Canadian Energy Centre

Canada remains on the sidelines as global competitors double down on energy projects

By Deborah Jaremko of the Canadian Energy Centre

From the Taliban to Russia, billions in oil and gas investment underway around the world

As Canada’s oil and gas industry faces the uncertainty of a looming emissions cap and a “Just Transition,” billions of dollars of investment is underway in other countries to grow oil and gas supply for the future.

Here’s just a handful of examples.

Afghanistan – Amu Darya basin

US$690 million

Xinjiang Central Asia Petroleum and Gas Co.

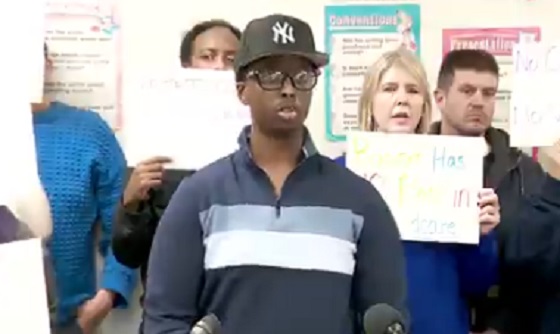

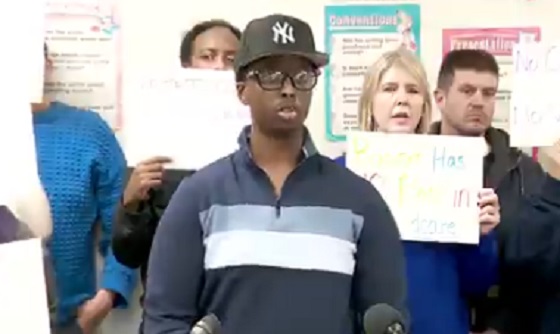

Afghan Deputy PM Mullah Abdul Ghani Baradar at a news conference in Kabul announcing an oil development agreement with Xinjiang Central Asia Petroleum and Gas Co. Photo: Twitter/Zabihullah Mujahid

In January, Chinese state-owned Xinjiang Central Asia Petroleum and Gas Co. signed a deal with the Taliban-controlled Afghanistan government to invest nearly US$700 million over four years on oil development in the country’s north.

The 25-year contract also involves building Afghanistan’s first oil refinery.

The Taliban militant group returned to power in Afghanistan after the withdrawal of U.S. forces in 2021. Its ownership share of the oil project will gradually rise to 75 per cent, according to spokesman Zabihullah Mujahid.

The Taliban maintains close ties with the terrorist group al-Qaeda, according to the Council on Foreign Relations (CFR). Since resuming its rule in Afghanistan, authorities have resumed public floggings and executions, violently cracked down on protesters and activists, “obliterated” women’s rights, and “enforced prohibitions on behavior deemed un-Islamic,” the CFR says.

Brazil – Santos Basin

TotalEnergies

US$1 billion

Map courtesy TotalEnergies

France-based TotalEnergies announced in January it will go ahead with a US$1 billion expansion of oil production offshore Brazil.

The development is located about 300 kilometres off the coast in the Santos Basin. TotalEnergies, which has operated in Brazil for more than 40 years, is 45 per cent owner along with partners Shell, Repsol and Sinopec.

The project will consist of three new deepwater wells connected to an existing floating production and storage vessel. It is expected to increase production to 60,000 barrels per day in 2025, up from about 35,000 barrels per day today.

Norway – Norwegian Continental Shelf

Aker BP

US$29 billion

Rendering courtesy Aker BP

Oslo, Norway-based Aker BP and its partners filed formal plans in December for four offshore oil and gas projects on the Norwegian Continental Shelf.

A total investment of nearly US$30 billion, the developments are expected to increase Aker BP’s oil and gas production to around 525,000 barrels per day in 2028, compared to 400,000 in 2022.

The company’s strategy is to meet the world’s growing need for energy while simultaneously contributing to reducing emissions, said CEO Karl Johnny Hersvik.

The projects are enabled by a 2020 government stimulus package that “allowed oil companies to embark upon new commitments,” he said.

Qatar – North Field East LNG expansion

Qatar Energy

US$29 billion

Qatar’s Minister of State for Energy Affairs and QatarEnergy CEO Saad Sherida al-Kaabi (R) and TotalEnergies CEO Patrick Pouyanne announce partnership in the giant North Field East LNG project at the QatarEnergy headquarters in Doha on June 12, 2022. Getty Images photo

One of the world’s largest LNG exporters is expanding its capacity with the largest LNG project ever built.

State-owned QatarEnergy’s US$29 billion North Field East Expansion will increase the country’s LNG export capacity to 110 million tonnes per year, from 77 million tonnes per year. Startup is expected in late 2024.

A planned second phase of the project will further increase capacity to 126 million tonnes per year. QatarEnergy’s partners include Shell, TotalEnergies, Exxon Mobil, ConocoPhillips and Eni.

World LNG demand reached a record 409 million tonnes in 2022, according to data provider Revintiv. It’s expected to rise to over 700 million tonnes by 2040, according to Shell’s most recent industry outlook.

Russia – Vostok Oil

Rosneft

US$170 billion

Russian President Vladimir Putin and executives with state oil company Rosneft present a major shipbuilding complex to Indian Prime Minister Narendra Modi. India will be an investor in a new US$170 billion oil project in the Russian Arctic. Photograph courtesy Rosneft

Despite the war in Ukraine and wide-ranging energy sanctions, Russian state-owned oil company Rosneft says work continues to advance on schedule for the massive Vostok oil project.

The US$170 billion project will use the Northern Sea Route to export about 600,000 barrels per day by 2024. Production is expected to increase to two million barrels per day after the second phase.

Rosneft reports that as of mid-2022, more than 1,000 units of special construction equipment are in operation, as well as seven new Russian arctic class drilling rigs, with another five on the way. Over 4,000 people and 2,000 vehicles have been mobilized.

“This means that the project lives and develops as planned, the inevitable difficulties are being overcome, but we have full confidence that all the tasks will be completed,” Rosneft CEO Igor Sechin said.

“In the context of decreasing investment in the oil and gas sector, Vostok Oil is the only project in the world capable to provide a stabilizing effect on the hydrocarbon markets.”

From the Canadian Energy Centre Ltd.

Alberta

The Canadian Energy Centre’s biggest stories of 2025

From the Canadian Energy Centre

Canada’s energy landscape changed significantly in 2025, with mounting U.S. economic pressures reinforcing the central role oil and gas can play in safeguarding the country’s independence.

Here are the Canadian Energy Centre’s top five most-viewed stories of the year.

5. Alberta’s massive oil and gas reserves keep growing – here’s why

The Northern Lights, aurora borealis, make an appearance over pumpjacks near Cremona, Alta., Thursday, Oct. 10, 2024. CP Images photo

Analysis commissioned this spring by the Alberta Energy Regulator increased the province’s natural gas reserves by more than 400 per cent, bumping Canada into the global top 10.

Even with record production, Alberta’s oil reserves – already fourth in the world – also increased by seven billion barrels.

According to McDaniel & Associates, which conducted the report, these reserves are likely to become increasingly important as global demand continues to rise and there is limited production growth from other sources, including the United States.

4. Canada’s pipeline builders ready to get to work

Canada could be on the cusp of a “golden age” for building major energy projects, said Kevin O’Donnell, executive director of the Mississauga, Ont.-based Pipe Line Contractors Association of Canada.

That eagerness is shared by the Edmonton-based Progressive Contractors Association of Canada (PCA), which launched a “Let’s Get Building” advocacy campaign urging all Canadian politicians to focus on getting major projects built.

“The sooner these nation-building projects get underway, the sooner Canadians reap the rewards through new trading partnerships, good jobs and a more stable economy,” said PCA chief executive Paul de Jong.

3. New Canadian oil and gas pipelines a $38 billion missed opportunity, says Montreal Economic Institute

Steel pipe in storage for the Trans Mountain Pipeline expansion in 2022. Photo courtesy Trans Mountain Corporation

In March, a report by the Montreal Economic Institute (MEI) underscored the economic opportunity of Canada building new pipeline export capacity.

MEI found that if the proposed Energy East and Gazoduq/GNL Quebec projects had been built, Canada would have been able to export $38 billion worth of oil and gas to non-U.S. destinations in 2024.

“We would be able to have more prosperity for Canada, more revenue for governments because they collect royalties that go to government programs,” said MEI senior policy analyst Gabriel Giguère.

“I believe everybody’s winning with these kinds of infrastructure projects.”

2. Keyera ‘Canadianizes’ natural gas liquids with $5.15 billion acquisition

Keyera Corp.’s natural gas liquids facilities in Fort Saskatchewan, Alta. Photo courtesy Keyera Corp.

In June, Keyera Corp. announced a $5.15 billion deal to acquire the majority of Plains American Pipelines LLP’s Canadian natural gas liquids (NGL) business, creating a cross-Canada NGL corridor that includes a storage hub in Sarnia, Ontario.

The acquisition will connect NGLs from the growing Montney and Duvernay plays in Alberta and B.C. to markets in central Canada and the eastern U.S. seaboard.

“Having a Canadian source for natural gas would be our preference,” said Sarnia mayor Mike Bradley.

“We see Keyera’s acquisition as strengthening our region as an energy hub.”

1. Explained: Why Canadian oil is so important to the United States

Enbridge’s Cheecham Terminal near Fort McMurray, Alberta is a key oil storage hub that moves light and heavy crude along the Enbridge network. Photo courtesy Enbridge

The United States has become the world’s largest oil producer, but its reliance on oil imports from Canada has never been higher.

Many refineries in the United States are specifically designed to process heavy oil, primarily in the U.S. Midwest and U.S. Gulf Coast.

According to the Alberta Petroleum Marketing Commission, the top five U.S. refineries running the most Alberta crude are:

- Marathon Petroleum, Robinson, Illinois (100% Alberta crude)

- Exxon Mobil, Joliet, Illinois (96% Alberta crude)

- CHS Inc., Laurel, Montana (95% Alberta crude)

- Phillips 66, Billings, Montana (92% Alberta crude)

- Citgo, Lemont, Illinois (78% Alberta crude)

Alberta

Alberta’s huge oil sands reserves dwarf U.S. shale

From the Canadian Energy Centre

By Will Gibson

Oil sands could maintain current production rates for more than 140 years

Investor interest in Canadian oil producers, primarily in the Alberta oil sands, has picked up, and not only because of expanded export capacity from the Trans Mountain pipeline.

Enverus Intelligence Research says the real draw — and a major factor behind oil sands equities outperforming U.S. peers by about 40 per cent since January 2024 — is the resource Trans Mountain helps unlock.

Alberta’s oil sands contain 167 billion barrels of reserves, nearly four times the volume in the United States.

Today’s oil sands operators hold more than twice the available high-quality resources compared to U.S. shale producers, Enverus reports.

“It’s a huge number — 167 billion barrels — when Alberta only produces about three million barrels a day right now,” said Mike Verney, executive vice-president at McDaniel & Associates, which earlier this year updated the province’s oil and gas reserves on behalf of the Alberta Energy Regulator.

Already fourth in the world, the assessment found Alberta’s oil reserves increased by seven billion barrels.

Verney said the rise in reserves despite record production is in part a result of improved processes and technology.

“Oil sands companies can produce for decades at the same economic threshold as they do today. That’s a great place to be,” said Michael Berger, a senior analyst with Enverus.

BMO Capital Markets estimates that Alberta’s oil sands reserves could maintain current production rates for more than 140 years.

The long-term picture looks different south of the border.

The U.S. Energy Information Administration projects that American production will peak before 2030 and enter a long period of decline.

Having a lasting stable source of supply is important as world oil demand is expected to remain strong for decades to come.

This is particularly true in Asia, the target market for oil exports off Canada’s West Coast.

The International Energy Agency (IEA) projects oil demand in the Asia-Pacific region will go from 35 million barrels per day in 2024 to 41 million barrels per day in 2050.

The growing appeal of Alberta oil in Asian markets shows up not only in expanded Trans Mountain shipments, but also in Canadian crude being “re-exported” from U.S. Gulf Coast terminals.

According to RBN Energy, Asian buyers – primarily in China – are now the main non-U.S. buyers from Trans Mountain, while India dominates purchases of re-exports from the U.S. Gulf Coast. .

BMO said the oil sands offers advantages both in steady supply and lower overall environmental impacts.

“Not only is the resulting stability ideally suited to backfill anticipated declines in world oil supply, but the long-term physical footprint may also be meaningfully lower given large-scale concentrated emissions, high water recycling rates and low well declines,” BMO analysts said.

-

International2 days ago

International2 days agoTrump confirms first American land strike against Venezuelan narco networks

-

Business2 days ago

Business2 days agoHow convenient: Minnesota day care reports break-in, records gone

-

International17 hours ago

International17 hours agoMaduro says he’s “ready” to talk

-

Business2 days ago

Business2 days agoThe great policy challenge for governments in Canada in 2026

-

Bruce Dowbiggin17 hours ago

Bruce Dowbiggin17 hours agoThe Rise Of The System Engineer: Has Canada Got A Prayer in 2026?

-

International17 hours ago

International17 hours agoLOCKED AND LOADED: Trump threatens U.S. response if Iran slaughters protesters