Alberta

25 facts about the Canadian oil and gas industry in 2023: Facts 11 to 15

From the Canadian Energy Centre

One of the things that really makes us Albertans, and Canadians is what we do and how we do it. It’s taking humanity a while to figure it out, but we seem to be grasping just how important access to energy is to our success. This makes it important that we all know at least a little about the industry that drives Canadians and especially Albertans as we make our way in the world.

The Canadian Energy Centre has compiled a list of 25 (very, extremely) interesting facts about the oil and gas industry in Canada. Over the 5 days we will post all 25 amazing facts, 5 at a time. Here are facts 11 to 15.

The Canadian Energy Centre’s 2023 reference guide to the latest research on Canada’s oil and gas industry

The following summary facts and data were drawn from 30 Fact Sheets and Research Briefs and various Research Snapshots that the Canadian Energy Centre released in 2023. For sources and methodology and for additional data and information, the original reports are available at the research portal on the Canadian Energy Centre website: canadianenergycentre.ca.

11. Breakeven costs in Canadian natural gas sector fifth lowest in the world

The Canadian natural gas sector had a weighted average breakeven gas price of US$2.31 per thousand cubic feet (mcf) in 2022, fifth lowest among major natural gas producing countries. Only in Saudi Arabia (US$1.09 per mcf), Iran (US$1.39 per mcf), Qatar (US$1.93 per mcf), and the United States (US$2.22 per mcf) was the breakeven gas price lower. The weighted average breakeven costs for Canada‘s natural gas sector in 2022 were lower than in Russia, Norway, Algeria, China, and Australia.

Source: Derived from Rystad Energy

12. Natural gas prices have skyrocketed

Natural gas prices have skyrocketed around the world in the last two years. In 2021, the price of natural gas in Asia was US$18.60 per million British thermal units (mmbtu) compared to US$4.40 per mmbtu in 2020—an increase of 323 per cent in just one year. By comparison, in 2021 natural gas sold for US$2.80 per mmbtu on Alberta’s AECO-C trading hub; in Asia it was US$15.88 per mmbtu more (or 564 per cent higher). Between 2019 and 2021, the price gap between Henry Hub in the US and AECO-C natural gas fluctuated from a high of 98 per cent in 2019 to a low of 26 per cent in 2020. In 2021, U.S. natural gas sold for US$3.84 per mmbtu, 40 per cent higher than the US$2.75 per mmbtu average price for AECO-C natural gas that year.

Sources: BP Statistical Review of World Energy and International Monetary Fund

13. Projected government revenues from the Canadian natural gas sector: over US$227 billion through 2050

Government revenues from the Canadian natural gas sector are projected to reach over US$227 billion through 2050. Under a Henry Hub price for natural gas of US$3.00 per thousand cubic feet (kcf), government revenues from the country’s natural gas sector are expected to rise from US$1.4 billion in 2023 to US$3.4 billion in 2050. Should the Henry Hub price reach US$4.00 per kcf, government revenues from the country’s natural gas sector would be projected to rise from US$2.0 billion in 2023 to US$10.0 billion in 2050.

Source: Derived from Rystad Energy

14. Small business plays a key role in the oil and gas sector

Small business plays a key job creation role in Canada’s economy. Statistics Canada defines small businesses as those with between one and 99 paid employees. Medium-size enterprises are those with 100 to 499 employees, while large enterprises have 500 or more employees. In 2022, of the oil and gas firms in Canada, 96.0 per cent were small, 3.5 per cent were medium-sized, and 0.6 per cent were large companies.

With the exception of construction, the oil and gas sector in Canada has a higher proportion of small businesses than other major industries. As of 2022, 96.0 per cent of all oil and gas energy firms had between 1 and 99 employees compared with 93.2 per cent in manufacturing, 89.6 per cent in utilities, and 99.0 per cent in the construction sector. The all-industry average is 98.0 per cent.

Source: Authors’ calculation based on Statistics Canada Table 33-10-0661-01

15. Canada’s oil and gas sector has an impact on key industries across the Canadian economy

In 2019, the activities of the Canadian oil and gas sector were indirectly responsible for significant portions of the GDP created by other key industries across Canada. The sector’s activities generated $100.9 million in GDP in the food and beverage merchant wholesalers industry that year and nearly $4.1 billion in GDP in architectural, engineering, and related services. In 2019, the top five industries whose GDP was most affected by their association with Canada’s oil and gas sector included:

- Architectural, engineering, and related services: $4.1 billion

- Machinery, equipment, and supplies merchant wholesalers: $3.4 billion

- Banking and other depository credit intermediation: $2.1 billion

- Computer systems design and related services: $1.7 billion

- Electrical power generation, transmission, and distribution: $1.5 billion

Source: Statistics Canada

CEC Research Briefs

Canadian Energy Centre (CEC) Research Briefs are contextual explanations of data as they relate to Canadian energy. They are statistical analyses released periodically to provide context on energy issues for investors, policymakers, and the public. The source of profiled data depends on the specific issue. This research brief is a compilation of previous Fact Sheets and Research Briefs released by the centre in 2023. Sources can be accessed in the previously released reports. All percentages in this report are calculated from the original data, which can run to multiple decimal points. They are not calculated using the rounded figures that may appear in charts and in the text, which are more reader friendly. Thus, calculations made from the rounded figures (and not the more precise source data) will differ from the more statistically precise percentages we arrive at using the original data sources.

About the author

This CEC Research Brief was compiled by Ven Venkatachalam, Director of Research at the Canadian Energy Centre.

Acknowledgements

The author and the Canadian Energy Centre would like to thank and acknowledge the assistance of an anonymous reviewer for the review of this paper.

Alberta

Central Alberta MP resigns to give Conservative leader Pierre Poilievre a chance to regain a seat in Parliament

From LifeSiteNews

Conservative MP Damien Kurek stepped aside in the Battle River-Crowfoot riding to allow Pierre Poilievre to enter a by-election in his native Alberta.

Conservative MP Damien Kurek officially resigned as an MP in the Alberta federal riding of Battle River-Crowfoot in a move that will allow Conservative Party of Canada leader Pierre Poilievre to run in a by-election in that riding to reclaim his seat in Parliament.

June 17 was Kurek’s last day as an MP after he notified the House Speaker of his resignation.

“I will continue to work with our incredible local team to do everything I can to remain the strong voice for you as I support Pierre in this process and then run again here in Battle River-Crowfoot in the next general election,” he said in a statement to media.

“Pierre Poilievre is a man of principle, character, and is the hardest working MP I have ever met,” he added. “His energy, passion, and drive will have a huge benefit in East Central Alberta.”

Kurek won his riding in the April 28 election, defeating the Liberals by 46,020 votes with 81.8 percent of the votes, a huge number.

Poilievre had lost his Ottawa seat to his Liberal rival, a seat that he held for decades, that many saw as putting his role as leader of the party in jeopardy. He stayed on as leader of the Conservative Party.

Poilievre is originally from Calgary, Alberta, so should he win the by-election, it would be a homecoming of sorts.

It is now up to Prime Minister of Canada Mark Carney to call a by-election in the riding.

Carney had promised that he would “trigger” a by-election at once, saying there would be “no games” trying to prohibit Poilievre from running and win a seat in a safe Conservative riding.

Despite Kurek’s old seat being considered a “safe” seat, a group called the “Longest Ballot Committee” is looking to run hundreds of protest candidates against Poilievre in the by-election in the Alberta Battle River–Crowfoot riding, just like they did in his former Ottawa-area Carleton riding in April’s election.

Alberta

Alberta pro-life group says health officials admit many babies are left to die after failed abortions

From LifeSiteNews

Alberta’s abortion policy allows babies to be killed with an ‘induced cardiac arrest’ before a late-term abortion and left to die without medical care if they survive.

A Canadian provincial pro-life advocacy group says health officials have admitted that many babies in the province of Alberta are indeed born alive after abortions and then left to die, and because of this are they are calling upon the province’s health minister to put an end to the practice.

Official data from the Canadian Institute for Health Information (CIHI), which is the federal agency in charge of reporting the nation’s health data, shows that in Alberta in 2023-2024, there were 133 late-term abortions. Of these, 28 babies were born alive after the abortion and left to die.

As noted by Prolife Alberta’s President Murray Ruhl in a recent email, this means the reality in the province is that “some of these babies are born alive… and left to die.”

“Babies born alive after failed late-term abortions are quietly abandoned—left without medical help, comfort, or even a chance to survive,” noted Ruhl.

This fact was brought to light in a recent opinion piece published in the Western Standard by Richard Dur, who serves as the executive director of Prolife Alberta.

Ruhl observed that Dur’s opinion piece has “got the attention of both Alberta Health Services (AHS) and Acute Care Alberta (ACA),” whom he said “confirmed many of the practices we exposed.”

Alberta’s policy when it comes to an abortion committed on a baby older than 21 weeks allows that all babies are killed before being born, however this does not always happen.

“In some circumstances… the patient and health practitioner may consider the option of induced fetal cardiac arrest prior to initiating the termination procedures,” notes Alberta Health Services’ Termination of Pregnancy, PS-92 (PS-92, Section 6.4).

Ruhl noted that, in Alberta, before an “abortion begins, they stop the baby’s heart. On purpose. Why? Because they don’t want a live birth. But sometimes—the child survives. And what then?”

When it comes to the same policy for babies older that 21 weeks, the policy states, “For terminations after 21 weeks and zero (0) days there must be careful consideration and documentation concerning a Do Not Resuscitate order in anticipation of a possible live birth.” (PS-92, Section 6.4).”

Ruhl observed that the reality is, “They plan in advance not to save her—even if she’s born alive.”

If the baby is born alive, the policy states, “Comfort measures and palliative care should be provided.” (PS-92, Section 6.4).

This means, however, that there is no oxygen given, no NICU, “no medical care,” noted Ruhl.

“Their policies call this ‘palliative care.’ We call it what it is: abandonment. Newborns deserve care—not a death sentence,” he noted.

As reported by LifeSiteNews recently, a total of 150 babies were born after botched abortions in 2023-2024 in Canada. However, it’s not known how many survived.

Only two federal parties in Canada, the People’s Party of Canada, and the Christian Heritage Party, have openly called for a ban on late abortions in the nation.

Policy now under ‘revision’ says Alberta Health Services

Ruhl said that the province’s policies are now “under revision,” according to AHS.

Because of this, Ruhl noted that now is the time to act and let the province’s Health Minister, Adriana LaGrange, who happens to be pro-life, act and “demand” from her real “action to protect babies born alive after failed abortions.”

The group is asking the province to do as follows below:

- Amend the AHS Termination of Pregnancy policy to require resuscitative care for any baby born with signs of life, regardless of how the birth occurred.

- Require that these newborns receive the same level of care as any other premature baby. Newborns deserve care—not a death sentence.

- Recognize that these babies have a future—there is a literal waiting list of hundreds of families ready to adopt them. There is a home for every one of them.

While many in the cabinet and caucus of Alberta Premier Danielle Smith’s United Conservative government are pro-life, she has still been relatively soft on social issues of importance to conservatives, such as abortion.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoWOKE NBA Stars Seems Natural For CDN Advertisers. Why Won’t They Bite?

-

Crime1 day ago

Crime1 day agoUK finally admits clear evidence linking Pakistanis and child grooming gangs

-

Health1 day ago

Health1 day agoLast day and last chance to win this dream home! Support the 2025 Red Deer Hospital Lottery before midnight!

-

conflict14 hours ago

conflict14 hours agoTrump: ‘We’ have control over Iranian airspace; know where Khomeini is hiding

-

Business1 day ago

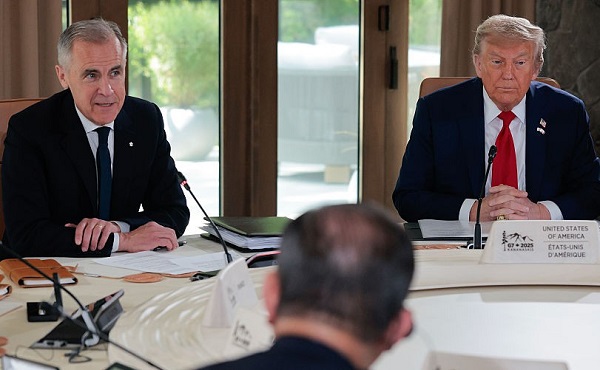

Business1 day agoCarney praises Trump’s world ‘leadership’ at G7 meeting in Canada

-

Energy2 days ago

Energy2 days agoCould the G7 Summit in Alberta be a historic moment for Canadian energy?

-

Crime2 days ago

Crime2 days agoMinnesota shooter arrested after 48-hour manhunt

-

conflict1 day ago

conflict1 day agoIsrael bombs Iranian state TV while live on air