’t buying what he’s selling on carbon taxes.

Just 12 per cent of Canadians believe Carney that businesses will pay most of the cost of his carbon tax, according to a Leger poll. Nearly 70 per cent of Canadians say businesses will pass most or some of the cost to consumers.

Canadians understand that it doesn’t matter what type of lipstick politicians put on their carbon tax pig, all carbon taxes make life more expensive.

Carney is also continuing his predecessor’s tradition of automatically increasing booze taxes.

Ottawa will once again hike taxes on beer, wine and spirits in 2026 through its undemocratic alcohol tax escalator.

First passed in the 2017 federal budget, the alcohol escalator tax automatically increases federal taxes on beer, wine and spirits every year without a vote in Parliament.

Federal alcohol taxes are expected to increase by two per cent on April 1, and cost taxpayers $41 million in 2026. Since being imposed, the alcohol escalator tax has cost taxpayers about $1.6 billion, according to industry estimates.

Canadians are overtaxed and need the federal government to seriously lighten the load.

The biggest expense for the average Canadian family isn’t the home they live in, the food they eat or the clothes they buy. It’s the taxes they pay to all levels of government. More than 40 per cent of the average family’s budget goes to paying taxes, according to the Fraser Institute.

Politicians are taking too much money from Canadians. And their high taxes are driving away investment and jobs.

Canada ranks a dismal 27th out of 38 industrialized countries on individual tax competitiveness, according to the Tax Foundation. Canada ranks 22nd on business tax competitiveness. Canada is behind the United States on both measures.

A little bit of tax relief here and there isn’t going to cut it. Carney’s New Year’s resolution needs to be to embark on a massive tax cutting campaign.

Business

DOOR TO DOOR: Feds descend on Minneapolis day cares tied to massive fraud

Federal agents are now going “DOOR TO DOOR” in Minneapolis, launching what the Department of Homeland Security itself describes as an on-the-ground sweep of businesses and day-care centers tied to Minnesota’s exploding fraud scandal — a case that has already burned through at least $1 billion in taxpayer money and is rapidly closing in on Democrat Gov. Tim Walz and his administration.

ICE agents, working under the umbrella of the Department of Homeland Security, fanned out across the city this week, showing up unannounced at locations suspected of billing state and federal programs for services that never existed. One day-care worker told reporters Monday that masked agents arrived at her facility, demanded paperwork, and questioned staff about operations and enrollment.

“DHS is on the ground in Minneapolis, going DOOR TO DOOR at suspected fraud sites,” the agency posted on X. “The American people deserve answers on how their taxpayer money is being used and ARRESTS when abuse is found.”

DHS is on the ground in Minneapolis, going DOOR TO DOOR at suspected fraud sites.

The American people deserve answers on how their taxpayer money is being used and ARRESTS when abuse is found. Under the leadership of @Sec_Noem, DHS is working to deliver results. pic.twitter.com/7XtRflv36b

— Homeland Security (@DHSgov) December 29, 2025

Authorities say the confirmed fraud already totals roughly $300 million tied to fake food programs, $220 million linked to bogus autism services, and more than $300 million charged for housing assistance that never reached the people it was meant to help. Investigators from the FBI, Justice Department, and Department of Labor have now expanded their probes after a viral investigation exposed taxpayer-funded day cares that received more than $1 million each while allegedly serving few — or zero — children.

One of the most glaring examples, the Minneapolis-based Quality “Learing” Center — infamous for its misspelled sign — suddenly appeared busy Monday as national media arrived. Locals told reporters the center is typically empty and often looks permanently closed, despite receiving about $1.9 million in public funds. State inspection records show the facility has racked up 95 violations since 2019. Employees allegedly cursed at reporters while children were bused in during posted afternoon hours.

DHS officials say the “DOOR TO DOOR” operation is deliberate. In videos released online, agents are seen questioning nearby business owners about whether adjacent buildings ever had foot traffic, whether they appeared open, and whether operators used subcontractors or outside partners to pad billing. DHS Secretary Kristi Noem posted footage of agents pressing workers about business relationships and transportation services used by suspected fraud sites.

“This is a large-scale investigation,” DHS Assistant Secretary Tricia McLaughlin told the New York Post, confirming that Homeland Security Investigations and ICE are targeting fraudulent day-care and health-care centers as well as related financial schemes.

FBI Director Kash Patel warned that what investigators have uncovered so far is “just the tip of a very large iceberg.” He pointed to the bureau’s dismantling of a $250 million COVID-era food-aid scam tied to the Feeding Our Future network, a case that resulted in 78 indictments and 57 convictions. Patel has also made clear that denaturalization and deportation remain on the table for convicted fraudsters where the law allows.

Dozens of arrests have already been made across the broader scheme, many involving Somali immigrants, though federal officials stress the investigation targets criminal behavior — not communities. Some local residents say the scandal is hurting law-abiding families. One Somali Uber driver told reporters he works 16-hour days and is furious that “some people are taking advantage of the system,” making the entire community look bad.

Now, with federal agents going “DOOR TO DOOR” across Minneapolis, the era of polite indifference appears to be over. The message from Washington is blunt: the money trail is being followed, the paperwork is being checked, and the days of treating taxpayer-funded programs like an open vault are coming to an end.

-

Energy1 day ago

Energy1 day agoWhy Japan wants Western Canadian LNG

-

Business2 days ago

Business2 days agoWhat Do Loyalty Rewards Programs Cost Us?

-

Business1 day ago

Business1 day agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud

-

Business1 day ago

Business1 day agoLand use will be British Columbia’s biggest issue in 2026

-

International21 hours ago

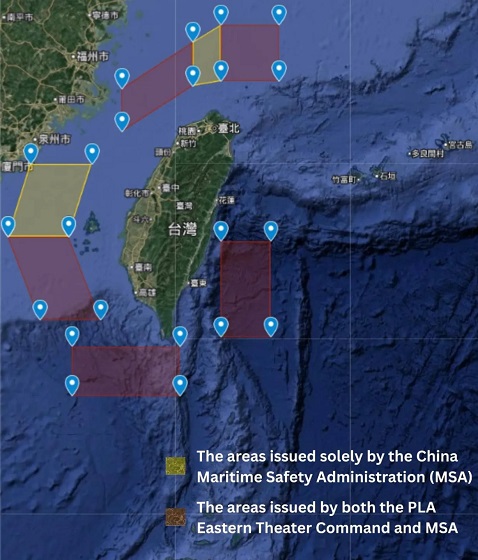

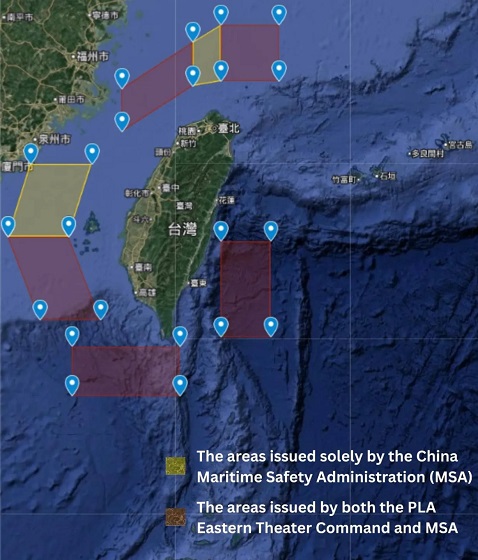

International21 hours agoChina Stages Massive Live-Fire Encirclement Drill Around Taiwan as Washington and Japan Fortify

-

Digital ID20 hours ago

Digital ID20 hours agoThe Global Push for Government Mandated Digital IDs And Why You Should Worry

-

Energy21 hours ago

Energy21 hours agoRulings could affect energy prices everywhere: Climate activists v. the energy industry in 2026

-

Haultain Research2 days ago

Haultain Research2 days agoSweden Fixed What Canada Won’t Even Name