Alberta

Alberta rail hub doubling in size to transport plastic from major new carbon-neutral plant

Haulage bridge at Cando Rail & Terminals’ Sturgeon Terminal in Alberta’s Industrial Heartland, near Edmonton. Photo courtesy Cando Rail & Terminals

From the Canadian Energy Centre

By Will Gibson

Cando Rail & Terminals to invest $200 million to support Dow’s Path2Zero petrochemical complex

A major rail hub in Alberta’s Industrial Heartland will double in size to support a new carbon-neutral plastic production facility, turning the terminal into the largest of its kind in the country.

Cando Rail & Terminals will invest $200 million at its Sturgeon Terminal after securing Dow Chemical as an anchor tenant for its expanded terminal, which will support the planned $8.9 billion Path2Zero petrochemical complex being built in the region northeast of Edmonton.

“Half of the terminal expansion will be dedicated to the Dow project and handle the products produced at the Path2Zero complex,” says Steve Bromley, Cando’s chief commercial officer.

By incorporating carbon capture and storage, the complex, which began construction this spring, is expected to be the world’s first to produce polyethylene with net zero scope 1 and 2 emissions.

The widely used plastic’s journey to global markets will begin by rail.

“Dow stores their polyethylene in covered railcars while waiting to sell it,” Bromley says.

“When buyers purchase it, we will build unit trains and those cars will go to the Port of Prince Rupert and eventually be shipped to their customers in Asia.”

A “unit train” is a single train where all the cars carry the same commodity to the same destination.

The expanded Cando terminal will have the capacity to prepare 12,000-foot unit trains – or trains that are more than three-and-a-half kilometers long.

Construction will start on the expansion in 2025 at a 320-acre site west of Cando’s existing terminal, which 20 industrial customers use to stage and store railcars as well as assemble unit trains.

Bromley, a former CP Rail executive who joined Cando in 2013, says the other half of the terminal’s capacity not used by the Dow facility will be sold to other major projects in the region.

The announcement is the latest in a series of investments for Cando to grow its operations in Alberta that will see the company spend more than $500 million by 2027.

The company, which is majority owned by the Alberta Investment Management Corporation previously spent $100 million to acquire a 1,700-railcar facility in Lethbridge along with $150 million to build its existing Sturgeon terminal.

Cando Rail’s existing Sturgeon Terminal near Edmonton, Alberta. Photo courtesy Cando Rail & Terminals

“Alberta is important to us – we have 300 active employees in this province and handle 900,000 railcars annually here,” Bromley says.

“But we are looking for opportunities across North America, both in Canada and the United States as well.”

Cando released the news of the Sturgeon Terminal expansion at the Alberta Industrial Heartland Association’s annual conference on Sept. 19.

“This is an investment in critical infrastructure that underpins additional growth in the region,” says Mark Plamondon, the association’s executive director.

The announcement came as the association marked its 25th anniversary at the event, which Plamondon saw as fitting.

“Dow’s Path2Zero came to the region because of the competitive advantages gained by clustering heavy industry. Competitive advantages are built from infrastructure that’s already here, such as the Alberta Carbon Trunk Line, which transports and stores carbon dioxide for industry,” he says.

“Having that level of integration can turn inputs into one operation into outputs for another. Competitive advantages for one become advantages for others. Cando’s investment will attract others just as Dow’s Path2Zero was a pull for additional investment.”

Alberta

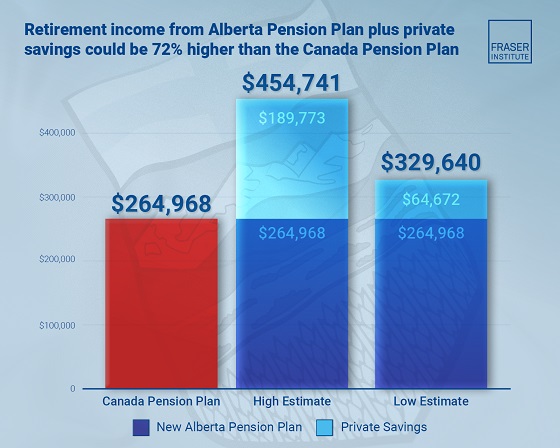

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Alberta1 day ago

Alberta1 day agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Daily Caller21 hours ago

Daily Caller21 hours ago‘Strange Confluence Of Variables’: Mike Benz Wants Transparency Task Force To Investigate What Happened in Butler, PA

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Business1 day ago

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts