Alberta

Alberta Justice Minister says Feds planning to use RCMP to confiscate firearms starting in PEI

Federal confiscation program: Minister Shandro

Minister of Justice Tyler Shandro issued the following statement on the federal firearms confiscation program:

“Last week, Minister Mendicino admitted that the federal government has still not figured out how to implement their firearms confiscation program.

“This admission comes shortly after the Canadian Association of Chiefs of Police called on the federal government to not to use police services to confiscate firearms.

“Now, media reports have drawn attention to a federal government memo that outlines Minister Mendicino’s plans to confiscate firearms across Canada.

“The memo admits that efforts to find private sector companies to implement the federal firearms confiscation program failed this summer.

“With no private sector companies willing to participate, the memo outlines how the RCMP will first be deployed to Prince Edward Island (PEI), which has been deemed to be an easy ‘low-risk’ target.

“The federal government is treating PEI as a ‘pilot’ that will help them learn on the job as they implement their confiscation plan through trial and error.

“This ‘program’ is expected to cost a billion dollars or more and has supposedly been in the works for three years.

“Despite a mountain of money and years worth of lead time, Ottawa appears to be lost – especially given their latest attack on hunting rifles and shotguns – at minimum, they should proactively extend the amnesty that is currently scheduled to end in October 2023.

“Such a decision, however, would involve showing Canadian firearms owners a measure of decency, something that Minister Mendicino and this federal government is seemingly incapable of.”

—–

Public Safety Canada’s Buyback Program

Overview

The Government of Canada committed to implementing a mandatory buyback program so that the assault-style firearms that became prohibited on May 1, 2020 are safely removed from our communities. Public Services and Procurement Canada’s role is to provide procurement services to Public Safety Canada (PS) to support their implementation of the buyback program.

Mandate

As of May 1, 2020, the Government of Canada has prohibited over 1,500 models of assault-style firearms (ASFs) and certain components of some newly-prohibited firearms. New maximum thresholds for muzzle energy and bore diameter are also in place. Any firearm that exceeds these is now prohibited. A Criminal Code amnesty period is currently in effect to October 30, 2023. The amnesty is designed to protect individuals or businesses who, at the time the prohibition came into force, were in lawful possession of a newly prohibited firearm from criminal liability while they take steps to comply with the law.

The primary intent of the buyback program would be to safely buyback these now prohibited firearms from society, while offering fair compensation to businesses and lawful owners impacted by the prohibition. PSPC is currently examining options for implementation of the buyback program, including the potential of contracting out specific activities.

Key activities

The program approach currently being considered by PS senior management envisages 2 phases, with a pilot in the first phase that would inform the national roll-out of the program:

- phase 1: commence in December 2022 and conclude at the end of the amnesty period. Primarily led by Royal Canadian Mounted Police (RCMP) with support from PS and other government departments. Prince Edward Island (PE) will be used as a pilot and will be the first point of collection based on the smaller number of firearms. As a result, lessons learned, gaps analysis and risk assessment would inform the phase 2 national roll-out

- phase 2: national roll-out is planned for spring 2023 once an information management/information technology (IM/IT) case management system is in place. It will be implemented in collaboration with other government departments, provincial, municipal and territorial governments and potential Industry partners

Public Services and Procurement posted a request for information on July 14, 2022 seeking feedback from industry on potential capacities to support delivery of the buyback program. It closed on August 31, 2022 and with very limited interest from the industry.

Partners and stakeholders

The program owner is Public Safety Canada. They are responsible for the buyback planning and oversight.

Public Services and Procurement Canada has been supporting PS with the buyback program since August 2021 supporting the development of procurement strategies for the delivery of the various potential requirements such as:

- collection and transportation

- professional services

- tracking

- storage solutions

- package inspection

- destruction

- post-destruction recycling

Shared Services Canada will assist with procurement of information technology (IT) solutions and other required IT support, based on its mandate.

The RCMP will start collection of ASFs in December 2022. They are also supporting the buyback program by providing a high level process map or written description of the programmatic phases.

Employment and Social Development Canada may support the buyback program with call-centres and payment solutions for the compensation.

Provincial, municipal and territorial governments are also being engaged to support the implementation and program delivery.

Key considerations

The prohibition applies to all current and future firearm variants that meet the criteria—now, over 1,800 firearms. These firearms can no longer be legally used, sold, or imported.

Currently owners have the option to dispose of their firearm by surrendering it to police, deactivating through an approved business or exporting the firearm with a valid export permit, all without government compensation. The buyback program aims to offer fair compensation to affected owners and businesses.

Work at the officials level is ongoing to develop, design and engage on the program. This includes public consultations on the government’s price list, which was posted on July 28, 2022 on Public Safety’s website and would be used to establish compensation levels for affected firearms.

Alberta

Canada’s heavy oil finds new fans as global demand rises

From the Canadian Energy Centre

By Will Gibson

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices”

Once priced at a steep discount to its lighter, sweeter counterparts, Canadian oil has earned growing admiration—and market share—among new customers in Asia.

Canada’s oil exports are primarily “heavy” oil from the Alberta oil sands, compared to oil from more conventional “light” plays like the Permian Basin in the U.S.

One way to think of it is that heavy oil is thick and does not flow easily, while light oil is thin and flows freely, like fudge compared to apple juice.

“The refining industry wants heavy oil. We are actually in a shortage of heavy oil globally right now, and you can see that in the prices,” said Susan Bell, senior vice-president of downstream research with Rystad Energy.

A narrowing price gap

Alberta’s heavy oil producers generally receive a lower price than light oil producers, partly a result of different crude quality but mainly because of the cost of transportation, according to S&P Global.

The “differential” between Western Canadian Select (WCS) and West Texas Intermediate (WTI) blew out to nearly US$50 per barrel in 2018 because of pipeline bottlenecks, forcing Alberta to step in and cut production.

So far this year, the differential has narrowed to as little as US$10 per barrel, averaging around US$12, according to GLJ Petroleum Consultants.

“The differential between WCS and WTI is the narrowest I’ve seen in three decades working in the industry,” Bell said.

Trans Mountain Expansion opens the door to Asia

Oil tanker docked at the Westridge Marine Terminal in Burnaby, B.C. Photo courtesy Trans Mountain Corporation

The price boost is thanks to the Trans Mountain expansion, which opened a new gateway to Asia in May 2024 by nearly tripling the pipeline’s capacity.

This helps fill the supply void left by other major regions that export heavy oil – Venezuela and Mexico – where production is declining or unsteady.

Canadian oil exports outside the United States reached a record 525,000 barrels per day in July 2025, the latest month of data available from the Canada Energy Regulator.

China leads Asian buyers since the expansion went into service, along with Japan, Brunei and Singapore, Bloomberg reports.

Asian refineries see opportunity in heavy oil

“What we are seeing now is a lot of refineries in the Asian market have been exposed long enough to WCS and now are comfortable with taking on regular shipments,” Bell said.

Kevin Birn, chief analyst for Canadian oil markets at S&P Global, said rising demand for heavier crude in Asia comes from refineries expanding capacity to process it and capture more value from lower-cost feedstocks.

“They’ve invested in capital improvements on the front end to convert heavier oils into more valuable refined products,” said Birn, who also heads S&P’s Center of Emissions Excellence.

Refiners in the U.S. Gulf Coast and Midwest made similar investments over the past 40 years to capitalize on supply from Latin America and the oil sands, he said.

While oil sands output has grown, supplies from Latin America have declined.

Mexico’s state oil company, Pemex, reports it produced roughly 1.6 million barrels per day in the second quarter of 2025, a steep drop from 2.3 million in 2015 and 2.6 million in 2010.

Meanwhile, Venezuela’s oil production, which was nearly 2.9 million barrels per day in 2010, was just 965,000 barrels per day this September, according to OPEC.

The case for more Canadian pipelines

Worker at an oil sands SAGD processing facility in northern Alberta. Photo courtesy Strathcona Resources

“The growth in heavy demand, and decline of other sources of heavy supply has contributed to a tighter market for heavy oil and narrower spreads,” Birn said.

Even the International Energy Agency, known for its bearish projections of future oil demand, sees rising global use of extra-heavy oil through 2050.

The chief impediments to Canada building new pipelines to meet the demand are political rather than market-based, said both Bell and Birn.

“There is absolutely a business case for a second pipeline to tidewater,” Bell said.

“The challenge is other hurdles limiting the growth in the industry, including legislation such as the tanker ban or the oil and gas emissions cap.”

A strategic choice for Canada

Because Alberta’s oil sands will continue a steady, reliable and low-cost supply of heavy oil into the future, Birn said policymakers and Canadians have options.

“Canada needs to ask itself whether to continue to expand pipeline capacity south to the United States or to access global markets itself, which would bring more competition for its products.”

Alberta

Gondek’s exit as mayor marks a turning point for Calgary

This article supplied by Troy Media.

The mayor’s controversial term is over, but a divided conservative base may struggle to take the city in a new direction

Calgary’s mayoral election went to a recount. Independent candidate Jeromy Farkas won with 91,112 votes (26.1 per cent). Communities First candidate Sonya Sharp was a very close second with 90,496 votes (26 per cent) and controversial incumbent mayor Jyoti Gondek finished third with 71,502 votes (20.5 per cent).

Gondek’s embarrassing tenure as mayor is finally over.

Gondek’s list of political and economic failures in just a single four-year term could easily fill a few book chapters—and most likely will at some point. She declared a climate emergency on her first day as Calgary’s mayor that virtually no one in the city asked for. She supported a four per cent tax increase during the COVID-19 pandemic, when many individuals and families were struggling to make ends meet. She snubbed the Dec. 2023 menorah lighting during Hanukkah because speakers were going to voice support for Israel a mere two months after the country was attacked by the bloodthirsty terrorist organization Hamas. The

Calgary Party even accused her last month of spending over $112,000 in taxpayers’ money for an “image makeover and brand redevelopment” that could have benefited her re-election campaign.

How did Gondek get elected mayor of Calgary with 176,344 votes in 2021, which is over 45 per cent of the electorate?

“Calgary may be a historically right-of-centre city,” I wrote in a recent National Post column, “but it’s experienced some unusual voting behaviour when it comes to mayoral elections. Its last three mayors, Dave Bronconnier, Naheed Nenshi and Gondek, have all been Liberal or left-leaning. There have also been an assortment of other Liberal mayors in recent decades like Al Duerr and, before he had a political epiphany, Ralph Klein.”

In fairness, many Canadians used to support the concept of balancing their votes in federal, provincial and municipal politics. I knew of some colleagues, friends and family members, including my father, who used to vote for the federal Liberals and Ontario PCs. There were a couple who supported the federal PCs and Ontario Liberals in several instances. In the case of one of my late

grandfathers, he gave a stray vote for Brian Mulroney’s federal PCs, the NDP and even its predecessor, the Co-operative Commonwealth Federation.

That’s not the case any longer. The more typical voting pattern in modern Canada is one of ideological consistency. Conservatives vote for Conservative candidates, Liberals vote for Liberal candidates, and so forth. There are some rare exceptions in municipal politics, such as the late Toronto mayor Rob Ford’s populistconservative agenda winning over a very Liberal city in 2010. It doesn’t happen very often these days, however.

I’ve always been a proponent of ideological consistency. It’s a more logical way of voting instead of throwing away one vote (so to speak) for some perceived model of political balance. There will always be people who straddle the political fence and vote for different parties and candidates during an election. That’s their right in a democratic society, but it often creates a type of ideological inconsistency that doesn’t benefit voters, parties or the political process in general.

Calgary goes against the grain in municipal politics. The city’s political dynamics are very different today due to migration, immigration and the like. Support for fiscal and social conservatism may still exist in Alberta, but the urban-rural split has become more profound and meaningful than the historic left-right divide. This makes the task of winning Calgary in elections more difficult for today’s provincial and federal Conservatives, as well as right-leaning mayoral candidates.

That’s what we witnessed during the Oct. 20 municipal election. Some Calgary Conservatives believed that Farkas was a more progressive-oriented conservative or centrist with a less fiscally conservative plan and outlook for the city. They viewed Sharp, the leader of a right-leaning municipal party founded last December, as a small “c” conservative and much closer to their ideology. Conversely, some Calgary Conservatives felt that Farkas, and not Sharp, would be a better Conservative option for mayor because he seemed less ideological in his outlook.

When you put it all together, Conservatives in what used to be one of the most right-leaning cities in a historically right-leaning province couldn’t decide who was the best political option available to replace the left-wing incumbent mayor. Time will tell if they chose wisely.

Fortunately, the razor-thin vote split didn’t save Gondek’s political hide. Maybe ideological consistency will finally win the day in Calgary municipal politics once the recount has ended and the city’s next mayor has been certified.

Michael Taube is a political commentator, Troy Media syndicated columnist and former speechwriter for Prime Minister Stephen Harper. He holds a master’s degree in comparative politics from the London School of Economics, lending academic rigour to his political insights.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

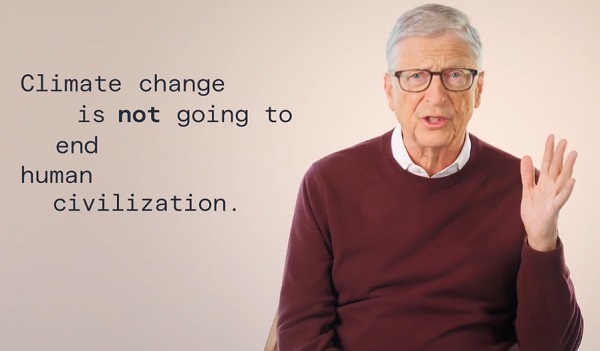

Environment22 hours ago

Environment22 hours agoThe era of Climate Change Alarmism is over

-

Aristotle Foundation14 hours ago

Aristotle Foundation14 hours agoB.C. government laid groundwork for turning private property into Aboriginal land

-

Business1 day ago

Business1 day agoYou Won’t Believe What Canada’s Embassy in Brazil Has Been Up To

-

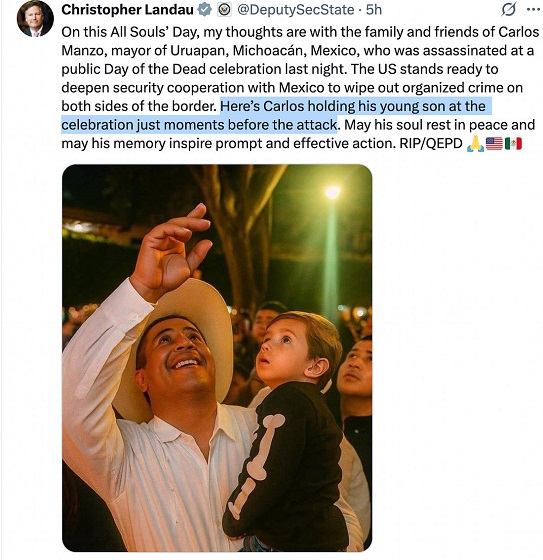

Crime14 hours ago

Crime14 hours agoPublic Execution of Anti-Cartel Mayor in Michoacán Prompts U.S. Offer to Intervene Against Cartels

-

Automotive1 day ago

Automotive1 day agoCarney’s Budget Risks Another Costly EV Bet

-

Business1 day ago

Business1 day agoMystery cloaks Doug Ford’s funding of media through Ontario advertising subsidy

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoSenate Grills Meta and Google Over Biden Administration’s Role in COVID-Era Content Censorship

-

International14 hours ago

International14 hours agoNigeria better stop killing Christians — or America’s coming “guns-a-blazing”