Energy

Canada’s Climate Fetish Could Decimate Key Industry For First Nations

From the Daily Caller News Foundation

From the Daily Caller News Foundation

Obsessed with the faux climate crisis, the Canadian government in Ottawa seemingly discounts altogether the social and economic benefits of natural gas to First Nations communities of the country’s western region.

Approximately 5% of the world’s gas comes from Canada, mainly from the vast Western Canadian Sedimentary Basin underlying several provinces, including British Columbia, Alberta and Saskatchewan. In 2023, the country ranked fifth in global production behind the U.S., Russia, Iran and China.

Some First Nations communities — a designation that takes in indigenous people living south of the Arctic Circlehave — historically faced challenges in terms of economic development and social well-being. Limited access to education, healthcare and infrastructure has resulted in lower living standards compared to the national averagea — fact that I observed firsthand as a researcher in British Columbia. Unemployment rates are often higher in First Nations communities, and poverty remains a persistent issue.

However, oil and gas development has provided a pathway to prosperity for many of these communities. Liquified natural gas (LNG) projects, for example, require a significant workforce in both construction and operational phases. This translates into direct employment opportunities and much needed income for First Nations people otherwise lacking financial security.

The development of natural gas resources also necessitates infrastructure upgrades in nearby communities. These can include the construction or enhancements of roads, bridges and communication networks. Such improvements benefit the entire community by providing access to markets, educational opportunities and other essential services.

“For far too long, First Nations could only watch as others built generational wealth from the resources of our traditional lands” says Eva Clayton, president of the Nisga’a Lisims government. “But times are changing.”

First Nations participation in natural gas development goes beyond economic benefits. It represents an opportunity for communities to assert their self-determination and participate in shaping their own future. Communities can participate in natural gas projects through equity ownership and various arrangements, including Impact Benefit Agreements. According to the Canada Energy Centre, more than 75 First Nations and Métis communities in Alberta and British Columbia have agreed to ownership stakes in energy projects, including the Coastal GasLink pipeline and major transportation networks for oil sands production.

One such example is the recent Musqueam Partnership agreement by FortisBC, which will share the benefits of the Tilbury LNG facility’s expansion phase to begin in 2025. First Nations beneficiaries will include communities of the Snuneymuxw, T’Sou-ke, Esquimalt, Scia’new, Pacheedaht, Pauquachin, Huu-ay-aht, Kyuquot/Checleseht, Toquaht, Uchucklesaht and Ucluelet. Similarly, the Woodfibre LNG project to begin production in 2027 will directly benefit the Squamish community.

DemandObsessed with the faux climate crisis, the Canadian government in Ottawa seemingly discounts altogether the social and economic benefits of natural gas to First Nations communities for natural gas in North America and across the world should ensure increasing prosperity into the future, unless the federal government’s climate fetish undermines the industry.

Just such a possibility has prompted an alarm to be sounded by the First Nations LNG Alliance—a collective of communities supportive of LNG development in British Columbia.

“First Nations have made their choice about the LNG opportunity, informed by research and consultation,” says Karen Ogen, CEO of the LNG Alliance.

“However, when 88 environmental groups and other organizations recently demanded an end to LNG, no one bothered to talk to us,” she said. “I view that as a ‘re-colonization’ of energy by environmentalists. It’s a type of eco-colonialism that First Nations people like me are all-too familiar with, particularly as we seek to diversify our economies and provide opportunities for young people and future generations.”

Ms. Ogen’s complaint of “eco-colonialism” is not unlike the charge of “climate imperialism” that has been leveled against Western elites by leaders of the Global South who bristle at being pressured to adopt “green” agendas at the expense of actual economic development supported gas and other fossil fuels.

Indeed, the sentiments of Ms. Ogen almost certainly resonate with those who favor common sense over ideology. “Canadian LNG is Indigenous LNG, and that is good for the world and good for all of us here,” she says.

Vijay Jayaraj is a Research Associate at the CO2 Coalition, Arlington, Virginia. He holds a master’s degree in environmental sciences from the University of East Anglia, U.K.

Energy

China undermining American energy independence, report says

From The Center Square

By

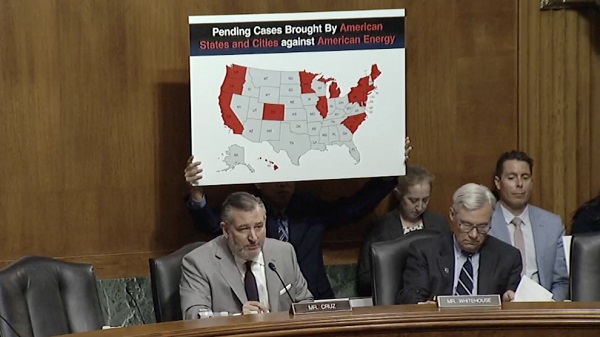

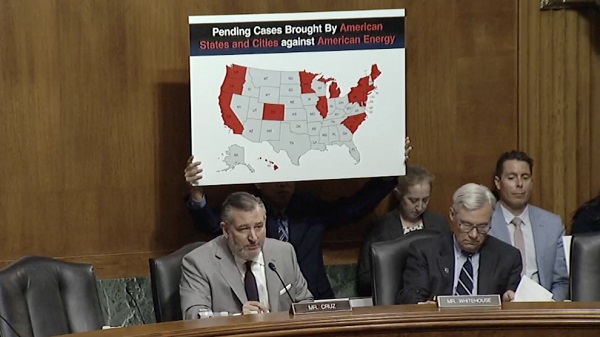

The Chinese Communist Party is exploiting the left’s green energy movement to hurt American energy independence, according to a new report from State Armor.

Michael Lucci, founder and CEO of State Armor, says the report shows how Energy Foundation China funds green energy initiatives that make America more reliant on China, especially on technology with known vulnerabilities.

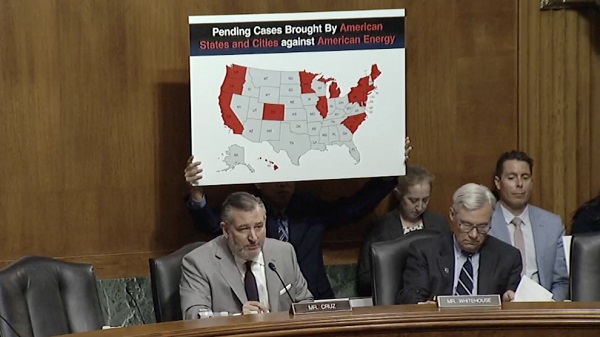

“Our report exposes how Energy Foundation China functions not as an independent nonprofit, but as a vehicle advancing the strategic interests of the Chinese Communist Party by funding U.S. green energy initiatives to shift American supply chains toward Beijing and undermine our energy security,” Lucci said in a statement before the Senate Judiciary Subcommittee’s hearing on Wednesday titled “Enter the Dragon – China and the Left’s Lawfare Against American Energy Dominance.”

Lucci said the group’s operations represent a textbook example of Chinese influence in America.

“This is a very good example of how the Chinese Communist Party operates influence operations within the United States. I would actually describe it as a perfect case study from their perspective,” he told The Center Square in a phone interview. “They’re using American money to leverage American policy changes that make the American energy grid dependent upon China.”

Lucci said one of the most concerning findings is that China-backed technology entering the U.S. power grid includes components with “undisclosed back doors” – posing a direct threat to the power grid.

“These are not actually green tech technologies. They’re red technologies,” he said. “We are finding – and this is open-source news reporting – they have undisclosed back doors in them. They’re described in a Reuters article as rogue communication devices… another way to describe that is kill switches.”

Lucci said China exploits American political divisions on energy policy to insert these technologies under the guise of environmental progress.

“Yes, and it’s very crafty,” he said. “We are not addressing the fact that these green technologies are red. Technologies controlled by the Communist Party of China should be out of the question.”

Although Lucci sees a future for carbon-free energy sources in the United States – particularly nuclear and solar energy – he doesn’t think the country should use technology from a foreign adversary to do it.

“It cannot be Chinese solar inverters that are reported in Reuters six weeks ago as having undisclosed back doors,” he said. “It cannot be Chinese batteries going into the grid … that allow them to sabotage our grid.”

Lucci said energy is a national security issue, and the United States is in a far better position to achieve energy independence than China.

“We are luckily endowed with energy independence if we choose to have it. China is not endowed with that luxury,” he said. “They’re poor in natural resources. We’re very well endowed – one of the best – with natural resources for energy production.”

He said that’s why China continues to build coal plants – and some of that coal comes from Australia – while pushing the United States to use solar energy.

“It’s very foolish of us to just make ourselves dependent on their technologies that we don’t need, and which are coming with embedded back doors that give them actual control over our energy grid,” he said.

Lucci says lawmakers at both the state and federal levels need to respond to this threat quickly.

“The executive branch should look at whether Energy Foundation China is operating as an unregistered foreign agent,” he said. “State attorneys general should be looking at these back doors that are going into our power grid – undisclosed back doors. That’s consumer fraud. That’s a deceptive trade practice.”

Energy

Carney’s Bill C-5 will likely make things worse—not better

From the Fraser Institute

By Niels Veldhuis and Jason Clemens

The Carney government’s signature legislation in its first post-election session of Parliament—Bill C-5, known as the Building Canada Act—recently passed the Senate for final approval, and is now law. It gives the government unprecedented powers and will likely make Canada even less attractive to investment than it is now, making a bad situation even worse.

Over the past 10 years, Canada has increasingly become known as a country that is un-investable, where it’s nearly impossible to get large and important projects, from pipelines to mines, approved. Even simple single-site redevelopment projects can take a decade to receive rezoning approval. It’s one of the primary reasons why Canada has experienced a mass exodus of investment capital, some $387 billion from 2015 to 2023. And from 2014 to 2023, the latest year of comparable data, investment per worker (excluding residential construction and adjusted for inflation) dropped by 19.3 per cent, from $20,310 to $16,386 (in 2017 dollars).

In theory, Bill C-5 will help speed up the approval process for projects deemed to be in the “national interest.” But the cabinet (and in practical terms, the prime minister) will determine the “national interest,” not the private sector. The bill also allows the cabinet to override existing laws, regulations and guidelines to facilitate investment and the building of projects such as pipelines, mines and power transmission lines. At a time when Canada is known for not being able to get large projects done, many are applauding this new approach, and indeed the bill passed with the support of the Opposition Conservatives.

But basically, it will allow the cabinet to go around nearly every existing hurdle impeding or preventing large project developments, and the list of hurdles is extensive: Bill C-69 (which governs the approval process for large infrastructure projects including pipelines), Bill C-48 (which effectively bans oil tankers off the west coast), the federal cap on greenhouse gas emissions for only the oil and gas sector (which effectively means a cap or even reductions in production), a quasi carbon tax on fuel (called the Clean Fuels Standard), and so on.

Bill C-5 will not change any of these problematic laws and regulations. It simply will allow the cabinet to choose when and where they’re applied. This is cronyism at its worst and opens up the Carney government to significant risks of favouritism and even corruption.

Consider firms interested in pursuing large projects. If the bill becomes the law of the land, there won’t be a new, better and more transparent process to follow that improves the general economic environment for all entrepreneurs and businesses. Instead, there will be a cabinet (i.e. politicians) with new extraordinary powers that firms can lobby to convince that their project is in the “national interest.”

Indeed, according to some reports, some senators are referring to Bill C-5 as the “trust me” law, meaning that because there aren’t enough details and guardrails within the legislation, senators who vote in favour are effectively “trusting” Prime Minister Carney and his cabinet to do the right thing, effectively and consistently over time.

Consider the ambiguity in the legislation and how it empowers discretionary decisions by the cabinet. According to the legislation, cabinet “may consider any factor” it “considers relevant, including the extent to which the project can… strengthen Canada’s autonomy, resilience and security” or “provide economic benefits to Canada” or “advance the interests of Indigenous peoples” or “contribute to clean growth and to meeting Canada’s objectives with respect to climate change.”

With this type of “criteria,” nearly anything cabinet or the prime minister can dream up could be deemed in the “national interest” and therefore provide the prime minister with unprecedented and near unilateral powers.

In the preamble to the legislation, the government said it wants an accelerated approval process, which “enhances regulatory certainty and investor confidence.” In all likelihood, Bill C-5 will do the opposite. It will put more power in the hands of a very few in government, lead to cronyism, risks outright corruption, and make Canada even less attractive to investment.

-

Alberta6 hours ago

Alberta6 hours agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Automotive1 day ago

Automotive1 day agoElectric vehicle sales are falling hard in BC, and it is time to recognize reality.

-

Automotive1 day ago

Automotive1 day agoPower Struggle: Electric vehicles and reality

-

Business1 day ago

Business1 day agoTrump on Canada tariff deadline: ‘We can do whatever we want’

-

Business8 hours ago

Business8 hours agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoFDA Exposed: Hundreds of Drugs Approved without Proof They Work

-

Energy1 day ago

Energy1 day agoChina undermining American energy independence, report says

-

Crime8 hours ago

Crime8 hours agoSuspected ambush leaves two firefighters dead in Idaho