Business

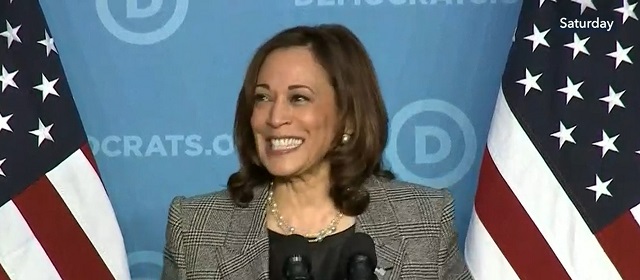

‘Bad Case Scenario’: Former Obama Economist Slams Kamala Harris’ Plan For Nationwide ‘Price Controls’

From the Daily Caller News Foundation

From the Daily Caller News Foundation

Former President Barack Obama’s top economist joined the chorus of experts critiquing Vice President Kamala Harris’ proposed plan to lower costs for housing and groceries, according to The Washington Post Friday.

Jason Furman, former deputy director of the National Economic Council under Obama, expressed his concerns on Harris’ proposal to fine companies that practice “price gouging” on food and groceries, warning of the negative economic effects of the policy due to the apparent need to control prices to a degree, according to The Washington Post. Harris blamed corporate greed for the rise in prices in her speech on Friday, instead of massive government spending under the Biden administration which some economists argue has fueled inflation.

“The good case scenario is price gouging is a message, not a reality, and the bad case scenario is that this is a real proposal,” Furman told The Washington Post. “You’ll end up with bigger shortages, less supply and ultimately risk higher prices and worse outcomes for consumers if you try to enforce this in a real way, which I don’t know if they would or wouldn’t do.”

The Federal Reserve of San Francisco released research in May showing that corporate greed is not the main driver of inflation, saying that the price hikes seen following the COVID-19 pandemic were comparable to those seen following other economic recoveries that did not have not similar levels of inflation.

“This is economic lunacy. Price controls are a SERIOUSLY bad idea,” Samuel Gregg, Friedrich Hayek chair in economics and economic history at the American Institute for Economic Research, said on X. “They lead to shortages, severe misallocations of capital, and distort the ability to prices to signal the information we all need to make choices.”

The proposal from Harris would task the Federal Trade Commission (FTC) with handing out fines for companies that make “excessive” price hikes on groceries, the Harris campaign told The Washington Post. Price controls can initially lower prices for customers, but many economists argue that it would also “cause shortages which lead to arbitrary rationing and, over time, reduce product innovation and quality,” according to the Joint Economic Committee Republicans in 2022.

Prices have risen 19.4% since the Biden administration first took office, and grocery prices have risen 21%, according to the Federal Reserve of St. Louis (FRED).

“Harris has made a set of policy choices over the last several weeks that make it clear that the Democratic Party is committed to a pro-working-family agenda. The days of ‘What’s good for free enterprise is good for America’ are over,” Felicia Wong, president of the left-leaning think tank Roosevelt Forward, told The Washington Post.

Inflation peaked under the Biden administration at 9% in June 2022, with the rate only falling below 3% for the first time since in July. Under former President Donald Trump, prices increased just 7.8% from January 2017 to 2021, according to FRED.

Harris has also proposed the use of federal funds to forgive medical debt from healthcare providers, price caps on prescription drugs, a $25,000 subsidy for first-time home buyers and a $6,000 child tax credit for families for the first year of their child’s life, according to The Washington Post.

“The days of pivoting to the center to win on economics are over, even though there are good economic reasons to do so, especially on fiscal policy,” Bill Galston, a former Clinton aide, told The Washington Post.

Furman, the Harris campaign and Democrat economists Jay Shambaugh and Lawrence Summers did not immediately respond to the Daily Caller News Foundation’s request for comment. Democrat economist Sandra Black declined to comment.

Business

Carney’s Ethics Test: Opposition MP’s To Challenge Prime Minister’s Financial Ties to China

Brookfield’s 2017 purchase of Teekay Offshore tied it to a corporate family whose LNG arm partnered with China’s COSCO to ship Russian Arctic gas under the shadow of Crimea-era sanctions.

In 2017, Brookfield, the investment giant that would later launch Prime Minister Mark Carney’s global business and political reach, bought control of Teekay Offshore Partners — a shipping deal that now casts a long geopolitical shadow.

On the surface, it looked like just another Brookfield deal. But behind it lies a complicated backstory, one that deepens concerns about the global-security risks lurking beneath Carney’s sprawling portfolio of more than 550 corporate holdings.

Teekay Offshore was part of the wider Teekay corporate family, which also included Teekay LNG Partners. That LNG arm entered a major joint venture with China LNG Shipping (CLNG), a subsidiary of COSCO, the Chinese state-owned shipping giant. Together, they financed and operated six ice-breaking carriers built to transport Russian natural gas from the Arctic Yamal LNG project.

The timing could hardly have been more sensitive. The Teekay-COSCO venture was launched in 2014 — the same year Russia seized Crimea and the West hit Moscow with sanctions. Five years later, in 2019, the U.S. government sanctioned a COSCO affiliate for carrying Iranian oil, which briefly caused Teekay’s joint venture with COSCO’s China LNG Shipping on the Arctic Yamal project to be treated as a “Blocked Person” under American rules.

The sanction was lifted after COSCO restructured its ownership.

Brookfield never owned Teekay LNG; its stake was in the Teekay Offshore arm, a separate division of the Teekay corporate family. But the two companies shared the Teekay brand, and as long as Brookfield remained tied to that structure, it was positioned uncomfortably close to a Sino-Russian natural gas venture that Washington had already flagged as risky.

COSCO – or China Ocean Shipping Company, a state-owned maritime giant – is a story in itself.

It has repeatedly faced U.S. scrutiny over its potential role in illicit and sensitive activities. In 1996, U.S. Customs agents seized 2,000 disassembled Chinese assault rifles hidden in containers on a COSCO ship at the Port of Oakland, allegedly bound for Mexican drug cartels. While official blame fell on Poly Technologies Inc. — a Chinese arms exporter — and the smuggling network behind the shipment, the incident heightened concerns about COSCO’s links to Beijing’s military and underground proliferation networks.

Other troubling episodes include a 1993 incident involving a COSCO vessel suspected of carrying chemical-weapons precursors to Iran, a 2015 seizure of explosives on a COSCO ship in Colombia headed for Cuba, and the 2019 U.S. sanctions on COSCO subsidiaries for violating Iran oil embargoes.

The Bureau has also reported on Canadian concerns. In December 1999, former Crown prosecutor Scott Newark wrote to an Ottawa intelligence review panel, noting that Canadian intelligence officials had long scrutinized COSCO’s activities at Vancouver’s port, citing alleged ties to both Chinese Triads and the People’s Liberation Army.

As Carney steps back into Parliament today, he is likely to face scathing questions from the Opposition not only about his Brookfield holdings and potential conflicts tied to deals like Teekay, but also over his government’s billion-dollar loan to BC Ferries for vessels built at a Chinese state-owned shipyard linked to Beijing’s civil-military fusion strategy.

This is where Carney himself enters the Brookfield story. After stepping down from the Bank of England in 2020, he joined Brookfield as Vice Chair and Head of ESG and Impact Investing. He later became Chair of Brookfield Asset Management. That means while Brookfield was still closely tied to Teekay Offshore, Carney was one of the most senior figures shaping Brookfield’s strategy — and holding significant personal stakes in its success.

Today, Brookfield has no exposure through Teekay. Teekay Offshore has since been renamed Altera Infrastructure and separated from its parent. In other words: while Brookfield has avoided direct legal risk, the reputational and geopolitical iceberg remains just beneath the waterline. Fresh controversy now looms in the case of the BC Ferries deal, in which the federal government, through the Canada Infrastructure Bank, which is overseen by Housing Minister and former Vancouver mayor Gregor Robertson, has provided a $1 billion low-interest loan to help BC Ferries purchase four hybrid vessels built by CMI Weihai, a Chinese state-owned shipyard. Opposition MPs say the loan contradicts Carney’s “Buy Canada” rhetoric and risks strengthening a PRC enterprise under civil-military fusion policy, at a moment when Beijing is openly threatening to invade Taiwan — with vessels constructed by state-owned shipbuilders such as CMI Weihai potentially part of that buildup.

As The Bureau has reported, an Ottawa democracy watchdog has already warned that Prime Minister Carney’s sprawling private investments — including substantial holdings in Brookfield as well as shares in more than 550 other companies — create a disabling conflict of interest that cannot be solved by his so-called “ethics screen,” ultimately undermining Ottawa’s credibility and weakening Carney’s capacity to confront hostile regimes, including China.

“PM Carney’s so-called ‘blind’ trust isn’t blind at all,” Democracy Watch stated this summer. “He knows exactly what he put in, he chose his own trustee, can instruct them not to sell, and can receive updates at any time. On top of that, he owns stock options in Brookfield that he can’t sell for years, guaranteeing he stays tethered to these corporate interests.”

These warnings echo The Bureau’s March 2025 pre-election investigation, which outlined in granular detail Carney’s deep entanglements with Brookfield and China. The Bureau revealed that Brookfield, the $900 billion investment giant Carney joined in 2020, held over $3 billion in politically sensitive assets connected to Chinese state-linked real estate and energy conglomerates, as well as a significant offshore banking footprint. One of its headline deals — a $750 million stake in a Shanghai commercial property project dating back to 2013 — was tied to a Hong Kong tycoon with official links to the Chinese People’s Political Consultative Conference, a central “united front” body identified by the CIA as a tool of Beijing’s overseas influence operations.

Business

Carney Admits Deficit Will Top $61.9 Billion, Unveils New Housing Bureaucracy

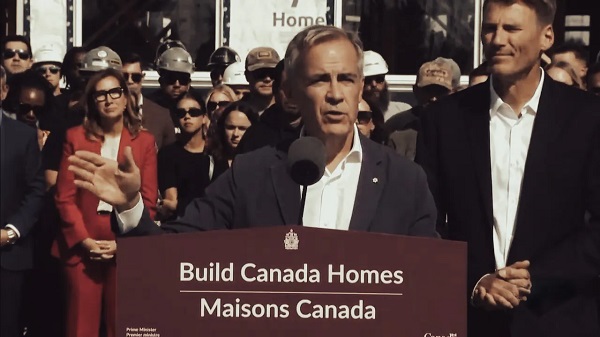

The Prime Minister said this year’s shortfall will exceed last year’s $61.9B as Ottawa creates Build Canada Homes to expand affordable housing.

Prime Minister Mark Carney just admitted that this year’s federal budget deficit will be “substantial” larger than last year’s $61.9 billion shortfall. Speaking in Nepean ahead of Parliament’s return yesterday, Carney defended the red ink as the cost of what he called “nation-building” investments in housing, defense, and protection from global trade shocks.

Lets recap for those at home not keeping score, the federal government ran a $61.9 billion deficit last year. It was supposed to be closer to $40 billion, but like every Liberal promise, the reality was far worse. That single number, that $61.9 billion hole, was a turning point. It destroyed what little credibility Justin Trudeau had left, and it forced his own finance minister, Chrystia Freeland, to walk away.

Now, let’s pause here. Chrystia Freeland didn’t just “move on.” She resigned in December 2024 after a bitter clash with Trudeau. She couldn’t defend the runaway spending anymore, couldn’t keep pretending the numbers added up. And when your own finance minister, the person who signed off on the books, decides she can’t be part of the game, and yet she’s ok with Carney spending more???

But here’s the part that’s truly insane. Just last week, those same media outlets were floating headlines about the Liberals preparing an “austerity budget.” The Globe and Mail literally told us Carney was weighing “austerity” alongside “investments.” CTV reported the government’s own House Leader was warning Canadians about “tough choices” ahead of the fall budget. Austerity! After sixty billion dollars in red ink.

And these idiots actually had the gall to use that word, “austerity” while the country drowns in debt, while the deficit is climbing even higher, and while Carney is out there hiring new bureaucrats and creating brand-new agencies with billions of your dollars. You can’t make this up.

And speaking of spin, let’s get to the real show. Because once Carney slipped and admitted the deficit was going to be bigger, he launched into the propaganda portion of the presser, the part where he pretends to be solving the housing crisis. And what’s the solution? You guessed it. Another federal agency. A brand-new bureaucracy carved out of CMHC. Because in Carney’s Canada, the answer to too much red tape is… more red tape.

They’re calling it Build Canada Homes. Sounds nice. It gets $13 billion of your money on day one. It has a mandate to “plan, finance, and build homes.” And who’s running it? Anna Belo — a former Toronto deputy mayor turned private-sector consultant. Because nothing says “housing affordability” like another revolving-door insider cashing a taxpayer-funded paycheck.

The agency’s first big ideas? Modular housing, a $1.5 billion “rental protection fund,” and lots of partnerships with provinces, municipalities, and Indigenous groups. In other words: buzzwords. More meetings. More layers of government. More bureaucracy.

And then, as if to drive the joke home, Carney rolled out his housing minister. Who is it? Gregor Robertson. Yes, the same Gregor Robertson who, as mayor of Vancouver, presided over one of the worst housing affordability collapses in Canadian history. The man under whose watch prices skyrocketed, taxes doubled, and working families were driven out of the city. That’s the expert. That’s the guy they put in charge. Yeah, he’s got “experience” all right. Eye roll.

Even Pierre Poilievre saw straight through it. Speaking to his caucus on Parliament Hill ahead of the fall sitting, the Conservative leader mocked Carney’s shiny new agency as just another layer of government that won’t build homes.

“After six months in office, not a single home has been built. Instead, he’s created another bureaucracy. Meanwhile, CMHC’s own forecast shows homebuilding will fall 13%. In the GTA, it’s already down by half. That is the Carney record.”

Poilievre tied the criticism to Carney’s broader record of announcements without results, comparing the “nation-building” pitch to the agency’s empty promise: new logos, new titles, no shovels in the ground.

This is the Liberal solution in a nutshell: take a crisis they helped create, build another layer of bureaucracy, and put the very people who caused the problem in charge of fixing it. And then tell you, with a straight face, that this time, it’ll be different.

And here’s the kicker. Every dollar of this so-called “nation-building” deficit is a dollar borrowed against your future. Last year alone, interest payments on the debt blew past PBO’s estimate of $49.1 billion… THAT’S MORE than Ottawa spends on health care transfers.

Lets be clear, thank God the fall session is back. Because here’s the truth: these Liberals only shine when the press is playing duck and cover for them. When it’s just press conferences, glossy slogans, and clapping seals, they look untouchable. But the moment Parliament is sitting, the moment committees start pulling threads, the whole show falls apart.

Remember what happened when they had just two days of committee hearings on that ferry contract? Over a billion dollars, handed to China, while they were busy telling Canadians “Canada First.” They were humiliated. Because when the facts are out in the open, when the spin stops working, this government has nothing left to stand on.

This fall will be no different. Mark Carney can rebrand deficits as “nation-building,” he can launch new bureaucracies and hire insiders at half a million dollars a year, but once Question Period starts, none of that will save him. The reality is simple: this government is not long for the world. And soon enough, we’ll see real austerity… Not because they choose it, but because they’ve run out of money and credibility to keep the game going.

-

espionage2 days ago

espionage2 days agoInside Xi’s Fifth Column: How Beijing Uses Gangsters to Wage Political Warfare in Taiwan — and the West

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoDecision expected soon in case that challenges Alberta’s “safe spaces” law

-

International2 days ago

International2 days agoBrazil sentences former President Bolsonaro to 27 years behind bars

-

Energy1 day ago

Energy1 day agoThe IEA’s Peak Oil Fever Dream Looks To Be In Full Collapse

-

Crime1 day ago

Crime1 day agoTransgender Roomate of Alleged Charlie Kirk Assassin Cooperating with Investigation

-

COVID-191 day ago

COVID-191 day agoWhy FDA Was Right To Say No To COVID-19 Vaccines For Healthy Kids

-

Crime20 hours ago

Crime20 hours agoDown the Charlie Kirk Murder Rabbit Hole

-

Business17 hours ago

Business17 hours agoIt’s time to finally free the beer