Economy

Canada’s housing crisis deepens as landuse policies push prices beyond reach

This article supplied by Troy Media.

Vancouver, Toronto, Montreal among the world’s least affordable housing markets, says international report

Canada’s housing affordability crisis has worsened, with no major market rated affordable and several ranked among the least affordable in the world, according to a new international report

The Demographia International Housing Affordability 2025 report by Wendell Cox, published by the Frontier Centre for Public Policy and the Urban Reform Institute, ranks 95 housing markets across eight countries using the “median multiple,” which compares the median house price to the median household income— essentially, how many years of income it would take to buy a home. A ratio of 3.0 or below is considered affordable. Canada’s national median multiple is now 5.4, placing it in the severely unaffordable category.

Among the six Canadian cities included in the report, three are rated severely or impossibly unaffordable, two are seriously unaffordable, and one is moderately unaffordable.

Vancouver (11.8) ranks as the fourth least affordable market globally, behind Hong Kong (14.4), Sydney (13.8) and San Jose (12.1). It is classified as impossibly unaffordable —three times the level considered affordable.

Toronto (8.4) ranks 84th out of 95 markets and is severely unaffordable. Montreal (5.8). Calgary (4.8) and Ottawa–Gatineau (5.0) are considered seriously unaffordable.

Edmonton (3.7) is rated moderately unaffordable, the most affordable major Canadian city in the report.

The report attributes Canada’s deteriorating housing affordability to restrictive land-use policies, especially in Ontario and British Columbia. These include urban containment strategies (policies that limit how far cities can grow outward), such as greenbelts, zoning limits and densification rules. While intended to limit sprawl and support sustainability, these measures have created artificial land shortages, increased housing costs and made it commercially unfeasible to build the detached homes many families prefer.

As affordability worsens in Toronto and Vancouver, nearby smaller cities, including Kelowna, Chilliwack, London, Guelph and Kitchener–Cambridge– Waterloo, are seeing sharp price increases. From 2015 to 2023, affordability declined by 2.5 years of income in smaller B.C. markets and by 3.3 years in midsized Ontario cities. In comparison, affordability dropped by 1.2 years in Vancouver and 2.6 years in Toronto.

“These numbers reflect the ripple effect of unaffordability spreading outward from Canada’s largest cities,” Cox said.

Canada’s largest urban centres—census metropolitan areas—lost nearly 275,000 domestic migrants between 2019 and 2023, as people relocated to smaller cities, towns and rural areas in search of more affordable housing and a better quality of life.

Governments continue to promote densification as a solution, but the report argues it isn’t enough.

“Building more high-density units won’t solve the problem if land prices remain artificially inflated by growth boundaries and zoning constraints,” the report says.

The report points to New Zealand’s Going for Housing Growth initiative, launched in 2023, as a potential model. It expands suburban land supply by lifting restrictions on greenfield development—the construction of housing on previously undeveloped land—and uses long-term financing to fund

infrastructure without overburdening taxpayers.

Without similar reforms, the report warns, housing affordability will continue to erode and place greater economic pressure on middle-income households.

“Canada’s middle class is being squeezed out of homeownership,” said Cox. “Unless land-use rules change, that trend is unlikely to reverse.”

Despite years of debate and political pledges, the affordability gap keeps growing. In 1971, the difference between Canada’s most and least affordable

markets was 1.5 points on the median multiple scale. By 2024, the gap had widened to 8.1 points—the equivalent of 6.6 years of household income.

As housing costs climb, younger Canadians and working families face mounting barriers to homeownership, worsening inequality, social stress and urban decline. For many, it means putting off starting a family, living with parents longer or leaving their hometowns entirely.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Business

Bank of Canada governor warns citizens to anticipate lower standard of living

From LifeSiteNews

“Unless something changes, our incomes will be lower than they otherwise would be.”

Bank of Canada Governor Tiff Macklem gave a grim assessment of the state of the economy, essentially telling Canadians that they should accept a “lower” standard of living.

In an update on Wednesday in which he also lowered Canada’s interest rate to 2.25 percent, Macklem gave the bleak news, which no doubt will hit Canadian families hard.

“What’s most concerning is, unless we change some other things, our standard of living as a country, as Canadians, is going to be lower than it otherwise would have been,” Macklem told reporters.

“Unless something changes, our incomes will be lower than they otherwise would be.”

Macklem said what Canada is going through “is not just a cyclical downturn.”

Asked what he meant by a “cyclical downturn,” Macklem blamed what he said were protectionist measures the United States has put in place such as tariffs, which have made everything more expensive.

“Part of it is structural,” he said, adding, “The U.S. has swerved towards protectionism.”

“It is harder to do business with the United States. That has destroyed some of the capacity in this country. It’s also adding costs.”

Macklem stopped short of saying out loud that a recession is all but inevitable but did say growth is “pretty close to zero” at the moment.

While some U.S. protectionist measures put in place by President Donald Trump have impacted Canada, the reality is that since the Liberals took power in 2015, first under former Prime Minister Justin Trudeau and now under Mark Carney, government spending has been out of control, according to experts. Rising inflation is rampant.

Canadian taxpayers are already dealing with high inflation and high taxes, in part due to the Liberal government overspending and excessive money printing, and even admitting that giving money to Ukraine comes at the “taxpayers’” expense.

As reported by LifeSiteNews, Carney boldly proclaimed earlier this week that his Liberal government’s upcoming 2025 budget will include millions more in taxpayer money for “SLGBTQI+ communities” and “gender” equality and “pride” safety.

As reported by LifeSiteNews, the Canadian Taxpayers Federation (CTF) recently blasted the Carney government for spending $13 million on promotional merchandise such as “climate change card games,” “laser pens and flying saucers,” and “Bamboo toothbrushes” since 2022.

Canadians pay some of the highest income and other taxes in the world. As reported by LifeSiteNews, Canadian families spend, on average, 42 percent of their income on taxes, more than food and shelter costs. Inflation in Canada is at a high not seen in decades.

Business

Canada’s economic performance cratered after Ottawa pivoted to the ‘green’ economy

From the Fraser Institute

By Jason Clemens and Jake Fuss

There are ostensibly two approaches to economic growth from a government policy perspective. The first is to create the best environment possible for entrepreneurs, business owners and investors by ensuring effective government that only does what’s needed, maintains competitive taxes and reasonable regulations. It doesn’t try to pick winners and losers but rather introduces policies to create a positive environment for all businesses to succeed.

The alternative is for the government to take an active role in picking winners and losers through taxes, spending and regulations. The idea here is that a government can promote certain companies and industries (as part of a larger “industrial policy”) better than allowing the market—that is, individual entrepreneurs, businesses and investors—to make those decisions.

It’s never purely one or the other but governments tend to generally favour one approach. The Trudeau era represented a marked break from the consensus that existed for more than two decades prior. Trudeau’s Ottawa introduced a series of tax measures, spending initiatives and regulations to actively constrain the traditional energy sector while promoting what the government termed the “green” economy.

The scope and cost of the policies introduced to actively pick winners and losers is hard to imagine given its breadth. Direct spending on the “green” economy by the federal government increased from $600 million the year before Trudeau took office (2014/15) to $23.0 billion last year (2024/25).

Ottawa introduced regulations to make it harder to build traditional energy projects (Bill C-69), banned tankers carrying Canadian oil from the northwest coast of British Columbia (Bill C-48), proposed an emissions cap on the oil and gas sector, cancelled pipeline developments, mandated almost all new vehicles sold in Canada to be zero-emission by 2035, imposed new homebuilding regulations for energy efficiency, changed fuel standards, and the list goes on and on.

Despite the mountain of federal spending and regulations, which were augmented by additional spending and regulations by various provincial governments, the Canadian economy has not been transformed over the last decade, but we have suffered marked economic costs.

Consider the share of the total economy in 2014 linked with the “green” sector, a term used by Statistics Canada in its measurement of economic output, was 3.1 per cent. In 2023, the green economy represented 3.6 per cent of the Canadian economy, not even a full one-percentage point increase despite the spending and regulating.

And Ottawa’s initiatives did not deliver the green jobs promised. From 2014 to 2023, only 68,000 jobs were created in the entire green sector, and the sector now represents less than 2 per cent of total employment.

Canada’s economic performance cratered in line with this new approach to economic growth. Simply put, rather than delivering the promised prosperity, it delivered economic stagnation. Consider that Canadian living standards, as measured by per-person GDP, were lower as of the second quarter of 2025 compared to six years ago. In other words, we’re poorer today than we were six years ago. In contrast, U.S. per-person GDP grew by 11.0 per cent during the same period.

Median wages (midpoint where half of individuals earn more, and half earn less) in every Canadian province are now lower than comparable median wages in every U.S. state. Read that again—our richest provinces now have lower median wages than the poorest U.S. states.

A significant part of the explanation for Canada’s poor performance is the collapse of private business investment. Simply put, businesses didn’t invest much in Canada, particularly when compared to the United States, and this was all pre-Trump tariffs. Canada’s fundamentals and the general business environment were simply not conducive to private-sector investment.

These results stand in stark contrast to the prosperity enjoyed by Canadians during the Chrétien to Harper years when the focus wasn’t on Ottawa picking winners and losers but rather trying to establish the most competitive environment possible to attract and retain entrepreneurs, businesses, investors and high-skilled professionals. The policies that dominated this period are the antithesis of those in place now: balanced budgets, smaller but more effective government spending, lower and competitive taxes, and smart regulations.

As the Carney government prepares to present its first budget to the Canadian people, many questions remain about whether there will be a genuine break from the policies of the Trudeau government or whether it will simply be the same old same old but dressed up in new language and fancy terms. History clearly tells us that when governments try to pick winners and losers, the strategy doesn’t lead to prosperity but rather stagnation. Let’s all hope our new prime minister knows his history and has learned its lessons.

-

Crime1 day ago

Crime1 day agoCanada Seizes 4,300 Litres of Chinese Drug Precursors Amid Trump’s Tariff Pressure Over Fentanyl Flows

-

Alberta19 hours ago

Alberta19 hours agoFrom Underdog to Top Broodmare

-

Alberta1 day ago

Alberta1 day agoHow one major media torqued its coverage – in the take no prisoners words of a former Alberta premier

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoGet Ready: Your House May Not Be Yours Much Longer

-

Alberta1 day ago

Alberta1 day agoProvince orders School Boards to gather data on class sizes and complexity by Nov 24

-

Business2 days ago

Business2 days agoCanada’s attack on religious charities makes no fiscal sense

-

Business2 days ago

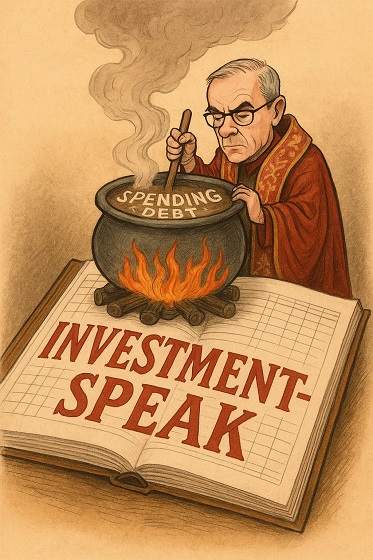

Business2 days agoWhen Words Cook the Books: The Politics of ‘Investment-Speak’

-

Opinion1 day ago

Opinion1 day agoBill Gates Shakes Up the Climate Discussion