Business

Biden’s $20B grant to climate groups involved “self-dealing”

Quick Hit:

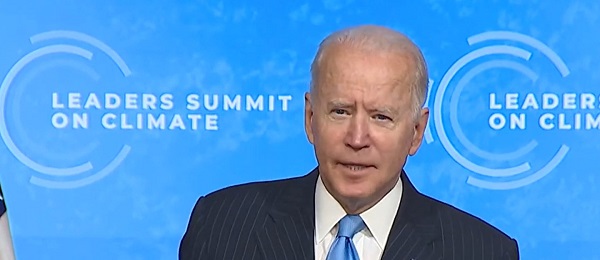

EPA Administrator Lee Zeldin has raised concerns about the Biden administration’s $20 billion in climate project grants, alleging “a lot of self-dealing” and potential conflicts of interest. Zeldin pointed to the $2 billion allocated to Power Forward Communities (PFC), a group linked to Stacey Abrams, as a clear example of waste and abuse.

Key Details:

- Zeldin questioned the $2 billion grant to PFC, noting the group only reported $100 in revenue within its first three months after being founded in late 2023.

- He criticized the grant agreement, which gave PFC three weeks to distribute the funds and 90 days to complete a training course on budget development.

- Zeldin stated the Justice Department has been investigating the issue, thanking the EPA for its cooperation in tracking the funds.

At the EPA, we are dialed in on efficiently delivering on our core mission and Powering the Great American Comeback. America’s Golden Age is upon us. pic.twitter.com/lUOKoJ53Cr

— Lee Zeldin (@epaleezeldin) February 23, 2025

Diving Deeper:

EPA Administrator Lee Zeldin appeared on Fox News’s Sunday Morning Futures with Maria Bartiromo to discuss his concerns about the Biden administration’s $20 billion climate grant program. He alleged that the grant distribution involved “a lot of self-dealing” and lacked proper oversight, leading to potential conflicts of interest. Zeldin pointed to a specific case involving Power Forward Communities (PFC), a group linked to former Georgia gubernatorial candidate Stacey Abrams, which received $2 billion in grants despite only reporting $100 in revenue during its first three months.

Zeldin criticized the grant’s terms, which allowed PFC three weeks to distribute the $2 billion and required the group to complete a budget development training course within 90 days. “I would say that any entity that needs training on how to develop a budget shouldn’t be actually distributing money before they take that training,” Zeldin argued. He further alleged that the rapid distribution of funds resembled a “gold bar scheme,” citing a leaked video where a Biden EPA political appointee described the process as “throwing gold bars off the Titanic.”

When asked about the potential for criminal activity, Zeldin suggested the Department of Justice would need to investigate but characterized the grant to PFC as “a clear cut case of waste and abuse.” He noted that the Justice Department had been actively investigating the matter and expressed appreciation for the EPA’s cooperation in tracking down the missing funds.

Zeldin also mentioned his discussions with President Donald Trump, emphasizing their shared commitment to restoring accountability at the EPA. The controversy has drawn attention from other lawmakers, including Rep. Byron Donalds (R-FL), who questioned why PFC received $2 billion when its reported revenue was only $100.

Business

What Pelosi “earned” after 37 years in power will shock you

Nancy Pelosi isn’t just walking away from Congress — she’s cashing out of one of the most profitable careers ever built inside it. According to an investigation by the New York Post, the former House Speaker and her husband, venture capitalist Paul Pelosi, turned a modest stock portfolio worth under $800,000 into at least $130 million over her 37 years in office — a staggering 16,900% return that would make even Wall Street’s best blush.

The 85-year-old California Democrat — hailed as the first woman to wield the Speaker’s gavel and infamous for her uncanny market timing — announced this week she will retire when her term ends in January 2027. The Post reported that when Pelosi first entered Congress in 1987, her financial disclosure showed holdings in just a dozen stocks, including Citibank, worth between $610,000 and $785,000. Today, the Pelosis’ net worth is estimated around $280 million — built on trades that have consistently outperformed the Dow, the S&P 500, and even top hedge funds.

The Post found that while the Dow rose roughly 2,300% over those decades, the Pelosis’ reported returns soared nearly seven times higher, averaging 14.5% a year — double the long-term market average. In 2024 alone, their portfolio reportedly gained 54%, more than twice the S&P’s 25% and better than every major hedge fund tracked by Bloomberg.

Pelosi’s latest financial disclosure shows holdings in some two dozen individual stocks, including millions invested in Apple, Nvidia, Salesforce, Netflix, and Palo Alto Networks. Apple remains their single largest position, valued between $25 million and $50 million. The couple also owns a Napa Valley winery worth up to $25 million, a Bay Area restaurant, commercial real estate, and a political data and consulting firm. Their home in San Francisco’s Pacific Heights is valued around $8.7 million, and they maintain a Georgetown townhouse bought in 1999 for $650,000.

The report comes as bipartisan calls grow to ban lawmakers and their spouses from trading individual stocks — a move critics say is long overdue. “What I’ll miss most is how she trades,” said Dan Weiskopf, portfolio manager of an ETF that tracks congressional investments known as “NANC.” He described Pelosi’s trading as “high conviction and aggressive,” noting her frequent use of leveraged options trades. “You only do that if you’ve got confidence — or information,” Weiskopf told the Post.

Among her most striking trades was a late-2023 move that allowed the Pelosis to buy 50,000 shares of Nvidia at just $12 each — less than a tenth of the market price. The $2.4 million investment is now worth more than $7 million. “She’s buying deep in the money and putting up a lot of money doing it,” Weiskopf said. “We don’t see a lot of flip-flopping on her trading activity.”

Republicans blasted Pelosi’s record as proof of Washington’s double standard. “Nancy Pelosi’s true legacy is becoming the most successful insider trader in American history,” said RNC spokesperson Kiersten Pels. “If anyone else had turned $785,000 into $133 million with better returns than Warren Buffett, they’d be retiring behind bars.”

Business

Ottawa should stop using misleading debt measure to justify deficits

From the Fraser Institute

By Jake Fuss and Grady Munro

Based on the rhetoric, the Carney government’s first budget was a “transformative” new plan that will meet and overcome the “generational” challenges facing Canada. Of course, in reality this budget is nothing new, and delivers the same approach to fiscal and economic policy that has been tried and failed for the last decade.

First, let’s dispel the idea that the Carney government plans to manage its finances any differently than its predecessor. According to the budget, the Carney government plans to spend more, borrow more, and accumulate more debt than the Trudeau government had planned. Keep in mind, the Trudeau government was known for its recklessly high spending, borrowing and debt accumulation.

While the Carney government has tried to use different rhetoric and a new accounting framework to obscure this continued fiscal mismanagement, it’s also relied on an overused and misleading talking point about Canada’s debt as justification for higher spending and continued deficits. The talking point goes something like, “Canada has the lowest net debt-to-GDP ratio in the G7” and this “strong fiscal position” gives the government the “space” to spend more and run larger deficits.

Technically, the government is correct—Canada’s net debt (total debt minus financial assets) is the lowest among G7 countries (which include France, Germany, Italy, Japan, the United Kingdom and the United States) when measured as a share of the overall economy (GDP). The latest estimates put Canada’s net debt at 13 per cent of GDP, while net debt in the next lowest country (Germany) is 49 per cent of GDP.

But here’s the problem. This measure assumes Canada can use all of its financial assets to offset debt—which is not the case.

When economists measure Canada’s net debt, they include the assets of the Canada Pension Plan (CPP) and the Quebec Pension Plan (QPP), which were valued at a combined $890 billion as of mid-2025. But obviously Canada cannot use CPP and QPP assets to pay off government debt without compromising the benefits of current and future pensioners. And we’re one of the only industrialized countries where pension assets are accounted in such a way that it reduces net debt. Simply put, by falsely assuming CPP and QPP assets could pay off debt, Canada appears to have a stronger fiscal position than is actually the case.

A more accurate measure of Canada’s indebtedness is to look at the total level of debt.

Based on the latest estimates, Canada’s total debt (as a share of the economy) ranked 5th-highest among G7 countries at 113 per cent of GDP. That’s higher than the total debt burden in the U.K. (103 per cent) and Germany (64 per cent), and close behind France (117 per cent). And over the last decade Canada’s total debt burden has grown faster than any other G7 country, rising by 25 percentage points. Next closest, France, grew by 17 percentage points. Keep in mind, G7 countries are already among the most indebted, and continue to take on some of the most debt, in the industrialized world.

In other words, looking at Canada’s total debt burden reveals a much weaker fiscal position than the government claims, and one that will likely only get worse under the Carney government.

Prior to the budget, Prime Minister Mark Carney promised Canadians he will “always be straight about the challenges we face and the choices that we must make.” If he wants to keep that promise, his government must stop using a misleading measure of Canada’s indebtedness to justify high spending and persistent deficits.

-

Business2 days ago

Business2 days agoCarney’s Deficit Numbers Deserve Scrutiny After Trudeau’s Forecasting Failures

-

Alberta1 day ago

Alberta1 day agoTell the Province what you think about 120 km/h speed limit on divided highways

-

International2 days ago

International2 days agoKazakhstan joins Abraham Accords, Trump says more nations lining up for peace

-

Energy13 hours ago

Energy13 hours agoThawing the freeze on oil and gas development in Treaty 8 territory

-

Automotive2 days ago

Automotive2 days agoElon Musk Poised To Become World’s First Trillionaire After Shareholder Vote

-

Alberta1 day ago

Alberta1 day agoAlberta’s number of inactive wells trending downward

-

National24 hours ago

National24 hours agoNew Canadian bill would punish those who deny residential indigenous schools deaths claims

-

Business2 days ago

Business2 days agoBill Gates Gets Mugged By Reality