National

Canada’s NDP is now calling women ‘non-males’

From LifeSiteNews

This is all very amusing, but it poses a problem for the Conservative Party.

Has Canada become a two-party system? This is one of the key questions political strategists and MPs have been asking each other in Ottawa. In the past federal election, the New Democratic Party’s (NDP’s) support collapsed, with the progressive standard-bearer securing only 7 seats (12 are necessary for official party status) and getting only 6 percent of the popular vote. Both the Liberals and the Conservatives wonder—one with glee, the other with concern—if the NDP will survive.

The NDP, however, is filled with self-loathing for its blue collar, labor roots. It is now the party of “sexual diversity.” In September, interim leader Don Davies admitted that the party needed to recognize that there were differences between the interests of straight, white male workers and a non-white lesbian; the party then promptly demanded that at least 50 percent of the signatures collected for the leadership race be from NDP members who do not identify as a “cisgender male,” but from “equity-seeking groups” such as non-white people, Indigenous members, LGBTQ+ people, and people with disabilities.

“Cisgender” is LGBT-speak for someone who has a “gender identity” that “aligns” with their body; basically, it means someone who is not transgender. Or as the comedian Norm Macdonald noted, “cisgender” is a term used to stigmatize normal people.

The NDP did not learn from the combination of chortling and contempt that greeted this story; they take themselves far too seriously for that. In fact, they have lurched directly into another gender scandal. According to the UK Daily Mail, the NDP “has come under scrutiny for an email that appeared to be sent to members, announcing newly elected leaders as ‘non-male’ and ‘male.’” The email was shared on X by journalist Jonathan Kay:

The @NDP now apparently classifies its executive members in two categories: (1) NON-MALE, and (2) MALE pic.twitter.com/0S8Kq4kbRx

— Jonathan Kay (@jonkay) October 25, 2025

The email, which Kay screenshotted, was sent by the New Westminster-Burnaby-Maillardville chapter of the NDP and “detailed highlights from the party’s last annual general meeting. The new members who identified as ‘non-male’ were listed as Doris Mah, Alodie Yen, Agnes Jackman, Penny Oyama, and Marla Penner. The ‘male’ members were listed as Dante Abbey, Eric Van Fleet, Aidan McDonough, Peter Julian, and Kebebe Abate.”

Hilariously, the NDP—which struggles not to say that they resent being the party of the white working man and desperately want to be the party of intersectional two-spirited lesbianism instead—is now being accused of “erasing women” due to their linguistic kowtowing to the transgender movement. What is a woman? Well, the NDP can’t quite say. And so instead, they simply refer to “non-males,” which I’m sure seemed quite an efficient way to solve the problem to whoever made the list. Doris, Agnes, Marla, and Penny did not say whether they appreciated being downgraded from “women” to “non-males.”

This is all very amusing, but it poses a problem for the Conservative Party. With the NDP determined to offend as many voters as possible in their search for intersectionality, the Liberals—who are, in practice, just as woke but far more powerful—actually manage to look somewhat moderate. Mark Carney may show up at Vancouver Pride and hug a near-naked LGBT activist wearing nothing but a thong, but he doesn’t use the term “cisgender” or refer to women as “non-males.” But like Trudeau—who has left politics for Katy Perry—he does raise the LGBT flag over Parliament Hill every June.

The NDP continues their freefall. The Liberals are close behind them, but with an adult-looking central banker in charge. The Conservatives need to provide an alternative. If they need ideas, they might look to Premier Danielle Smith in Alberta, who, despite being non-male, has more guts than any of them.

National

Canadian MPs order ethics investigation into Mark Carney’s corporate interests

From LifeSiteNews

The House of Commons ethics committee voted to look into personal financial disclosures as well as blind trust arrangements made before Mark Carney became prime minister.

Canadian MPs voted to launch an ethics investigation of Liberal Prime Minister Mark Carney to look into whether or not there is a conflict of interest because of his personal “corporate and shareholding interests” while serving as the nation’s leader.

“The standard needs to be very high for people who want to serve in Canada’s highest office,” said Conservative MP Michael Barrett, who sponsored the motion.

“Canadians expect that. We need this transparency,” he added.

Conservative, NDP, and Bloc Québécois MPs all voted in favor in a 170-164 vote to pass Barrett’s motion calling for the probe. Green Party leader Elizabeth May was the only non-Liberal MP to vote against the motion, joining all Liberal MPs.

The motion asks the House of Commons ethics committee to look into Carney’s personal financial disclosures as well as blind trust arrangements he made before becoming prime minister.

This past July, a 16-page report detailed Carney’s private investments that include stock options in federally regulated companies such as Coca-Cola, Tesla, Canadian Pacific, Netflix, oil companies, and Microsoft.

Carney’s holdings are now in a blind trust with a “conflict of interest screen.”

According to Barrett, “Canadians are the ones left blind while the Prime Minister continues to be aware of how he can benefit from the decisions he takes, how they will improve his financial standing and how he can make more money based on the decisions he or his government takes while he is in office.”

“That is why this review of the Conflict of Interest Act is so necessary,” he said.

In particular, Barrett’s motion asks about Carney’s connections to the Brookfield Corporation.

“Should a Prime Minister have investments in tax havens? I would say no,” Barrett told his fellow MPs while speaking about the motion.

“They should be paying taxes like everyone else, not using accounting tricks that the wealthy rely on to avoid paying their fair share.”

Carney’s investments included shares in more than 600 worldwide companies. Barrett and now most MPs want answers as to whether or not this creates a conflict of interest.

The motion now means a list of high-profile witnesses will be called to testify November 21 regarding Carney’s alleged financial conflicts of interest. Witnesses include Carney’s chief of staff, Marc-André Blanchard, as well as Brookfield executives Bruce Flatt and Connor Teskey.

Carney was in Singapore when the motion was called forth.

Before Carney became PM earlier this year, he worked as an executive for Brookfield Asset Management, where he, as reported by LifeSiteNews, championed the idea of “net zero” climate goals to spur a financial “revolution.”

Shortly after becoming PM, he admitted he would “probably” have to recuse himself on certain governmental matters because of potential conflicts of interest.

Before becoming prime minister, Carney worked for Brookfield Asset Management and the United Nations special envoy on climate action.

Recent reports claim that Carney held $6.8 million in Brookfield Asset Management Ltd. stock options before quitting the company.

Banks

Bank of Canada Cuts Rates to 2.25%, Warns of Structural Economic Damage

Governor Tiff Macklem concedes the downturn runs deeper than a business cycle, citing trade wars, weak investment, and fading population growth as permanent drags on Canada’s economy.

In an extraordinary press conference on October 29th, 2025, Bank of Canada Governor Tiff Macklem stood before reporters in Ottawa and calmly described what most Canadians have already been feeling for months: the economy is unraveling. But don’t expect him to say it in plain language. The central bank’s message was buried beneath bureaucratic doublespeak, carefully manicured forecasts, and bilingual spin. Strip that all away, and here’s what’s really going on: the Canadian economy has been gutted by a combination of political mismanagement, trade dependence, and a collapsing growth model based on mass immigration. The central bank knows it. The data proves it. And yet no one dares to say the quiet part out loud.

Start with the headline: the Bank of Canada cut interest rates by 25 basis points, bringing the policy rate down to 2.25%, its second consecutive cut and part of a 100 basis point easing campaign this year. That alone should tell you something is wrong. You don’t slash rates in a healthy economy. You do it when there’s pain. And there is. Canada’s GDP contracted by 1.6% in the second quarter of 2025. Exports are collapsing, investment is weak, and the unemployment rate is stuck at 7.1%, the highest non-pandemic level since 2016.

Macklem admitted it: “This is more than a cyclical downturn. It’s a structural adjustment. The U.S. trade conflict has diminished Canada’s economic prospects. The structural damage caused by tariffs is reducing the productive capacity of the economy.” That’s not just spin—that’s an admission of failure. A major trading nation like Canada has built its economic engine around exports, and now, thanks to years of reckless dependence on U.S. markets and zero effort to diversify, it’s all coming apart.

And don’t miss the implications of that phrase “structural adjustment.” It means the damage is permanent. Not temporary. Not fixable with a couple of rate cuts. Permanent. In fact, the Bank’s own Monetary Policy Report says that by the end of 2026, GDP will be 1.5% lower than it was forecast back in January. Half of that hit comes from a loss in potential output. The other half is just plain weak demand. And the reason that demand is weak? Because the federal government is finally dialing back the immigration faucet it’s been using for years to artificially inflate GDP growth.

The Bank doesn’t call it “propping up” GDP. But the facts are unavoidable. In its MPR, the Bank explicitly ties the coming consumption slowdown to a sharp drop in population growth: “Population growth is a key factor behind this expected slowdown, driven by government policies designed to reduce the inflow of newcomers. Population growth is assumed to slow to average 0.5% over 2026 and 2027.” That’s down from 3.3% just a year ago. So what was driving GDP all this time? People. Not productivity. Not innovation. Not exports. People.

And now that the government has finally acknowledged the political backlash of dumping half a million new residents a year into an overstretched housing market, the so-called “growth” is vanishing. It wasn’t real. It was demographic window dressing. Macklem admitted as much during the press conference when he said: “If you’ve got fewer new consumers in the economy, you’re going to get less consumption growth.” That’s about as close as a central banker gets to saying: we were faking it.

And yet despite all of this, the Bank still clings to its bureaucratic playbook. When asked whether Canada is heading into a recession, Macklem hedged: “Our outlook has growth resuming… but we expect that growth to be very modest… We could get two negative quarters. That’s not our forecast, but we can’t rule it out.” Translation: It’s already here, but we’re not going to admit it until StatsCan confirms it six months late.

Worse still, when reporters pressed him on what could lift the economy out of the ditch, he passed the buck. “Monetary policy can’t undo the damage caused by tariffs. It can’t target the hard-hit sectors. It can’t find new markets for companies. It can’t reconfigure supply chains.” So what can it do? “Mitigate spillovers,” Macklem says. That’s central banker code for “stand back and pray.”

So where’s the recovery supposed to come from? The Bank pins its hopes on a moderate rebound in exports, a bit of resilience in household consumption, and “ongoing government spending.” There it is. More public sector lifelines. More debt. More Ottawa Band-Aids.

And looming behind all of this is the elephant in the room: U.S. trade policy. The Bank explicitly warns that the situation could worsen depending on the outcome of next year’s U.S. election. The MPR highlights that tariffs are already cutting into Canadian income, raising business costs, and eliminating entire trade-dependent sectors. Governor Macklem put it plainly: “Unless something else changes, our incomes will be lower than they otherwise would have been.”

Canadians should be furious. For years, we were told everything was fine. That our economy was “resilient.” That inflation was “transitory.” That population growth would solve all our problems. Now we’re being told the economy is structurally impaired, trade-dependent to a fault, and stuck with weak per-capita growth, high unemployment, and sticky core inflation between 2.5–3%. And the people responsible for this mess? They’ve either resigned (Trudeau), failed upward (Carney), or still refuse to admit they spent a decade selling us a fantasy.

This isn’t just bad economics. It’s political malpractice.

Canada isn’t failing because of interest rates or some mysterious global volatility. It’s failing because of deliberate choices—trade dependence, mass immigration without infrastructure, and a refusal to confront reality. The central bank sees the iceberg. They’re easing the throttle. But the ship has already taken on water. And no one at the helm seems willing to turn the wheel.

So here’s the truth: The Bank of Canada just rang the alarm bell. Quietly. Cautiously. But clearly. The illusion is over. The fake growth era is ending. And the reckoning has begun.

-

Business2 days ago

Business2 days agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Crime2 days ago

Crime2 days agoSuspect caught trying to flee France after $100 million Louvre jewel robbery

-

Alberta2 days ago

Alberta2 days agoThousands of Albertans march to demand independence from Canada

-

Economy2 days ago

Economy2 days agoStunning Climate Change pivot from Bill Gates. Poverty and disease should be top concern.

-

Addictions2 days ago

Addictions2 days agoThe Shaky Science Behind Harm Reduction and Pediatric Gender Medicine

-

International1 day ago

International1 day agoBiden’s Autopen Orders declared “null and void”

-

Business2 days ago

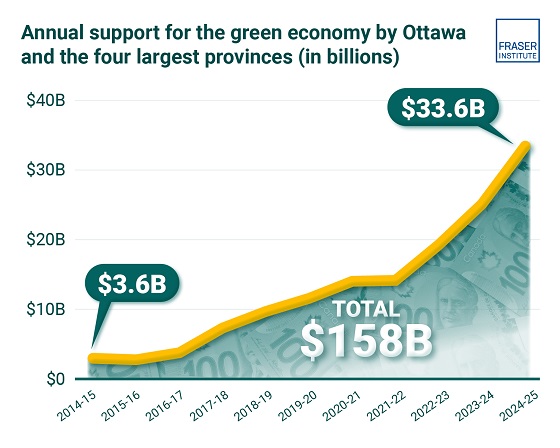

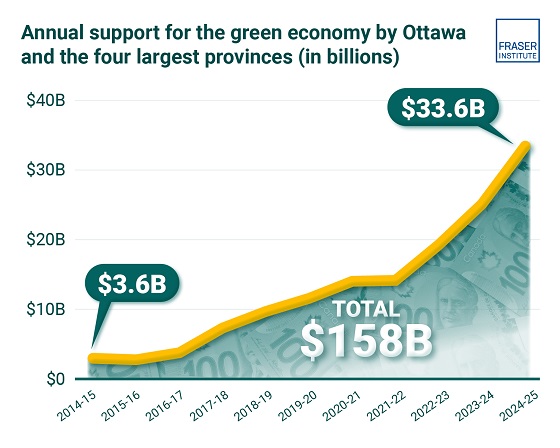

Business2 days agoClean energy transition price tag over $150 billion and climbing, with very little to show for it

-

Business2 days ago

Business2 days agoFlying saucers, crystal paperweights and branded apples: inside the feds’ promotional merch splurge