International

10 reasons Donald Trump is headed for a landslide victory over Kamala Harris

From LifeSiteNews

By Stephen Kokx

Republicans voting early, Democrats’ dislike for Kamala Harris, and polling and gambling numbers are all signs that the former president will win the election.

There is one week left in the presidential race and by all indications Donald Trump is headed for a landslide victory.

Many people I talk to tell me that they are fearful that it will be stolen from him. Here’s why I don’t think that’s likely at this point.

First, there are more registered Republicans in battleground states like Pennsylvania, North Carolina, and elsewhere than there were four years ago. This is a built-in statistical advantage for Trump.

🚨 BREAKING: LAST-MINUTE PENNSYLVANIA GOP SURGE in voter registration for the last week.

🔴 REP: +36,507

🔵 DEM: +19,744Per @UPTGOP, these are *backlogged* registrations.

— Eric Daugherty (@EricLDaugh) October 28, 2024

North Carolina 🌄

Mail: 134,428 ballots

Early In-Person: 2,162,661 ballotsBallots by party registration:

🔴 Republican 34.3% | 789,048 votes (+102,419)

🔵 Democratic 33.6% | 772,899 votes (+89,634)

⚪️ Other 32.1% | 735,142 votes (+96,868) pic.twitter.com/OoYfaa79ER— VoteHub (@VoteHubUS) October 25, 2024

Second, early voting and mail-in voting show that more Republicans are casting their ballots before Election Day than Democrats this year, which has not been the case in previous presidential races.

ELECTION ALERT: Nevada GOP leads Democrats in early vote and absentee balloting by a statewide margin of 32,000

— Election Wizard (@ElectionWiz) October 28, 2024

BREAKING: Pennsylvania Voter Registration Update 10/28 Shows Massive Surge for GOP

🟥GOP: +36,507 (+16,763)

🟦DEM: +19,744*This marks the new best single week of 2024, beating the records from the last two weeks.

— Election Wizard (@ElectionWiz) October 28, 2024

Through 11 days of early voting in NC, Republicans still lead for the first time ever. Democrat ballots are down 350,000 versus 2020.

A sweeping Republican victory is at hand IF WE: keep voting, vote early, and volunteer to GOTV. https://t.co/O53s2yhmBY#ncpol pic.twitter.com/CSRDd1CKUj

— Dan Bishop (@danbishopnc) October 28, 2024

The Trump county of Waukesha, Wisconsin has a higher mail-in ballot return rate than deep-blue Dane.

The red county of Brown has a higher return rate than Blue Milwaukee.

— Eric Daugherty (@EricLDaugh) October 28, 2024

Analyst Mark Halperin has predicted that if those trends continue, Trump will be declared the winner relatively early after polls close next Tuesday.

BREAKING: Donald Trump is set to become the next president of the United States, early voting data reveals.

This stunning revelation comes from veteran political journalist Mark Halperin.

“Make no mistake,” Halperin says, “if these numbers hold up in the states where we can… pic.twitter.com/eVGpxJYT5t

— The Vigilant Fox 🦊 (@VigilantFox) October 23, 2024

Third, key Democratic voting blocs aren’t enthusiastic about Harris, especially black and Hispanic men, who Trump has made historic gains with.

Dekalb in GA is at 38.7 percent turnout

White turnout in Dekalb is 50.4 and black turnout is 35.8

Population of Dekalb

Black (non-Hispanic): 53.7%

White (non-Hispanic): 29.6%Vote share :

Black – 43.6%

White – 38.69%White voteshare is outperforming black relative to their…

— Indian American Voice (@Freespeech212) October 26, 2024

That fact was recognized by Barack Obama a week ago when he told the media that “the brothas” do not have the same “energy” for Harris as they did when he himself ran for president.

Barack Obama SOUNDS THE ALARM, says energy is down with black men:

“That seems to be more pronounced with the brothers…”

He then says black men should vote for Kamala because she knows the “struggles” of being black.

Pure identity politics from Obama. pic.twitter.com/LvlSUVZKBx

— Charlie Kirk (@charliekirk11) October 11, 2024

Obama’s comment did not go unnoticed. During an MSNBC town hall at a barbershop in Philadelphia, black males told reporter Alex Wagner they were “offended” by Obama lecturing them how to vote.

@WagnerTonight visits a West Philadelphia barbershop to talk with Black men about the role gender plays in the 2024 election, Obama’s recent remarks and their thoughts on supporting Kamala Harris. pic.twitter.com/HM4qpRIBKl

— MSNBC (@MSNBC) October 23, 2024

Left-wing MSNBC anchor Andrea Mitchell has also admitted that Harris has a “big problem with men,” as have other websites.

Fourth, if you look at where Trump is campaigning this week, you can only conclude that his internal polling indicates he has shored up enough support in key battleground states that he can afford to go elsewhere to expand the map.

To be sure, he will still be visiting Wisconsin, North Carolina, and other Midwestern states over the next seven days, but he’s also headed to New Mexico, where, according to one poll he is within the margin of error.

Recent polling shows that 45th President Donald Trump is closing in on Democratic candidate Vice President Kamala Harris, with just a three-point difference between them in the latest KA Consulting poll.

Trump is polling at 46% while Harris holds 49%, but the margin of error of… pic.twitter.com/D0223eyJdX

— Republican Party of New Mexico (@NewMexicoGOP) October 22, 2024

Trump’s decision is notable because New Mexico hasn’t voted for a Republican president since George Bush in 2004. Mark Halperin has said, “if Trump wins New Mexico, he’s going to win in a landslide.”

🚨 New Mexico is within the margin of error for Trump… It would be first Republican to win the presidential race in NM in 20 years.

It’s happening… History is meant to be broken! pic.twitter.com/bvaqPk9wDC

— Gunther Eagleman™ (@GuntherEagleman) October 22, 2024

Trump is also headed to Virginia, another historically Democrat state. Virginia elected Republican Glenn Youngkin in 2022. He is fighting to prevent illegal immigrants from voting and has instituted a number of other reforms that will likely have the effect of ensuring the count is accurate.

Trump’s daughter-in-law, Lara Trump, appeared with Youngkin in the state last week. It’s clear the campaign believes he has a chance there.

🚨 NEW 2024 Virginia GENERAL ELECTION POLL: QUANTUS INSIGHTS 🚨

🔵 Harris: 49%

🔴 Trump: 48%

🟡 Other: 3%725 LV | Oct 22-24 | MoE 3.6%

Sponsored by: Trending Politics NewsCross tabs and full report at 2pm CST. pic.twitter.com/5jsSo8doUT

— Quantus Insights (@QuantusInsights) October 25, 2024

Fifth, almost all polling data in recent days, even those from left-leaning organizations, shows a decisive break in Trump’s favor.

Trump now leads in all seven swing states according to the Real Clear Politics average.

This is a trend that began shortly after the vice presidential debate.

And if you’re somehow in the camp that Kamala’s interview with Fox News somehow helped her, good luck with that. pic.twitter.com/RpDIE5u1mS

— Joe Concha (@JoeConchaTV) October 17, 2024

Harris’ decision to skip the Al Smith Dinner and her awful appearances on Fox, MSNBC, and her CNN town hall with Anderson Cooper are likely to blame.

NEW: CNN’s Scott Jennings says Kamala Harris is a “double-threat” because she can’t think on her feet and can’t answer the expected questions.

CNN has railed on Harris after her town hall event.

Here are the top reactions:

6. Axelrod: She is word salad city.

5. Jennings:… pic.twitter.com/Mdrr46uzbz

— Collin Rugg (@CollinRugg) October 24, 2024

The “vibe shift,” as Tucker Carlson has called it, has been so dramatic that even liberal outlets like CNN are admitting that Trump very may well capture the popular vote.

🚨 CNN ANALYST: Trump has a real shot at winning the national popular vote. This is something he'd love to do. It would be historic.pic.twitter.com/oOADpzlJzm

— Eric Daugherty (@EricLDaugh) October 25, 2024

Michigan and New Hampshire are also states he has improved in in recent days.

#NEW MICHIGAN poll

🔴 Trump 50% (+1)

🔵 Harris 49%Last poll: Harris +1

Patriot Polling | 10/24-26 | N=796RV

— Eric Daugherty (@EricLDaugh) October 28, 2024

Starting to remind me a lot of the eve of 2016. Except this time he actually leads the other battlegrounds… https://t.co/ZIlxkBI2h1

— Eric Daugherty (@EricLDaugh) October 28, 2024

NEW HAMPSHIRE

Praecones Analytica / @NewHampJournal poll:Trump 50.2% (+0.4)

Harris 49.8%622 RV, 10/24-26

— Political Polls (@Politics_Polls) October 28, 2024

At least in 2020 there was a plausible explanation for Joe Biden’s supposed victory as many polls showed he was ahead going into Election Day. This time around, that argument is not on the table.

Sixth, Democrats have no end game. They are trying to link Trump to “fascism.” This is an awful closing message, especially for a candidate who promised to “unite” Americans. This shows how desperate they are.

Hillary Clinton, for example, went on MSNBC and laughably claimed Trump’s epic Madison Square Garden rally Sunday night was a Neo-Nazi rally. Why she didn’t use the term “deplorables” is beyond me.

Hillary Clinton popped up just in time to call (over) half the country, N*zis.

She says President Donald Trump is going to Madison Square Garden in my city—New York City—to re-enact the 1939 Madison Square Garden N*zi rally.

What an irresponsible and reprehensible thing to say. pic.twitter.com/1ZfCa7HHlc

— Rudy W. Giuliani (@RudyGiuliani) October 25, 2024

During its own coverage of the event, MSNBC ludicrously compared it a pro-Hitler gathering there in 1939 while failing to note that Bill Clinton himself accepted the Democratic Party’s nomination at the same arena in 1992.

NEW: MSNBC directly compares Donald Trump's Madison Square Garden rally to a 1939 N*zi rally, directly compares Donald Trump to Adolf H*tler.

You don't hate the media enough.

"But that jamboree happening right now, you see it there on your screen in that place is particularly… pic.twitter.com/iGY6Mph4Ms

— Collin Rugg (@CollinRugg) October 28, 2024

President Bill Clinton attending his Nazi Rally at Madison Square Garden in 1992. pic.twitter.com/gSqhlKBfLZ

— Dustin Grage (@GrageDustin) October 27, 2024

Even ABC’s Jonathan Karl couldn’t deny that the rally was a pivotal moment in the campaign.

“Trump has created a movement, there is no doubt. I cannot think of another Republican figure of my lifetime who could’ve come into a Democrat city like New York and put together anything like that,” he said.

ABC’s Jonathan Karl: "Madison Square Garden was PACKED… Trump has created a movement, there is no doubt. I cannot think of another Republican figure of my lifetime who could've come into a Democrat city like New York and put together anything like that." pic.twitter.com/ZrYuvHV9jw

— Charlie Kirk (@charliekirk11) October 28, 2024

Conservative Charlie Kirk has theorized that the constant Hitler references are intentional, and that Democrats are laying the groundwork for yet another assassination attempt.

The purpose of the Hitler messaging is very simple.

They want to create permission for someone to try and murder Trump while also creating urgency for their rank and file to commit micro actions of fraud on the ground.

If you believe you are actually running against Hitler,…

— Charlie Kirk (@charliekirk11) October 28, 2024

Only a campaign that realizes it is on its death bed does such desperate things.

Seventh, Democrats are admitting that Trump is doing exceptionally well.

Left-wing New York City Mayor Eric Adams told the press this weekend that Trump is not a fascist.

NYC mayor Eric Adams says Trump isn’t a fascist, rebukes comparing him to Hitler, says Trump should be able to safely have his rally at Madison Square Garden, condemns overheated rhetoric of fascism. This is well said: pic.twitter.com/2ExCPKiIqi

— Clay Travis (@ClayTravis) October 27, 2024

Progressive commentator Cenk Uygar commented that Trump “looked presidential and personable” during his Joe Rogan interview. He called Harris a robot who acts like a “talking point machine.”

WATCH: Even Cenk Uygur admits that Trump's podcast with Joe Rogan was amazing.

"I thought Trump looked presidential and personable. I hate that, but he did… Standard politicians including Kamala Harris are talking point machines, that's not what Trump is doing.

"He doesn't… pic.twitter.com/t30GypxSsF

— George (@BehizyTweets) October 28, 2024

Former CNN anchor Chris Cuomo, who relentlessly pushed the COVID shot and is now injured from receiving it, hosted a town hall with JD Vance on News Nation. Cuomo could not deny that Vance and Trump appeal to many ordinary voters.

Here’s my take on what just happened in my town hall with JD Vance. pic.twitter.com/yL47loL6vm

— Christopher C. Cuomo (@ChrisCuomo) October 25, 2024

If Adams, Uygar, and Cuomo are admitting this, then regular Americans, even those who have supported Democrats in the past, are thinking it too.

Eighth, the betting markets favor Trump.

BREAKING: Donald Trump winning in all the swing states as per betting markets. pic.twitter.com/UQHpAlvPRy

— DogeDesigner (@cb_doge) October 27, 2024

Alright, so this is a pretty unscientific way to gauge an election, but money talks, does it not?

If the oddsmakers are hedging their bets and predicting a Trump win, then chances are they know what they are doing. If they didn’t, they’d be out of business. I don’t think it is realistic to think they are up to some sinister game by tinkering with the numbers right now given all the other trends mentioned above.

Ninth, there is no obvious explanation for a Harris victory if a steal were to occur, as there is no voting bloc she can point to right now that could win the election for her.

Over the past two months, Trump has enlisted a small army of politicians, influencers, and media personalities to cast as wide a net for him as possible.

While Tucker Carlson is out riling up young male voters, Robert F. Kennedy Jr. is courting moderate Democrats and health-conscious medical freedom activists.

What’s more, while Tulsi Gabbard is on the stump speaking with women, Elon Musk is making it easier for tech executives and business owners to support Trump.

What segment of the voting population is left for Harris to convince in this last week of the campaign? The sponge has been rung dry and the constant heckling of her at her rallies suggests folks have grown tired of her constant lies and evasiveness.

Tenth, there is no “October Surprise” that could derail Trump’s campaign at this point, especially with voting already underway.

Trump has been in the public spotlight for well over 40 years. He is a known entity, and the American people are preferring him — yet again — to the Democratic option, despite his personal flaws and scandals.

It is simply not possible for Harris to get the polls to go back to even and then rally not just the Democratic base but crucial independent voters next Tuesday.

As Carlson said at a rally in Georgia last week, if the Deep State does cheat and Harris is declared the winner, the people won’t put up with it this time. It will be too obvious that it was fraudulent as all the traditional indicators show she is headed for an historic defeat. I could be wrong, and I have been before, but I’m more inclined today to place a bet on Trump on one of those websites than Harris.

Economy

Trump opens door to Iranian oil exports

This article supplied by Troy Media.

U.S. President Donald Trump’s chaotic foreign policy is unravelling years of pressure on Iran and fuelling a surge of Iranian oil into global markets. His recent pivot to allow China to buy Iranian crude, despite previously trying to crush those exports, marks a sharp shift from strategic pressure to transactional diplomacy.

This unpredictability isn’t just confusing allies—it’s transforming global oil flows. One day, Trump vetoes an Israeli plan to assassinate Iran’s supreme leader, Ayatollah Khamenei. Days later, he calls for Iran’s unconditional surrender. After announcing a ceasefire between Iran, Israel and the United States, Trump praises both sides then lashes out at them the next day.

The biggest shock came when Trump posted on Truth Social that “China can now continue to purchase Oil from Iran. Hopefully, they will be purchasing plenty from the U.S., also.” The statement reversed the “maximum pressure” campaign he reinstated in February, which aimed to drive Iran’s oil exports to zero. The campaign reimposes sanctions on Tehran, threatening penalties on any country or company buying Iranian crude,

with the goal of crippling Iran’s economy and nuclear ambitions.

This wasn’t foreign policy—it was deal-making. Trump is brokering calm in the Middle East not for strategy, but to boost American oil sales to China. And in the process, he’s giving Iran room to move.

The effects of this shift in U.S. policy are already visible in trade data. Chinese imports of Iranian crude hit record levels in June. Ship-tracking firm Vortexa reported more than 1.8 million barrels per day imported between June 1 and 20. Kpler data, covering June 1 to 27, showed a 1.46 million bpd average, nearly 500,000 more than in May.

Much of the supply came from discounted May loadings destined for China’s independent refineries—the so-called “teapots”—stocking up ahead of peak summer demand. After hostilities broke out between Iran and Israel on June 12, Iran ramped up exports even further, increasing daily crude shipments by 44 per cent within a week.

Iran is under heavy U.S. sanctions, and its oil is typically sold at a discount, especially to China, the world’s largest oil importer. These discounted barrels undercut other exporters, including U.S. allies and global producers like Canada, reducing global prices and shifting power dynamics in the energy market.

All of this happened with full knowledge of the U.S. administration. Analysts now expect Iranian crude to continue flowing freely, as long as Trump sees strategic or economic value in it—though that position could reverse without warning.

Complicating matters is progress toward a U.S.-China trade deal. Commerce Secretary Howard Lutnick told reporters that an agreement reached in May has now been finalized. China later confirmed the understanding. Trump’s oil concession may be part of that broader détente, but it comes at the cost of any consistent pressure on Iran.

Meanwhile, despite Trump’s claims of obliterating Iran’s nuclear program, early reports suggest U.S. strikes merely delayed Tehran’s capabilities by a few months. The public posture of strength contrasts with a quieter reality: Iranian oil is once again flooding global markets.

With OPEC+ also boosting output monthly, there is no shortage of crude on the horizon. In fact, oversupply may once again define the market—and Trump’s erratic diplomacy is helping drive it.

For Canadian producers, especially in Alberta, the return of cheap Iranian oil can mean downward pressure on global prices and stiffer competition in key markets. And with global energy supply increasingly shaped by impulsive political decisions, Canada’s energy sector remains vulnerable to forces far beyond its borders.

This is the new reality: unpredictability at the top is shaping the oil market more than any cartel or conflict. And for now, Iran is winning.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Banks

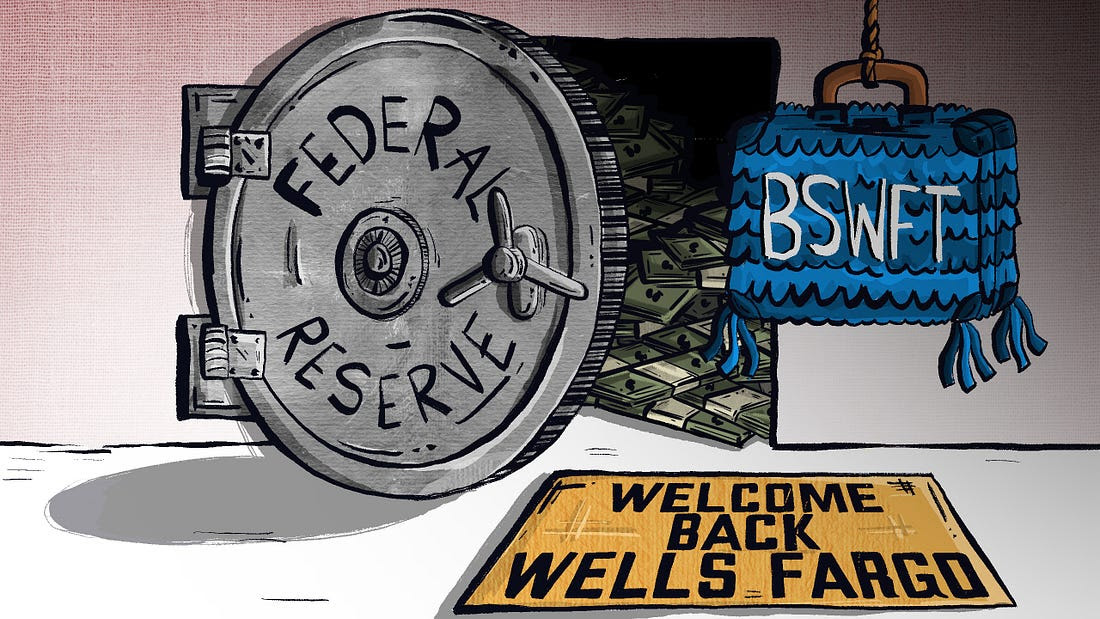

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

-

Opinion1 day ago

Opinion1 day agoBlind to the Left: Canada’s Counter-Extremism Failure Leaves Neo-Marxist and Islamist Threats Unchecked

-

Business2 days ago

Business2 days agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Alberta1 day ago

Alberta1 day agoAlberta Provincial Police – New chief of Independent Agency Police Service

-

Alberta2 days ago

Alberta2 days agoPierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

-

COVID-191 day ago

COVID-191 day agoTop COVID doctor given one of Canada’s highest honors

-

Business2 days ago

Business2 days agoLatest shakedown attempt by Canada Post underscores need for privatization

-

MxM News2 days ago

MxM News2 days agoUPenn strips Lia Thomas of women’s swimming titles after Title IX investigation

-

Agriculture8 hours ago

Agriculture8 hours agoCanada’s supply management system is failing consumers