Alberta

Alberta’s projected surplus balloons: Mid-year budget update

Mid-year update: Keeping Alberta’s finances on track

Alberta’s government continues to manage the province’s finances responsibly with the future in mind.

Alberta continues to lead the nation in economic growth and is forecasting a surplus of $5.5 billion in 2023-24, an increase of $3.2 billion from Budget 2023. The province’s fiscal outlook continued to improve in the second quarter of 2023-24, boosted by strong bitumen royalties and higher income tax revenues.

However, volatile oil prices, continued inflation challenges and uncertainty due to slowing global growth could still affect the province’s finances going forward. Debt servicing costs will be higher than previous years due to higher interest rates, reinforcing the importance of the government’s commitment to balance the budget.

“Alberta continues to stand out as a leader when it comes to fiscal stability and economic resilience in the midst of so much global uncertainty. Our second-quarter fiscal update is another positive report, showing strength in Alberta’s finances and economy and positioning us for future growth and prosperity.”

The government continues to spend responsibly, maintaining its commitment to keep funds in the province’s contingency for disasters and emergencies. The government’s new fiscal framework requires the government to use at least half of available surplus cash to pay down debt, freeing up money that can support the needs of Albertans for generations. The government continues to reduce the province’s debt burden and will pay down a forecasted $3.2 billion in debt this fiscal year.

Alberta’s government is turning its focus to developing next year’s budget, so it supports Albertans’ needs and the province’s economic growth while maintaining the government’s commitment to responsible spending within the fiscal framework. Budget 2024 consultations are open and Albertans are encouraged to share their feedback to help set the province’s financial priorities.

Revenue

- Revenue for 2023-24 is forecast at $74.3 billion, a $3.7-billion increase from Budget 2023. The increase is due to increases across different revenue streams. In addition, the price of West Texas Intermediate (WTI) oil is forecast to average US$79 per barrel over the course of the fiscal year, in line with the Budget 2023 forecast.

- Personal and corporate income tax revenue is forecast at $21.8 billion, $1.8 billion higher than at budget.

- Bitumen royalties are forecast at $14.4 billion, an increase of $1.8 billion from budget.

- Overall resource revenue is forecast at $19.7 billion, $1.3 billion higher than the budget forecast.

- Beginning in 2024, Alberta’s government will continue to offer fuel tax relief when oil prices are high, even as the province transitions back to the original fuel tax relief program, which is based on average quarterly oil prices.

- Albertans will save some or all of the provincial fuel tax on gasoline and diesel when oil prices are $80 per barrel or higher during each quarter’s review period.

- Although oil prices have been below $80 in recent weeks, Albertans will continue to save at least four cents per litre on the provincial fuel tax in the first three months of 2024 as the tax is phased back in.

- The government’s fuel tax relief efforts, which include the pause to the end of 2023 and additional savings over the first three months of 2024, are forecast to reduce other tax revenue by $524 million in 2023-24.

Expense

- Expense for 2023-24 is forecast at $68.8 billion, a $481-million increase from Budget 2023.

- Capital grants are up marginally from Budget 2023, but down from the first-quarter forecast, mainly due to funding schedules for Calgary and Edmonton LRT projects.

- Debt servicing costs are forecast to increase $309 million from budget, a reflection of ongoing high interest rates and inflation.

- Total expense has increased by $1.9 billion, $0.5 billion is directly offset by revenue and $1.4 billion is absorbed by the $1.5-billion contingency.

- In total, $123 million of the 2023-24 contingency remains unallocated.

- $1.2 billion in disaster and emergency costs are forecast for the current fiscal year.

- $750 million for fighting wildfires in the province

- $165 million for AgriRecovery to support livestock producers affected by dry conditions

- $253 million to provide financial assistance to communities for uninsurable damage from spring wildfires and summer flooding

- $61 million for evacuation and other support

- The operating expense forecast has increased by $319 million, including an additional:

- $301 million for Health

- $48 million for Advanced Education

- $48 million for Energy and Minerals

- $33 million for Mental Health and Addiction

- $30 million for Education

- $14 million for Indigenous Relations

- Offset by decreases of $187 million for lower-than-expected program take-up of affordability payments and re-profiling of TIER spending to 2024-25.

Alberta Heritage Savings Trust Fund

- The Alberta Heritage Savings Trust Fund’s market value on Sept. 30, 2023, was $21.4 billion, up from the $21.2 billion reported at March 31, 2023.

- The Heritage Fund returned 0.9 per cent over the first six months of 2023-24.

- Over the five-year period ending on Sept. 30, 2023, the Heritage Fund returned 5.9 per cent, which is 0.5 per cent above the return of its passive benchmark. While the Heritage Fund is outperforming its benchmark return, it is below the long-term real return target of 6.9 per cent, again a result of interest pressures.

- The Heritage Fund generated net investment income of $1 billion in the first half of the fiscal year.

Economic outlook

- Alberta’s economy continues to be resilient, with continued growth projected over the three-year forecast.

- Alberta’s real gross domestic product (GDP) is expected to grow 2.8 per cent in 2023, in line with the Budget 2023 forecast.

- Despite interest rate increases, high prices and slower global economic growth, Alberta’s economy is forecast to keep expanding. The pace of growth, however, will be slower compared with the last two years when the province was recovering from the pandemic.

Alberta Fund

- The amount of surplus cash available for debt repayment and the Alberta Fund is determined after a number of required cash adjustments have been made. For 2023-24, this includes $5.1 billion from the 2022-23 final results to start the year.

- The Alberta Fund contribution for 2023-24 is forecast at $1.6 billion.

- Money in the Alberta Fund can be used toward additional debt repayment, the Heritage Savings Trust Fund, or one-time initiatives that do not permanently increase government spending.

Related information

Alberta

Here’s why city hall should save ‘blanket rezoning’ in Calgary

From the Fraser Institute

By Tegan Hill and Austin Thompson

According to Calgarians for Thoughtful Growth (CFTG)—an organization advocating against “blanket rezoning”— housing would be more affordable if the mayor and council restricted what homes can be built in Calgary and where. But that gets the economics backwards.

Blanket rezoning—a 2024 policy that allowed homebuilders to construct duplexes, townhomes and fourplexes in most neighbourhoods—allowed more homebuilding, giving Calgarians more choice, and put downward pressure on prices. Mayor Farkas and several councillors campaigned on repealing blanket rezoning and on December 15 council will debate a motion that could start that process. As Calgarians debate the city’s housing rules, residents should understand the trade-offs involved.

When CFTG claims that blanket rezoning does “nothing” for affordability, it ignores a large body of economic research showing the opposite.

New homes are only built when they can be sold to willing homebuyers for a profit. Restrictions that limit the range of styles and locations for new homes, or that lock denser housing behind a long, costly and uncertain municipal approval process, inevitably eliminate many of these opportunities. That means fewer new homes are built, which worsens housing scarcity and pushes up prices. This intuitive story is backed up by study after study. An analysis by Canada’s federal housing agency put it simply: “higher residential land use regulation seems to be associated with lower housing affordability.”

CFTG also claims that blanket rezoning merely encourages “speculation” (i.e. buying to sell in the short-term for profit) by investors. Any profitable housing market may invite some speculative activity. But homebuilders and investors can only survive financially if they make homes that families are willing to buy or rent. The many Calgary families who bought or rented a new home enabled by blanket rezoning did so because they felt it was their best available option given its price, amenities and location—not because they were pawns in some speculative game. Calgarians benefit when they are free to choose the type of home and neighbourhood that best suits their family, rather than being constrained by the political whims of city hall.

And CFTG’s claim that blanket rezoning harms municipal finances also warrants scrutiny. More specifically, CFTG suggests that developers do not pay for infrastructure upgrades in established neighbourhoods, but this is simply incorrect. The City of Calgary charges an “Established Area Levy” to cover the cost of water and wastewater upgrades spurred by redevelopment projects—raising $16.5 million in 2024 alone. Builders in the downtown area must pay the “Centre City Levy,” which funds several local services (and generated $2.5 million in 2024).

It’s true that municipal fees on homes in new communities are generally higher, but that reflects the reality that new communities require far more new pipes, roads and facilities than established neighbourhoods.

Redeveloping established areas of the city means more residents can make use of streets, transit and other city services already in place, which is often the most cost-effective way for a city to grow. The City of Calgary’s own analysis finds that redevelopment in established neighbourhoods saves billions of taxpayer dollars on capital and operating costs for city services compared to an alternative scenario where homebuilding is concentrated in new suburban communities.

An honest debate about blanket rezoning ought to acknowledge the advantages this system has in promoting housing choice, housing affordability and the sustainability of municipal finances.

Clearly, many Calgarians felt blanket rezoning was undesirable when they voted for mayoral and council candidates who promised to change Calgary’s zoning rules. However, Calgarians also voted for a mayor who promised that more homes would be built faster, and at affordable prices—something that will be harder to achieve if city hall imposes tighter restrictions on where and what types of homes can be built. This unavoidable tension should be at the heart of the debate.

CFTG is promoting a comforting fairy tale where Calgary can tighten restrictions on homebuilding without limiting supply or driving up prices. In reality, no zoning regime delivers everything at once—greater neighbourhood control inevitably comes at the expense of housing choice and affordability. Calgarians—including the mayor and council—need a clear understanding of the trade-offs.

Alberta

The case for expanding Canada’s energy exports

From the Canadian Energy Centre

For Canada, the path to a stronger economy — and stronger global influence — runs through energy.

That’s the view of David Detomasi, a professor at the Smith School of Business at Queen’s University.

Detomasi, author of Profits and Power: Navigating the Politics and Geopolitics of Oil, argues that there is a moral case for developing Canada’s energy, both for Canadians and the world.

CEC: What does being an energy superpower mean to you?

DD: It means Canada is strong enough to affect the system as a whole by its choices.

There is something really valuable about Canada’s — and Alberta’s — way of producing carbon energy that goes beyond just the monetary rewards.

CEC: You talk about the moral case for developing Canada’s energy. What do you mean?

DD: I think the default assumption in public rhetoric is that the environmental movement is the only voice speaking for the moral betterment of the world. That needs to be challenged.

That public rhetoric is that the act of cultivating a powerful, effective economic engine is somehow wrong or bad, and that efforts to create wealth are somehow morally tainted.

I think that’s dead wrong. Economic growth is morally good, and we should foster it.

Economic growth generates money, and you can’t do anything you want to do in social expenditures without that engine.

Economic growth is critical to doing all the other things we want to do as Canadians, like having a publicly funded health care system or providing transfer payments to less well-off provinces.

Over the last 10 years, many people in Canada came to equate moral leadership with getting off of oil and gas as quickly as possible. I think that is a mistake, and far too narrow.

Instead, I think moral leadership means you play that game, you play it well, and you do it in our interest, in the Canadian way.

We need a solid base of economic prosperity in this country first, and then we can help others.

CEC: Why is it important to expand Canada’s energy trade?

DD: Canada is, and has always been, a trading nation, because we’ve got a lot of geography and not that many people.

If we don’t trade what we have with the outside world, we aren’t going to be able to develop economically, because we don’t have the internal size and capacity.

Historically, most of that trade has been with the United States. Geography and history mean it will always be our primary trade partner.

But the United States clearly can be an unreliable partner. Free and open trade matters more to Canada than it does to the U.S. Indeed, a big chunk of the American people is skeptical of participating in a global trading system.

As the United States perhaps withdraws from the international trading and investment system, there’s room for Canada to reinforce it in places where we can use our resource advantages to build new, stronger relationships.

One of these is Europe, which still imports a lot of gas. We can also build positive relationships with the enormous emerging markets of China and India, both of whom want and will need enormous supplies of energy for many decades.

I would like to be able to offer partners the alternative option of buying Canadian energy so that they are less reliant on, say, Iranian or Russian energy.

Canada can also maybe eventually help the two billion people in the world currently without energy access.

CEC: What benefits could Canadians gain by becoming an energy superpower?

DD: The first and primary responsibility of our federal government is to look after Canada. At the end of the day, the goal is to improve Canada’s welfare and enhance its sovereignty.

More carbon energy development helps Canada. We have massive debt, an investment crisis and productivity problems that we’ve been talking about forever. Economic and job growth are weak.

Solving these will require profitable and productive industries. We don’t have so many economic strengths in this country that we can voluntarily ignore or constrain one of our biggest industries.

The economic benefits pay for things that make you stronger as a country.

They make you more resilient on the social welfare front and make increasing defence expenditures, which we sorely need, more affordable. It allows us to manage the debt that we’re running up, and supports deals for Canada’s Indigenous peoples.

CEC: Are there specific projects that you advocate for to make Canada an energy superpower?

DD: Canada’s energy needs egress, and getting it out to places other than the United States. That means more transport and port facilities to Canada’s coasts.

We also need domestic energy transport networks. People don’t know this, but a big chunk of Ontario’s oil supply runs through Michigan, posing a latent security risk to Ontario’s energy security.

We need to change the perception that pipelines are evil. There’s a spiderweb of them across the globe, and more are being built.

Building pipelines here, with Canadian technology and know-how, builds our competitiveness and enhances our sovereignty.

Economic growth enhances sovereignty and provides the resources to do other things. We should applaud and encourage it, and the carbon energy sector can lead the way.

-

C2C Journal2 days ago

C2C Journal2 days agoWisdom of Our Elders: The Contempt for Memory in Canadian Indigenous Policy

-

National22 hours ago

National22 hours agoCanada’s free speech record is cracking under pressure

-

Sports2 days ago

Sports2 days agoEgypt, Iran ‘completely reject’ World Cup ‘Pride Match’ plan

-

Energy13 hours ago

Energy13 hours agoTanker ban politics leading to a reckoning for B.C.

-

Energy13 hours ago

Energy13 hours agoMeet REEF — the massive new export engine Canadians have never heard of

-

Alberta2 days ago

Alberta2 days agoAlberta introducing three “all-season resort areas” to provide more summer activities in Alberta’s mountain parks

-

Business24 hours ago

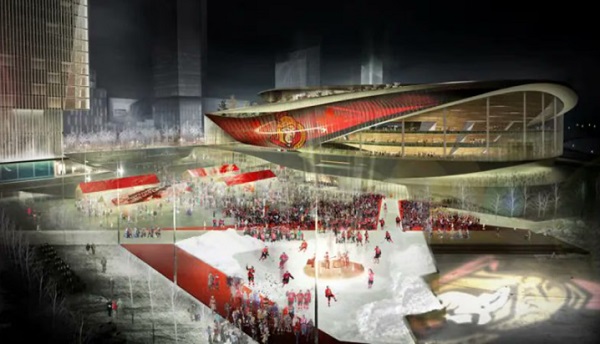

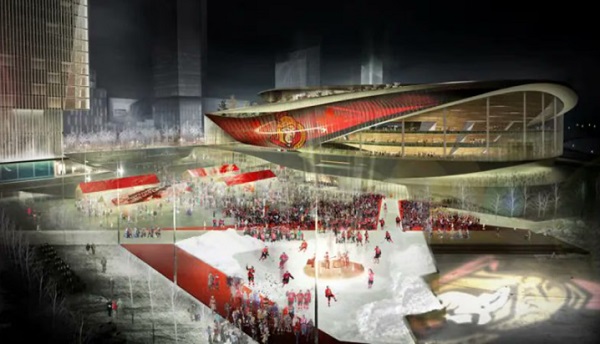

Business24 hours agoTaxpayers Federation calls on politicians to reject funding for new Ottawa Senators arena

-

Business13 hours ago

Business13 hours agoToo nice to fight, Canada’s vulnerability in the age of authoritarian coercion