Alberta

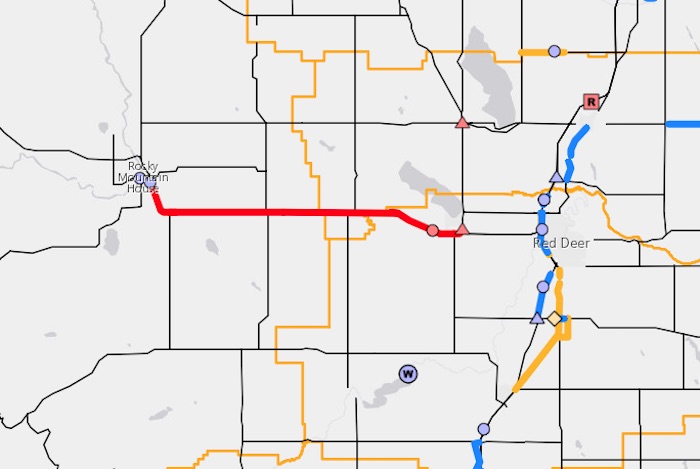

Alberta 2023 budget plows ahead with twinning highway 11 from Sylvan Lake to Rocky Mountain House

Building Alberta’s economic corridor network

Budget 2023 includes strategic investments in Alberta’s highway network to build economic corridors, creating jobs, improving safety and supporting economic development.

Budget 2023 includes $8 billion for the Ministry of Transportation and Economic Corridors’ three-year capital plan, a $718-million increase compared with Budget 2022.

“Budget 2023 is focused on securing Alberta’s future by growing the economy. Our investments will enhance economic corridors that provide vital links to markets in and out of Alberta, helping our industries expand and succeed. These projects will increase the safety and efficiency of our provincial highway network, improving travel for Albertans and commercial carriers in key industries.”

The total capital investment is $2 billion for planning, design and construction of major highway and bridge projects. This work focuses on improving traffic flow and supporting investments in the province’s major trade corridors. Examples of projects across the province that are receiving funding include the Calgary and Edmonton ring roads, Highway 3 twinning, Highway 11 twinning, and replacing the Highway 2 and Highway 556 interchange at Balzac. This capital investment funding also includes $75.5 million over three years for 23 engineering or planning projects to address known future needs.

“Budget 2023 is investing in Alberta drivers through improvements to Highway 60 through Acheson. These improvements will help families save time on their commute while improving the efficient movement of goods across the province. Budget 2023 also responds to safety concerns from the community with a new intersection at Highway 16A and Range Road 20 in Parkland County. The new intersection will not only help area residents get to and from home safely but will also improve traffic flow along this major economic corridor.”

“Highway 63, north of Fort McMurray, is a critical link in northern Alberta for oversize and overweight vehicles transporting goods for the energy sector. Twinning this highway will improve efficiency and safety for both commercial drivers and commuters. It also enables oilsands workers to more easily commute from Fort McMurray, which we know provides a healthier lifestyle for them and their families as opposed to flying from out of province and living in a camp. The workers who decide to make this move will see the benefits of living in such an amazing province like Alberta.”

“Alberta’s Industrial Heartland Association is pleased that the 55-year-old Vinca Bridge replacement is included in the Government of Alberta’s 2023 budget. As a vital component of Alberta’s high-load corridor and a strategic connector in Alberta’s Industrial Heartland, the bridge services a thriving industrial zone with over $45 billion in total capital investment and billions more expected in the coming years. Replacing Vinca Bridge will shorten travel times, reduce greenhouse gas emissions and enhance the competitiveness of both the Industrial Heartland and the manufacturing supply chain that contributes to its success.”

“We have been advocating hard for twinning and rail grade separation for Highway 60, and we are pleased to see this commitment from the Government of Alberta. Acheson is not only the beating, industrial heart of Parkland County, it is one of the largest industrial areas in Western Canada. Completing this work in a timely matter will improve access and movement along Highway 60 and allow for further development in Acheson, which will contribute to economic growth and job creation throughout Parkland County and the Edmonton region.”

“Representing hundreds of businesses in the Acheson area, the Acheson Business Association is thrilled with and would like to thank the Government of Alberta for this latest announcement for the twinning and rail grade separation for Highway 60. Highway 60 is an important connector of arterial highways, allowing products to move all directions through the metro Edmonton area, and the twinning and overpass will create a safer route for employees, travellers and business owners who are passing through this stretch of road every day. This will also enable the region to continue to attract more investors and businesses by reducing delays and eliminating congestion along this major trade corridor.”

Budget 2023 also includes $1.7 billion over three years for capital maintenance and renewal, which extends the life of the province’s existing road and bridge network and helps industry create and maintain jobs. These investments will allow the province to maintain existing roads and bridges to support safe and efficient travel to benefit Albertans and the economy.

Transportation and Economic Corridors will also be providing $3.9 billion for capital grants to municipalities over the next three years. This includes maintaining the funding commitment to Calgary and Edmonton for their LRT projects and continuing to provide funding for the Strategic Transportation Infrastructure Program to help municipalities improve critical local transportation infrastructure. Ongoing investments in water and wastewater infrastructure programs will also ensure all Albertans have reliable access to clean drinking water and effective wastewater services.

Additionally, Budget 2023 will provide nearly $400 million to support building and repairing water management infrastructure that provides irrigation for the agriculture sector and flood mitigation for Alberta communities such as the Springbank Off-stream Reservoir.

Budget 2023 secures Alberta’s future by transforming the health-care system to meet people’s needs, supporting Albertans with the high cost of living, keeping our communities safe and driving the economy with more jobs, quality education and continued diversification.

Alberta

Alberta government should create flat 8% personal and business income tax rate in Alberta

From the Fraser Institute

By Tegan Hill

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America

Over the past decade, Alberta has gone from one of the most competitive tax jurisdictions in North America to one of the least competitive. And while the Smith government has promised to create a new 8 per cent tax bracket on personal income below $60,000, it simply isn’t enough to restore Alberta’s tax competitiveness. Instead, the government should institute a flat 8 per cent personal and business income tax rate.

Back in 2014, Alberta had a single 10 per cent personal and business income tax rate. As a result, it had the lowest top combined (federal and provincial/state) personal income tax rate and business income tax rate in North America. This was a powerful advantage that made Alberta an attractive place to start a business, work and invest.

In 2015, however, the provincial NDP government replaced the single personal income tax rate of 10 percent with a five-bracket system including a top rate of 15 per cent, so today Alberta has the 10th-highest personal income tax rate in North America. The government also increased Alberta’s 10 per cent business income tax rate to 12 per cent (although in 2019 the Kenney government began reducing the rate to today’s 8 per cent).

If the Smith government reversed the 2015 personal income tax rate increases and instituted a flat 8 per cent tax rate, it would help restore Alberta’s position as one of the lowest tax jurisdictions in North America, all while saving Alberta taxpayers $1,573 (on average) annually.

And a truly integrated flat tax system would not only apply a uniform tax 8 per cent rate to all sources of income (including personal and business), it would eliminate tax credits, deductions and exemptions, which reduce the cost of investments in certain areas, increasing the relative cost of investment in others. As a result, resources may go to areas where they are not most productive, leading to a less efficient allocation of resources than if these tax incentives did not exist.

Put differently, tax incentives can artificially change the relative attractiveness of goods and services leading to sub-optimal allocation. A flat tax system would not only improve tax efficiency by reducing these tax-based economic distortions, it would also reduce administration costs (expenses incurred by governments due to tax collection and enforcement regulations) and compliance costs (expenses incurred by individuals and businesses to comply with tax regulations).

Finally, a flat tax system would also help avoid negative incentives that come with a progressive marginal tax system. Currently, Albertans are taxed at higher rates as their income increases, which can discourage additional work, savings and investment. A flat tax system would maintain “progressivity” as the proportion of taxes paid would still increase with income, but minimize the disincentive to work more and earn more (increasing savings and investment) because Albertans would face the same tax rate regardless of how their income increases. In sum, flat tax systems encourage stronger economic growth, higher tax revenues and a more robust economy.

To stimulate strong economic growth and leave more money in the pockets of Albertans, the Smith government should go beyond its current commitment to create a new tax bracket on income under $60,000 and institute a flat 8 per cent personal and business income tax rate.

Author:

Alberta

Province to stop municipalities overcharging on utility bills

Making utility bills more affordableAlberta’s government is taking action to protect Alberta’s ratepayers by introducing legislation to lower and stabilize local access fees. Affordability is a top priority for Alberta’s government, with the cost of utilities being a large focus. By introducing legislation to help reduce the cost of utility bills, the government is continuing to follow through on its commitment to make life more affordable for Albertans. This is in addition to the new short-term measures to prevent spikes in electricity prices and will help ensure long-term affordability for Albertans’ basic household expenses.

Local access fees are functioning as a regressive municipal tax that consumers pay on their utility bills. It is unacceptable for municipalities to be raking in hundreds of millions in surplus revenue off the backs of Alberta’s ratepayers and cause their utility bills to be unpredictable costs by tying their fees to a variable rate. Calgarians paid $240 in local access fees on average in 2023, compared to the $75 on average in Edmonton, thanks to Calgary’s formula relying on a variable rate. This led to $186 million more in fees being collected by the City of Calgary than expected.

To protect Alberta’s ratepayers, the Government of Alberta is introducing the Utilities Affordability Statutes Amendment Act, 2024. If passed, this legislation would promote long-term affordability and predictability for utility bills by prohibiting the use of variable rates when calculating municipalities’ local access fees. Variable rates are highly volatile, which results in wildly fluctuating electricity bills. When municipalities use this rate to calculate their local access fees, it results in higher bills for Albertans and less certainty in families’ budgets. These proposed changes would standardize how municipal fees are calculated across the province, and align with most municipalities’ current formulas.

If passed, the Utilities Affordability Statutes Amendment Act, 2024 would prevent municipalities from attempting to take advantage of Alberta’s ratepayers in the future. It would amend sections of the Electric Utilities Act and Gas Utilities Act to ensure that the Alberta Utilities Commission has stronger regulatory oversight on how these municipal fees are calculated and applied, ensuring Alberta ratepayer’s best interests are protected.

If passed, this legislation would also amend sections of the Alberta Utilities Commission Act, the Electric Utilities Act, Government Organizations Act and the Regulated Rate Option Stability Act to replace the terms “Regulated Rate Option”, “RRO”, and “Regulated Rate Provider” with “Rate of Last Resort” and “Rate of Last Resort Provider” as applicable. Quick facts

Related information |

-

Alberta2 days ago

Alberta2 days agoCoutts Three verdict: A warning to protestors who act as liaison with police

-

Alberta2 days ago

Alberta2 days agoAlberta moves to protect Edmonton park from Trudeau government’s ‘diversity’ plan

-

Energy2 days ago

Energy2 days agoCanada Has All the Elements to be a Winner in Global Energy — Now Let’s Do It

-

Freedom Convoy2 days ago

Freedom Convoy2 days agoOttawa spent “excessive” $2.2 million fighting Emergencies Act challenge

-

Brownstone Institute2 days ago

Brownstone Institute2 days agoA Coup Without Firing a Shot

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCoyotes Ugly: The Sad Obsession Of Gary Bettman

-

COVID-192 days ago

COVID-192 days agoWHO Official Admits the Truth About Passports

-

Energy2 days ago

Energy2 days agoAnti-LNG activists have decided that they now actually care for LNG investors after years of calling to divest