Business

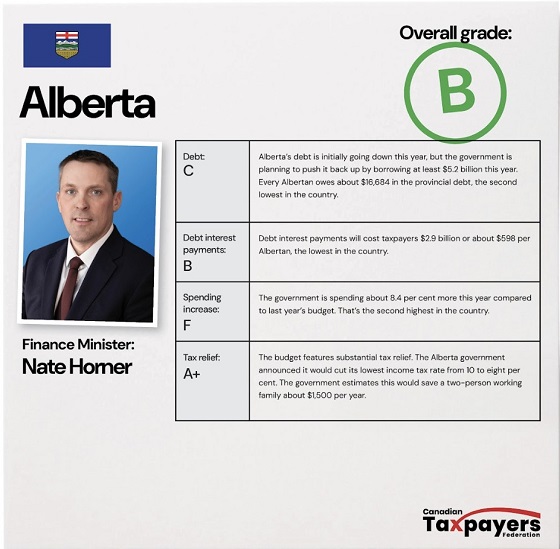

Alberta’s Nate Horner scores a B on CTF Finance Minister Report Card – Second highest rating in Canada

The Canadian Taxpayers Federation released its Finance Minister Report Card today, ranking provincial finance ministers on spending, debt and tax relief in the latest provincial budgets.

Alberta Finance Minister Nate Horner received an overall grade of B, the second highest in the country.

“Horner is doing well compared to other provincial finance ministers, but he must cut the size and cost of government and tackle interest costs on the provincial debt,” said Kris Sims, CTF Alberta Director. “It’s great to see Alberta cut taxes and protecting taxpayers, but the government also needs to stop racking up debt and wasting billions of dollars on those debt interest payments.”

Horner received the following grades in each category:

Debt: C

- Alberta’s debt is initially going down this year, but the government is planning to push it back up by borrowing at least $5.2 billion this year. Every Albertan owes about $16,684 in the provincial debt, the second lowest in the country.

Debt interest payments: B

- Debt interest payments will cost taxpayers $2.9 billion or about $598 per Albertan, the lowest in the country.

Spending Increase: F

- The government is spending about 8.4 per cent more this year compared to last year’s budget. That’s the second highest in the country.

Tax Relief: A+

- The government is cutting the lowest income tax rate from 10 to eight per cent. The government estimates this will save a two-person working family about $1,500 per year.

“Alberta’s tax relief really helps families and businesses and that makes our province stand out as a strong place to live and set up shop,” Sims said. “But it’s unwise to hike spending and dive back into debt when the province is already wasting nearly eight million dollars a day on debt interest payments.”

Overall ranking of provincial finance ministers:

You can find the full report card HERE.

Taxpayers are the biggest losers when it comes to this year’s provincial budgets. From B.C. to P.E.I, most provincial governments are saddling their taxpayers with more debt and higher interest payments this year.

All provincial governments but Alberta are increasing their debt this year compared to last year’s budgets. However, Alberta is planning to start increasing its own debt next year.

In terms of tax relief, some taxpayers across the country are seeing serious savings. In Alberta, taxpayers got an income tax cut that will save a two-person working family about $1,500 per year.

In Ontario, taxpayers are getting a permanent 5.7 cents per litre cut to the gas tax, but the government is also planning to borrow almost $15 billion more this year. Nova Scotia cut the province’s sales tax by one percentage point and Prince Edward Island brought in a small cut to both income and business taxes. The Manitoba government is raising taxes on Manitobans by bringing back bracket creep to the province. This tax hike will cost Manitobans $82 million this year.

Winners and losers

# Province Spending increase

1 Prince Edward Island 9.1%

2 Alberta 8.4%

3 Ontario 8.4%

4 New Brunswick 8.2%

5 Manitoba 7.1%

6 Nova Scotia 6.4%

7 British Columbia 6.1%

8 Newfoundland & Labrador 5.7%

9 Quebec 5.2%

10 Saskatchewan 4.5%

# Province Debt interest costs per person

1 Newfoundland & Labrador $2,088

2 Manitoba $1,554

3 Quebec $1,061

4 Ontario $1,001

5 Prince Edward Island $946

6 British Columbia $917

7 Nova Scotia $842

8 New Brunswick $784

9 Saskatchewan $702

10 Alberta $598

# Province Debt per person

1 Newfoundland & Labrador $35,649

2 Ontario $28,472

3 Quebec $28,356

4 British Columbia $27,372

5 Manitoba $24,268

6 Nova Scotia $20,766

7 Prince Edward Island $19,867

8 Saskatchewan $18,753

9 Alberta $16,684

10 New Brunswick $15,635

Business

Justice Centre launches new petition: Keep cash legal and accessible. Stop Bill C-2

Public Safety Minister Gary Anandasangaree speaks to Bill C-2 (Screenshot from CBC video)

The Justice Centre for Constitutional Freedoms has launched a petition calling upon the Prime Minister of Canada to strike the criminalization of cash payments of $10,000 or more from Bill C-2 and to introduce legislation protecting the right of Canadians to use cash of any amount for legal transactions.

Public Safety Minister Gary Anandasangaree introduced Bill C-2, or the Strong Borders Act, in the House of Commons on June 3, 2025. According to a Government of Canada statement, Bill C-2 will equip law enforcement with tools to secure borders and to combat crime, the drug trade, and money laundering.

Buried deep within the Bill, however, are provisions that would make it a criminal offence for businesses, professionals, and charities to accept cash payments of $10,000 or more in a single transaction or in a series of related transactions.

Bill C-2 at page 59

Justice Centre President John Carpay warns that the criminalization of cash transactions threatens the privacy, freedom of expression, and autonomy of all Canadians. When cash transactions are criminalized, governments, banks, and law enforcement can track and interfere with legitimate purchases and donations.

“We must not criminalize everyday Canadians for using physical currency. Once $10,000 is criminalized, it will be all too easy for future governments to lower the threshold to $5,000, then $1,000, and eventually nothing.”

Bill C-2 is just one point in a concerning anti-cash trend in Canada.

Quebec’s controversial Bill 54, passed into law in March 2024, allows police to assume that any person carrying $2,000 or more in cash is connected to criminal activity. Officers can seize the cash, and citizens must prove their innocence to get the cash back.

“Restricting the use of cash is a dangerous step towards tyranny,” continued Mr. Carpay. “Cash protects citizens from surveillance by government and banks, credit card companies, and other corporations. In a free society, violating the right of law-abiding citizens to use cash is not the answer to money laundering or the drug trade.”

Signers of the petition call upon the Prime Minister of Canada to strike the criminalization of cash payments from Bill C-2.

Signers of the petition also call upon the Prime Minister of Canada to introduce legislation that protects Canadians’ right to use cash of any amount for legal transactions.

Business

Audit report reveals Canada’s controversial COVID travel app violated multiple rules

From LifeSiteNews

Canada’s Auditor General found that government procurement rules were not followed in creating the ArriveCAN app.

Canada’s Auditor General revealed that the former Liberal government under Prime Minister Justin Trudeau failed multiple times by violating contract procurement rules to create ArriveCAN, its controversial COVID travel app.

In a report released Tuesday, Auditor General Karen Hogan noted that between April 2015 to March 2024, the Trudeau government gave out 106 professional service contracts to GC Strategies Inc. This is the same company that made the ArriveCAN app.

The contracts were worth $92.7 million, with $64.5 million being paid out.

According to Hogan, Canada’s Border Services Agency gave four contracts to GC Strategies valued at $49.9 million. She noted that only 54 percent of the contracts delivered any goods.

“We concluded that professional services contracts awarded and payments made by federal organizations to GC Strategies and other companies incorporated by its co-founders were not in accordance with applicable policy instruments and that value for money for these contracts was not obtained,” Hogan said.

She continued, “Despite this, federal government officials consistently authorized payments.”

The report concluded that “Federal organizations need to ensure that public funds are spent with due regard for value for money, including in decisions about the procurement of professional services contracts.”

Hogan announced an investigation of ArriveCAN in November 2022 after the House of Commons voted 173-149 for a full audit of the controversial app.

Last year, Hogan published an audit of ArriveCAN and on Tuesday published a larger audit of the 106 contracts awarded to GC Strategies by 31 federal organizations under Trudeau’s watch.

The report concluded that one in five contracts did not have proper documentation to show correct security clearances. Also, the report found that federal organizations did not monitor how the contract work was being performed.

‘Massive scandal,’ says Conservative leader Pierre Poilievre

Conservative Party leader Pierre Poilievre said Hogan’s report on the audit exposed multiple improprieties.

“This is a massive scandal,” he told reporters Tuesday.

“The facts are extraordinary. There was no evidence of added value. In a case where you see no added value, why are you paying the bill?”

ArriveCAN was introduced in April 2020 by the Trudeau government and made mandatory in November 2020. The app was used by the federal government to track the COVID jab status of those entering the country and enforce quarantines when deemed necessary.

ArriveCAN was supposed to have cost $80,000, but the number quickly ballooned to $54 million, with the latest figures showing it cost $59.5 million.

As for the app itself, it was riddled with technical glitches along with privacy concerns from users.

LifeSiteNews has published a wide variety of reports related to the ArriveCAN travel app.

-

espionage2 days ago

espionage2 days agoFBI Director: CCP Behind Wave of Pathogen Smuggling as Third Chinese Student Charged in Michigan Lab Probe

-

Immigration2 days ago

Immigration2 days agoMass immigration can cause enormous shifts in local culture, national identity, and community cohesion

-

Economy1 day ago

Economy1 day agoCarney’s Promise of Expediting Resource Projects Feels Like a Modern Version of the Wicked Stepmother from Disney’s Cinderella

-

Crime17 hours ago

Crime17 hours agoOntario Police’s Record Fentanyl Bust Suggests Cartel–Iranian–PRC-Supplied Nexus from Ottawa to Hamilton Along Six Nations Corridor

-

Health2 days ago

Health2 days agoRFK Jr. purges CDC vaccine panel, citing decades of ‘skewed science’

-

Business16 hours ago

Business16 hours agoTelegram founder Pavel Durov exposes crackdown on digital privacy in Tucker Carlson interview

-

Red Deer2 days ago

Red Deer2 days agoRed Deer Student honoured with Chief Youth Courage Award

-

Business1 day ago

Business1 day agoEU investigates major pornographic site over failure to protect children