International

Attempted Trump assassin wanted to fight against Russia, may have been motivated by Ukraine policy

From LifeSiteNews

By Matt Lamb

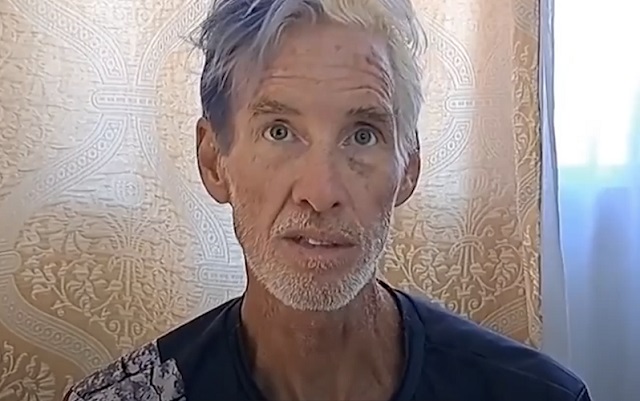

Donald Trump’s attempted assassin Ryan Wesley Routh traveled to Ukraine in 2022 to fight against Russia and tried to recruit Americans to join in the conflict.

The 58-year-old man accused of trying to assassinate President Donald Trump on Sunday was a pro-Ukraine American who wanted others to join in the fight.

Ryan Wesley Routh is in FBI custody after he allegedly tried to kill Trump on Sunday at the president’s country club in West Palm Beach, Florida. Routh reportedly pushed his AK-47 rifle through a fence at the country club before fleeing when Secret Service opened fired. He was arrested by law enforcement soon after.

He traveled to Ukraine in 2022 to fight against Russia and tried to recruit Americans and ex-Afghanistan soldiers to do the same.

Routh voted for Trump in 2016 but turned against him because of the president’s stance on Ukraine, according to Newsweek. “While you were my choice in 2016, I and the world hoped that President Trump would be different and better than the candidate, but we all were greatly disappointed and it seems you are getting worse and devolving,” he wrote on X (formerly Twitter) in July, Newsweek reported.

He donated to a handful of Democrats in 2020, according to reporting from Newsweek. The outlet said Routh “appears to have been motivated by frustration with U.S. policy on the war in Ukraine.”

The New York Times interviewed Routh for a story about ill-trained Americans who wanted to join the fight against Russia for an article titled “Stolen Valor: The U.S. Volunteers in Ukraine Who Lie, Waste and Bicker” with a subhead: “People who would not be allowed anywhere near the battlefield in a U.S.-led war are active on the Ukrainian front, with ready access to American weapons.”

“Ryan Routh, a former construction worker from Greensboro, N.C., is seeking recruits from among Afghan soldiers who fled the Taliban,” the Times reported in 2023. “Mr. Routh, who spent several months in Ukraine last year, said he planned to move them, in some cases illegally, from Pakistan and Iran to Ukraine. He said dozens had expressed interest.”

“We can probably purchase some passports through Pakistan, since it’s such a corrupt country,” he told the newspaper.

He did not actually fight because he was too old and inexperienced, Newsweek reported. Its Romania affiliate had also interviewed Routh several years ago.

“The question as far as why I’m here… to me, a lot of the other conflicts are grey, but this conflict is definitely black and white,” Routh told Newsweek Romania. “This is about good versus evil. This is a storybook, you know, any movie we’ve ever watched, this is definitely evil against good.”

“If the governments will not send their official military, then we, civilians, have to pick up the torch and make this thing happen and we have gotten some wonderful people here but it is a small fraction of the number that should be here,” Routh said.

He reportedly ran a group called the “International Volunteer Center in Ukraine,” according to a 2023 Semafor article. “I have had partners meeting with [Ukraine’s Ministry of Defense] every week and still have not been able to get them to agree to issue one single visa,” Routh said.

The International Legion in Ukraine said it has no links to Routh, as reported recently by Reuters.

Routh had a sketchy past, including reportedly barricading himself inside a building while armed in 2002, the News and Record reported.

“The arrest coincides with North Carolina criminal court records that include Routh’s conviction for possession of a weapon of mass destruction,” NBC News reported.

“Records also show convictions for carrying a concealed weapon, possession of stolen property and hit-and-run,” NBC reported. “In those cases, which included misdemeanor convictions for violations such as resisting an officer and driving on a suspended license, the defendant received a suspended sentence and parole or probation.”

Trump thanks law enforcement, calls it an ‘interesting day’

Late last night Trump put out a message on Truth Social thanking law enforcement and calling Sunday an “interesting day.”

“I would like to thank everyone for your concern and well wishes – It was certainly an interesting day!” he wrote.

“Most importantly, I want to thank the U.S. Secret Service, Sheriff Ric Bradshaw and his Office of brave and dedicated Patriots, and, all of Law Enforcement, for the incredible job done today at Trump International in keeping me, as the 45th President of the United States, and the Republican Nominee in the upcoming Presidential Election, SAFE. THE JOB DONE WAS ABSOLUTELY OUTSTANDING. I AM VERY PROUD TO BE AN AMERICAN!”

Business

Trump Raises US Tariffs on Canadian Products by 10% after Doug Ford’s $75,000,000 Ad Campaign

From the Daily Caller News Foundation

President Donald Trump announced Saturday he is increasing U.S. tariffs on Canada by 10%, after the leader of the country’s largest province said he would be pulling an anti-tariff ad — but not until after it could air during Game 2 of the World Series.

Ontario Premier Doug Ford stated Friday his government plans to pull the ad in question after Trump said he was ending trade negotiations with Canada the night before. The spot featured the voice of President Ronald Reagan appearing to sharply criticize “high tariffs” and “protectionist” policy, and used an edited form of remarks the then-president made in an 1987 radio address.

In announcing his intention to pull the ad — which was intentionally broadcast on major networks in American markets — Ford noted he “directed” his team to keep it live until after the second game of baseball’s Fall Classic on Saturday night, a move Trump initially called a “dirty play.” The ad also ran Friday night during Game 1.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Trump then declared Saturday he was going forward with a 10% tariff increase on Canada.

“Their Advertisement was to be taken down, IMMEDIATELY, but they let it run last night during the World Series, knowing that it was a FRAUD,” Trump wrote in a Saturday afternoon Truth Social post. “Because of their serious misrepresentation of the facts, and hostile act, I am increasing the Tariff on Canada by 10% over and above what they are paying now.”

“Canada was caught, red handed, putting up a fraudulent advertisement on Ronald Reagan’s Speech on Tariffs. The Reagan Foundation said that they, ‘created an ad campaign using selective audio and video of President Ronald Reagan. The ad misrepresents the Presidential Radio Address,’ and ‘did not seek nor receive permission to use and edit the remarks. The Ronald Reagan Presidential Foundation and Institute is reviewing its legal options in this matter,’” Trump added in his post, citing an organization dedicated to continuing the late 40th president’s legacy.

“The sole purpose of this FRAUD was Canada’s hope that the United States Supreme Court will come to their ‘rescue’ on Tariffs that they have used for years to hurt the United States,” Trump’s post continues. “Now the United States is able to defend itself against high and overbearing Canadian Tariffs (and those from the rest of the World as well!). Ronald Reagan LOVED Tariffs for purposes of National Security and the Economy, but Canada said he didn’t!”

The ad campaign carried a price tag of $75 million CAD (Canadian), roughly equivalent to $54 million, according to The Associated Press (AP). The taxpayer-funded ad was paid for by Ontario’s provincial government, which the premier leads.

“We’ve achieved our goal, having reached U.S. audiences at the highest levels,” Ford said in a Friday statement reported by AP announcing his plan to pull the ad after Game 2. “Our intention was always to initiate a conversation about the kind of economy that Americans want to build and the impact of tariffs on workers and businesses.”

“I’ve directed my team to keep putting our message in front of Americans over the weekend so that we can air our commercial during the first two World Series games,” the Ontario premier added.

Trump announced Thursday night on Truth Social he was ending trade negotiations with Canada due to the ad.

“Based on their egregious behavior, ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED,” the president wrote in the post.

“TARIFFS ARE VERY IMPORTANT TO THE NATIONAL SECURITY, AND ECONOMY, OF THE U.S.A.,” he added [sic].

“High tariffs inevitably lead to retaliation by foreign countries and the triggering of fierce trade wars. Then the worst happens. Markets shrink and collapse,” Reagan’s edited radio message can be heard in the ad, which included a backdrop of mellow music and a video montage of people and landscapes. “Businesses and industries shut down and millions of people lose their jobs. Throughout the world, there’s a growing realization that the way to prosperity for all nations is rejecting protectionist legislation and promoting fair and free competition.”

“America’s job and growth are at stake,” Reagan can be seen delivering the ad’s final line on a TV screen before the words “Ontario” and “Canada” flash on the screen.

The 2025 World Series features the Toronto Blue Jays and Los Angeles Dodgers. The Blue Jays are the only Major League Baseball (MLB) team based in Canada despite having only one Canadian-born player on its 26-man World Series roster.

Ford, a member of the center-right Progressive Conservative Party has led Ontario, Canada’s most populous province, since 2018. His late younger brother, Rob Ford, served as Toronto’s mayor from 2010 to 2014. The younger Ford made national headlines in 2013 after admitting to having smoked crack cocaine “in a drunken stupor.”

Premier Ford’s office did not respond to the Daily Caller News Foundation’s (DCNF) request for comment. The White House did not immediately respond to the DCNF’s request for comment.

Economy

Top Scientists Deliberately Misrepresented Sea Level Rise For Years

From Michael Shellenberger

Accelerated sea level is one of the main justifications for predicting very high costs for adapting to climate change. And while good scientists have debunked acceleration claims in the past, they did not clearly show how IPCC scientists engaged in their manipulations.

Scientists for years said they had proof that climate change was accelerating sea level rise. But that's not what the evidence shows. They knew the truth and misled the public. And now I have a long email exchange with a top scientist that shows how they did it. Massive scandal. pic.twitter.com/MNIX1025Fe

— Michael Shellenberger (@shellenberger) October 24, 2025

-

Business1 day ago

Business1 day agoCarney government risks fiscal crisis of its own making

-

Alberta1 day ago

Alberta1 day agoB.C. would benefit from new pipeline but bad policy stands in the way

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoChurches Are All That Stands Between Canada And Tyranny

-

Alberta1 day ago

Alberta1 day agoAlberta introduces bill allowing province to reject international agreements

-

Business10 hours ago

Business10 hours agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Energy9 hours ago

Energy9 hours agoCAPP calls on federal government to reset energy policy before it’s too late

-

Business1 day ago

Business1 day agoTrump Admin Establishing Council To Make Buildings Beautiful Again

-

International1 day ago

International1 day agoUS Deploys Gerald Ford Carrier Strike Group To Target Cartels