Tension grows between ambition and market truths

Host Stewart Muir talks on Power Struggle with Brian Maas, president of the California New Car Dealers Association, and Maas introduces us to a U.S. problem that Canada and B.C. also face right now. “The problem is there are mandates that apply in California and 11 other states that require, for the 2026 model year, 35% of all vehicles manufactured for sale in our state must be zero-emission, even though the market share right now is 20%. “So we’ve got a mandate that virtually none of the manufacturers our dealers represent are going to be able to meet.”

Maas adds: “We’re trying to communicate with policymakers that nobody’s opposed to the eventual goal of electrification. California’s obviously led that effort, but a mandate that nobody can comply with and one that California voters are opposed to deserves to be recalibrated.” Meanwhile, in Canada, the same objections apply to the federal government’s requirement, set in 2023, that 100% of new light-duty vehicles sold must be zero-emission vehicles, ZEVs (electric or plug-in hybrid) by 2035, with interim targets of 20 per cent by 2026 and 60 per cent by 2030. There are hefty penalties for dealers missing the targets.

Market researchers note that it now takes 55 days to sell an electric vehicle in Canada, up from 22 days in the first quarter of 2023. The researchers cite a lack of desirable models and high consumer prices despite government subsidies to buyers in six provinces that run as high as $7,000 in Quebec.

In the U.S. The Wall Street Journal reports that, on average, electric vehicles and plug-in hybrids sit in dealer lots longer than gasoline-powered cars and hybrids, despite government pressure to switch to electric. (The Biden administration ruled that two-thirds of new vehicles sold must be electric by 2032.) For Canada, the small-c conservative Fraser Institute reports: “The targets were wild to begin with. As Manhattan Institute senior fellow Mark P. Mills observed, bans on conventional vehicles and mandated switches to electric means, consumers will need to adopt EVs at a scale and velocity 10 times greater and faster than the introduction of any new model of car in history.”

When Ottawa scrapped federal consumer subsidies earlier this year, EV manufacturers and dealers in Canada called on the feds to scrap the sales mandates. “The federal government’s mandated ZEV sales targets are increasingly unrealistic and must end,” said Brian Kingston, CEO of the Canadian Vehicle Manufacturers’ Association. “Mandating Canadians to buy ZEVs without providing them the supports needed to switch to electric is a made-in-Canada policy failure.” And Tim Reuss, CEO of the Canadian Automobile Dealers Association, said: “The Liberal federal government has backed away from supporting the transition to electric vehicles and now we are left with a completely unrealistic plan at the federal level. “There is hypocrisy in imposing ambitious ZEV mandates and penalties on consumers when the government is showing a clear lack of motivation and support for their own policy goals.”

In B.C., sales growth of ZEVs has recently slowed, and the provincial government is considering easing its ZEV targets. “The Energy Ministry acknowledged that it will be ‘challenging’ to reach the target that 90 per cent of new vehicles be zero emission by 2030.” Nat Gosman, an assistant deputy minister in the B.C. energy ministry, cited reasons for the slowdown that include affordability concerns due to a pause in government rebates, supply chain disruptions caused by U.S. tariffs, and concerns about reliability of public charging sites.

Barry Penner, chair of the Energy Futures Institute and a former B.C. Liberal environment minister, said the problem is that the government has “put the cart before the horse” when it comes to incentivizing people to buy electric vehicles. “The government imposed these electric vehicle mandates before the public charging infrastructure is in place and before we’ve figured out how we’re going to make it easy for people to charge their vehicles in multi-family dwellings like apartment buildings.”

Penner went on to write an article for Resource Works that said: “Instead of accelerating into economically harmful mandates, both provincial and federal governments should recalibrate. We need to slow down, invest in required charging infrastructure, and support market-based innovation, not forced adoption through penalties. “A sustainable energy future for BC and Canada requires smart, pragmatic policy, not economic coercion. Let’s take our foot off the gas and realign our policies with reality, protect jobs, consumer affordability, and real environmental progress. Then we can have a successful transition to electric vehicles.”

Back to Power Struggle, and Brian Maas tells Stewart: “I think everybody understands that it’s great technology and I think a lot of Californians would like to have one. . . . The number one reason consumers cited for not making the transition to a zero-emission vehicle is the lack of public charging infrastructure. We’re woefully behind what would be required to move to 100% environment. “And if you live in a multifamily dwelling, an apartment building or something like that, you can’t charge at home, so you would have to rely on a public charger. Where do you go to get that charged?

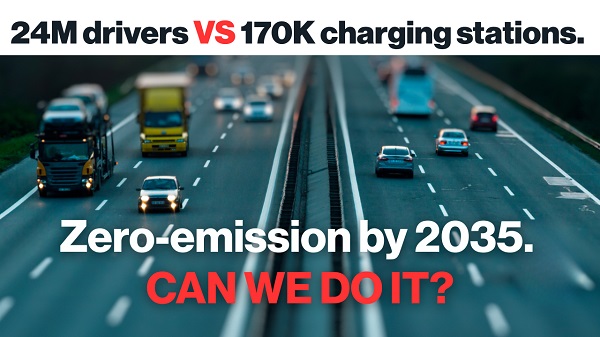

“The state’s Energy Commission has said we need a million public chargers by 2030 and two million public chargers by 2035. We only have 178,000 now and we’re adding less than 50,000 public chargers a year. We’re just not going to get there fast enough to meet the mandate that’s on the books now.”

In Canada, Resource Works finds there now are more than 33,700 public charging ports, at 12,955 locations. But Ottawa says that to support its EV mandate, Canada will need about 679,000 public ports. “This will require the installation of, on average, 40,000 public ports each year between 2025 and 2040.”

And we remind readers of Penner’s serious call on governments to lighten the push on the accelerator when it comes to ZEV mandates: “Let’s take our foot off the gas and realign our policies with reality, protect jobs, consumer affordability, and real environmental progress. Then we can have a successful transition to electric vehicles.”

- Power Struggle YouTube video: https://ow.ly/8J4T50WhK5i

- Audio and full transcript: https://ow.ly/Np8550WhK5j

- Stewart Muir on LinkedIn: https://ow.ly/Smiq50UWpSB

- Brian Maas on LinkedIn: https://ow.ly/GuTh50WhK8h

- Power Struggle on LinkedIn: https://ow.ly/KX4r50UWpUa

- Power Struggle on Instagram: https://ow.ly/3VIM50UWpUg

- Power Struggle on Facebook: https://ow.ly/4znx50UWpUs

- Power Struggle on X: https://ow.ly/tU3R50UWpVu