Energy

Canada must build 840 solar-power stations or 16 nuclear power plants to meet Ottawa’s 2050 emission-reduction target

From the Fraser Institute

The federal government’s plan to eliminate greenhouse gas (GHG) emissions from electricity generation by 2050 is impossible in practical terms, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

Due to population growth, economic growth and the transition to electrified transportation, electricity demand in Canada will increase substantially in coming years. “To meet existing and future electricity demand with low-emitting or zero-emitting sources within the government’s timeline, Canada would need to rapidly build infrastructure on a scale never before seen in the country’s history,” said Kenneth P.

Green, senior fellow at the Fraser Institute and author of Rapid Decarbonization of Electricity and Future Supply Constraints.

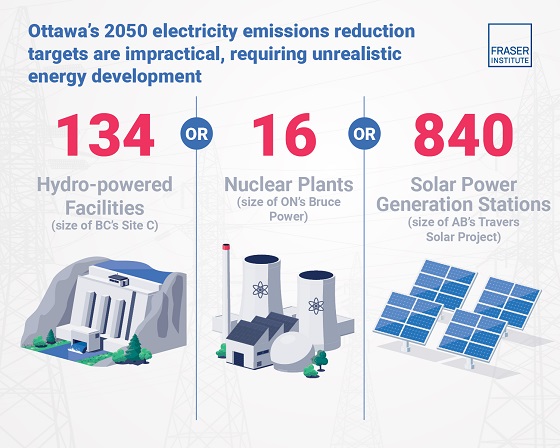

For example, to generate the electricity needed through 2050 solely with solar power, we’d need to build 840 solar-power generation stations the size of Alberta’s Travers Solar Project. At a construction time of two years per project, this would take 1,680 construction years to accomplish.

If we relied solely on wind power, Canada would need to build 574 wind-power installations the size of Quebec’s Seigneurie de Beaupre wind-power station. At a construction time of two years per project, this would take 1,150 construction years to accomplish.

If we relied solely on hydropower, we’d need to build 134 hydro-power facilities the size of the Site C power station in British Columbia. At a construction time of seven years per project, this would take 938 construction years to accomplish.

If we relied solely on nuclear power, we’d need to construct 16 new nuclear plants the size of Ontario’s Bruce Nuclear Generating Station. At a construction time of seven years per project, this would take 112 construction years to accomplish.

Currently, the process of planning and constructing electricity-generation facilities in Canada is often marked by delays and significant cost overruns. For B.C.’s Site C project, it took approximately 43 years from the initial planning studies in 1971 to environmental certification in 2014, with project completion expected in 2025 at a cost of $16 billion.

“When Canadians assess the viability of the federal government’s emission-reduction timelines, they should understand the practical reality of electricity generation in Canada,” Green said.

Decarbonizing Canada’s Electricity Generation: Rapid Decarbonization of Electricity and Future Supply Constraints

- Canada’s Clean Electricity Regulations (Canada, 2024a) require all provinces to fully “decarbonize” their electricity generation as part of the federal government’s broader “Net-Zero 2050” greenhouse gas emissions mitigation plan.

- Canada’s electricity demands are expected to grow in line with the country’s population, economic growth, and the transition to electrified transportation. Projections from the Canada Energy Regulator, Canadian Climate Institute, and Department of Finance estimate the need for an additional 684 TWh of generation capacity by 2050.

- If Canada were to meet this demand solely with wind power, it would require the construction of approximately 575 wind-power installations, each the size of Quebec’s Seigneurie de Beaupré Wind Farm, over 25 years. However, with a construction timeline of two years per project, this would equate to 1,150 construction years. Meeting future Canadian electricity demand using only wind power would also require over one million hectares of land—an area nearly 14.5 times the size of the municipality of Calgary.

- If Canada were to rely entirely on hydropower, it would need to construct 134 facilities similar in size to the Site C power station in British Columbia. Meeting all future demand with hydropower would occupy approximately 54,988 hectares of land—roughly 1.5 times the area of the municipality of Montreal.

- If Canada were to meet its future demand exclusively with nuclear power, it would need to construct 16 additional nuclear plants, each equivalent to Ontario’s Bruce Nuclear Generating Station.

- Meeting the predicted future electricity demand with these low/no CO2 sources will be a daunting challenge and is likely impossible within the 2050 timeframe.

Business

Inflation Reduction Act, Green New Deal Causing America’s Energy Crisis

From the Daily Caller News Foundation

By Greg Blackie

Our country is facing an energy crisis. No, not because of new demand from data centers or AI. Instead, it’s because utilities in nearly every state, due to government imposed “renewable” mandates, self-imposed mandates, and the supercharging of the Green New Scam under the so-called “Inflation Reduction Act,” have been shutting down vital coal resources and building out almost exclusively intermittent and costly resources like solar, wind, and battery storage.

President Donald Trump understands this, and that is why on day one of his administration he declared an Energy Emergency. Then, a few months later, the President signed a trio of Executive Orders designed to keep our “beautiful, clean coal” burning and providing the reliable, baseload, and affordable electricity Americans have benefitted from for generations.

Those orders have been used to keep coal generation online that was slated to shut down in Michigan and will potentially keep two units operating that were scheduled to shut down in Colorado this December. In Arizona, however, the Cholla Power Plant in Navajo County was shuttered by the utility just weeks after Trump explicitly called out the plant for saving in a press conference.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Unlike states with green mandates, Arizona essentially has none. Instead, our utilities, like many around the country, have self-imposed commitments to go “Net Zero” by 2050. To meet that target, they have planned to shut down all coal generation in the state by 2032 and plan to build out almost exclusively solar, wind, and battery storage to meet an expected explosive growth in demand, at a cost of tens of billions of dollars. So it is no surprise that like much of the rest of the country, Arizona is facing an energy crisis.

Taking a look at our largest regulated utilities (APS, TEP, and UNS) and the largest nonprofit utility, SRP, future plans paint an alarming picture. Combined, over the next 15 years, these utilities expect to see demand increase from 19,200 MW to 28,000 MW. For reference, 1,000 MW of electricity is enough to power roughly 250,000 homes. To meet that growth in demand, however, Arizonans will only get a net increase of 989 MW of reliable generation (coal, natural gas, and nuclear) compared to 22,543 MW (or nearly 23 times as much) of intermittent solar, wind, and battery storage.

But what about all of the new natural gas coming into the state? The vast majority of it will be eaten up just to replace existing coal resources, not to bring additional affordable energy to the grid. For example, the SRP board recently voted to approve the conversion of their Springerville coal plant to natural gas by 2030, which follows an earlier vote to convert another of their coal plants, Coronado, to natural gas by 2029. This coal conversion trap leaves ratepayers with the same amount of energy as before, eating up new natural gas capacity, without the benefit of more electricity.

So, while the Arizona utilities plan to collectively build an additional 4,538 MW of natural gas capacity over the next 15 years, at the same time they will be removing -3,549 MW (all of what is left on the grid today) of coal. And there are no plans for more nuclear capacity anytime soon. Instead, to meet their voluntary climate commitments, utilities plan to saddle ratepayers with the cost and resultant blackouts of the green new scam.

It’s no surprise then that Arizona’s largest regulated utilities, APS and TEP, are seeking double digit rate hikes next year. It’s not just Arizona. Excel customers in Colorado (with a 100% clean energy commitment) and in Minnesota (also with a 100% clean energy commitment) are facing nearly double-digit rate hikes. The day before Thanksgiving, PPL customers in Rhode Island (with a state mandate of 100% renewable by 2033) found out they may see rate hikes next year. Dominion (who has a Net Zero by 2050 commitment) wanted to raise rates for customers in Virginia by 15%. Just last month, regulators approved a 9% increase. Importantly, these rate increases are to recover costs for expenses incurred years ago, meaning they are clearly to cover the costs of the energy “transition” supercharged under the Biden administration, not from increased demand from data centers and AI.

It’s the same story around the country. Electricity rates are rising. Reliability is crumbling. We know the cause. For generations, we’ve been able to provide reliable energy at an affordable cost. The only variable that has changed has been what we are choosing to build. Then, it was reliable, dispatchable power. Now, it is intermittent sources that we know cost more, and that we know cause blackouts, all to meet absurd goals of going 100% renewable – something that no utility, state, or country has been able to achieve. And we know the result when they try.

This crisis can be avoided. Trump has laid out the plan to unleash American Energy. Now, it’s time for utilities to drop their costly green new scam commitments and go back to building reliable and affordable power that generations to come will benefit from.

Greg Blackie, Deputy Director of Policy at the Arizona Free Enterprise Club. Greg graduated summa cum laude from Arizona State University with a B.S. in Political Science in 2019. He served as a policy intern with the Republican caucus at the Arizona House of Representatives and covered Arizona political campaigns for America Rising during the 2020 election cycle.

Automotive

Politicians should be honest about environmental pros and cons of electric vehicles

From the Fraser Institute

By Annika Segelhorst and Elmira Aliakbari

According to Steven Guilbeault, former environment minister under Justin Trudeau and former member of Prime Minister Carney’s cabinet, “Switching to an electric vehicle is one of the most impactful things Canadians can do to help fight climate change.”

And the Carney government has only paused Trudeau’s electric vehicle (EV) sales mandate to conduct a “review” of the policy, despite industry pressure to scrap the policy altogether.

So clearly, according to policymakers in Ottawa, EVs are essentially “zero emission” and thus good for environment.

But is that true?

Clearly, EVs have some environmental advantages over traditional gasoline-powered vehicles. Unlike cars with engines that directly burn fossil fuels, EVs do not produce tailpipe emissions of pollutants such as nitrogen dioxide and carbon monoxide, and do not release greenhouse gases (GHGs) such as carbon dioxide. These benefits are real. But when you consider the entire lifecycle of an EV, the picture becomes much more complicated.

Unlike traditional gasoline-powered vehicles, battery-powered EVs and plug-in hybrids generate most of their GHG emissions before the vehicles roll off the assembly line. Compared with conventional gas-powered cars, EVs typically require more fossil fuel energy to manufacture, largely because to produce EVs batteries, producers require a variety of mined materials including cobalt, graphite, lithium, manganese and nickel, which all take lots of energy to extract and process. Once these raw materials are mined, processed and transported across often vast distances to manufacturing sites, they must be assembled into battery packs. Consequently, the manufacturing process of an EV—from the initial mining of materials to final assembly—produces twice the quantity of GHGs (on average) as the manufacturing process for a comparable gas-powered car.

Once an EV is on the road, its carbon footprint depends on how the electricity used to charge its battery is generated. According to a report from the Canada Energy Regulator (the federal agency responsible for overseeing oil, gas and electric utilities), in British Columbia, Manitoba, Quebec and Ontario, electricity is largely produced from low- or even zero-carbon sources such as hydro, so EVs in these provinces have a low level of “indirect” emissions.

However, in other provinces—particularly Alberta, Saskatchewan and Nova Scotia—electricity generation is more heavily reliant on fossil fuels such as coal and natural gas, so EVs produce much higher indirect emissions. And according to research from the University of Toronto, in coal-dependent U.S. states such as West Virginia, an EV can emit about 6 per cent more GHG emissions over its entire lifetime—from initial mining, manufacturing and charging to eventual disposal—than a gas-powered vehicle of the same size. This means that in regions with especially coal-dependent energy grids, EVs could impose more climate costs than benefits. Put simply, for an EV to help meaningfully reduce emissions while on the road, its electricity must come from low-carbon electricity sources—something that does not happen in certain areas of Canada and the United States.

Finally, even after an EV is off the road, it continues to produce emissions, mainly because of the battery. EV batteries contain components that are energy-intensive to extract but also notoriously challenging to recycle. While EV battery recycling technologies are still emerging, approximately 5 per cent of lithium-ion batteries, which are commonly used in EVs, are actually recycled worldwide. This means that most new EVs feature batteries with no recycled components—further weakening the environmental benefit of EVs.

So what’s the final analysis? The technology continues to evolve and therefore the calculations will continue to change. But right now, while electric vehicles clearly help reduce tailpipe emissions, they’re not necessarily “zero emission” vehicles. And after you consider the full lifecycle—manufacturing, charging, scrapping—a more accurate picture of their environmental impact comes into view.

-

Crime18 hours ago

Crime18 hours agoTerror in Australia: 12 killed after gunmen open fire on Hanukkah celebration

-

Crime18 hours ago

Crime18 hours agoHero bystander disarms shooter in Australian terror attack

-

Business1 day ago

Business1 day agoInflation Reduction Act, Green New Deal Causing America’s Energy Crisis

-

Business1 day ago

Business1 day agoFuelled by federalism—America’s economically freest states come out on top

-

Daily Caller1 day ago

Daily Caller1 day ago‘There Will Be Very Serious Retaliation’: Two American Servicemen, Interpreter Killed In Syrian Attack

-

illegal immigration2 days ago

illegal immigration2 days agoUS Notes 2.5 million illegals out and counting

-

Automotive1 day ago

Automotive1 day agoPoliticians should be honest about environmental pros and cons of electric vehicles

-

Alberta2 days ago

Alberta2 days agoThe Recall Trap: 21 Alberta MLA’s face recall petitions