Opinion

Biden Promised To Build Half A Million EV Charging Stations. So far, There Are A Grand Total Of 8.

From the Daily Caller News Foundation

From the Daily Caller News Foundation

The Biden administration has spent tens of billions of dollars on green energy and yet last year the U.S. and the world used record amounts of fossil fuels.

That would seem to be prima facie evidence that this “great transition” to renewable energy has so far been an expensive policy belly flop.

The evidence is everywhere. Americans aren’t buying EVs anymore than they were before Biden was elected. The car companies even with record federal subsidies are losing billions of dollars making EVs that people don’t want. Wind and solar still account for less than 15% of American energy, and across the country hundreds of communities are saying “not in my backyard” to ugly and spacious solar and wind farms. And of course gas prices at the pump and electric bills are 30% to 50% higher, even though we were promised that the green revolution would save us money.

A case in point is the scandalous mismanagement of how these green energy programs are being implemented. Consider the $7.5 billion federal program stuck inside the Biden 2021 Infrastructure bill — a law that Biden touts as one of his great achievements. That bill promised half a million EV charging stations installed all over the country.

Instead, there have been a grand total of… drum roll please…”seven or eight installed.” To be fair, that was through last month. They might be up to nine now.

When Transportation Secretary Pete Buttigieg was confronted recently on CBS’s “Face the Nation” about what happened with all the money, he hemmed and hawed and replied: “In order to do a charger, it’s more than just plunking a small device into the ground, there’s utility work, and this is also, really, a new category of federal investment.”

Uh huh! Sure. Installing an electric charger for a Tesla in your garage is very complicated business. It’s like trying to Build the Taj Mahal (which may not have cost $7.5 billion).

Here’s another mystery. Why can’t Pete give us an exact count on the progress when the number is small enough to use his fingers? What is for sure is that at this pace they may get 500 built by 2030 — not the 500,000 promised.

Thank God our celebrated transportation secretary renowned for riding his bike to his office in Washington wasn’t in charge of the Normandy landing.

Then there is the question of where the $7.5 billion of taxpayer money has actually gone. At their current rate of production the final program’s price tag could inflate to more than $1 trillion.

If Trump were president, he’d have long ago summoned Mayor Pete to the Oval Office and greet him with those two words that made him famous: “YOU’RE FIRED.”

Instead many Democrats are quietly talking about throwing Joe Biden off the ticket and one of the front runners to take his place is none other than the highly accomplished Pete Buttigieg.

But there are some serious lessons to be learned from this monumental screw-up.

First, though Biden loves to chat up how much money the government is “investing” — where are the signs that any of these trillions of dollars of borrowed money have improved our lives. This EV charger scandal is just another reminder that the government generally doesn’t “invest” tax dollars — it mostly wastes them.

Second, competence matters. At the Committee to Unleash Prosperity we released a study finding that more than 90% of the Biden top economic and finance team has NO experience running a business. We have an energy secretary who knows nothing about energy and a transportation secretary who knows nothing about transportation. They are either lawyers, academics, politicians or government employees.

They are not bad people. They just don’t know how to run anything — and it shows.

Finally, why do we need the government to build EV charging stations? One hundred years ago the government didn’t build gas stations. They just magically sprouted up all over the roads that crisscross America because entrepreneurs responded to the demand. So two or three brothers would scrap together some cash, buy a small plot of land on I-66, build a service station with four to eight hoses connected to a tank, put up a tall sign posting the gas price and drivers would pull in and fill er up.

All of this “infrastructure” without a single penny or instruction manual from Washington.

Can you imagine if Biden had been president in the 1920s and proclaimed that the government will build 500,000 gas stations? They still wouldn’t be built and we’d all be waiting in long gas lines.

Stephen Moore is a visiting fellow at the Heritage Foundation and a co-founder of the Committee to Unleash Prosperity.

Business

Canada’s critical minerals are key to negotiating with Trump

From Resource Works

The United States wants to break its reliance on China for minerals, giving Canada a distinct advantage.

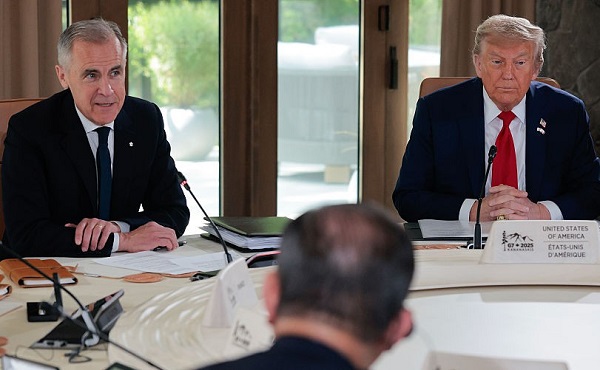

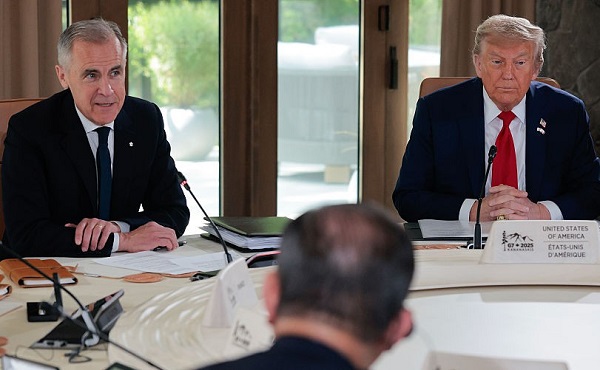

Trade issues were top of mind when United States President Donald Trump landed in Kananaskis, Alberta, for the G7 Summit. As he was met by Prime Minister Mark Carney, Canada’s vast supply of critical minerals loomed large over a potential trade deal between North America’s two largest countries.

Although Trump’s appearance at the G7 Summit was cut short by the outbreak of open hostilities between Iran and Israel, the occasion still marked a turning point in commercial and economic relations between Canada and the U.S. Whether they worsen or improve remains to be seen, but given Trump’s strategy of breaking American dependence on China for critical minerals, Canada is in a favourable position.

Despite the president’s early exit, he and Prime Minister Carney signed an accord that pledged to strike a Canada-US trade deal within 30 days.

Canada’s minerals are a natural advantage during trade talks due to the rise in worldwide demand for them. Without the minerals that Canada can produce and export, it is impossible to power modern industries like defence, renewable energy, and electric vehicles (EV).

Nickel, gallium, germanium, cobalt, graphite, and tungsten can all be found in Canada, and the U.S. will need them to maintain its leadership in the fields of technology and economics.

The fallout from Trump’s tough talk on tariff policy and his musings about annexing Canada have only increased the importance of mineral security. The president’s plan extends beyond the economy and is vital for his strategy of protecting American geopolitical interests.

Currently, the U.S. remains dependent on China for rare earth minerals, and this is a major handicap due to their rivalry with Beijing. Canada has been named as a key partner and ally in addressing that strategic gap.

Canada currently holds 34 critical minerals, offering a crucial potential advantage to the U.S. and a strategic alternative to the near-monopoly currently held by the Chinese. The Ring of Fire, a vast region of northern Ontario, is a treasure trove of critical minerals and has long been discussed as a future powerhouse of Canadian mining.

Ontario’s provincial government is spearheading the region’s development and is moving fast with legislation intended to speed up and streamline that process. In Ottawa, there is agreement between the Liberal government and Conservative opposition that the Ring of Fire needs to be developed to bolster the Canadian economy and national trade strategies.

Whether Canada comes away from the negotiations with the US in a stronger or weaker place will depend on the federal government’s willingness to make hard choices. One of those will be ramping up development, which can just as easily excite local communities as it can upset them.

One of the great drags on the Canadian economy over the past decade has been the inability to finish projects in a timely manner, especially in the natural resource sector. There was no good reason for the Trans Mountain pipeline expansion to take over a decade to complete, and for new mines to still take nearly twice that amount of time to be completed.

Canada is already an energy powerhouse and can very easily turn itself into a superpower in that sector. With that should come the ambition to unlock our mineral potential to complement that. Whether it be energy, water, uranium, or minerals, Canada has everything it needs to become the democratic world’s supplier of choice in the modern economy.

Given that world trade is in flux and its future is uncertain, it is better for Canada to enter that future from a place of strength, not weakness. There is no other choice.

Economy

Ottawa’s muddy energy policy leaves more questions than answers

From the Fraser Institute

Based on the recent throne speech (delivered by a King, no less) and subsequent periodic statements from Prime Minister Carney, the new federal government seems stuck in an ambiguous and ill-defined state of energy policy, leaving much open to question.

After meeting with the premiers earlier this month, the prime minister talked about “decarbonized barrels” of oil, which didn’t clarify matters much. We also have a stated goal of making Canada the world’s “leading energy superpower” in both clean and conventional energy. If “conventional energy” includes oil and gas (although we’re not sure), this could represent a reversal of the Trudeau government’s plan to phase-out fossil fuel use in Canada over the next few decades. Of course, if it only refers to hydro and nuclear (also forms of conventional energy) it might not.

According to the throne speech, the Carney government will work “closely with provinces, territories, and Indigenous Peoples to identify and catalyse projects of national significance. Projects that will connect Canada, that will deepen Canada’s ties with the world, and that will create high-paying jobs for generations.” That could mean more oil and gas pipelines, but then again, it might not—it might only refer to power transmission infrastructure for wind and solar power. Again, the government hasn’t been specific.

The throne speech was a bit more specific on the topic of regulatory reform and the federal impact assessment process for energy projects. Per the speech, a new “Major Federal Project Office” will ensure the time needed to approve projects will be reduced from the currently statutory limit of five years to two. Also, the government will strike cooperation agreements with interested provinces and territories within six months to establish a review standard of “one project, one review.” All of this, of course, is to take place while “upholding Canada’s world-leading environmental standards and its constitutional obligations to Indigenous Peoples.” However, what types of projects are likely to be approved is not discussed. Could be oil and gas, could be only wind and solar.

Potentially good stuff, but ill-defined, and without reference to the hard roadblocks the Trudeau government erected over the last decade that might thwart this vision.

For example, in 2019 the Trudeau government enacted Bill C-48 (a.k.a. the “Tanker Ban Bill”), which changed regulations for large oil transports coming and going from ports on British Columbia’s northern coast, effectively banning such shipments and limiting the ability of Canadian firms to export to non-U.S. markets. Scrapping C-48 would remove one obstacle from the government’s agenda.

In 2023, the Trudeau government introduced a cap on Canadian oil and gas-related greenhouse gas emissions, and in 2024, adopted major new regulations for methane emissions in the oil and gas sector, which will almost inevitably raise costs and curtail production. Removing these regulatory burdens from Canada’s energy sector would also help Canada achieve energy superpower status.

Finally, in 2024, the Trudeau government instituted new electricity regulations that will likely drive electricity rates through the roof, while ushering in an age of less-reliable electricity supply: a two-handed slap to Canadian energy consumers. Remember, the throne speech also called for building a more “affordable” Canada—eliminating these onerous regulations would help.

In summation, while the waters remain somewhat muddy, the Carney government appears to have some good ideas for Canadian energy policy. But it must act and enact some hard legislative and regulatory reforms to realize the positive promises of good policy.

-

Alberta1 day ago

Alberta1 day agoAlberta health care blockbuster: Province eliminating AHS Health Zones in favour of local decision-making!

-

Crime2 days ago

Crime2 days agoUK finally admits clear evidence linking Pakistanis and child grooming gangs

-

Alberta19 hours ago

Alberta19 hours agoAlberta pro-life group says health officials admit many babies are left to die after failed abortions

-

conflict1 day ago

conflict1 day agoTrump: ‘We’ have control over Iranian airspace; know where Khomeini is hiding

-

Alberta18 hours ago

Alberta18 hours agoCentral Alberta MP resigns to give Conservative leader Pierre Poilievre a chance to regain a seat in Parliament

-

Daily Caller19 hours ago

Daily Caller19 hours ago‘Not Held Hostage Anymore’: Economist Explains How America Benefits If Trump Gets Oil And Gas Expansion

-

Business2 days ago

Business2 days agoCarney praises Trump’s world ‘leadership’ at G7 meeting in Canada

-

Alberta12 hours ago

Alberta12 hours agoCalls for a new pipeline to the coast are only getting louder