From The Center Square

“The Pentagon recently failed its seventh consecutive audit, suggesting that the agency’s leadership has little idea how its annual budget of more than $800 billion is spent”

President-elect Donald Trump’s new Department of Government Efficiency has energized Republicans, but it’s also receiving attention from some liberal lawmakers, including Bernie Sanders.

Sanders, the independent from Vermont, wants to help Trump’s DOGE, which is co-led by Tesla CEO Elon Musk and tech entrepreneur Vivek Ramaswamy.

Sanders has his eye on the U.S. military budget.

“Elon Musk is right,” Sanders wrote on X. “The Pentagon, with a budget of $886 billion, just failed its 7th audit in a row. It’s lost track of billions. Last year, only 13 senators voted against the Military Industrial Complex and a defense budget full of waste and fraud. That must change.”

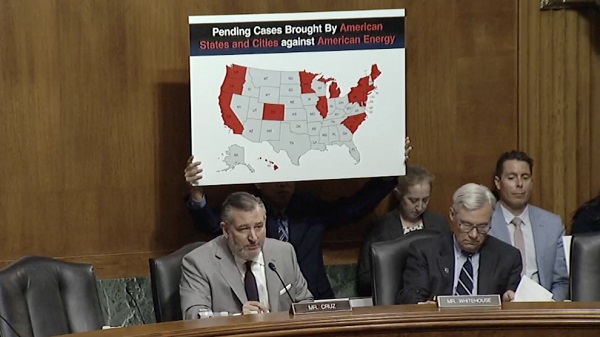

Sanders comments come before the U.S. House is set to vote on a compromise version of the National Defense Authorization Act, which authorizes nearly $900 billion to support U.S. military service members, infrastructure, and defense capabilities during the 2025 fiscal year. The 1,813-page document released Saturday by the Senate and House Armed Services Committees outlines U.S. defense policy priorities and their costs for 2025. Most of the proposed funds, $849.9 billion out of the $895.2 billion topline, would go to programs within the Department of Defense.

Ramaswamy and Musk wrote in a November op-ed that the military is on their list.

“The Pentagon recently failed its seventh consecutive audit, suggesting that the agency’s leadership has little idea how its annual budget of more than $800 billion is spent,” they wrote.

The U.S. Department of Defense’s annual audit once again resulted in a disclaimer opinion. That means the federal government’s largest agency can’t fully explain its spending. The disclaimer this year was expected. And it’s expected again next year. The Pentagon previously said it will be able to accurately account for its spending by 2027.

Musk has gone even farther in his criticism of military spending. He called the military’s most expensive ever project, the F-35 stealth fighter, “obsolete.”

“The F-35 design was broken at the requirements level, because it was required to be too many things to too many people,” Musk wrote on X. “This made it an expensive & complex jack of all trades, master of none. Success was never in the set of possible outcomes. And manned fighter jets are obsolete in the age of drones anyway. Will just get pilots killed.”

U.S. Air Force F-35 Lightning IIs from the 356th Fighter Squadron at Eielson Air Force Base fly side by side with Republic of Korea Air Force F-35s from the 151st and 152nd Combat Flight Squadrons as part of a bilateral exercise over the Yellow Sea, Republic of Korea, July 12, 2022.

In May, the U.S. Government Accountability Office found the cost of the Pentagon’s most expensive weapon system was projected to increase by more than 40% despite plans to use the stealth fighter less, in part because of reliability issues.

The U.S. Department of Defense’s F-35 Lightning II is the most advanced and costly weapon system in the U.S. arsenal. It’s a joint, multinational program that includes the Air Force, Navy, Marine Corps, seven international partners and foreign military sales customers.

The Pentagon has about 630 F-35s. It plans to buy about 1,800 more. And it intends to use them through 2088. DOD estimates the F-35 program will cost over $2 trillion to buy, operate, and sustain over its lifetime.

The Pentagon hasn’t responded to Musk’s comments. Late last month, a reporter asked Defense Department Press Secretary Air Force Major General Pat Ryder about Musk’s comments on the F-35.

“Yeah, as I’m sure you can appreciate, Mr. Musk is, currently, a private citizen, I’m not going to make any comments about what a private citizen may have to say about the F-35.”

Trump set lofty goals for the new group.

“It will become, potentially, ‘The Manhattan Project,’ of our time,” Trump’s announcement said. “Republican politicians have dreamed about the objectives of ‘DOGE’ for a very long time.”

The original Manhattan Project was a research and development project during the second World War that led to the creation of nuclear weapons.

Ramaswamy and Musk have previously outlined their plans for DOGE, which could include mass federal layoffs and reductions in federal regulations. Musk and Ramaswamy said they won’t rely on action from Congress and will instead “focus particularly on driving change through executive action based on existing legislation rather than by passing new laws.”