Business

Brookfield’s Deep Ties to Chinese Land, Loans, and Green Deals—And a Real Estate Tycoon With CCP Links—Raise Questions as Carney Takes Over from Trudeau

From The Bureau

Brookfield Bet Billions on Shanghai Land as China’s Market Peaked and Secured $276 Million Bank of China Refinancing Under Mark Carney as Market Crashed

A review of corporate documents reveals that Brookfield—the influential $900 billion Canadian investment fund from which Liberal Prime Minister-to-be Mark Carney stepped away from in order to replace Justin Trudeau as Canada’s leader—maintains over $3 billion in politically sensitive investments with Chinese state-linked real estate and energy companies, along with a substantial offshore banking presence. One of its major real estate ventures, a $750 million entry into high-end Shanghai commercial property in 2013, involved a Hong Kong tycoon affiliated with the Chinese People’s Political Consultative Conference (CPPCC)—which the CIA labels a central “united front” entity of Beijing.

The investment occurred while China’s real estate bubble was peaking. Last year, as China’s market crashed, and vacancies soared in Shanghai, Brookfield under Carney secured hundreds of millions of dollars in loans from the Bank of China to refinance its Shanghai commercial land holdings. According to The Bureau’s research, this emergency loan came a decade after Carney, serving as Governor of the Bank of England, aided Beijing by facilitating the Bank of China’s expansion of its global financial footprint. In his 2013 speech, UK at the Heart of Renewed Globalisation, Carney announced that “The Bank of England [has] signed an agreement with the People’s Bank of China … Helping the internationalisation of the Renminbi is a global good.”

While Brookfield had already amassed well over three billion dollars in estimated investments and managed assets in China before Carney took the helm in 2020, research indicates that he played a role in expanding the firm’s footprint there. This included refinancing its 2019 acquisition of Shanghai commercial real estate—initially valued at approximately CAD $2 billion at the peak of China’s real estate bubble—though its actual worth was likely significantly lower when Brookfield secured nearly $300 million at four percent interest from the Bank of China last year.

Given that his history of deep investment in China—if not his holdings, reportedly now placed in a blind trust—could potentially color Carney’s plans for Canada, these developments are especially notable as a trade war between the United States and Beijing escalates.

Carney and his cabinet members will be sworn in at 11 a.m. this morning at Rideau Hall, the Governor General’s official residence. The timing of Carney’s appointment as prime minister adds urgency to ongoing questions about potential conflicts of interest, with matters further complicated by reports that his first international meeting will be with European leaders next week—who are themselves grappling with sweeping tariffs imposed by the Trump Administration.

Brookfield’s substantial investments in China—directly or indirectly involving state-linked entities—include hundreds of millions in renewable energy assets acquired through TerraForm Global in 2017, a $750 million real estate stake in China Xintiandi since 2013, a 2019 Shanghai land purchase valued at approximately $2 billion, a $100 million joint venture with GLP for solar projects launched in 2018, and reported plans to raise hundreds of millions more in both real estate and China green sector investments.

In 2013, the year Xi Jinping became president, Brookfield made its first major foray into China’s real estate sector, investing up to $750 million for a 22% stake in China Xintiandi, a subsidiary of Hong Kong-listed developer Shui On Land. “The cornerstone investment in China Xintiandi gives Brookfield access to high-quality assets in Shanghai while creating opportunities for future growth through asset acquisitions and strategic partnerships,” Bill Powell, Brookfield’s Australasian chief executive, said in a press release. “China is a key market in Brookfield’s long-term growth strategy, and partnering with Shui On Land to invest in China Xintiandi is an ideal entry point for us.”

Although Shui On Land is not state-owned, it operates within China’s tightly regulated urban redevelopment sector. One of Brookfield’s primary real estate partners in the region is Vincent Lo, Shui On Land’s principal, who previously served as a member of the Chinese People’s Political Consultative Conference (CPPCC)—an advisory body that ostensibly includes diverse political parties and organizations but ultimately operates under Chinese Communist Party leadership.

Its members, especially high-profile business leaders, often support policy objectives aligned with the central government’s agenda. Lo’s decades of membership in the CPPCC highlights his proximity to Beijing and adds important context to any business dealings he undertakes—such as those with Brookfield.

For example, in a 2024 interview with China Daily, Lo made his position on Chinese Communist rule in Hong Kong clear: “I think a lot of people don’t really understand what ‘one country, two systems’ is, until after a lot of disruptive demonstrations in Hong Kong that really made us realize we are under one country,” he told the Communist Party–controlled news outlet.

Further illuminating sensitive questions that geopolitical analysts might consider regarding Brookfield’s partnership with such investors, the China Daily interviewer asked:

“Vincent, since you mentioned that our motherland has improved and matured, understanding what the world is all about—does that diminish Hong Kong’s role in any way?”

“No, [Hong Kong is] more so [important] because right now, for example, the US and its close allies are all trying to contain China’s growth,” Lo answered. “And so Hong Kong as a special administrative region, we have a special sort of angle to handle this situation. Because I don’t believe multinational corporations can ignore the China market.”

According to China Daily, Vincent Lo served as a director of Hang Seng Bank in 2010 alongside Cheng Yu-tung, a prominent Hong Kong tycoon and member of the Chinese People’s Political Consultative Conference. Documents show Cheng was involved in Macau casino holdings through a consortium of Hong Kong investors, including Stanley Ho—an association that drew scrutiny from U.S. and Canadian law enforcement and intelligence. Authorities were particularly concerned about Cheng’s dealings with individuals suspected by New Jersey gaming regulators of engaging in illicit activities within Macau’s private VIP gaming rooms. [Cheng Yu-tung also had reported dealings with Donald Trump, before Trump ran for office in the United States.]

During his tenure as Governor of the Bank of England from 2013 to 2020, Carney deepened financial ties between the UK and China, most notably with his ‘money swap deal’ with China’s central bank, letting each country borrow the other’s cash—up to £21 billion. Carney said it could lead to a yuan-trading hub in London. This pact made it easier for businesses to use China’s money worldwide, boosting Beijing’s goal to rival the U.S. dollar.

In March 2024, as Brookfield’s chair, Mark Carney was among a select group of Western executives who met with President Xi Jinping in Beijing—an event The Telegram described as part of a “charm offensive” amid Beijing’s efforts to stabilize its economy.

Then, 11 years after strengthening ties between London and Beijing through the Bank of China agreement, Carney returned to Beijing in October 2024—just a month after joining Liberal Prime Minister Justin Trudeau’s economic task force. During this visit, he held meetings with senior Chinese officials, including a private session with Beijing Mayor Yin Yong.

The following month, as reported by Bloomberg on November 5, 2024, Brookfield secured a $276 million loan from the Bank of China—underscoring Carney and the firm’s deep financial connections to the People’s Republic.

According to Bloomberg’s anonymous sources, the Canadian asset manager faced a looming offshore senior loan of approximately $700 million due by year-end. The loan was originally used to finance Brookfield’s 2019 acquisition of a Shanghai office tower complex from Greenland Hong Kong Holdings Ltd.—a CAD 2-billion transaction that ranked among the largest commercial property purchases by a foreign firm in China. Bloomberg reported that the Bank of China loan carried an annual interest rate of around 4%.

“Talks are unfolding against the backdrop of a severe real estate slump in China, where rising supply and a slowing economy have pushed office vacancy in some prime Shanghai districts to 21.5 percent, the highest level in two decades,” Bloomberg noted.

That a state-owned bank provided this financing amid China’s plunging real estate market suggests the Bank of China extended a critical financial lifeline to Brookfield during a period of acute economic stress. While not classified as an investment, the loan underscores Brookfield’s politically sensitive ties to Beijing’s main bank—helping to sustain its multibillion-dollar real estate footprint in China under Carney’s leadership.

In 2017, Brookfield invested $750 million to acquire TerraForm Global, a renewable power company originally spun out of SunEdison, an American solar power company that filed for bankruptcy in 2016. TerraForm’s portfolio included 952 megawatts of solar and wind assets in emerging markets. “This transaction expands our presence in Brazil and provides a platform for further growth in India and China’s attractive, high-growth renewables markets,” the company said.

Notably, TerraForm’s indirect ties to JIC Capital—a Chinese state-owned entity that invested in SunEdison—suggest that these power purchase agreements may have involved government-backed contracts. This acquisition positioned Brookfield as a direct investor in China’s expanding clean energy market, a sector that the Chinese government has actively encouraged for foreign partnerships. It also aligns with Carney’s urgent vision—promoted through multilateral entities such as the World Economic Forum—to mobilize cross-border investment in pursuit of climate change mitigation.

Brookfield has also transacted directly with a Chinese state-owned enterprise. In 2017, Brookfield Infrastructure Partners sold its 28% stake in Transelec—Chile’s largest electric transmission company—to China Southern Power Grid for approximately $1.3 billion. The Transelec sale is one of the largest Chinese acquisitions in Chile’s energy sector and exemplifies Brookfield’s lucrative conduit role in high-level infrastructure transactions with Chinese state-owned entities.

Brookfield’s presence in China extends beyond asset sales. In 2018, the company formed a 50:50 joint venture with Global Logistic Properties (GLP), a leading Asia-based logistics firm, to install 300 megawatts of distributed solar projects across China, with a pipeline that could eventually expand to 1 gigawatt. Although GLP is not a Chinese state entity, it is partially owned by Vanke Group, whose largest shareholder is Shenzhen Metro—a well-known state-owned enterprise.

In his capacity at Brookfield, Carney’s interactions with Chinese leadership became even more direct. On October 20, 2024, he traveled to Beijing to attend the Financial Street Forum, an annual conference organized by the Chinese government to advance financial policy coordination with foreign investors. During this visit, Carney held a private meeting with Beijing’s Mayor Yin Yong at the city’s Financial Regulatory Bureau headquarters.

In language reminiscent of Chinese Communist Party framing, according to a Chinese government website statement, Beijing’s mayor “encouraged Brookfield Asset Management and BlackRock to seize opportunities, tap into their strengths, and increase their investment and business presence in Beijing. He invited both companies to further deepen mutually beneficial cooperation, and share the dividends of Beijing’s high-quality development and high-standard opening-up.” Meanwhile, “Carney highlighted Brookfield Asset Management’s keen interest in seizing development opportunities in China, further expanding its business in Beijing, and deepening cooperation with relevant partners in areas such as green finance, fund management, and infrastructure investment,” the Chinese statement said.

Beyond his corporate dealings, Carney has also interacted with Chinese financial institutions at global economic forums, appearing alongside figures such as Jin Liqun, President of the Asian Infrastructure Investment Bank (AIIB). The AIIB is a China-led institution that promotes large-scale infrastructure investments backed by Chinese capital. These ties suggest that Carney has built close relationships with key figures in China’s financial and political circles—connections that could shape his economic policies as he assumes leadership of Canada’s government today.

Carney resigned from Brookfield in January 2025 to focus on his leadership bid for Canada’s Liberal Party and secured a stunning victory this week in what CBC described as “largely a referendum on who is best to take on the U.S. president.”

“Carney, who does not hold a seat in the House of Commons and has never been elected, secured more than 85 percent of the points … [and] dominated in all 343 ridings,” CBC reported, noting that while he was widely seen as the front-runner, “even members of his camp were surprised by the resounding results Sunday evening.”

Carney’s team has stated that he placed all his assets in a blind trust to prevent conflicts of interest. However, questions remain about whether this step fully distances him from Brookfield. His opponent, Pierre Poilievre, has called for greater transparency regarding Brookfield’s financial dealings, while Poilievre’s party argues that Canadian media has not sufficiently scrutinized Carney’s background.

Meanwhile, Centre for International Corporate Tax Accountability and Research (CICTAR) has reported that Brookfield’s offshore structuring enabled it to avoid an estimated $6.5 billion in taxes in 2021 alone. “While this may be legal, it has large negative impacts on public funding for essential services,” the report stated. Two years ago, with Carney at the helm, Brookfield faced criticism for using offshore tax havens and various loopholes on its properties in London and its Manhattan West holdings in New York. According to CICTAR, in the case of Brookfield’s Canary Wharf properties, the management firm’s £2.6 billion co-ownership deal in 2015—alongside the Qatar Investment Authority—was structured through a labyrinth of holding companies and subsidiaries, including entities in known tax havens like Jersey and Bermuda

The Paradise Papers (a 2017 leak of offshore records) further revealed numerous Brookfield-linked entities registered through the Appleby law firm. For example, Brookfield Infrastructure Partners Limited and Brookfield Property Partners Limited were incorporated in Bermuda, according to the Paradise Papers data. Records show Brookfield had many Bermuda-based vehicles dating back to the mid-2000s—such as Brookfield Asset Management Holdings Ltd. (Bermuda, incorporated 2006)—and various Brookfield Infrastructure and Property subsidiaries formed between 2007 and 2013. Brookfield Asset Management was also listed as an officer of a Cayman Islands company (Brookfield Brazil Ltd., incorporated in 1995) in the Offshore Leaks database.

As Carney takes office today, scrutiny of his financial dealings and Brookfield’s deep ties to China and offshore banking is likely to intensify. With Canada’s economic future becoming ever more entangled in global trade conflicts, Carney’s business background offers both a wealth of expertise and a complex network of financial entanglements—factors that could potentially produce lasting consequences for Canadian citizens, whether they are fully aware or not.

Earlier this week, The Global Times, widely regarded as a vocal outlet for the Chinese Communist Party, signaled Beijing’s approval of Carney’s victory—at least for now.

“When asked about Mark Carney’s leadership win in Canada’s ruling Liberal Party and his expected rise to prime minister, Chinese Foreign Ministry spokesperson Mao Ning said Monday that China has taken note of the reports and extends its congratulations to Mr. Carney,” the outlet reported.

Mao added, “We hope Canada maintains an objective and rational understanding of China and adopts a pragmatic approach, working with China to improve and develop bilateral relations.”

The Bureau is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Business

Prime minister can make good on campaign promise by reforming Canada Health Act

From the Fraser Institute

While running for the job of leading the country, Prime Minister Carney promised to defend the Canada Health Act (CHA) and build a health-care system Canadians can be proud of. Unfortunately, to have any hope of accomplishing the latter promise, he must break the former and reform the CHA.

As long as Ottawa upholds and maintains the CHA in its current form, Canadians will not have a timely, accessible and high-quality universal health-care system they can be proud of.

Consider for a moment the remarkably poor state of health care in Canada today. According to international comparisons of universal health-care systems, Canadians endure some of the lowest access to physicians, medical technologies and hospital beds in the developed world, and wait in queues for health care that routinely rank among the longest in the developed world. This is all happening despite Canadians paying for one of the developed world’s most expensive universal-access health-care systems.

None of this is new. Canada’s poor ranking in the availability of services—despite high spending—reaches back at least two decades. And wait times for health care have nearly tripled since the early 1990s. Back then, in 1993, Canadians could expect to wait 9.3 weeks for medical treatment after GP referral compared to 30 weeks in 2024.

But fortunately, we can find the solutions to our health-care woes in other countries such as Germany, Switzerland, the Netherlands and Australia, which all provide more timely access to quality universal care. Every one of these countries requires patient cost-sharing for physician and hospital services, and allows private competition in the delivery of universally accessible services with money following patients to hospitals and surgical clinics. And all these countries allow private purchases of health care, as this reduces the burden on the publicly-funded system and creates a valuable pressure valve for it.

And this brings us back to the CHA, which contains the federal government’s requirements for provincial policymaking. To receive their full federal cash transfers for health care from Ottawa (totalling nearly $55 billion in 2025/26) provinces must abide by CHA rules and regulations.

And therein lies the rub—the CHA expressly disallows requiring patients to share the cost of treatment while the CHA’s often vaguely defined terms and conditions have been used by federal governments to discourage a larger role for the private sector in the delivery of health-care services.

Clearly, it’s time for Ottawa’s approach to reflect a more contemporary understanding of how to structure a truly world-class universal health-care system.

Prime Minister Carney can begin by learning from the federal government’s own welfare reforms in the 1990s, which reduced federal transfers and allowed provinces more flexibility with policymaking. The resulting period of provincial policy innovation reduced welfare dependency and government spending on social assistance (i.e. savings for taxpayers). When Ottawa stepped back and allowed the provinces to vary policy to their unique circumstances, Canadians got improved outcomes for fewer dollars.

We need that same approach for health care today, and it begins with the federal government reforming the CHA to expressly allow provinces the ability to explore alternate policy approaches, while maintaining the foundational principles of universality.

Next, the Carney government should either hold cash transfers for health care constant (in nominal terms), reduce them or eliminate them entirely with a concordant reduction in federal taxes. By reducing (or eliminating) the pool of cash tied to the strings of the CHA, provinces would have greater freedom to pursue reform policies they consider to be in the best interests of their residents without federal intervention.

After more than four decades of effectively mandating failing health policy, it’s high time to remove ambiguity and minimize uncertainty—and the potential for politically motivated interpretations—in the CHA. If Prime Minister Carney wants Canadians to finally have a world-class health-care system then can be proud of, he should allow the provinces to choose their own set of universal health-care policies. The first step is to fix, rather than defend, the 40-year-old legislation holding the provinces back.

-

Alberta2 days ago

Alberta2 days agoCOWBOY UP! Pierre Poilievre Promises to Fight for Oil and Gas, a Stronger Military and the Interests of Western Canada

-

MAiD1 day ago

MAiD1 day agoCanada’s euthanasia regime is already killing the disabled. It’s about to get worse

-

Crime2 days ago

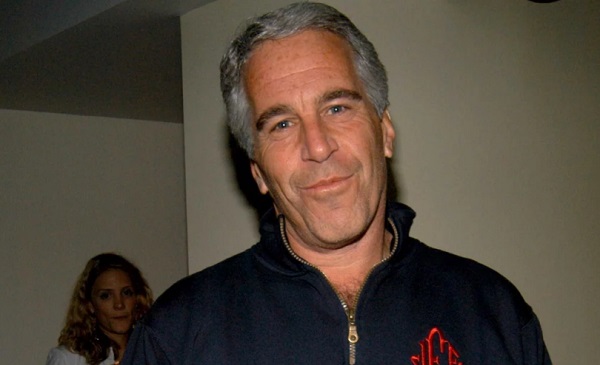

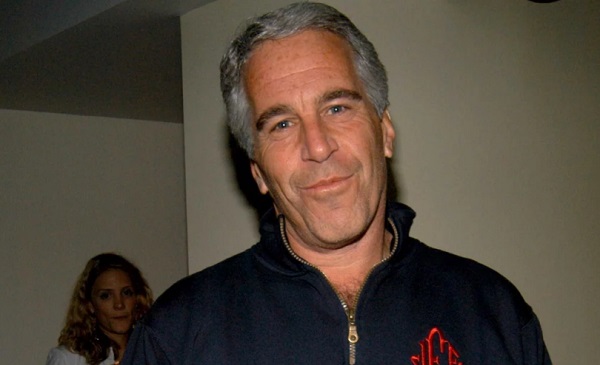

Crime2 days agoEyebrows Raise as Karoline Leavitt Answers Tough Questions About Epstein

-

Alberta2 days ago

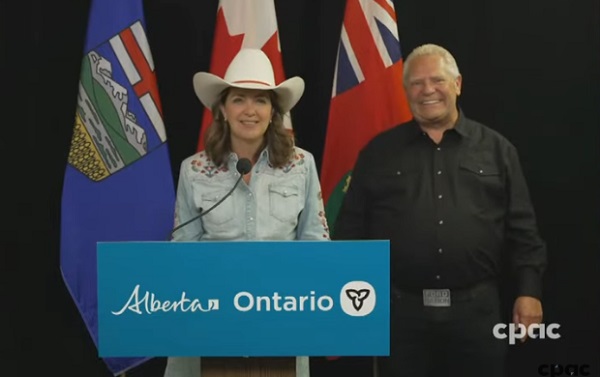

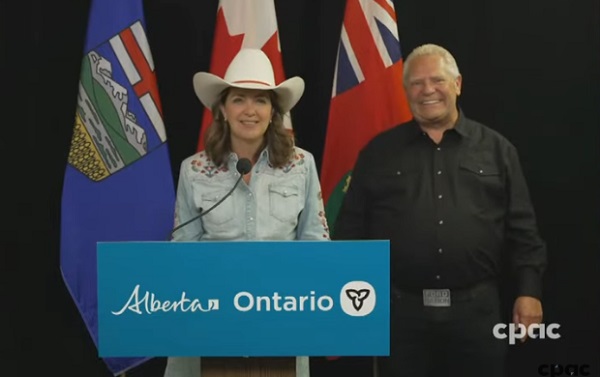

Alberta2 days agoAlberta and Ontario sign agreements to drive oil and gas pipelines, energy corridors, and repeal investment blocking federal policies

-

Fraser Institute1 day ago

Fraser Institute1 day agoBefore Trudeau average annual immigration was 617,800. Under Trudeau number skyrocketted to 1.4 million from 2016 to 2024

-

Censorship Industrial Complex14 hours ago

Censorship Industrial Complex14 hours agoCanadian pro-freedom group sounds alarm over Liberal plans to revive internet censorship bill

-

Daily Caller2 days ago

Daily Caller2 days ago‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

-

International2 days ago

International2 days agoChicago suburb purchases childhood home of Pope Leo XIV