Business

Canada’s great PONI race – projects of national interest

From Resource Works

The Roberts Bank terminal expansion would generate 132,400 jobs across Canada, according to an economic analysis by the Port of Vancouver, generate $9.3 billion in wages, $16.3 billion in GDP and $32.7 billion in economic output. It was approved by the federal government in 2023 with 370 legally binding conditions. The environmental review process has gone on for about a decade now, and continues to get bogged down in a permitting morass.

Sometime this year, the Mark Carney government is expected to announce a list of major “nation-building” projects that it will help advance with its Bill C-5 fast-tracking legislation. These projects have been dubbed as PONIs – projects of national interest. Let’s hope this doesn’t turn into some kind of federal welfare scheme in which the taxpayer ends up footing the full bill. “We should absolutely start with the ones where there’s already a private proponent, not a province seeking subsidies,” says Heather Exner-Pirot, senior fellow and director of energy, natural resources and environment for the Macdonald Laurier Institute.

I would argue that projects that facilitate exports — pipelines, rail, ports — ultimately provide the most economic value because it means increasing market access and getting a higher price for our commodities. I think there’s a strong argument to be made that a new crude oil pipeline to the West Coast and infrastructure needed to develop Ontario’s Ring of Fire mining region are two nation building proposals that would have maximum economic impacts, and therefore should top the PONI priority list. “Energy projects or anything related to manufacturing-value added initiatives should be categorized as nation building projects,” says Ellis Ross, Conservative MP for Skeena-Bulkley.

We need to attract private capital to help build mega-projects. So let’s hope Alberta Premier Danielle Smith can find a proponent in the private sector willing to invest in the new pipeline to the West Coast. So far, it doesn’t look promising. Two Canadian midstream companies – Enbridge and TC Energy – have basically said they’re not interested in Canada anymore and are more focused on the U.S. now. And who can blame them? They wasted hundreds of millions of dollars on pipeline proposals – Northern Gateway and Keystone XL – that became deflated political footballs. But if Danielle Smith can find a private sector partner to build a new crude oil pipeline from Alberta to Prince Rupert, I think that should be a top priority for the Carney government. The Carney government will need to consider just how realistic some of the projects being proposed are. How close to shovel-ready are they? How quickly could they be built?

The federal government’s own criteria for designation of projects for federal support and fast-tracking include:

- projects that “strengthen Canada’s autonomy, resilience and security”;

- contributes to clean growth and climate goals;

- advances First Nations interests; and

- have a high likelihood of success.

To tick that “clean growth” box, Smith’s new pipeline would need to be paired with the Pathways Alliance’s $20 billion carbon capture proposal. That project has private capital behind it, so it’s essentially shovel-ready. While other Canadian premiers have publicly championed their own pet projects for consideration, David Eby appears not to have pitched any projects yet, at least not publicly. Maybe that’s a tacit admission that nation building designations are likely to be limited to one per region, and that a new pipeline to the West Coast – Northern Gateway 2.0 – is the most likely candidate for Western Canada. Or maybe he feels B.C. may not need the federal government’s help in advancing projects in B.C. like Ksi Lisims LNG and new mines – that these projects can be advanced without Ottawa’s help. And that may, in fact, be the case.

B.C. has its own fast-tracking legislation – Bill 15 – with 18 projects already designated. They include the Teck Resources Highland Valley copper mine expansion, Cedar LNG, and Enbridge’s Aspen Point natural gas pipeline network expansion. Just last week, Teck announced the sanctioning of its $2.4 billion project Highland Valley copper expansion project, with construction to start this month. “What B.C. did — I have to give them credit, for once — is they just made it easier for proponents already in the system. They didn’t subsidize, it didn’t cost them money, there is a private proponent, there is a business case. And they just made it easier. And this seems to me to be the right approach.”

In other words, apart from an oil pipeline to Prince Rupert, Exner-Pirot does not believe B.C. necessarily needs to put any PONIs in the federal race. “B.C. is in the enviable position of having great resources, of having LNG, of having tidewater access already,” she said. “They have tens of billions of projects all in the queue with private investors. The territories don’t have that, Manitoba does not have that, Atlantic Canada does not have that. “They shouldn’t really even need the feds. They just need them to get out of the way.”

If there is one major project in B.C. that might warrant a federal designation, it’s the Roberts Bank terminal expansion, Exner-Pirot said. The Roberts Bank terminal expansion was approved by the federal government in 2023 with 370 legally binding conditions. The expansion would generate 132,400 jobs across Canada, according to an economic analysis by the Port of Vancouver, generate $9.3 billion in wages, $16.3 billion in GDP and $32.7 billion in economic output.

Surely this should qualify as nation-building, as it would facilitate the movement of Canadian goods and commodities to markets in the Asia Pacific.

But it has been in an environmental review process that has gone on for about a decade now, and which continues to get bogged down in a permitting morass. So if there is one project in B.C. that could use a federal designation for fast-tracking, it’s the Roberts Bank Terminal expansion, Exner-Pirot said. Otherwise, the only other PONI that B.C. would benefit from is Northern Gateway 2.0. “That would have the biggest GDP impact for Canada,” Exner-Pirot said. B.C. would benefit from billions spent on the B.C. portion of the pipeline. One need only look at the Trans Mountain pipeline expansion project to see what kind of an economic juggernaut a major pipeline project can be, for Alberta, for B.C. and for Canada.

In terms of job creation, TMX generated an estimated 36,917 jobs — 16,476 in Alberta and 16,476 for B.C. – according to Energy Connection Canada. EY has estimated that TMX, which cost $31 billion to build, would generate $52.8 billion in economic activity, add $26 billion to GDP, pay $11 billion in wages, and generate $2.9 billion in tax revenue.

Over the next 20 years, it is expected to generate $17.3 billion in total economic activity and add $9.2 billion to GDP. Oil is Canada’s most valuable export, accounting for 19% of Canada’s total exports. When Alberta’s oil sector is thriving, Canada thrives. Getting a private company to build the new pipeline will require the Carney government to scrap its West Coast oil tanker ban, oil and gas emissions cap, and essentially exempt it from the Impact Assessment Act, otherwise it just ain’t going to happen. As for some of the other major projects being proposed across Canada, like the Grays Bay road and port project and the Churchill port project, they certainly seem to qualify as nation-building projects, but would require massive amounts of public funding. “Those are all ones looking for the government to fund and build,” Exner-Pirot said. “Grays Bay has zero private dollars. They’re looking for 100% covered by the feds. “Is this just regional welfare? Is this an excuse to dole out money to different regions to buy votes? This is what it looks like.”

Nelson Bennett’s column appears weekly at Resource Works News. Contact him at [email protected].

Business

New airline compensation rules could threaten regional travel and push up ticket prices

New passenger compensation rules under review could end up harming passengers as well as the country’s aviation sector by forcing airlines to pay for delays and cancellations beyond their control, warns a new report published this morning by the MEI.

“Air travel in Canada is already unaffordable and inaccessible,” says Gabriel Giguère, senior public policy analyst at the MEI. “New rules that force airlines to cover costs they can’t control would only make a bad situation worse.”

Introduced in 2023 by then-Transport Minister Omar Alghabra, the proposed amendment to the Air Passenger Protection Regulations would make airlines liable for compensation in all cases except those deemed “exceptional.” Under the current rules, compensation applies only when the airline is directly responsible for the disruption.

If adopted, the new framework would require Canadian airlines to pay at least $400 per passenger for any “unexceptional” cancellation or delay exceeding three hours, regardless of fault. Moreover, the definition of “exceptional circumstances” remains vague and incomplete, creating regulatory uncertainty.

“A presumed-guilty approach could upend airline operations,” notes Mr. Giguère. “Reversing the burden of proof introduces another layer of bureaucracy and litigation, which are costs that will inevitably be passed on to consumers.”

The Canadian Transportation Agency estimates that these changes would impose over $512 million in additional costs on the industry over ten years, leading to higher ticket prices and potentially reducing regional air service.

Canadians already pay some of the highest airfares in the world, largely due to government-imposed fees. Passengers directly cover the Air Travellers Security Charge—$9.94 per domestic flight and $34.42 per international flight—and indirectly pay airport rent through Airport Improvement Fees included on every ticket.

In 2024 alone, airport authorities remitted a record $494.8 million in rent to the federal government, $75.6 million more than the previous year and 68 per cent higher than a decade earlier.

“This new regulation risks being the final blow to regional air travel,” warns Mr. Giguère. “Routes connecting smaller communities will be the first to disappear as costs rise and they become less profitable.”

For instance, a three-hour and one minute delay on a Montreal–Saguenay flight with 85 passengers would cost an airline roughly $33,000 in compensation. It would take approximately 61 incident-free return flights to recoup that cost.

Regional air service has already declined by 34 per cent since 2019, and the added burden of this proposed regulation could further reduce connectivity within Canada. It would also hurt Canadian airlines’ competitiveness relative to U.S. carriers operating out of airports just south of the border, whose passengers already enjoy lower fares.

“If the federal government truly wants to make air travel more affordable,” says Mr. Giguère, “it should start by cutting its own excessive fees instead of scapegoating airlines for political gain.”

You can read the Economic Note here.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

Business

Will the Port of Churchill ever cease to be a dream?

From Resource Works

The Port of Churchill has long been viewed as Canada’s northern gateway to global markets, but decades of under-investment have held it back.

A national dream that never materialised

For nearly a century, Churchill, Manitoba has loomed in the national imagination. In 1931, crowds on the rocky shore watched the first steamships pull into Canada’s new deepwater Arctic port, hailed as the “thriving seaport of the Prairies” that would bring western grain “1,000 miles nearer” to European markets. The dream was that this Hudson Bay town would become a great Canadian centre of trade and commerce.

The Hudson Bay Railway was blasted across muskeg and permafrost to reach what engineers called an “incomparably superior” harbour. But a short ice free season and high costs meant Churchill never grew beyond a niche outlet beside Canada’s larger ports, and the town’s population shrank.

False starts, failed investments

In 1997, Denver based OmniTrax bought the port and 900 kilometre rail line with federal backing and promises of heavy investment. Former employees and federal records later suggested those promises were not fully kept, even as Ottawa poured money into the route and subsidies were offered to keep grain moving north. After port fees jumped and the Canadian Wheat Board disappeared, grain volumes collapsed and the port shut, cutting rail service and leaving northern communities and miners scrambling.

A new Indigenous-led revival — with limits

The current revival looks different. The port and railway are now owned by Arctic Gateway Group, a partnership of First Nations and northern municipalities that stepped in after washouts closed the line and OmniTrax walked away. Manitoba and Ottawa have committed $262.5 million over five years to stabilize the railway and upgrade the terminal, with Manitoba’s share now at $87.5 million after a new $51 million provincial pledge.

Prime Minister Mark Carney has folded Churchill into his wider push on “nation building” infrastructure. His government’s new Major Projects Office is advancing energy, mining and transmission proposals that Ottawa says add up to more than $116 billion in investment. Against that backdrop, Churchill’s slice looks modest, a necessary repair rather than a defining project.

The paperwork drives home the point. The first waves of formally fast tracked projects include LNG expansion at Kitimat, new nuclear at Darlington and copper and nickel mines. Churchill sits instead on the office’s list of “transformative strategies”, a roster of big ideas still awaiting detailed plans and costings, with a formal Port of Churchill Plus strategy not expected until the spring of 2026 under federal–provincial timelines.

Churchill as priority — or afterthought?

Premier Wab Kinew rejects the notion that Churchill is an afterthought. Standing with Carney in Winnipeg, he called the northern expansion “a major priority” for Manitoba and cast the project as a way for the province “to be able to play a role in building up Canada’s economy for the next stage of us pushing back against” U.S. protectionism. He has also cautioned that “when we’re thinking about a major piece of infrastructure, realistically, a five to 10 year timeline is probably realistic.”

On paper, the Port of Churchill Plus concept is sweeping. The project description calls for an upgraded railway, an all weather road, new icebreaking capacity in Hudson Bay and a northern “energy corridor” that could one day move liquefied natural gas, crude oil, electricity or hydrogen. Ottawa’s joint statement with Manitoba calls Churchill “without question, a core component to the prosperity of the country.”

Concepts without commitments

The vision is sweeping, yet most of this remains conceptual. Analysts note that hard questions about routing, engineering, environmental impacts and commercial demand still have to be answered. Transportation experts say they struggle to see a purely commercial case that would make Churchill more attractive than larger ports, arguing its real value is as an insurance policy for sovereignty and supply chain resilience.

That insurance argument is compelling in an era of geopolitical risk and heightened concern about Arctic security. It is also a reminder of how limited Canada’s ambition at Churchill has been. For a hundred years, governments have been willing to dream big in northern Manitoba, then content to underbuild and underdeliver, as the port’s own history of near misses shows. A port that should be a symbol of confidence in the North has spent most of its life as a seasonal outlet.

A Canadian pattern — high ambition, slow execution

The pattern is familiar across the country. Despite abundant resources, capital and engineering talent, mines, pipelines, ports and power lines take years longer to approve and build here than in competing jurisdictions. A tangle of overlapping regulations, court challenges and political caution has turned review into a slow moving veto, leaving a politics of grand announcements followed by small, incremental steps.

Churchill is where those national habits are most exposed. The latest round of investment, led by Indigenous owners and backed by both levels of government, deserves support, as does Kinew’s insistence that Churchill is a priority. But until Canada matches its Arctic trading rhetoric with a willingness to build at scale and at speed, the port will remain a powerful dream that never quite becomes a real gateway to the world.

Headline photo credit to THE CANADIAN PRESS/John Woods

-

National1 day ago

National1 day agoPsyop-Style Campaign That Delivered Mark Carney’s Win May Extend Into Floor-Crossing Gambits and Shape China–Canada–US–Mexico Relations

-

Great Reset15 hours ago

Great Reset15 hours agoEXCLUSIVE: The Nova Scotia RCMP Veterans’ Association IS TARGETING VETERANS with Euthanasia

-

COVID-191 day ago

COVID-191 day agoCovid Cover-Ups: Excess Deaths, Vaccine Harms, and Coordinated Censorship

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoBurying Poilievre Is Job One In Carney’s Ottawa

-

Health1 day ago

Health1 day agoCDC’s Autism Reversal: Inside the Collapse of a 25‑Year Public Health Narrative

-

Alberta2 days ago

Alberta2 days agoAlberta to protect three pro-family laws by invoking notwithstanding clause

-

Alberta2 days ago

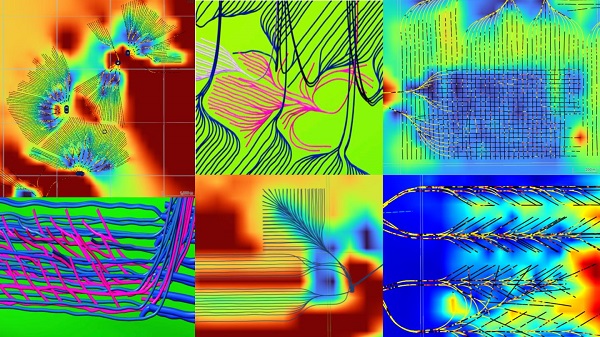

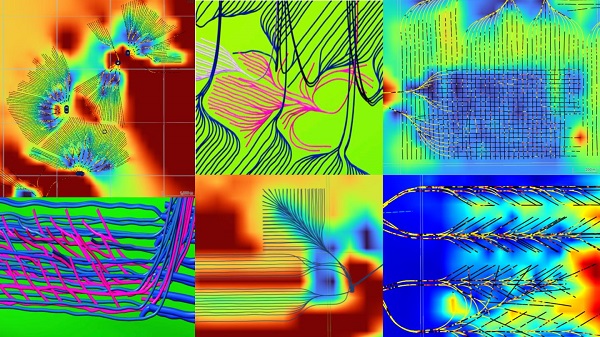

Alberta2 days ago‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

-

Daily Caller15 hours ago

Daily Caller15 hours agoSpreading Sedition? Media Defends Democrats Calling On Soldiers And Officers To Defy Chain Of Command