Business

Canada can – and should – crack down on trade-based money laundering

From the Macdonald Laurier Institute

By Jamie Ferrill for Inside Policy

Neglecting to take decisive action enables organized criminal networks whose activities cause significant harm on our streets and those of our international partners.

Financial crime bears considerable political and economic risk. For the incoming Trump administration, the threat that transnational organized crime and the illicit financial flows pose to global financial stability is a top priority. The threat of tariffs by the Trump administration makes the costs to Canada in enabling global financial crime all too apparent. In addition to the cost of tariffs themselves, the associated reputational risk and loss of confidence in Canada’s financial system has implications for investments, credit, supply chains, and bilateral co-operation and agreements.

Canada’s proximity to major international markets, stable economy, high standard of living, and strong institutions and frameworks make it an attractive place to do business: for both legitimate and criminal enterprises.

Trade is a key contributing sector for Canada’s economic security. It represents two-thirds of Canada’s GDP, and exports alone support nearly 3.3 million Canadian jobs. Trade is also highly vulnerable to criminal exploitation. Ineffective oversight, regulatory complexity, and lagging technology adoption, coupled with a lack of export controls, make it possible to move vast proceeds of crimes, such as those from drug trafficking, human trafficking, corruption, and tax evasion through the global trade system.

These vulnerabilities are well-known by transnational organized crime groups. They are able to effectively move billions of dollars of dirty money through the global trade system every year, a method commonly referred to as Trade-Based Money Laundering (TBML).

While any statistics must be interpreted with caution, evidence shows that TBML is a prevalent method of money laundering.

What is it?

There are several types of Trade-Based Financial Crimes such as terrorism financing through trade, sanctions evasion, and simply trade fraud. However, the TBML definition is necessarily specific. Essentially here, TBML is a money laundering method: the processing of criminal proceeds to disguise their illegal origin. TBML involves the movement of value through the global trade system to obfuscate the illicit origin. This is usually done through document fraud: undervaluing, overvaluing, phantom shipping, or multiple invoicing. Different techniques employ different aspects of the supply chain. And TBML may be just one method used within larger money laundering operations.

By way of example, US authorities allege that two Chinese nationals living in Chicago laundered tens of millions of dollars for the Sinaloa and Jalisco Cartels. Drugs were smuggled into the United States and sold throughout the country. The proceeds from these sales were collected by the Chinese nationals. Those proceeds were used to purchase bulk electronics in the United States, which were then shipped – with a falsified value – to co-conspirators in China, who sold them locally. The legitimacy provided by the electronics sales and the trade transaction provide cover to “clean” proceeds from precursor crime.

Either the importer and/or the exporter of the goods can shift value. Chances here are the electronics shipped were undervalued: on leaving the country, they are declared at a (much) lower value than they are actually worth. The importer in China pays the undervalued invoice, then sells the goods for what they are worth. The profit from those electronics now appears clean, since it was used for a “legitimate” sale. The ensuing value gap can be transferred informally or stored as illicit wealth. The value has now shifted, without fiat currency leaving the country of origin.

But the cycle does not stop there. The value and money itself continue to traverse around the world, through various intermediaries such as financial institutions or cryptocurrency exchanges. It then goes right back into the system and enables the very crimes and organized crime groups that generated it in the first place. It is, in short, the business model of organized crime.

The Canadian problem

Ultimately, the proceeds of crime that have been legitimised through TBML (and other money laundering methods) supports the criminal enterprises that generated the value in the first place. In the example, these are prolific cartels who have been behind the fentanyl crisis, migrant trafficking and abuse, corruption, and widespread violence that destabilizes communities and undermines governments across North America and beyond.

With new actors, drug routes, and ways of doing business, the cartels are very much active in Canada. The Sinaloa cartel in particular has established a significant presence in Canada where it controls the cocaine market, manufactures and distributes fentanyl, and is embedded in local criminal networks. This increases Canada’s role as a strategic location for drug trafficking and a base to export abroad, notably to Europe, the US, and Australia.

Hells Angels, Red Scorpions, ’Ndrangheta, and other organized crime groups are also exploiting Canada’s strategic location using their transnational links. These groups are active in criminal activities that generate proceeds of crime, which they launder through Canadian institutions. From drug trafficking to extortion to human and sex trafficking, the foundation of organized crime relies on generating and maximizing profits. The proceeds generally need to be laundered; otherwise, there are direct lines back to the criminal organizations. They are, without a doubt, exploiting the trade sector; the very sector that provides so much economic security for Canada.

Canada’s regulation, reporting, and prosecution record for money laundering is notoriously weak. Its record for regulation, reporting, and prosecution for trade-based financial crimes, namely here TBML, is even weaker.

As financial institutions and other regulated entities face increased scrutiny following the TD Bank scandal and the Cullen Commission’s inquiry into money laundering in BC, more criminal activity is likely to be displaced into the trade sector and the institutions it comprises.

TBML is difficult for financial institutions to detect, especially given that 80 per cent of trade is done through open accounts. It exploits established trade structures that are meant to protect the system –like documentation and invoicing processes – by manipulating transactions outside traditional payment systems, which requires more sophisticated anti-money laundering strategies to address these hidden vulnerabilities.

Addressing the problem

Trade is a gaping vulnerability. Yet, it attracts minimal attention in countering transnational financial crime. Containing the fentanyl crisis for one requires a collaborative effort to bolster supply chains and the trade sector against financial crime. This means global cooperation, technological advances (such as blockchain technology), appropriate resourcing, more scrutiny on high-risk countries and shippers, and regulatory innovation.

But political will is in short supply. The federal government’s Budget 2024 and the resulting proposed Regulations Amending Certain Regulations Made Under the Proceeds of Crime (Money Laundering) and Terrorism Financing Act will grant CBSA new authorities to counter TBML, but limited resources to make good on them. And CBSA cannot do it alone.

Transnational organized crime and the illicit financial flows that support it poses a threat to global financial stability. The enabling of financial crime hurts Canada’s reputation abroad. With a new political regime emerging in the US, Canada cannot afford to be seen as a weak link. Loss of confidence in a country and its financial system has implications for investments, credit, supply chains, and bilateral cooperation and agreements.

By neglecting to take decisive action, we inadvertently enable organized criminal networks whose activities cause significant harm on our streets and those of our international partners. With profits as their primary driver, it is imperative that we scrutinize financial pathways to disrupt these illicit operations effectively.

Organized crime groups are not bound by privacy laws, bureaucracy, political agendas, and government budgets. They are continually evolving and staying many steps ahead of what Canada is equipped to control: technologically, geographically, strategically, logistically, and tactically. Without appropriate regulations, technological advances, and resources in place, we will continue to be a laggard in countering financial crime.

More systematic change is needed across regulatory frameworks, law enforcement coordination and resourcing, and international partnerships to strengthen oversight, close loopholes, and enhance detection and disruption. It would be a low-cost signal to the Trump administration that Canada is committed to upping its game.

Jamie Ferrill is senior lecturer in Financial Crime at Charles Sturt University and co-editor of Dirty Money: Financial Crime in Canada.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Business

Prime minister can make good on campaign promise by reforming Canada Health Act

From the Fraser Institute

While running for the job of leading the country, Prime Minister Carney promised to defend the Canada Health Act (CHA) and build a health-care system Canadians can be proud of. Unfortunately, to have any hope of accomplishing the latter promise, he must break the former and reform the CHA.

As long as Ottawa upholds and maintains the CHA in its current form, Canadians will not have a timely, accessible and high-quality universal health-care system they can be proud of.

Consider for a moment the remarkably poor state of health care in Canada today. According to international comparisons of universal health-care systems, Canadians endure some of the lowest access to physicians, medical technologies and hospital beds in the developed world, and wait in queues for health care that routinely rank among the longest in the developed world. This is all happening despite Canadians paying for one of the developed world’s most expensive universal-access health-care systems.

None of this is new. Canada’s poor ranking in the availability of services—despite high spending—reaches back at least two decades. And wait times for health care have nearly tripled since the early 1990s. Back then, in 1993, Canadians could expect to wait 9.3 weeks for medical treatment after GP referral compared to 30 weeks in 2024.

But fortunately, we can find the solutions to our health-care woes in other countries such as Germany, Switzerland, the Netherlands and Australia, which all provide more timely access to quality universal care. Every one of these countries requires patient cost-sharing for physician and hospital services, and allows private competition in the delivery of universally accessible services with money following patients to hospitals and surgical clinics. And all these countries allow private purchases of health care, as this reduces the burden on the publicly-funded system and creates a valuable pressure valve for it.

And this brings us back to the CHA, which contains the federal government’s requirements for provincial policymaking. To receive their full federal cash transfers for health care from Ottawa (totalling nearly $55 billion in 2025/26) provinces must abide by CHA rules and regulations.

And therein lies the rub—the CHA expressly disallows requiring patients to share the cost of treatment while the CHA’s often vaguely defined terms and conditions have been used by federal governments to discourage a larger role for the private sector in the delivery of health-care services.

Clearly, it’s time for Ottawa’s approach to reflect a more contemporary understanding of how to structure a truly world-class universal health-care system.

Prime Minister Carney can begin by learning from the federal government’s own welfare reforms in the 1990s, which reduced federal transfers and allowed provinces more flexibility with policymaking. The resulting period of provincial policy innovation reduced welfare dependency and government spending on social assistance (i.e. savings for taxpayers). When Ottawa stepped back and allowed the provinces to vary policy to their unique circumstances, Canadians got improved outcomes for fewer dollars.

We need that same approach for health care today, and it begins with the federal government reforming the CHA to expressly allow provinces the ability to explore alternate policy approaches, while maintaining the foundational principles of universality.

Next, the Carney government should either hold cash transfers for health care constant (in nominal terms), reduce them or eliminate them entirely with a concordant reduction in federal taxes. By reducing (or eliminating) the pool of cash tied to the strings of the CHA, provinces would have greater freedom to pursue reform policies they consider to be in the best interests of their residents without federal intervention.

After more than four decades of effectively mandating failing health policy, it’s high time to remove ambiguity and minimize uncertainty—and the potential for politically motivated interpretations—in the CHA. If Prime Minister Carney wants Canadians to finally have a world-class health-care system then can be proud of, he should allow the provinces to choose their own set of universal health-care policies. The first step is to fix, rather than defend, the 40-year-old legislation holding the provinces back.

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Crime2 days ago

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Alberta2 days ago

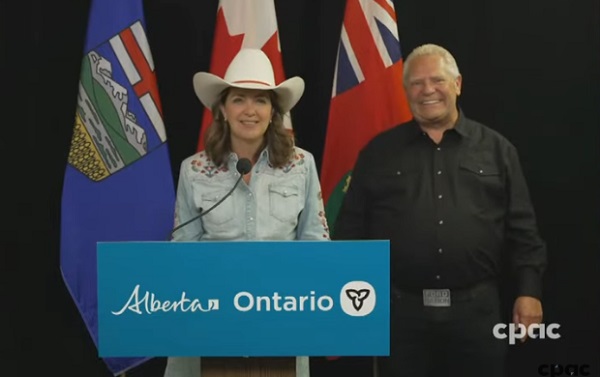

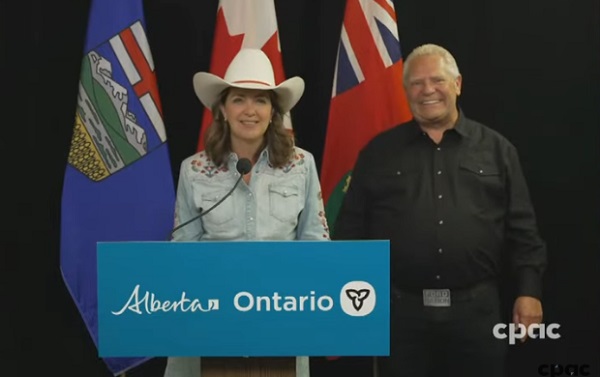

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Fraser Institute24 hours ago

Fraser Institute24 hours agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million from 2016 to 2024

-

Censorship Industrial Complex13 hours ago

Censorship Industrial Complex13 hours agoCanadian pro-freedom group sounds alarm over Liberal plans to revive internet censorship bill

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV