Economy

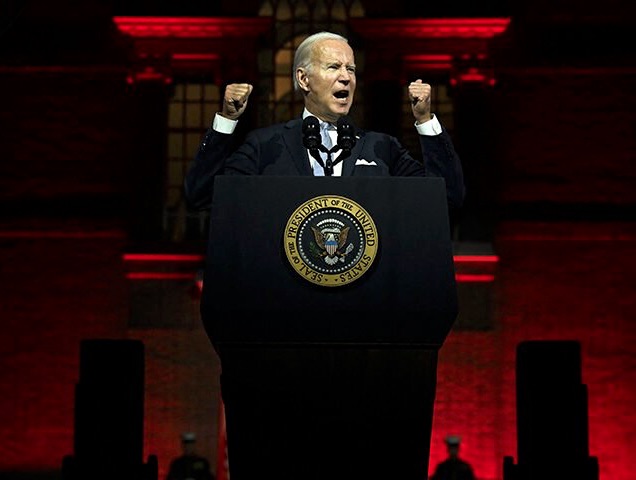

Biden Is Failing The World

You can see that in Poland people are actually burning trash to stay warm. Burning trash in your fireplace creates toxic smoke. It’s hazardous. The government’s considering handing out masks so people can breathe more safely when they’re outdoors.

Recall that natural gas is the reason the United States reduced its carbon emissions more than any other country in the world. Carbon emissions have been on the decline globally, in large measure, because of the transition from coal to gas. Natural gas is something that most reasonable people agree is a superior fuel to coal. Natural gas is the reason the United States reduced its emissions by 22% between 2005 and 2020, which is five percentage points more than the United States had agreed to reduce our emissions under cap and trade legislation, which nearly passed Congress in 2010 and under the UN Paris Climate Agreement.

The above is a graph that was produced by Matthew Yglesias, a well-known progressive blogger. He tweets it out whenever somebody points out that President Biden isn’t doing all he can to expand oil and gas production. It’s accurate. It does show that oil production increased on a daily average under Biden from under Trump. But it’s deeply misleading. You have to remember that under Trump, the Coronavirus pandemic, for several months, massively slashed oil production.

You can see from the below chart of the EIA data on crude oil production that we still haven’t gotten back to where we were before the pandemic. Now consider how the need is much greater for US oil now that Europe and the United States are rejecting Russian oil.Upgrade

The United States is the biggest liquified natural gas exporter, it’s true. But it takes five years to bring online new LNG capacity in the United States. So all of the new LNG that’s come online during Biden’s presidency was due to past presidents.

And Biden has leased less land than any President since World War II. It’s a shockingly small amount of land: 130,000 acres as opposed to seven million acres under Obama, four million acres under Trump, during the first 19 months of their administrations. It’s a huge reduction in the amount of land being leased.

You can see that in some particular cases, like a very large oil and gas sale in Alaska, the Department of Interior claimed there wasn’t any industry interest in the lease. This turned out not to be the case. The Senator from Alaska, Lisa Markowski said, “I can say with full certainty based on conversations as recently as last night, that Alaska’s industry does have an interest in lease sales and the Cook Inlet to claim otherwise is simply false, not to mention stunningly shortsighted.”

People point out the oil and gas industry does have many thousands of leases, and that’s true, but there’s a high degree of uncertainty about whether the leases they have will produce oil and gas at levels that make sense economically to produce from.

So increasing oil and gas leasing at a time of an energy crisis in Europe seems like a no-brainer, but the Biden administration is not doing that. In fact, it’s been preventing the expansion of gas in many other ways.

You can see the Biden administration denied a request to have a formaldehyde regulation exempted. All else being equal, you’d wanna reduce that pollution. But I think a little bit of formaldehyde is gonna be a less toxic airborne event than having people breathing toxic wood and plastic smoke in Europe. The right thing to do, in terms of aiding our allies, would be to wave that regulation. But the Biden administration refused.

You can see that the Biden administration is actively considering forgoing all new offshore drilling in the Atlantic and Pacific. It may do no offshore leases at all for oil and gas.

Instead, the Biden administration has sought to give sanctions relief to Venezuela in the hopes that Venezuela would produce more oil. And of course, most famously Biden went to Saudi Arabia to ask the Saudis to produce more oil in July. Now, everybody agrees that was a huge foreign policy failure. The Saudis announced they would be cutting production with the rest of OPEC+. The Biden administration’s pressure on the Saudis apparently annoyed them. Now, they’ve been pushed closer into the arms of Russia. This is a pretty significant setback for the Biden administration.

At the same time Biden was going to Venezuela and Saudi Arabia to produce more oil. Biden administration was refusing to even meet with oil and gas executives. That’s a pretty serious snub when you consider that it’s an industry you want to expand production.

An oil and gas analyst on Twitter criticized a Senator from Wisconsin for suggesting the Democrats are responsible for the lack of refining capacity. He said, “What — do you also blame a political party for a flat tire?”

I pointed out that a single oil refinery outage would have little impact if we had sufficient refinery capacity, and the reason we don’t is that politicians, mostly Democrats have used regulations to prevent their construction. When I interviewed executives one said to me, “If you were an oil company, why would you invest hundreds of millions of dollars into expanding refining capacity if you thought the federal government would shut you down in the next few years? The narrative coming out of this administration is absolutely insane.”

So you can see here that refinery capacity was increasing all the way through 2020. It then declined due to the pandemic. And it has not risen since then. When the analyst was asked, why don’t we get more refineries? He clearly didn’t know. Or at least he said he didn’t know. But it’s clear the Biden administration has not wanted more refineries.

There was a chance to retrofit a major refinery in the US Virgin Islands. It was a refinery that was older. It needed pretty significant upgrades. It was polluting. But these are machines that can be fixed. Several billion dollars of investment would’ve fixed it and it goes back many years. This is an article from 2008. It describes how, at that time, the Democrats in the Senate killed a proposal for refinery expansion.

Go back to 2006. The same thing happened. The House was in the hands of the Republicans who passed a piece of legislation to expand refineries. And it was the Democrats who killed it. And, incidentally, they’re using the exact same arguments today that they used back then.

More recently, we’ve seen an attack on expanded natural gas pipeline capacity, including from Pennsylvania to the Northeast, particularly to Boston. The result of not having pipeline capacity is that they’ve been burning more oil for electricity in New England. In fact, oil-fired power jumped to a four-year high earlier this year. And they’ve been having to import liquified natural gas to New England rather than just pipe it in, which is significantly cheaper. Probably half as expensive.

Grassroots advocacy and lawsuits have prevented pipelines from being built. You can see there’s a strong correlation between the price of natural gas and the ability to get pipelines built. We stop building pipelines and gas gets more expensive. Globally, the impact is that we’re gonna return to coal. This is the consequence of stifling oil and gas production.

One could argue that we just need more scarcity in order to accelerate the transition to electric cars. But it’s notable that the major figures in this, including President Biden, supporters of President Biden, and representatives of his administration aren’t defending a pro-scarcity position. They’re instead claiming that they’re doing all they can to bring down oil and gas prices and expand production.

I think this data, and the historical chronology, paint a picture that shows that there has, in fact, been a war on natural gas and oil United States and that it is impacting global supplies, and leaving Europe vulnerable.

Click to see the video presentation of this article. Additional slides and graphs are in the video.

Business

Canada’s economy has stagnated despite Ottawa’s spin

From the Fraser Institute

By Ben Eisen, Milagros Palacios and Lawrence Schembri

Canada’s inflation-adjusted per-person annual economic growth rate (0.7 per cent) is meaningfully worse than the G7 average (1.0 per cent) over this same period. The gap with the U.S. (1.2 per cent) is even larger. Only Italy performed worse than Canada.

Growth in gross domestic product (GDP), the total value of all goods and services produced in the economy annually, is one of the most frequently cited indicators of Canada’s economic performance. Journalists, politicians and analysts often compare various measures of Canada’s total GDP growth to other countries, or to Canada’s past performance, to assess the health of the economy and living standards. However, this statistic is misleading as a measure of living standards when population growth rates vary greatly across countries or over time.

Federal Finance Minister Chrystia Freeland, for example, recently boasted that Canada had experienced the “strongest economic growth in the G7” in 2022. Although the Trudeau government often uses international comparisons on aggregate GDP growth as evidence of economic success, it’s not the first to do so. In 2015, then-prime minister Stephen Harper said Canada’s GDP growth was “head and shoulders above all our G7 partners over the long term.”

Unfortunately, such statements do more to obscure public understanding of Canada’s economic performance than enlighten it. In reality, aggregate GDP growth statistics are not driven by productivity improvements and do not reflect rising living standards. Instead, they’re primarily the result of differences in population and labour force growth. In other words, they aren’t primarily the result of Canadians becoming better at producing goods and services (i.e. productivity) and thus generating more income for their families. Instead, they primarily reflect the fact that there are simply more people working, which increases the total amount of goods and services produced but doesn’t necessarily translate into increased living standards.

Let’s look at the numbers. Canada’s annual average GDP growth (with no adjustment for population) from 2000 to 2023 was the second-highest in the G7 at 1.8 per cent, just behind the United States at 1.9 per cent. That sounds good, until you make a simple adjustment for population changes by comparing GDP per person. Then a completely different story emerges.

Canada’s inflation-adjusted per-person annual economic growth rate (0.7 per cent) is meaningfully worse than the G7 average (1.0 per cent) over this same period. The gap with the U.S. (1.2 per cent) is even larger. Only Italy performed worse than Canada.

Why the inversion of results from good to bad? Because Canada has had by far the fastest population growth rate in the G7, growing at an annualized rate of 1.1 per cent—more than twice the annual population growth rate of the G7 as a whole at 0.5 per cent. In aggregate, Canada’s population increased by 29.8 per cent during this time period compared to just 11.5 per cent in the entire G7.

Clearly, aggregate GDP growth is a poor tool for international comparisons. It’s also not a good way to assess changes in Canada’s performance over time because Canada’s rate of population growth has not been constant. Starting in 2016, sharply higher rates of immigration have led to a pronounced increase in population growth. This increase has effectively partially obscured historically weak economic growth per person over the same period.

Specifically, from 2015 to 2023, under the Trudeau government, inflation-adjusted per-person economic growth averaged just 0.3 per cent. For historical perspective, per-person economic growth was 0.8 per cent annually under Brian Mulroney, 2.4 per cent under Jean Chrétien and 2.0 per cent under Paul Martin.

Due to Canada’s sharp increase in population growth in recent years, aggregate GDP growth is a misleading indicator for comparing economic growth performance across countries or time periods. Canada is not leading the G7, or doing well in historical terms, when it comes to economic growth measures that make simple adjustments for our rapidly growing population. In reality, we’ve become a growth laggard and our living standards have largely stagnated for the better part of a decade.

Authors:

Business

New capital gains hike won’t work as claimed but will harm the economy

From the Fraser Institute

By Alex Whalen and Jake Fuss

Capital taxes are among the most economically-damaging forms of taxation precisely because they reduce the incentive to innovate and invest.

Amid a federal budget riddled with red ink and tax hikes, the Trudeau government has increased capital gains taxes. The move will be disastrous for Canada’s growth prospects and its already-lagging investment climate, and to make matters worse, research suggests it won’t work as planned.

Currently, individuals and businesses who sell a capital asset in Canada incur capital gains taxes at a 50 per cent inclusion rate, which means that 50 per cent of the gain in the asset’s value is subject to taxation at the individual or business’ marginal tax rate. The Trudeau government is raising this inclusion rate to 66.6 per cent for all businesses, trusts and individuals with capital gains over $250,000.

The problems with hiking capital gains taxes are numerous.

First, capital gains are taxed on a “realization” basis, which means the investor does not incur capital gains taxes until the asset is sold. According to empirical evidence, this creates a “lock-in” effect where investors have an incentive to keep their capital invested in a particular asset when they might otherwise sell.

For example, investors may delay selling capital assets because they anticipate a change in government and a reversal back to the previous inclusion rate. This means the Trudeau government is likely overestimating the potential revenue gains from its capital gains tax hike, given that individual investors will adjust the timing of their asset sales in response to the tax hike.

Second, the lock-in effect creates a drag on economic growth as it incentivises investors to hold off selling their assets when they otherwise might, preventing capital from being deployed to its most productive use and therefore reducing growth.

And Canada’s growth prospects and investment climate have both been in decline. Canada currently faces the lowest growth prospects among all OECD countries in terms of GDP per person. Further, between 2014 and 2021, business investment (adjusted for inflation) in Canada declined by $43.7 billion. Hiking taxes on capital will make both pressing issues worse.

Contrary to the government’s framing—that this move only affects the wealthy—lagging business investment and slow growth affect all Canadians through lower incomes and living standards. Capital taxes are among the most economically-damaging forms of taxation precisely because they reduce the incentive to innovate and invest. And while taxes on capital do raise revenue, the economic costs exceed the amount of tax collected.

Previous governments in Canada understood these facts. In the 2000 federal budget, then-finance minister Paul Martin said a “key factor contributing to the difficulty of raising capital by new start-ups is the fact that individuals who sell existing investments and reinvest in others must pay tax on any realized capital gains,” an explicit acknowledgement of the lock-in effect and costs of capital gains taxes. Further, that Liberal government reduced the capital gains inclusion rate, acknowledging the importance of a strong investment climate.

At a time when Canada badly needs to improve the incentives to invest, the Trudeau government’s 2024 budget has introduced a damaging tax hike. In delivering the budget, Finance Minister Chrystia Freeland said “Canada, a growing country, needs to make investments in our country and in Canadians right now.” Individuals and businesses across the country likely agree on the importance of investment. Hiking capital gains taxes will achieve the exact opposite effect.

Authors:

-

Jordan Peterson1 day ago

Jordan Peterson1 day agoJordan Peterson slams CBC for only interviewing pro-LGBT doctors about UK report on child ‘sex changes’

-

Addictions1 day ago

Addictions1 day agoLiberal MP blasts Trudeau-backed ‘safe supply’ drug programs, linking them to ‘chaos’ in cities

-

Economy2 days ago

Economy2 days agoMassive deficits send debt interest charges soaring

-

International1 day ago

International1 day agoBrussels NatCon conference will continue freely after court overturns police barricade

-

Economy2 days ago

Economy2 days agoFederal budget’s scale of spending and debt reveal a government lacking self-control

-

Agriculture1 day ago

Agriculture1 day agoBill C-282, now in the Senate, risks holding back other economic sectors and further burdening consumers

-

Alberta20 hours ago

Alberta20 hours agoDanielle Smith warns arsonists who start wildfires in Alberta that they will be held accountable

-

COVID-192 days ago

COVID-192 days agoPro-freedom Canadian nurse gets two years probation for protesting COVID restrictions