Energy

8 ways the Biden / Harris government made gasoline prices higher

From Energy Talking Points

| By Alex Epstein |

Any politician who supports the “net zero” agenda is working to make gasoline prices much higher

This is Part 1 of a 4 part feature where I cover 4 of the top energy issues being discussed this summer

- Every politician will claim this summer that they’re working to make gasoline prices lower, because they know that’s what voters want to hear.

But the many politicians that support “net zero by 2050” are working to make gasoline prices higher.

- For the US to become anywhere near “net zero by 2050,” gasoline use needs to be virtually eliminated.¹

- Since Americans left to their own free will choose to use a lot of gasoline, the only way for “net zero” politicians to eliminate gasoline is to make it unaffordable or illegal.

Low gasoline prices are totally incompatible with “net zero.”

- The Biden-Harris administration knows that all fossil fuels, including gasoline, need to be far more expensive for them to pursue “net zero.” That’s why the EPA set a rising “social cost of carbon” starting at $190/ton—the equivalent of adding $1.50 a gallon to gasoline prices!²

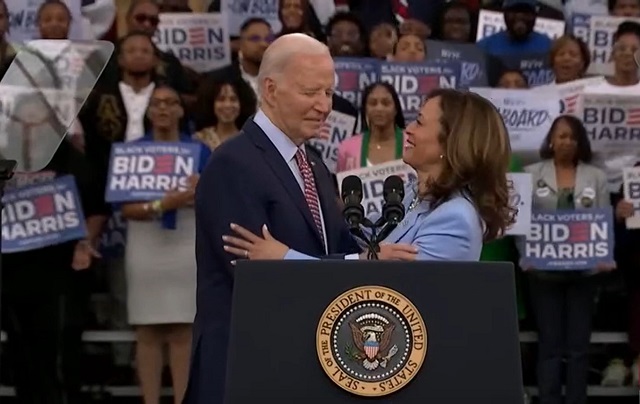

- From Day 1, President Biden has openly supported the destruction of the fossil fuel industry, from his 2019 campaign promise of “I guarantee you, we’re going to end fossil fuel” to his 2021 executive order declaring that America will be “net zero emissions economy-wide” by 2050.³

- Kamala Harris has, unfortunately, been even more supportive of the “net zero” agenda and therefore higher gasoline prices. In 2020 she supported a fracking ban, which would have destroyed 60% of US oil production. And she cosponsored the fossil fuel-destroying Green New Deal.⁴

- Of course, Joe Biden and Kamala Harris, like all politicians, claim to be for lower gasoline prices. But because their real priority is the “net zero” agenda, in practice they are doing everything they can to raise prices.

-

Here are 8 specific actions they’ve taken.

- Biden Gas Gouging Policy #1

Biden has worked to increase gasoline prices by taking a “whole-of-government” approach to reducing greenhouse gas emissions

. This entails reducing oil investment, production, refining, and transport, all of which serves to increase gas prices.⁵

- Biden Gas Gouging Policy #2

Biden has worked to increase gasoline prices by expanding the anti-fossil-fuel ESG divestment movement

. ESG contributed to a 50% decline in oil and gas exploration investments from 2011-2021, resulting in artificially higher prices. Biden is making it worse.The ESG movement is anti-energy, anti-development, and anti-America

·January 6, 2022ESG poses as a moral and financially savvy movement. In reality it is an immoral and financially ruinous movement that is destroying the free world’s ability to produce low-cost, reliable energy. This prevents poor countries from developing and threatens America’s security. Read full story - Biden Gas Gouging Policy #3

Biden has worked to increase gasoline prices via “climate disclosure rules,”

an oil and gas investment-slashing measure that coerces companies into spouting anti-fossil-fuel propaganda and committing to anti-fossil-fuel plans—plans that will raise gas prices.The “climate disclosure” fraud

·Mar 16Congress won’t support Biden’s anti-fossil-fuel agenda. Read full story

- Biden Gas Gouging Policy #4

Biden has worked to increase gasoline prices by issuing a moratorium on oil and gas leases on federal lands, stunting oil and gas production and investment

. When it’s harder to produce and invest in oil, gasoline gets more expensive.⁶

- Biden Gas Gouging Policy #5

Biden has worked to increase gasoline prices by hiking the royalty rate for new oil leases by 50%

. This is money the government gets from the industry on top of taxes. And it discourages oil investments, meaning less production meaning higher gas prices.⁷ - Biden Gas Gouging Policy #6

Biden has worked to increase gasoline prices by restricting oil and gas leasing on nearly 50% of Alaska’s vast petroleum reserve

. This is a crippling blow to Alaska’s oil and gas industry. Less Alaskan oil means higher gas prices.⁸ - Biden Gas Gouging Policy #7

Biden has worked to increase gasoline prices by threatening to stop oil and gas mergers

. Mergers, which increase efficiency, benefit domestic production and lower prices. Blocking mergers raises oil prices long-term, which means higher gas prices.Why government should leave oil and gas mergers alone

·Jun 3Myth: Oil and gas mergers are bad for America because they make oil more expensive. Read full story - Biden Gas Gouging Policy #8

Biden has worked to increase gasoline prices by cancelling the Keystone XL pipeline

. This prevented Canada from using its vast oil deposits to their full potential—meaning lower global supply and higher prices for oil and gasoline.⁹ - Joe Biden should level with the American people and make clear that his agenda is to increase gasoline prices—much like Obama’s infamous admission that “electricity rates would necessarily skyrocket” under his energy plan.

Or he should apologize and embrace energy freedom.¹⁰

“Energy Talking Points by Alex Epstein” is my free Substack newsletter designed to give as many people as possible access to concise, powerful, well-referenced talking points on the latest energy, environmental, and climate issues from a pro-human, pro-energy perspective.

Energy

China undermining American energy independence, report says

From The Center Square

By

The Chinese Communist Party is exploiting the left’s green energy movement to hurt American energy independence, according to a new report from State Armor.

Michael Lucci, founder and CEO of State Armor, says the report shows how Energy Foundation China funds green energy initiatives that make America more reliant on China, especially on technology with known vulnerabilities.

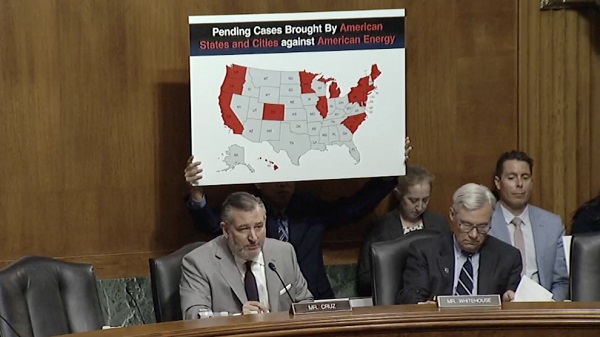

“Our report exposes how Energy Foundation China functions not as an independent nonprofit, but as a vehicle advancing the strategic interests of the Chinese Communist Party by funding U.S. green energy initiatives to shift American supply chains toward Beijing and undermine our energy security,” Lucci said in a statement before the Senate Judiciary Subcommittee’s hearing on Wednesday titled “Enter the Dragon – China and the Left’s Lawfare Against American Energy Dominance.”

Lucci said the group’s operations represent a textbook example of Chinese influence in America.

“This is a very good example of how the Chinese Communist Party operates influence operations within the United States. I would actually describe it as a perfect case study from their perspective,” he told The Center Square in a phone interview. “They’re using American money to leverage American policy changes that make the American energy grid dependent upon China.”

Lucci said one of the most concerning findings is that China-backed technology entering the U.S. power grid includes components with “undisclosed back doors” – posing a direct threat to the power grid.

“These are not actually green tech technologies. They’re red technologies,” he said. “We are finding – and this is open-source news reporting – they have undisclosed back doors in them. They’re described in a Reuters article as rogue communication devices… another way to describe that is kill switches.”

Lucci said China exploits American political divisions on energy policy to insert these technologies under the guise of environmental progress.

“Yes, and it’s very crafty,” he said. “We are not addressing the fact that these green technologies are red. Technologies controlled by the Communist Party of China should be out of the question.”

Although Lucci sees a future for carbon-free energy sources in the United States – particularly nuclear and solar energy – he doesn’t think the country should use technology from a foreign adversary to do it.

“It cannot be Chinese solar inverters that are reported in Reuters six weeks ago as having undisclosed back doors,” he said. “It cannot be Chinese batteries going into the grid … that allow them to sabotage our grid.”

Lucci said energy is a national security issue, and the United States is in a far better position to achieve energy independence than China.

“We are luckily endowed with energy independence if we choose to have it. China is not endowed with that luxury,” he said. “They’re poor in natural resources. We’re very well endowed – one of the best – with natural resources for energy production.”

He said that’s why China continues to build coal plants – and some of that coal comes from Australia – while pushing the United States to use solar energy.

“It’s very foolish of us to just make ourselves dependent on their technologies that we don’t need, and which are coming with embedded back doors that give them actual control over our energy grid,” he said.

Lucci says lawmakers at both the state and federal levels need to respond to this threat quickly.

“The executive branch should look at whether Energy Foundation China is operating as an unregistered foreign agent,” he said. “State attorneys general should be looking at these back doors that are going into our power grid – undisclosed back doors. That’s consumer fraud. That’s a deceptive trade practice.”

Energy

Carney’s Bill C-5 will likely make things worse—not better

From the Fraser Institute

By Niels Veldhuis and Jason Clemens

The Carney government’s signature legislation in its first post-election session of Parliament—Bill C-5, known as the Building Canada Act—recently passed the Senate for final approval, and is now law. It gives the government unprecedented powers and will likely make Canada even less attractive to investment than it is now, making a bad situation even worse.

Over the past 10 years, Canada has increasingly become known as a country that is un-investable, where it’s nearly impossible to get large and important projects, from pipelines to mines, approved. Even simple single-site redevelopment projects can take a decade to receive rezoning approval. It’s one of the primary reasons why Canada has experienced a mass exodus of investment capital, some $387 billion from 2015 to 2023. And from 2014 to 2023, the latest year of comparable data, investment per worker (excluding residential construction and adjusted for inflation) dropped by 19.3 per cent, from $20,310 to $16,386 (in 2017 dollars).

In theory, Bill C-5 will help speed up the approval process for projects deemed to be in the “national interest.” But the cabinet (and in practical terms, the prime minister) will determine the “national interest,” not the private sector. The bill also allows the cabinet to override existing laws, regulations and guidelines to facilitate investment and the building of projects such as pipelines, mines and power transmission lines. At a time when Canada is known for not being able to get large projects done, many are applauding this new approach, and indeed the bill passed with the support of the Opposition Conservatives.

But basically, it will allow the cabinet to go around nearly every existing hurdle impeding or preventing large project developments, and the list of hurdles is extensive: Bill C-69 (which governs the approval process for large infrastructure projects including pipelines), Bill C-48 (which effectively bans oil tankers off the west coast), the federal cap on greenhouse gas emissions for only the oil and gas sector (which effectively means a cap or even reductions in production), a quasi carbon tax on fuel (called the Clean Fuels Standard), and so on.

Bill C-5 will not change any of these problematic laws and regulations. It simply will allow the cabinet to choose when and where they’re applied. This is cronyism at its worst and opens up the Carney government to significant risks of favouritism and even corruption.

Consider firms interested in pursuing large projects. If the bill becomes the law of the land, there won’t be a new, better and more transparent process to follow that improves the general economic environment for all entrepreneurs and businesses. Instead, there will be a cabinet (i.e. politicians) with new extraordinary powers that firms can lobby to convince that their project is in the “national interest.”

Indeed, according to some reports, some senators are referring to Bill C-5 as the “trust me” law, meaning that because there aren’t enough details and guardrails within the legislation, senators who vote in favour are effectively “trusting” Prime Minister Carney and his cabinet to do the right thing, effectively and consistently over time.

Consider the ambiguity in the legislation and how it empowers discretionary decisions by the cabinet. According to the legislation, cabinet “may consider any factor” it “considers relevant, including the extent to which the project can… strengthen Canada’s autonomy, resilience and security” or “provide economic benefits to Canada” or “advance the interests of Indigenous peoples” or “contribute to clean growth and to meeting Canada’s objectives with respect to climate change.”

With this type of “criteria,” nearly anything cabinet or the prime minister can dream up could be deemed in the “national interest” and therefore provide the prime minister with unprecedented and near unilateral powers.

In the preamble to the legislation, the government said it wants an accelerated approval process, which “enhances regulatory certainty and investor confidence.” In all likelihood, Bill C-5 will do the opposite. It will put more power in the hands of a very few in government, lead to cronyism, risks outright corruption, and make Canada even less attractive to investment.

-

Business14 hours ago

Business14 hours agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

Alberta2 days ago

Alberta2 days agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Crime1 day ago

Crime1 day agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Alberta2 days ago

Alberta2 days agoWhy the West’s separatists could be just as big a threat as Quebec’s

-

Crime2 days ago

Crime2 days agoSuspected ambush leaves two firefighters dead in Idaho

-

Business2 days ago

Business2 days agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Health1 day ago

Health1 day agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Censorship Industrial Complex14 hours ago

Censorship Industrial Complex14 hours agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report