Alberta

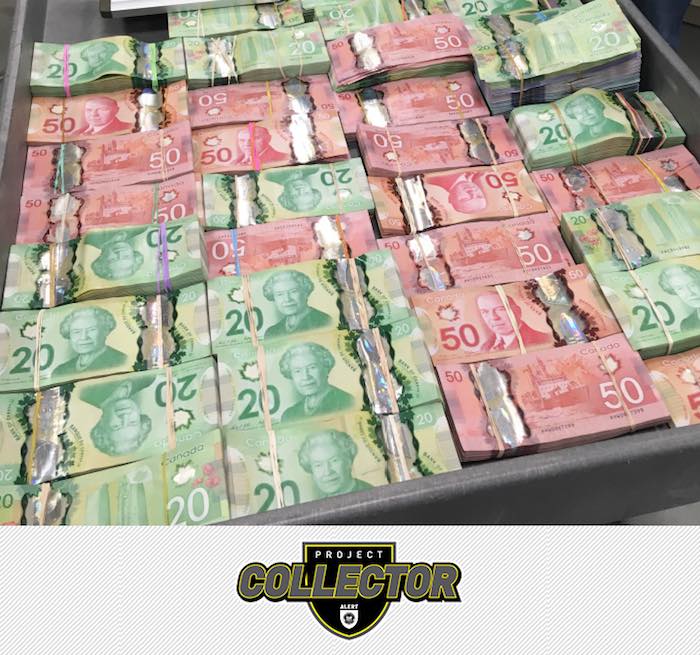

7 arrests. Police seize $16 million in cash, real estate, and vehicles from Alberta, BC money laundering operation

News release from ALERT (Alberta Law Enforcement Response Team)

Project Collector halts Cross-Canada money laundering

Calgary… A professional money laundering organization, working in support of some of Canada’s largest crime groups, has been dismantled following an unprecedented investigation by ALERT and the RCMP.

Project Collector is a three-year financial crime investigation conducted jointly between ALERT Calgary’s financial crime team and RCMP Federal Serious and Organized Crime (FSOC). The investigation began in Calgary and led to the dismantling of a nation-wide criminal organization involved in money laundering.

Seven suspects have been charged, with arrests taking place in Calgary and Vancouver. In addition, more than $16 million in bank accounts, real estate holdings, and vehicles have been placed under criminal restraint.

Proceeds of crime from some of Canada’s largest criminal organizations were allegedly being transported between Ontario, Alberta, and British Columbia. In a one-year period alone investigators identified the transfer of $24 million in cash, while the group’s money laundering activities date back to at least 2013.

Project Collector began in July 2018 after $1 million in cash, that was destined for Vancouver, was intercepted in Calgary. ALERT and RCMP launched an extensive investigation that relied heavily on intelligence from the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Project Collector revealed that the group operated pseudo-bank branches at either side of the country, which while holding large cash reserves, allowed organized crime groups utilizing its service to transfer funds while avoiding the detection of financial banking institutions and authorities. The money laundering was primarily connected back to drug trafficking proceeds.

In total, 71 criminal offences are being pursued against the money laundering organization. Charges include participation in a criminal organization, laundering proceeds of crime, and trafficking property obtained by crime. Charges were also laid under the Proceeds of Crime (Money Laundering) and Terrorist Financing Act.

The arrests took place in September 2022:

- Lien Ha, 42-year-old from Calgary,

- Donald Hoang, 26-year-old from Vancouver;

- Van Duc Hoang, 64-year-old from Vancouver;

- Van Thi Nguyen, 62-year-old from Vancouver;

- Cynthia Nguyen, 42-year-old from Calgary;

- Yuong Nguyen, 43-year-old from Calgary; and

- Grace Tang, 25-year-old from Vancouver.

During the course of the investigation, search warrants were executed at a total of 10 homes in the Calgary region, Toronto area, and Vancouver.

Project Collector relied on the assistance of a number of police agencies and specialized units, including: Calgary Police Service, Canada Revenue Agency, Financial Transactions and Reports Analysis Centre of Canada (FINTRAC), Forensic Accounting Management Group (FAMG), Vancouver Police, Toronto Police, Edmonton Police, Halton Police, Seized Property Management Directorate, and RCMP units in Ontario and British Columbia.

Members of the public who suspect drug or gang activity in their community can call local police, or contact Crime Stoppers at 1-800-222-TIPS (8477). Crime Stoppers is always anonymous.

ALERT was established and is funded by the Alberta Government and is a compilation of the province’s most sophisticated law enforcement resources committed to tackling serious and organized crime.

Alberta

Alberta judge sides with LGBT activists, allows ‘gender transitions’ for kids to continue

From LifeSiteNews

‘I think the court was in error,’ Alberta Premier Danielle Smith has said. ‘There will be irreparable harm to children who get sterilized.’

LGBT activists have won an injunction that prevents the Alberta government from restricting “gender transitions” for children.

On June 27, Alberta King’s Court Justice Allison Kuntz granted a temporary injunction against legislation that prohibited minors under the age of 16 from undergoing irreversible sex-change surgeries or taking puberty blockers.

“The evidence shows that singling out health care for gender diverse youth and making it subject to government control will cause irreparable harm to gender diverse youth by reinforcing the discrimination and prejudice that they are already subjected to,” Kuntz claimed in her judgment.

Kuntz further said that the legislation poses serious Charter issues which need to be worked through in court before the legislation could be enforced. Court dates for the arguments have yet to be set.

READ: Support for traditional family values surges in Alberta

Alberta’s new legislation, which was passed in December, amends the Health Act to “prohibit regulated health professionals from performing sex reassignment surgeries on minors.”

The legislation would also ban the “use of puberty blockers and hormone therapies for the treatment of gender dysphoria or gender incongruence” to kids 15 years of age and under “except for those who have already commenced treatment and would allow for minors aged 16 and 17 to choose to commence puberty blockers and hormone therapies for gender reassignment and affirmation purposes with parental, physician and psychologist approval.”

Just days after the legislation was passed, an LGBT activist group called Egale Canada, along with many other LGBT organizations, filed an injunction to block the bill.

In her ruling, Kuntz argued that Alberta’s legislation “will signal that there is something wrong with or suspect about having a gender identity that is different than the sex you were assigned at birth.”

She further claimed that preventing minors from making life-altering decisions could inflict emotional damage.

However, the province of Alberta argued that these damages are speculative and the process of gender-transitioning children is not supported by scientific evidence.

“I think the court was in error,” Alberta Premier Danielle Smith said on her Saturday radio show. “That’s part of the reason why we’re taking it to court. The court had said there will be irreparable harm if the law goes ahead. I feel the reverse. I feel there will be irreparable harm to children who get sterilized at the age of 10 years old – and so we want those kids to have their day in court.”

READ: Canadian doctors claim ‘Charter right’ to mutilate gender-confused children in Alberta

Overwhelming evidence shows that persons who undergo so-called “gender transitioning” procedures are more likely to commit suicide than those who are not given such irreversible surgeries. In addition to catering to a false reality that one’s sex can be changed, trans surgeries and drugs have been linked to permanent physical and psychological damage, including cardiovascular diseases, loss of bone density, cancer, strokes and blood clots, and infertility.

Meanwhile, a recent study on the side effects of “sex change” surgeries discovered that 81 percent of those who have undergone them in the past five years reported experiencing pain simply from normal movements in the weeks and months that followed, among many other negative side effects.

Alberta

Why the West’s separatists could be just as big a threat as Quebec’s

By Mark Milke

It is a mistake to dismiss the movement as too small

In light of the poor showing by separatist candidates in recent Alberta byelections, pundits and politicians will be tempted to again dismiss threats of western separatism as over-hyped, and too tiny to be taken seriously, just as they did before and after the April 28 federal election.

Much of the initial skepticism came after former Leader of the Opposition Preston Manning authored a column arguing that some in central Canada never see western populism coming. He cited separatist sympathies as the newest example.

In response, (non-central Canadian!) Jamie Sarkonak argued that, based upon Alberta’s landlocked reality and poll numbers (37 per cent Alberta support for the “idea” of separation with 25 per cent when asked if a referendum were held “today”), western separation was a “fantasy” that “shouldn’t be taken seriously.” The Globe and Mail’s Andrew Coyne, noting similar polling, opined that “Mr. Manning does not offer much evidence for his thesis that ‘support for Western secession is growing.’”

Prime Minister Mark Carney labelled Manning’s column “dramatic.” Toronto Star columnist David Olive was condescending. Alberta is “giving me a headache,” he wrote. He argued the federal government’s financing of “a $34.2-billion expansion of the Trans Mountain pipeline (TMX)” as a reason Albertans should be grateful. If not, wrote Olive, perhaps it was time for Albertans to “wave goodbye” to Canada.

As a non-separatist, born-and-bred British Columbian, who has also spent a considerable part of his life in Alberta, I can offer this advice: Downplaying western frustrations — and the poll numbers — is a mistake.

One reason is because support for western separation in at least two provinces, Alberta and Saskatchewan, is nearing where separatist sentiment was in Quebec in the 1970s.

In our new study comparing recent poll numbers from four firms (Angus Reid Institute, Innovative Research Group, Leger, and Mainstreet Research), the range of support in recent months for separation from Canada in some fashion is as follows, from low to high: Manitoba (6 per cent to 12 per cent); B.C. (nine per cent to 20 per cent); Saskatchewan (20 per cent to 33 per cent) and Alberta (18 per cent to 36.5 per cent). Quebec support for separation was in a narrow band between 27 per cent and 30 per cent.

What such polling shows is that, at least at the high end, support for separating from Canada is now higher in Saskatchewan and Alberta than in Quebec.

Another, even more revealing comparison is how western separatist sentiment now is nearing actual Quebec votes for separatism or separatist parties back five decades ago. The separatist Parti Québécois won the 1976 Quebec election with just over 41 per cent of the vote. In the 1980 Quebec referendum on separation, “only” 40 per cent voted for sovereignty association with Canada (a form of separation, loosely defined). Those percentages were eclipsed by 1995, when separation/sovereignty association side came much closer to winning with 49.4 per cent of the vote.

Given that current western support for separation clocks in at as much as 33 per cent in Saskatchewan and 36.5 per cent in Alberta, it begs this question: What if the high-end polling numbers for western separatism are a floor and not a ceiling for potential separatist sentiment?

One reason why western support for separation may yet spike is because of the Quebec separatist dynamic itself and its impact on attitudes in other parts of Canada. It is instructive to recall in 1992 that British Columbians opposed a package of constitutional amendments, the Charlottetown Accord, in a referendum, in greater proportion (68.3 per cent) than did Albertans (60.2 per cent) or Quebecers (56.7 per cent).

Much of B.C.’s opposition (much like in other provinces) was driven by proposals for special status for Quebec. It’s exactly why I voted against that accord.

Today, with Prime Minister Carney promising a virtual veto to any province over pipelines — and with Quebec politicians already saying “non” — separatist support on the Prairies may become further inflamed. And I can almost guarantee that any whiff of new favours for Quebec will likely drive anti-Ottawa and perhaps pro-separatist sentiment in British Columbia.

There is one other difference between historic Quebec separatist sentiment and what exists now in a province like Alberta: Alberta is wealthy and a “have” province while Quebec is relatively poor and a have-not. Some Albertans will be tempted to vote for separation because they feel the province could leave and be even more prosperous; Quebec separatist voters have to ask who would pay their bills.

This dynamic again became obvious, pre-election, when I talked with one Alberta CEO who said that five years ago, separatist talk was all fringe. In contrast, he recounted how at a recent dinner with 20 CEOs, 18 were now willing to vote for separation. They were more than frustrated with how the federal government had been chasing away energy investment and killing projects since 2015, and had long memories that dated back to the National Energy Program.

(For the record, they view the federal purchase of TMX as a defensive move in response to its original owner, Kinder Morgan, who was about to kill the project because of federal and B.C. opposition. They also remember all the other pipelines opposed/killed by the Justin Trudeau government.)

Should Canadians outside the West dismiss western separatist sentiment? You could do that. But it’s akin to the famous Clint Eastwood question: Do you feel lucky?

Mark Milke is president and founder of the Aristotle Foundation for Public Policy and co-author, along with Ven Venkatachalam, of Separatist Sentiment: Polling comparisons in the West and Quebec.

-

Alberta7 hours ago

Alberta7 hours agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Automotive1 day ago

Automotive1 day agoElectric vehicle sales are falling hard in BC, and it is time to recognize reality.

-

Automotive1 day ago

Automotive1 day agoPower Struggle: Electric vehicles and reality

-

Business9 hours ago

Business9 hours agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Business1 day ago

Business1 day agoTrump on Canada tariff deadline: ‘We can do whatever we want’

-

Crime9 hours ago

Crime9 hours agoSuspected ambush leaves two firefighters dead in Idaho

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoFDA Exposed: Hundreds of Drugs Approved without Proof They Work

-

Energy1 day ago

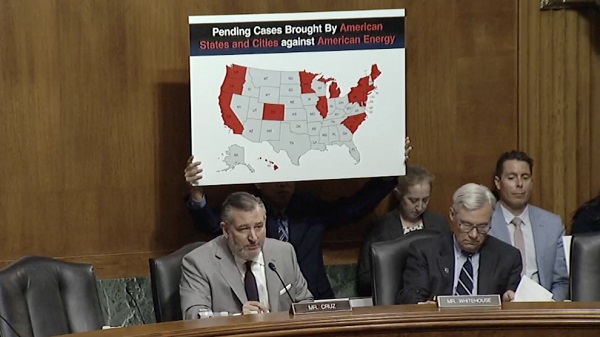

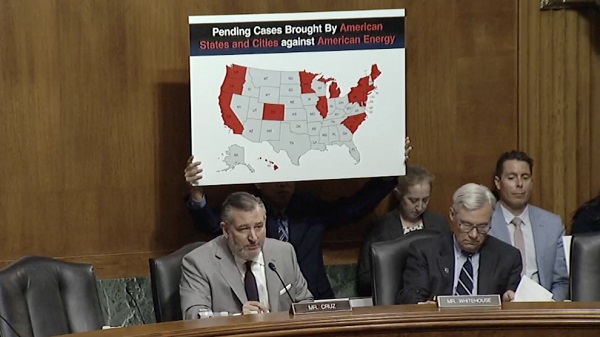

Energy1 day agoChina undermining American energy independence, report says